Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

A Comprehensive Guide to the W-9 Form: Understanding, Filling Out, and Submitting

Understanding the W-9 form

The W-9 form is a crucial document used in the United States, primarily required by the Internal Revenue Service (IRS). Its main purpose is to collect taxpayer identification information from individuals and entities that receive certain types of income. This information enables the payer to accurately report how much they paid to the individual or business during a tax year, thereby ensuring compliance with tax regulations.

For both individuals and businesses, the W-9 form is essential for various financial transactions, including freelance work, independent contracting, and certain banking operations. This form asks for specific information, such as the taxpayer’s name, business name, address, and taxpayer identification number (TIN), which can be either a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

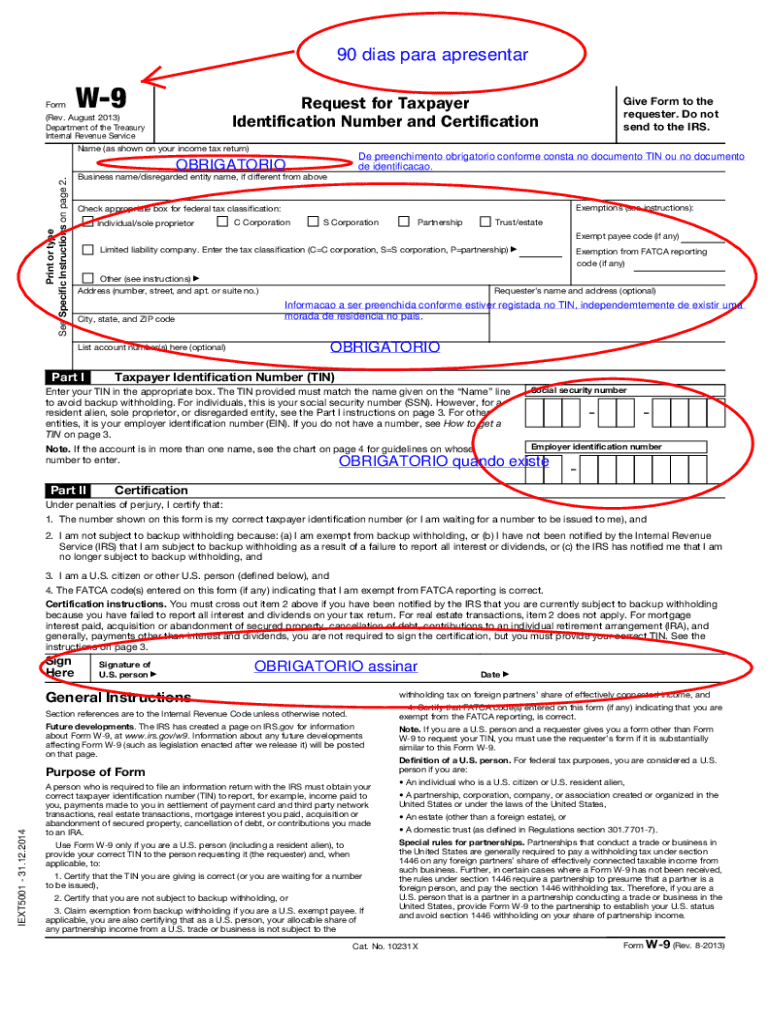

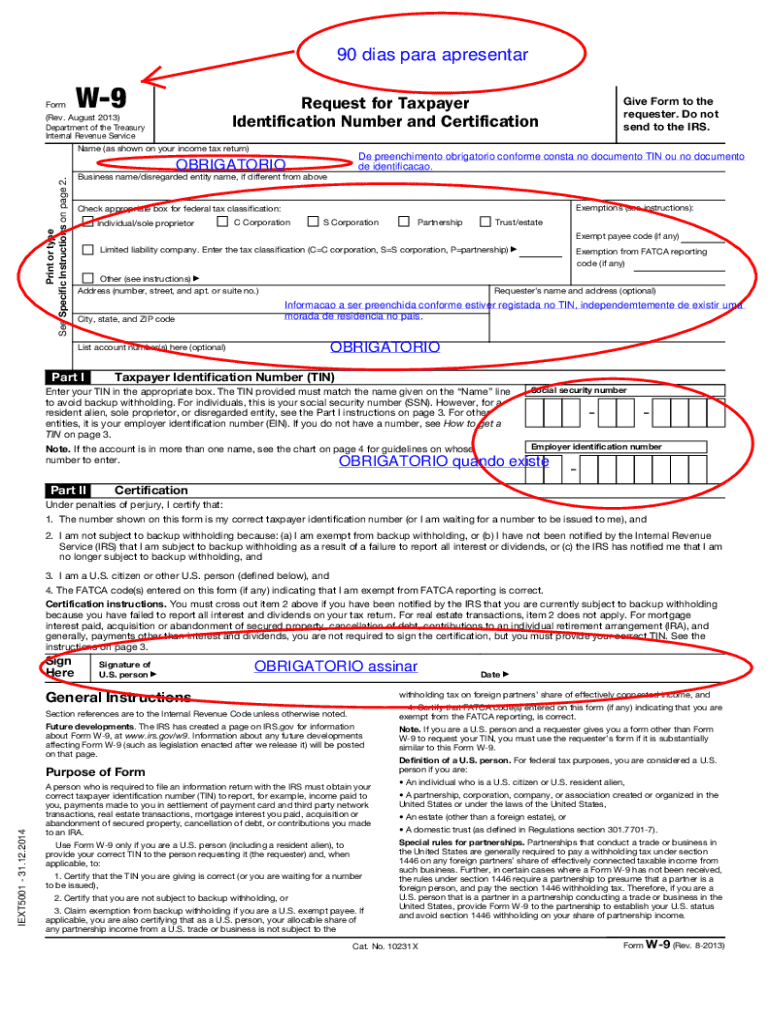

Step-by-step guide to filling out the W-9 form

Filling out the W-9 form accurately is essential to avoid potential issues with IRS reporting. Here’s a step-by-step breakdown:

Personal information section

In this section, you will be required to provide your full name or the name of your business if applicable. Make sure the name matches the one on your tax return to avoid discrepancies. Additionally, include your complete address, which helps in establishing your location for tax purposes.

Tax classification

You will need to indicate your tax classification on the W-9 form. This can be categorized as follows:

Taxpayer Identification Number (TIN)

Your TIN is critical for identifying your tax status. Indicate whether you are providing your Social Security Number (SSN) or your Employer Identification Number (EIN). Individuals typically use their SSN, while businesses are required to use their EIN to ensure accurate tax reporting.

Certification signature

Signing the form is a certification that the information provided is accurate. The signature must be your legal signature, and it should not be missing from the form. This step is imperative, as it verifies that you understand your tax obligations and the consequences of failing to provide accurate information.

Using the W-9 form for different scenarios

The W-9 form serves different purposes depending on who is conducting the business or financial transaction. Here are a few scenarios:

Independent contractors and freelancers

If you work as an independent contractor or freelancer, you are likely required to submit a W-9 to businesses that hire you. This form allows them to report the payments made to you during the year for tax purposes, usually on a 1099 form. It's important to submit a W-9 promptly to ensure that your income is reported correctly.

Financial institutions

Banks and financial institutions may request a W-9 form when you open an account, apply for loans, or participate in certain financial transactions. Having your TIN on file helps financial institutions match their records with IRS documentation and ensures accurate reporting of interest or dividends.

Employers

As an employer, you may request W-9 forms from contractors, freelancers, and vendors. Ensuring you have this information on file allows for correct tax reporting at the end of the year, especially when preparing 1099 forms for independent contractors.

Managing your W-9 form: Tips and best practices

Once you’ve filled out your W-9 form, proper management of this sensitive information is crucial.

Storing your W-9 form securely

Secure digital storage tools, such as pdfFiller, provide a safe environment for your W-9 forms. Using cloud-based solutions allows you to access your documents from anywhere while ensuring the security and privacy of your sensitive information.

When to update your W-9

You should update your W-9 form whenever there are significant changes to your personal information—such as a change of address—or a shift in your tax classification, such as transitioning from a sole proprietor to an LLC. Failing to do so could lead to discrepancies in reporting.

Dealing with common errors

Common errors in filling out a W-9 can include misspellings, incorrect TINs, or failing to sign. It's essential to review your form thoroughly before submission. If you discover mistakes after submission, you can simply fill out a new W-9 with the correct information and resubmit it.

Filing and submitting your W-9 form

Once the W-9 form is completed, you have various submission methods available. Understanding the best way to submit it can streamline the process.

Submission methods

You can submit the W-9 form in several ways, including:

Regardless of the method of submission, ensure accuracy to facilitate proper processing and reporting by the receiving entity.

Records retention

It's advisable to keep the W-9 form on file as long as you're engaged in a business relationship with the requester. Retaining a copy for your records also provides a point of reference when filing your taxes, especially if discrepancies arise.

Deadlines and compliance considerations

While the W-9 form itself does not have a direct submission deadline, it is essential to complete and submit it before the payer issues a 1099 form for the year. Understanding IRS requirements related to the W-9 helps ensure compliance and smooth tax filings.

Common questions and concerns regarding the W-9 form

Many individuals have questions about the W-9 form, especially during tax season. Here are some frequently asked questions:

FAQs about filling out the W-9

Some individuals may be unsure about what to include in certain sections of the form, especially the tax classification or what TIN to provide. It’s essential to clarify these points to avoid potential taxation issues.

Understanding backup withholdings

Backup withholding is a tax withholding requirement imposed by the IRS when payers cannot verify the payee's TIN. If a W-9 form isn’t provided or if the TIN doesn't match IRS records, the payer is obligated to withhold a percentage of payments to the payee and remit it to the IRS.

To prevent issues with backup withholding, ensure that the information provided on your W-9 form is accurate and up-to-date. Taking proactive steps can help avoid unnecessary withholding.

Exploring related forms and resources

In addition to the W-9 form, several related tax forms exist that may be relevant, such as the 1099-MISC or 1099-NEC, which report different types of income and may require supplemental documentation.

For more information, always refer to IRS resources, which provide guidelines for filling out various tax forms correctly, including the W-9.

Advanced scenarios involving the W-9 form

Certain complex situations may arise in relation to the W-9 form, especially when different entities are involved in a business arrangement. Business partners, for instance, might have unique needs for documenting their financial transactions. Similarly, international partnerships may require additional considerations regarding taxation and compliance with W-9 standards.

Appendix

Below is a sample completed W-9 form and a glossary of relevant terms to assist you in understanding tax classifications and definitions pertinent to the W-9 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the w-9 in Gmail?

How do I edit w-9 on an iOS device?

How can I fill out w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.