Get the free Ptax-324

Get, Create, Make and Sign ptax-324

How to edit ptax-324 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-324

How to fill out ptax-324

Who needs ptax-324?

Comprehensive Guide to the PTAX-324 Form

Understanding the PTAX-324 form

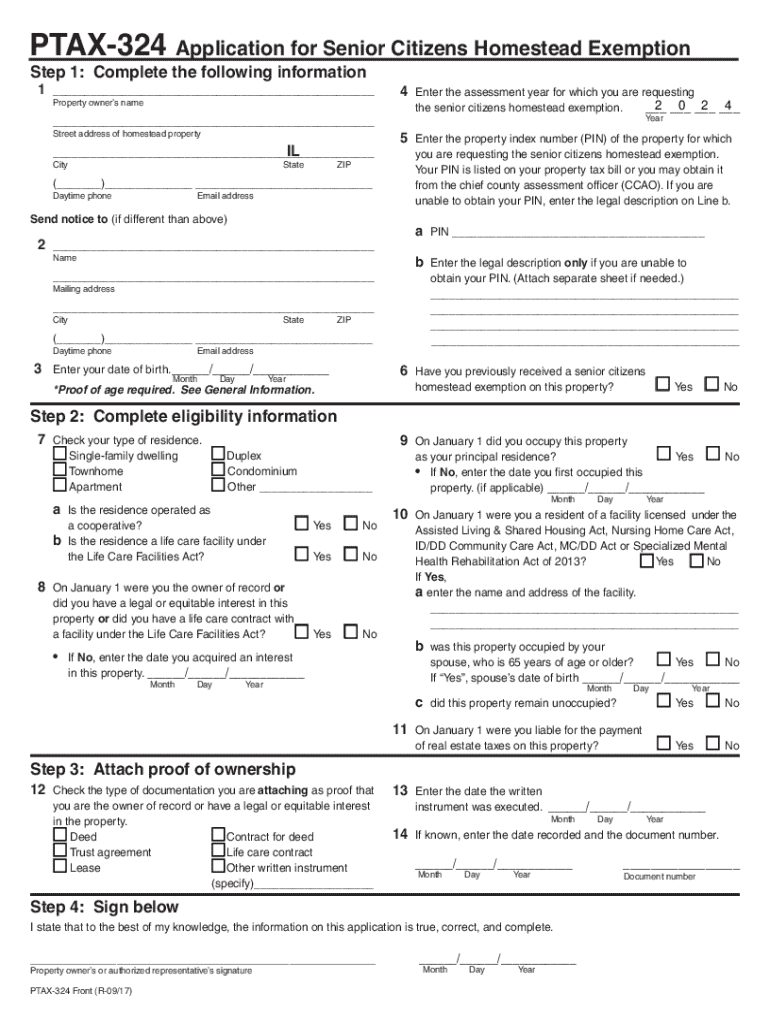

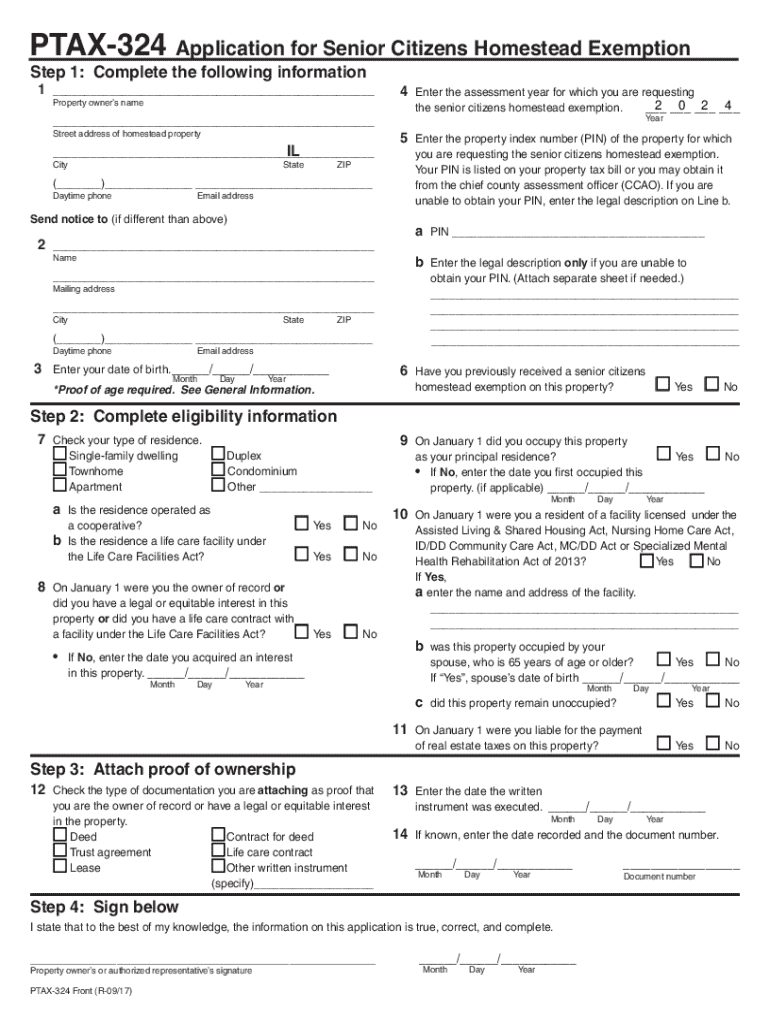

The PTAX-324 form is a crucial document used in the property tax assessment process within certain jurisdictions, particularly in Illinois. This form allows property owners to petition for an adjustment to their property tax assessments, which can significantly impact their overall tax liabilities. By filing a PTAX-324, individuals can challenge the assessed value of their property and seek a reevaluation, potentially resulting in reduced property taxes.

The importance of the PTAX-324 form cannot be overstated. It plays a vital role in ensuring fairness in property tax assessments, allowing homeowners and property investors to contest the valuation set by local assessors. The key benefits include financial savings on property taxes, an opportunity to correct any errors in assessment, and the empowerment to engage actively in the assessment process.

Who needs to fill out the PTAX-324 form?

Eligible applicants for the PTAX-324 form primarily include homeowners and other property owners or investors who believe that their properties have been overvalued in the assessment process. Homeowners may be motivated to fill out this form if they notice discrepancies in their property’s market value or if there have been significant changes in their community affecting property values.

Specific situations warranting the PTAX-324 form might include instances where a property has experienced a decline in market conditions, miscalculations by assessors, or recent improvements made to competing properties in the area that have raised the bar for comparable assessments.

Key features of the PTAX-324 form

The PTAX-324 form consists of several sections vital for processing a tax adjustment request. The personal information section requires the applicant's name, address, and contact details. Property details include the property's location, parcel number, and previous assessed value. Most importantly, applicants must provide a clear explanation of the tax adjustments they are requesting, backed by any supporting evidence that can substantiate their claims.

Familiarizing yourself with common terms and definitions associated with property taxation can enhance your understanding and help you articulate your situation better when filling out the form.

Step-by-step guide to filling out the PTAX-324 form

Filling out the PTAX-324 form efficiently involves a few methodical steps. First, gather all necessary documents that support your claim, such as tax bills, property deeds, and recent appraisals. This documentation will form the backbone of your submission and should clearly reflect the basis of your adjustment request.

Next, complete the form carefully. Start with your personal information and move through the property details section. In the adjustment explanation, make concise and compelling arguments. Once you’ve populated all necessary fields, take a moment to review and verify the accuracy of your entries.

When it comes to submission, check if your jurisdiction allows online submission or requires physical copies. Pay close attention to any deadlines related to filing to ensure your appeal is considered timely.

Editing and modifying your PTAX-324 form

Once you have submitted your PTAX-324 form, there may be instances where you need to make changes or corrections. The process can vary depending on local regulations, but generally, you will need to follow up with the tax office that received your submission. It is important to maintain accurate and updated records to reflect any modifications made, as this will facilitate better communication with tax authority representatives in case of inquiries.

Keeping a copy of the submitted form and any subsequent correspondence ensures that you have complete documentation in the event that the need arises for further clarification regarding your submission.

Signing and filing the PTAX-324 form

Filing the PTAX-324 form requires a signature, which can be completed via physical signatures or eSigning options available through platforms such as pdfFiller. Utilizing these options allows for a seamless submission of your completed document while ensuring that it meets all necessary legal requirements. eSigning through pdfFiller not only saves time, but it also provides a secure method for filing your form.

When signing, it’s crucial to double-check that all information is accurate, as any discrepancies could delay the processing of your appeal.

Common mistakes to avoid

Filling out the PTAX-324 form can be straightforward, but several common pitfalls may occur. Avoiding these mistakes can improve your chances of a successful submission. One frequent error is neglecting to check the accuracy of your property details, which can lead to immediate rejections of your petition.

Taking the time to verify your information and ensuring that you follow an organized approach to filling out the form can significantly reduce the likelihood of errors.

Tracking your PTAX-324 form application

After submission, it’s essential to keep tabs on the status of your PTAX-324 form application. Most tax offices offer a way to track your application’s progress directly through their websites or by contacting their offices directly. Having a record of your submission date, along with any confirmation emails or documents from the tax office, can be beneficial for follow-up inquiries.

If you experience any delays or issues, reach out to the tax office using the contact information provided during your submission process, as early communication can help resolve any complications.

Additional resources for the PTAX-324 form

To assist you further with the PTAX-324 form, various resources are available. Links to pertinent forms, including other tax adjustment applications, can be found on local government websites. Additionally, tools and calculators for estimating potential property tax assessments can be valuable, especially when preparing your evidence. It is also advisable to know your local tax office contacts for inquiries regarding your submission or specific tax-related questions.

Utilizing these resources in conjunction with the PTAX-324 form can enhance your understanding and navigation of the tax assessment process.

Expert tips for property owners

Property owners can maximize their tax benefits by staying informed about local market trends and understanding the specifics of property tax assessments. Engaging with a tax consultant or attorney may provide insights that could lead to substantial savings, especially in complex situations.

Utilizing resources like pdfFiller can aid in the efficient management of all related documents, including the PTAX-324 form.

Community feedback and experiences

Many individuals who have successfully navigated the PTAX-324 form have shared their experiences, highlighting the clear instruction and supportive resources available. User testimonials indicate that timely submissions and well-organized documentation often yield positive outcomes in terms of adjusted property tax assessments.

Success stories in various communities speak of significant property tax savings resulting from thorough preparation and use of the PTAX-324, shedding light on the form’s effectiveness as a tool for property owners.

Frequently asked questions (FAQs) about the PTAX-324 form

When it comes to filing the PTAX-324 form, numerous common inquiries often arise. Frequently asked questions typically focus on eligibility criteria and the accompanying documentation needed for submission. Understanding these aspects can clarify the process for first-time filers.

Answering these questions beforehand can alleviate concerns and streamline your experience when dealing with the PTAX-324 form.

Stay updated with property tax changes

Tax laws and regulations governing property taxes can change frequently. Staying informed about these alterations is essential for property owners, as they directly impact tax liabilities and assessment processes. Many local government websites and professional tax organizations regularly update their resources to inform taxpayers.

By engaging with these resources, property owners can educate themselves on any legislation affecting their properties, making the PTAX-324 form a more efficient tool in managing their tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ptax-324 online?

Can I create an electronic signature for signing my ptax-324 in Gmail?

How do I complete ptax-324 on an iOS device?

What is ptax-324?

Who is required to file ptax-324?

How to fill out ptax-324?

What is the purpose of ptax-324?

What information must be reported on ptax-324?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.