Get the free State Accounting Form a-54

Get, Create, Make and Sign state accounting form a-54

How to edit state accounting form a-54 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state accounting form a-54

How to fill out state accounting form a-54

Who needs state accounting form a-54?

Understanding the State Accounting Form A-54 Form

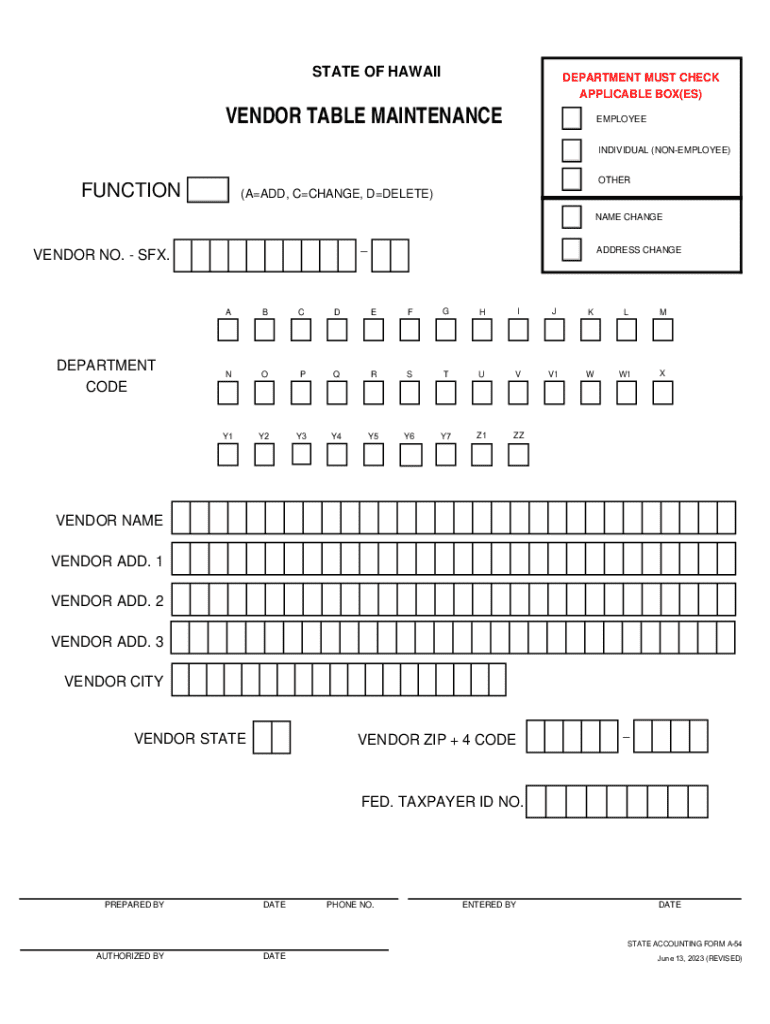

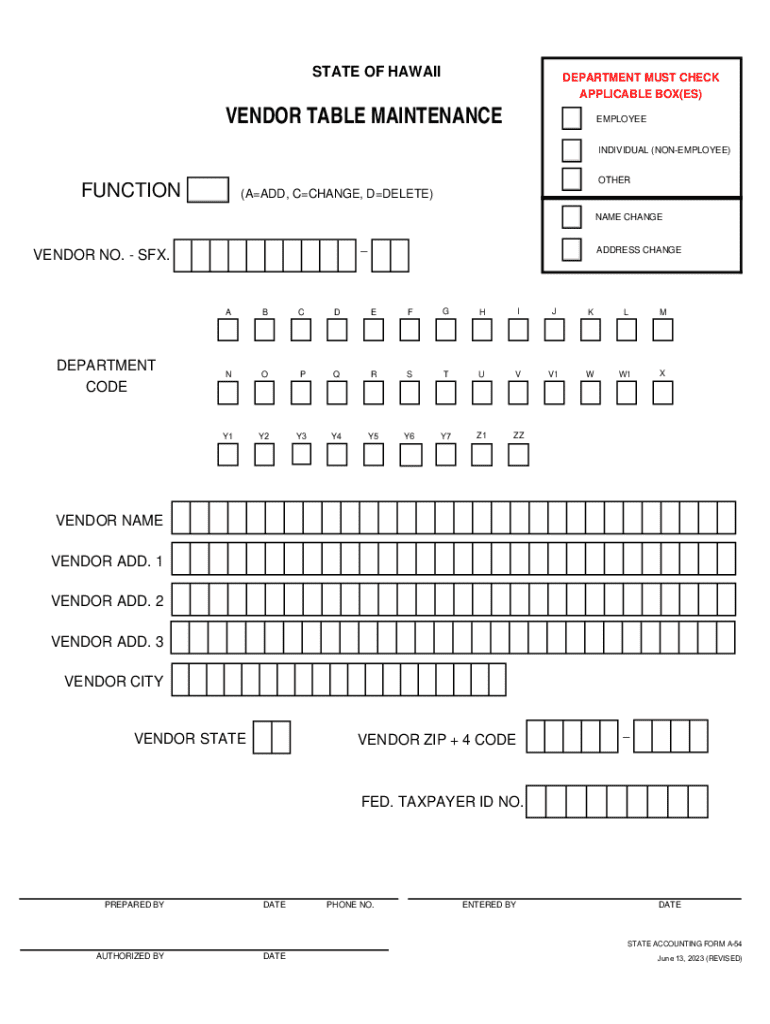

Overview of State Accounting Form A-54

The State Accounting Form A-54 is a critical document used in the management and reporting of public funds within state jurisdictions. Designed to provide a comprehensive overview of a state's financial activities, the form plays a pivotal role in ensuring transparency, accountability, and compliance in state accounting processes.

The primary purpose of the A-54 form is to gather detailed information on state revenues and expenditures. It serves as an official record that facilitates auditing processes, budget planning, and fiscal reviews, thereby ensuring that state funds are utilized effectively.

Accurate submission of the State Accounting Form A-54 is vital as it can influence funding decisions, affect public trust, and inform policy-making. Mistakes or discrepancies can lead to audits, financial penalties, or even legal repercussions, underscoring the importance of meticulous reporting and compliance.

Structure of State Accounting Form A-54

The Structure of the State Accounting Form A-54 is divided into several key sections, each designed to capture specific financial data relevant to state operations. Understanding the breakdown of these sections is essential for accurate completion.

Each section of Form A-54 has specific relevance; for instance, the revenue sources section influences budgetary decisions, while the expenditures section ensures funds are used efficiently and ethically. Familiarity with each section helps guide accurate data submission, reducing the likelihood of errors.

Step-by-step instructions for completing A-54

Completing the State Accounting Form A-54 can be a straightforward process if approached methodically. Here’s a step-by-step guide to help you navigate through the completion of the form effectively.

Following these steps diligently will not only facilitate the accurate completion of the State Accounting Form A-54 but will also enhance the efficiency of your reporting process.

Common mistakes to avoid

While completing the State Accounting Form A-54, it’s common for users to encounter pitfalls that can lead to discrepancies in reporting. Identifying and avoiding these mistakes is essential for effective compliance.

Being aware of these common mistakes provides a foundation for accurate and compliant completion of the State Accounting Form A-54, enhancing one's ability to manage state accounting effectively.

Interactive tools for document management

In an increasingly digital world, leveraging interactive tools for document management can streamline completing the State Accounting Form A-54. Platforms like pdfFiller offer user-friendly solutions that greatly enhance the document handling experience.

pdfFiller's interactive tools for filling out Form A-54 include features that cater to various document management needs:

By utilizing these tools in a cloud-based environment, users not only improve their document management workflows but also protect their data through enhanced security and accessibility.

Tips for efficient document management

Efficient document management is crucial for ensuring that forms like the State Accounting Form A-54 are prepared, submitted, and stored properly. Implementing best practices can save time and minimize errors.

By employing these strategies, users can enhance their document management processes, leading to more efficient and compliant completion of the A-54 form.

Frequently asked questions (FAQs)

Addressing common queries can empower users to confidently manage their reporting responsibilities. Here are some frequently asked questions about the State Accounting Form A-54.

Linked topics and related documents

Understanding the State Accounting Form A-54 also involves recognizing its connection to other state accounting forms and policies. This awareness fosters better overall financial reporting practices.

Familiarizing yourself with these linked topics enhances your ability to navigate state accounting practices, resulting in well-informed reporting.

User testimonials and success stories

Real-world experiences can illuminate the benefits of using pdfFiller for managing the State Accounting Form A-54. Users have reported significant improvements in their document workflows.

These success stories underscore the value of integrating effective document management solutions like pdfFiller into your accounting practices.

Conclusion on the importance of State Accounting Form A-54

The State Accounting Form A-54 is indispensable for effective state accounting, serving as a cornerstone for fiscal transparency and accountability. Its role in accurately reporting revenue and expenditures cannot be overstated.

By embracing tools like pdfFiller, users can significantly enhance their document management processes, leading to improved accuracy, compliance, and ultimately, better governance of state resources. Leveraging such tools is essential for anyone involved in state accounting to ensure that they meet the highest standards of financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my state accounting form a-54 in Gmail?

How can I send state accounting form a-54 to be eSigned by others?

How do I edit state accounting form a-54 in Chrome?

What is state accounting form a-54?

Who is required to file state accounting form a-54?

How to fill out state accounting form a-54?

What is the purpose of state accounting form a-54?

What information must be reported on state accounting form a-54?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.