Get the free St 1t

Get, Create, Make and Sign st 1t

How to edit st 1t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out st 1t

How to fill out st 1t

Who needs st 1t?

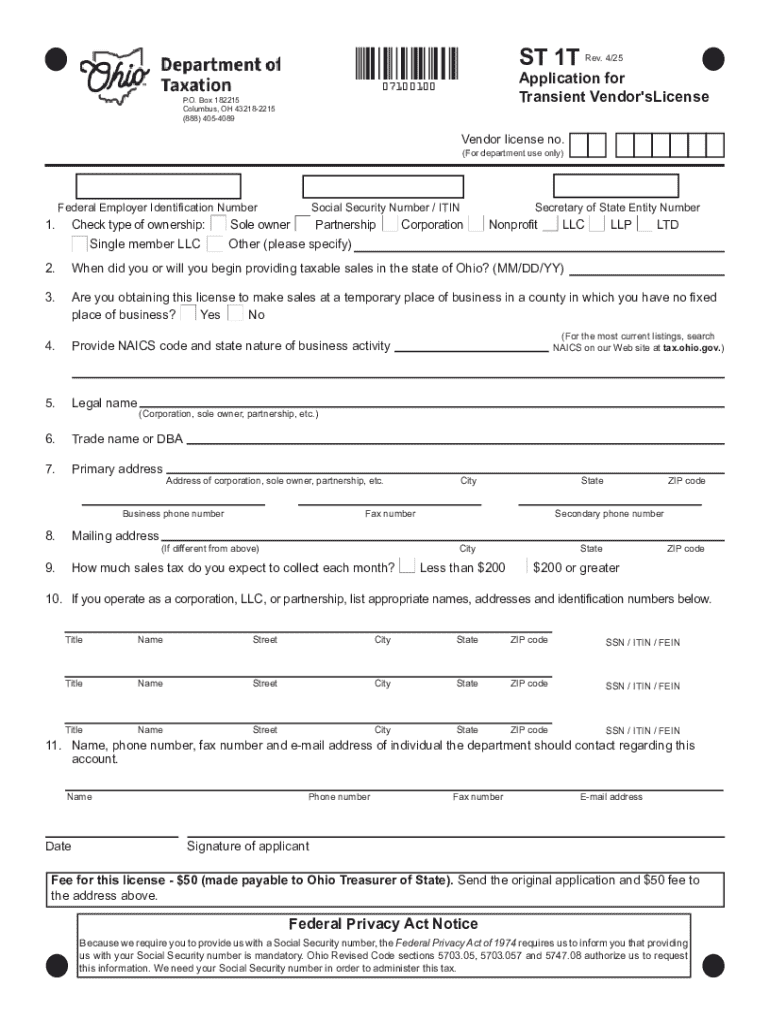

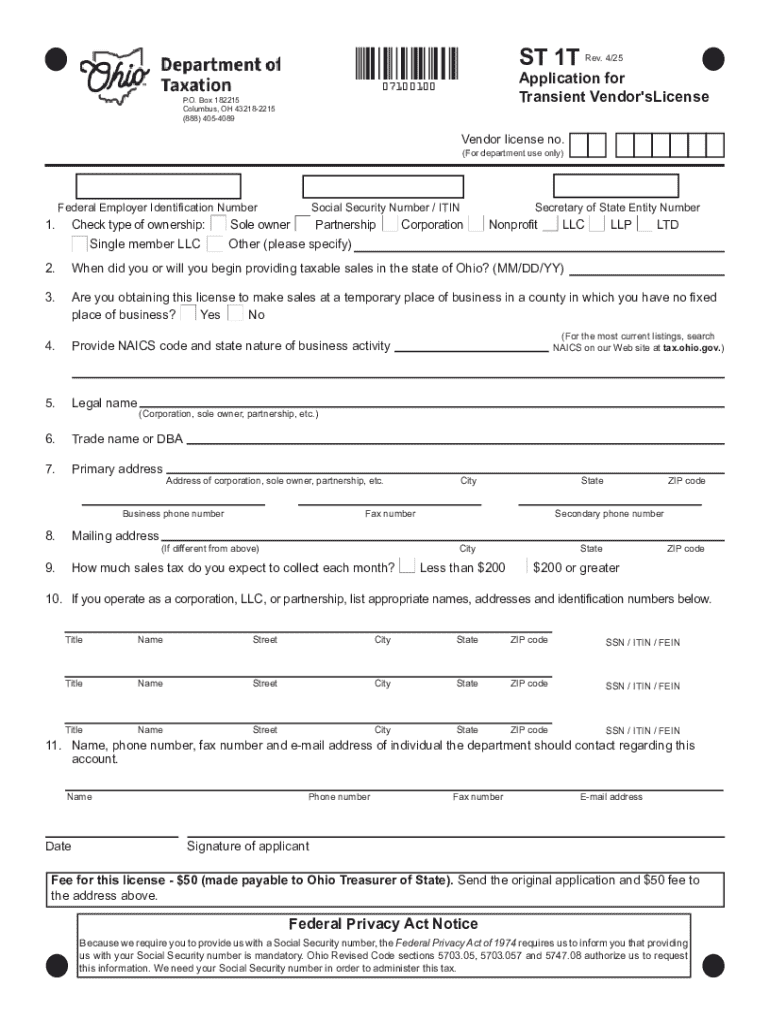

Comprehensive Guide to the ST 1T Form

Understanding the ST 1T Form

The ST 1T Form is a critical tax document used mainly in transactions within various sectors, including sales tax exemptions. This form acts as a certification that can be used by individuals or businesses to document their eligibility for obtaining goods or services without paying sales tax, making it critical in financial and accounting practices.

Its importance cannot be overstated, as it facilitates transparency and compliance with state regulations. Key stakeholders involved include individual taxpayers, vendors needing to verify the tax-exempt status of purchases, and municipalities that require compliance with local tax laws.

Eligibility requirements for using the ST 1T Form

To utilize the ST 1T Form, specific eligibility criteria must be met. Primarily, any individual or business that is exempt from sales tax, such as nonprofit organizations or governmental entities, is required to fill out this form. Additionally, businesses purchasing items for resale should also submit the ST 1T Form to ensure they are not incorrectly charged sales tax.

Many situations can lead to the requirement of the ST 1T Form, especially when the taxpayer is involved in continuous sales or a single large transaction. Understanding your eligibility will streamline the process and ensure compliance.

Step-by-step guide to completing the ST 1T Form

Completing the ST 1T Form accurately is crucial in avoiding delays or potential legal issues. Start by gathering all necessary documentation that supports your tax-exempt status or resale purpose. Essential data points typically include proof of tax-exempt status, Sales Tax Identification Number, and detailed information about the items being purchased.

Gathering required information

Before you fill out the ST 1T Form, make sure you have the following documentation ready:

Double-checking the information collected ensures correctness and compliance. Once all information is gathered, proceed to fill out each section of the ST 1T Form meticulously to avoid delays.

Detailed instructions for each section of the ST 1T Form

The ST 1T Form consists of several key sections. Each requires specific information:

Following these guidelines will facilitate a smoother completion process for the ST 1T Form.

Options for filling out the ST 1T Form

When it comes to filling out the ST 1T Form, you have options for both online and offline submission. Choosing to complete this form online can greatly streamline the process.

Online vs. offline submission

Opting for pdfFiller's online platform provides numerous advantages:

Features such as interactive form tools simplify the task of filling out, editing, and signing the ST 1T Form digitally, enhancing the user experience.

Interactive form features

With pdfFiller, you can utilize tools that facilitate filling, editing, and signing your documents quickly. For example, eSignature capabilities allow for instantaneous validation and reduce the need for physical presence, which is especially useful during busy business hours.

Managing your ST 1T Form after submission

After submitting your ST 1T Form, it's essential to stay updated on its status. Knowing how to check this can help mitigate any anxiety associated with waiting.

Tracking your application status

You can typically check your application status through the municipal or state website where you submitted your form. This transparency allows you to gauge whether your form was received on time.

Expected timelines can vary but staying proactive in checking your application's progress is advisable.

Handling rejections or requests for additional information

Unfortunately, rejections can happen. Be prepared to respond quickly. Common reasons for rejection include missing documentation or incorrect information. Addressing any issues efficiently can prevent delays in the resubmission of your ST 1T Form.

FAQs about the ST 1T Form

FAQs about the ST 1T Form can provide clarity on common uncertainties surrounding the process.

Being proactive about understanding these FAQs will save you time and effort in the long run.

Best practices for using the ST 1T Form

To ensure that your ST 1T Form is processed smoothly and accurately, best practices are essential. Focus on the completeness and correctness of the form before submission.

Tips for ensuring accuracy and compliance

Creating a checklist can be a crucial step in reviewing your form prior to submission. Consider the following items:

Using pdfFiller can significantly enhance your efficiency across these tasks, making your form management streamlined and straightforward.

Leveraging pdfFiller for efficiency

With features tailored for the ST 1T Form, pdfFiller can save time, minimize errors, and keep all your forms organized. Transitioning to a cloud-based platform allows for easier tracking of forms and communications with third parties.

Exploring additional resources related to the ST 1T Form

Understanding the ST 1T Form is just the tip of the iceberg. There are several related documents and forms each with its unique purpose and importance.

Related forms and documents

Other forms that may be relevant include state-specific exemption certificates and resale certificates, which can often accompany the ST 1T Form in transactions.

Connecting with professional help

Should you find yourself in need of additional assistance, consulting with tax professionals or utilizing resources from pdfFiller can provide expert guidance. Rely on these tools to enhance your understanding and compliance with the ST 1T Form.

The value proposition of using pdfFiller for form management

PdfFiller stands out for its unique features that streamline the management of the ST 1T Form. The ability to edit PDFs and sign documents online eliminates the hassle of traditional paperwork.

Unique features of pdfFiller tailored to the ST 1T Form

Many organizations have benefited from using pdfFiller, gaining increased efficiency and accuracy. This is particularly valuable in settings where numerous forms are handled simultaneously.

Testimonials from users who efficiently managed their ST 1T Forms with pdfFiller

Users report significant time savings and ease in tracking their ST 1T Forms after adopting pdfFiller, highlighting its collaborative features and flexibility.

Staying updated

Regulations surrounding the ST 1T Form may change periodically, making ongoing education essential.

Keeping abreast of changes related to the ST 1T Form

Regularly checking your local tax department’s website can help ensure you are compliant with the latest requirements and guidelines.

Engaging with pdfFiller's resources for ongoing education

PdfFiller frequently updates its platform with resources, helping users to stay informed about revisions or changes relevant to the ST 1T Form. Engaging with these resources fosters a better understanding and application of the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute st 1t online?

How do I edit st 1t online?

How do I edit st 1t on an iOS device?

What is st 1t?

Who is required to file st 1t?

How to fill out st 1t?

What is the purpose of st 1t?

What information must be reported on st 1t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.