Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

Editing form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

A Comprehensive Guide to Form 5500-SF Form

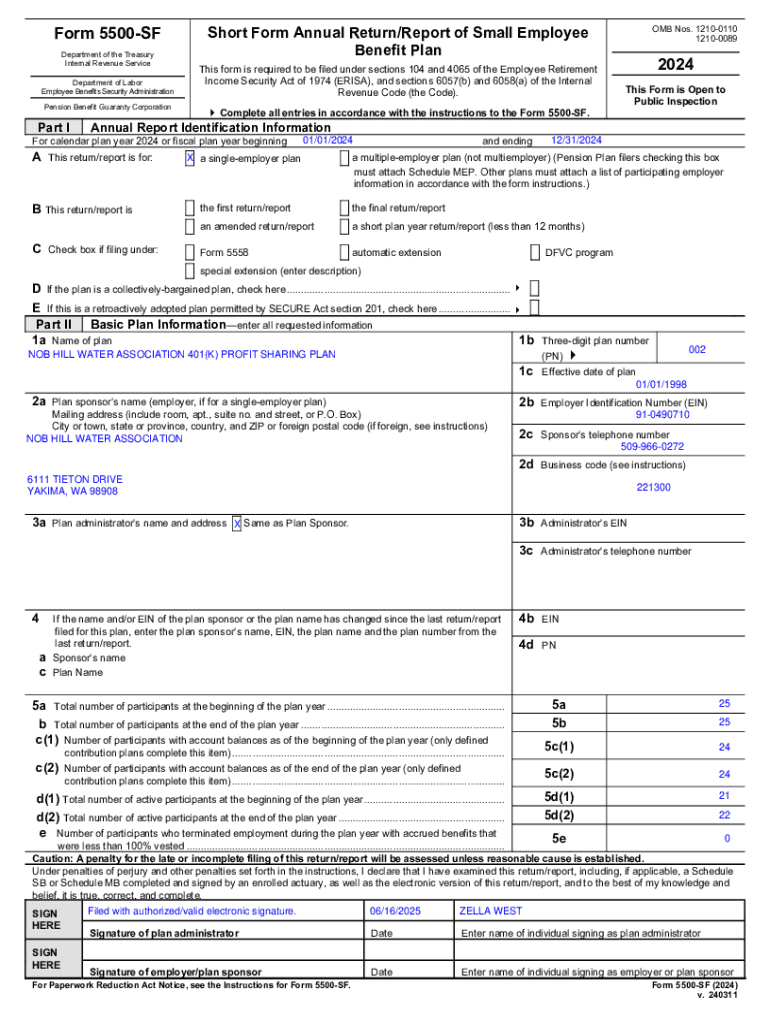

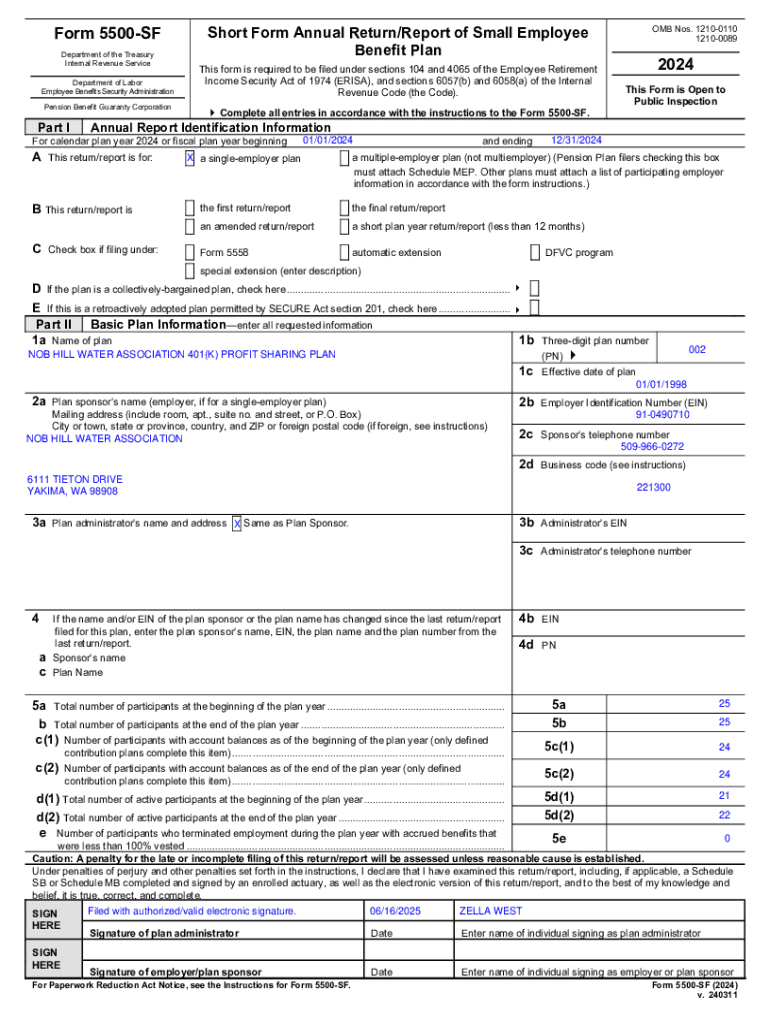

Understanding Form 5500-SF

Form 5500-SF is a streamlined version of the Form 5500 used by small employee benefit plans to satisfy annual reporting requirements under the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code (IRC). This form helps the Department of Labor (DOL) and the Internal Revenue Service (IRS) collect essential information about pension and welfare benefit plans.

The primary purpose of Form 5500-SF is to provide plan participants and beneficiaries, as well as the federal government, with important financial and structural details about employee benefit plans, particularly those with fewer than 100 participants. This helps to ensure that these plans are maintained in compliance with federal regulations.

The key differences between Form 5500 and Form 5500-SF lie in the size and complexity of the plans. While Form 5500 accommodates larger, more complicated benefit plans, the Form 5500-SF is designed for simpler, small plans, making it less burdensome to complete.

Who needs to file Form 5500-SF?

Form 5500-SF is specifically tailored for small employee benefit plans. Eligible plans for filing this form include defined contribution plans, defined benefit plans, and welfare plans with fewer than 100 participants at the beginning of the plan year.

Certain exemptions from filing requirements exist. For instance, plans such as IRA-based plans or certain government and church plans do not require Form 5500-SF. Identifying eligible filers involves ensuring that the plan structure complies with the criteria stated by the DOL and IRS, which can vary based on plan characteristics and participant counts.

Filing requirements and important dates

Filing Form 5500-SF has specific deadlines that must be adhered to. The key annual filing deadline is the last day of the seventh month after the plan year ends, which can be extended under certain conditions.

When filing, it's essential to attach required documentation, such as a signed Schedule A, if applicable, and any supporting information necessary for specific plan types. Compliance with these requirements ensures smoother processing and helps to avoid penalties.

Comprehensive guide to completing Form 5500-SF

Completing Form 5500-SF involves understanding its various sections. Each part collects different types of information, which are crucial for regulatory compliance.

Common mistakes when completing the form include omitting required signatures, providing inaccurate participant counts, and failing to attach necessary documents. Ensuring accuracy in each section can prevent delays in processing and potential penalties.

Electronic filing and EFAST2 processing

The EFAST2 (Electronic Filing Acceptance System) is the system through which Form 5500-SF is filed electronically. Using EFAST2, filers can submit their forms directly to the DOL, streamlining the filing process.

Electronic filing is mandatory for most plan sponsors. It greatly reduces paperwork, minimizing the chances of errors typically associated with manual submissions. To submit Form 5500-SF online, users must establish an EFAST2 account, upload the completed form, and follow the submission guidelines outlined by the DOL.

Changes to note for the current year (2023)

Each year, specific updates can impact the requirements surrounding Form 5500-SF. For 2023, the DOL has introduced some modifications to ensure compliance with recent legislation and enhance the clarity of information reported.

These changes may affect how plans report certain financial data, participant demographics, and compliance questions. Understanding the implications of these changes helps filers stay compliant and avoid potential penalties.

Delinquent Filer Voluntary Compliance (DFVC) program

The DFVC Program allows plan administrators who fail to file Form 5500-SF on time to come into voluntary compliance without incurring significant penalties. This program provides a pathway for filers to rectify their status while minimizing the financial impact of late filing.

Eligibility for participation in the DFVC program typically revolves around meeting specific criteria and submitting necessary paperwork. If a filing deadline is missed, administrators should act quickly to understand the requirements for rejoining compliance through the DFVC.

Consequences of non-compliance

Failing to file Form 5500-SF can result in serious implications for plan sponsors. Administrative penalties can accumulate quickly, resulting in fines that may be substantial in relation to the plan's financial resources.

Plan sponsors should understand that maintaining compliance not only safeguards against financial penalties but also ensures the integrity of benefit provisions for participants.

Using Form 5558 for extensions

Form 5558 is used for requesting an extension to file Form 5500-SF. By filing Form 5558, plan sponsors can obtain an automatic 2.5-month extension, allowing more time to complete the necessary reporting accurately.

To file for an extension, it's essential to submit Form 5558 on or before the original filing deadline of Form 5500-SF. Key considerations include ensuring that all information provided is accurate and fully completed to prevent application rejection.

Resources for assistance

Plan sponsors seeking assistance with Form 5500-SF should look into various resources available. The Department of Labor provides guidance and support for questions arising during the filing process.

These resources can alleviate confusion and streamline the filing process, contributing to the overall compliance journey.

Strategic tips for efficient filing

Preparing to file Form 5500-SF efficiently involves adhering to best practices that enhance the accuracy and speed of the filing process. Start by gathering all relevant plan information early to streamline data entry.

Employing these strategies helps filers submit accurate information promptly, reducing the likelihood of errors that might complicate the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 5500-sf online?

How do I fill out form 5500-sf using my mobile device?

Can I edit form 5500-sf on an iOS device?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.