Get the free Part-200-t

Get, Create, Make and Sign part-200-t

How to edit part-200-t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out part-200-t

How to fill out part-200-t

Who needs part-200-t?

A Comprehensive Guide to the PART-200-T Form

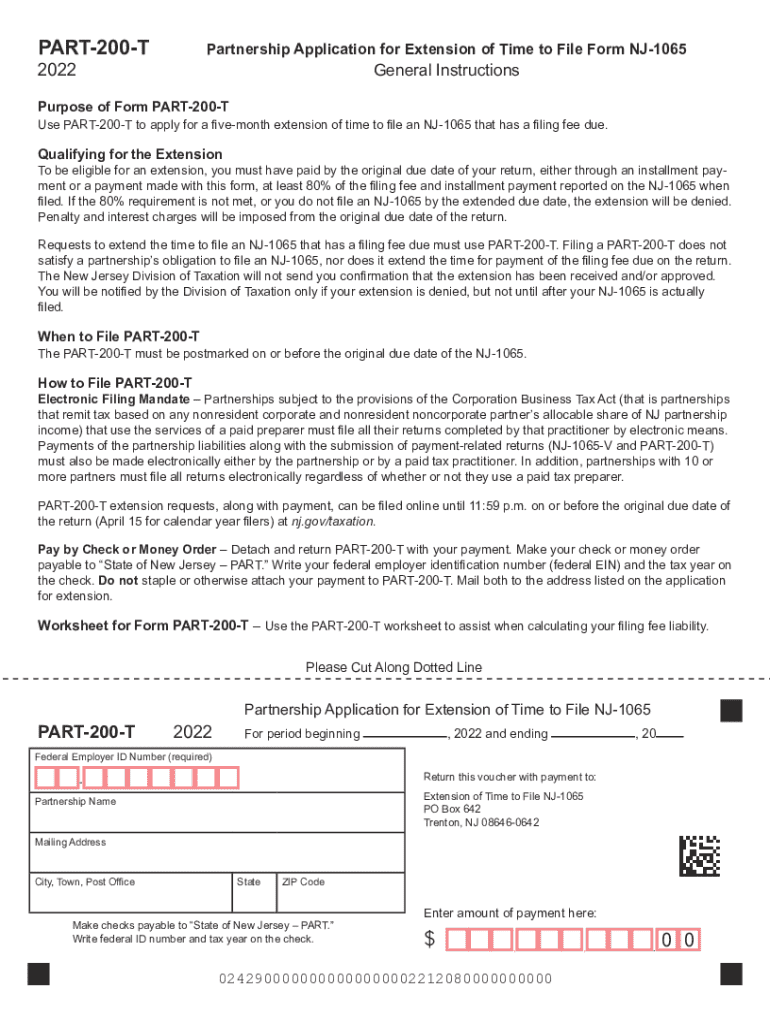

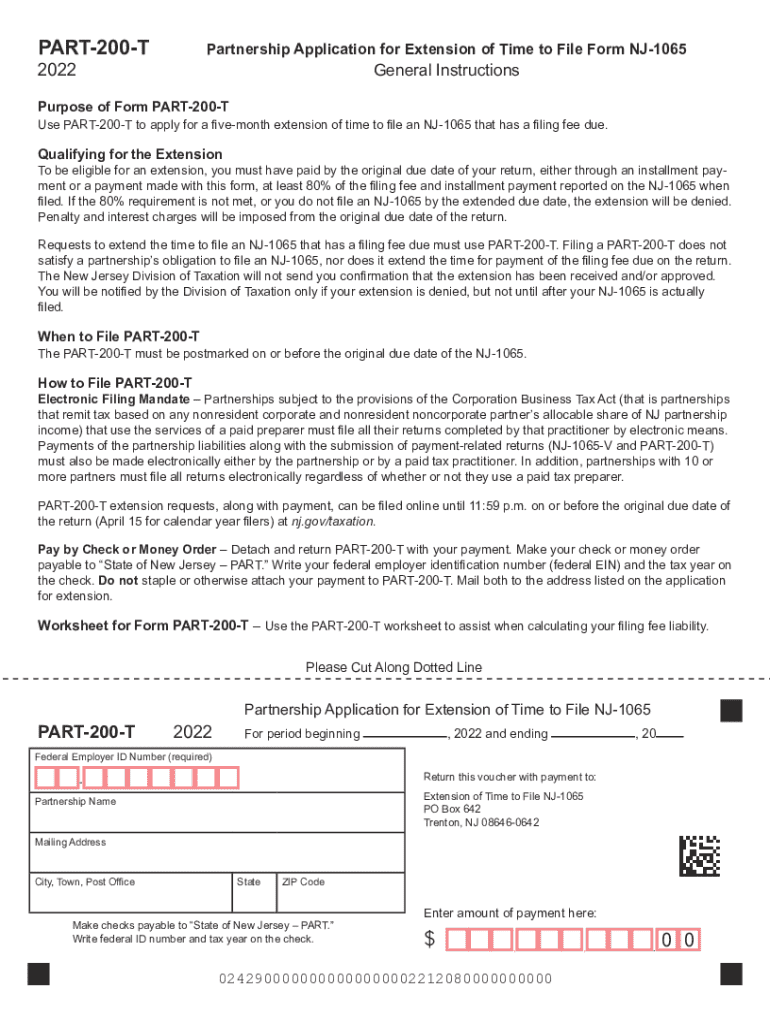

Understanding the PART-200-T form: Overview and significance

The PART-200-T form is a specialized document frequently utilized in specific sectors to facilitate compliance with regulatory requirements. Its structure is designed to collect essential information pertinent to the entities involved. Industries such as finance, healthcare, and manufacturing often require this form to ensure proper documentation of transactions, maintain audit trails, or comply with federal regulations.

This form serves as a critical link between businesses and regulatory authorities, underscoring its importance in effective data management and compliance. Whether you’re an entrepreneur or a corporate administrator, understanding who needs to use the PART-200-T form can help streamline your operational workflows and avoid potential compliance pitfalls.

Key features of the PART-200-T form

One of the primary advantages of using the PART-200-T form through pdfFiller is the interactive elements available that simplify the completion process. These elements allow users to fill in data seamlessly and efficiently, thereby minimizing errors. Editable fields, such as text boxes and drop-down menus, provide flexibility in customization, enabling users to tailor the form to their specific needs.

Additionally, the PART-200-T form is designed to be compatible with a variety of devices and platforms, allowing users to access and manage their documents from anywhere. This ensures that individuals and teams can work collaboratively or independently, regardless of their location.

Detailed instructions for completing the PART-200-T form

Filling out the PART-200-T form can seem daunting, but adhering to a structured approach simplifies the process. Start by gathering all necessary information, including relevant identification numbers, transaction details, and other specific data points of interest. Each section of the form is critical, and it’s crucial to read through the guidelines provided to ensure successful completion.

Once you’ve gathered the information, proceed to fill out the form diligently. Pay particular attention to sections that require precise inputs. After completing the form, review it thoroughly to catch any mistakes. Common errors include transposed digits or missed sections, which can lead to delays in processing.

Editing and managing the PART-200-T form on pdfFiller

Uploading your PART-200-T form to pdfFiller is a simple process. Navigate to the pdfFiller platform, and select the upload option. Once uploaded, users will have access to an array of editing tools designed to enhance the document. You can modify text, adjust formatting, and add annotations, ensuring the form meets personalized criteria.

After editing, save your changes to maintain an updated version of the document. pdfFiller allows easy sharing options, enabling users to distribute the completed form via email or through secure links.

eSigning the PART-200-T form

The eSigning process on pdfFiller is straightforward. To add a signature to the PART-200-T form, navigate to the signature field and select the option to create or upload a signature. This digital signing facility eliminates the need for physical signatures, streamlining the overall efficiency.

For situations requiring multiple signatories, pdfFiller supports collaborative features. This means that once a document is in progress, other stakeholders can be invited to sign, ensuring that everyone involved in the process can contribute without unnecessary delays.

Filing the PART-200-T form: what you need to know

Filing the PART-200-T form is a critical step in the process. Depending on your profession or industry, it may need to be submitted to specific agencies. It's important to familiarize yourself with the submission guidelines and available filing methods, whether online, via mail, or in person.

Timing is crucial. Be aware of the deadlines for submission, as late filings can lead to penalties or compliance issues. After submission, confirm receipt with the agency to ensure your form is processed in a timely manner.

FAQs about the PART-200-T form

Questions about the PART-200-T form often arise post-submission. One common concern is what steps to take if you realize there’s a mistake after filing. In such cases, promptly contact the relevant agency to clarify your options for correction.

Additionally, users may wonder about possible fees associated with filing the PART-200-T form. Typically, nonprofit submissions are free, but check your local guidelines to be certain. pdfFiller offers unparalleled support for inquiries around this form, ensuring that users have quick access to the information they need.

Utilizing pdfFiller's complete solution for informed form management

pdfFiller stands out as a comprehensive solution for managing the PART-200-T form with efficiency and ease. Compared to traditional document methods, using pdfFiller streamlines the workflow, reduces time spent on forms, and minimizes errors often associated with paper. Users can efficiently access customer support for any inquiries pertaining to the PART-200-T, ensuring that assistance is available at every step.

Success stories abound as users have reported significant enhancements in their form-filling experiences. The ability to edit, eSign, and manage documents online has transformed tedious tasks into straightforward workflows. Take advantage of pdfFiller’s full capabilities to experience these benefits firsthand.

Integrating the PART-200-T form into your workflow

Integrating the PART-200-T form into your organizational workflow can enhance team efficiency significantly. Establish clear protocols for document handling within teams, ensuring everyone knows their responsibilities in the process. Best practices include not only organized storage but also assigning roles for different stages of form completion and submission.

Additionally, using analytics provided by pdfFiller can be incredibly beneficial. Tracking the usage and status of the PART-200-T form allows for effective monitoring and adjustment of workflows to optimize future submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit part-200-t online?

How can I edit part-200-t on a smartphone?

Can I edit part-200-t on an iOS device?

What is part-200-t?

Who is required to file part-200-t?

How to fill out part-200-t?

What is the purpose of part-200-t?

What information must be reported on part-200-t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.