Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A Comprehensive How-to Guide

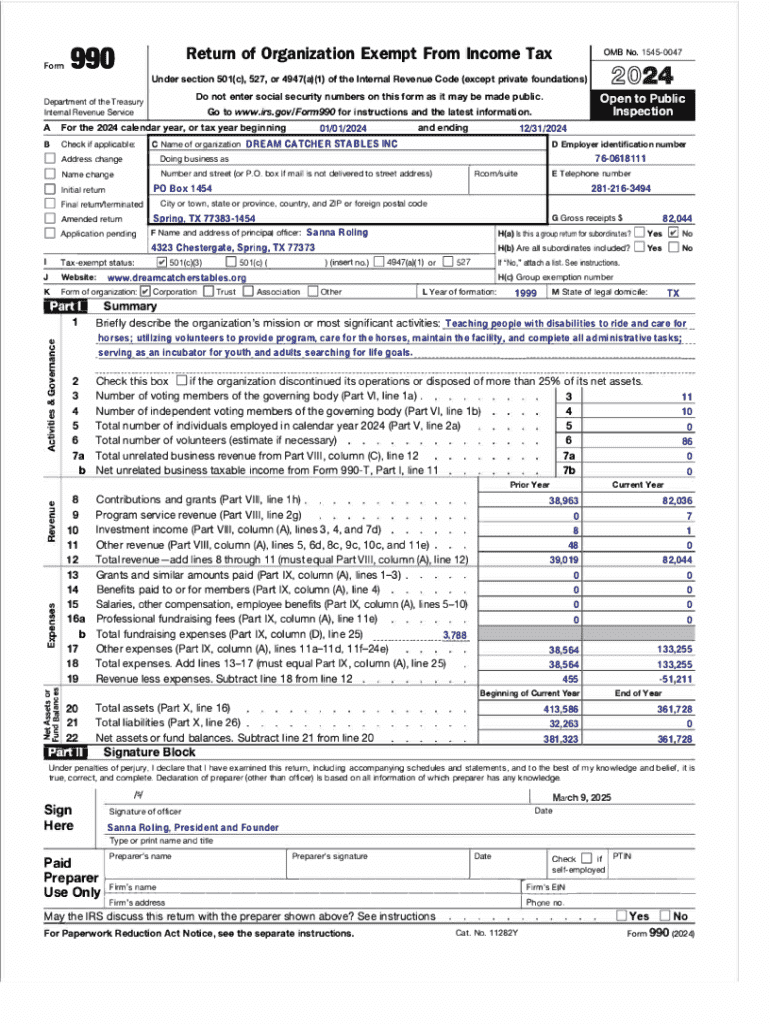

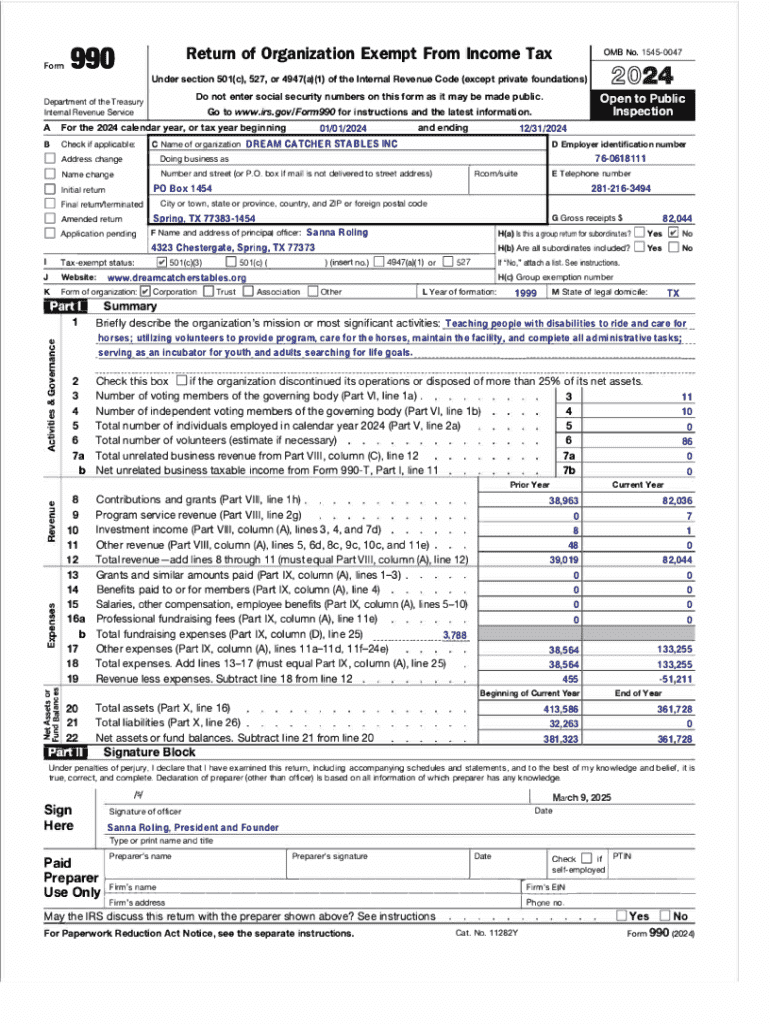

Overview of Form 990

Form 990 is an essential tax document that nonprofit organizations in the United States must file annually with the Internal Revenue Service (IRS). It provides detailed financial and operational information about the organization. Crucially, Form 990 serves to promote transparency and public accountability, thereby allowing donors, potential donors, and the general public to assess the health and efficacy of nonprofit organizations.

The importance of Form 990 in nonprofit reporting cannot be overstated. It is not merely a tax form; it is a vital tool for charity evaluations and maintaining public trust. By revealing how funds are collected and spent, it helps ensure that nonprofits are complying with their exempt status under IRS regulations.

Understanding the structure of Form 990

Form 990 is divided into several key sections, each designed to capture specific information about the organization. Understanding its structure is crucial for accurate and comprehensive reporting.

Variants and schedules of Form 990

Form 990 comes in several variants tailored to different types of organizations, with Form 990-EZ and Form 990-N as notable alternatives. Each version caters to the size and complexity of the nonprofit.

In addition to these forms, various schedules may be required based on the organization's specific activities. For example:

Filing requirements for Form 990

Determining who must file Form 990 is critical in maintaining compliance. Generally, most tax-exempt organizations are required to file, but there are exceptions based on type and revenue thresholds.

Filing deadlines for Form 990 vary depending on the organization's fiscal year-end. Typically, Form 990 is due on the 15th day of the 5th month after the end of the fiscal year. For example, for a fiscal year ending December 31, the deadline is May 15. Organizations can request a six-month extension, which must be submitted timely in order to avoid penalties.

Penalties and compliance for incorrect filings

Filing Form 990 inaccurately or late can lead to financial penalties and frustration. Common mistakes include failing to disclose all necessary schedules, providing incomplete information, or missing the filing deadline altogether.

Late filings can incur penalties from the IRS, starting from $20 per day up to a maximum of $10,000 for larger organizations. Additionally, inaccuracies can lead to further investigations or loss of tax-exempt status.

Insight into public inspection regulations

Form 990, once filed, becomes subject to public inspection, promoting transparency in the nonprofit sector. Organizations are obligated to make their Form 990 publicly accessible, usually via their website or upon request.

Donors and the general public can view this filing, reinforcing the accountability of nonprofits. Typically, Form 990 must be available for inspection within a reasonable time frame, usually within three years after filing.

Historical context and purpose of Form 990

Introduced in 1942, Form 990 has undergone significant changes to adapt to the evolving landscape of nonprofit management and oversight. Initially designed for the IRS to gather essential data on charities, it has transformed into a comprehensive tool for transparency and public accountability.

Over the decades, the form has been updated to include more detailed financial inputs and to reflect evolving compliance needs. Understanding its history underscores its value in fostering trust between nonprofits and those they serve, supporting the evaluation of charities based on systematic criteria.

Best practices for completing Form 990

Completing Form 990 can be daunting, but adhering to best practices can streamline the process. Start by ensuring that all necessary information is gathered. This includes financial statements, mission statements, and any supporting documentation.

Always cross-reference data to confirm accuracy, and consider collaborating with your team to enrich the quality of the submission. Using tools available through pdfFiller can enhance the filling experience by allowing easy editing, signature collection, and collaboration.

Step-by-step process to fill out Form 990

Filling out Form 990 necessitates a structured approach. Before you start, familiarize yourself with the layout and requirements. Prepare all documents, including financials, bylaws, and organizational charts.

Accessing the Form 990 can be straightforward through pdfFiller. Follow these detailed steps to complete your filing accurately.

Digital tools for managing Form 990

Utilizing digital tools plays a crucial role in the management of Form 990. Cloud-based solutions, such as pdfFiller, allow for seamless document creation, editing, and sharing, ensuring that all team members can collaborate effectively.

Features unique to pdfFiller, including interactive tools, enable enhanced navigation through the form, while integration capabilities make it possible to link various software platforms for more efficient reporting.

Understanding the aftermath of filing Form 990

After submitting Form 990, several key considerations emerge. First, it’s crucial to confirm that the IRS has received your submission and to monitor for any follow-up actions required. Maintaining accurate records of your filing can be beneficial in future audits or when answering inquiries from stakeholders.

Nonprofits also have a responsibility to keep their stakeholders informed about how their funds are being used. This transparency will help maintain trust and support from donors, who are keen on understanding the impact their contributions make.

Additional resources for users

Different resources are available for organizations seeking assistance navigating the intricacies of Form 990. Third-party services, IRS resources, and nonprofit advocacy groups offer guidance tailored to their needs, ensuring that nonprofits remain compliant and effective.

Keeping abreast of IRS announcements and updates on Form 990 can provide organizations with crucial information that affects filing requirements and deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 990 online?

How do I edit form 990 online?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.