Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

Comprehensive Guide to the W-9 Form

Understanding the W-9 form

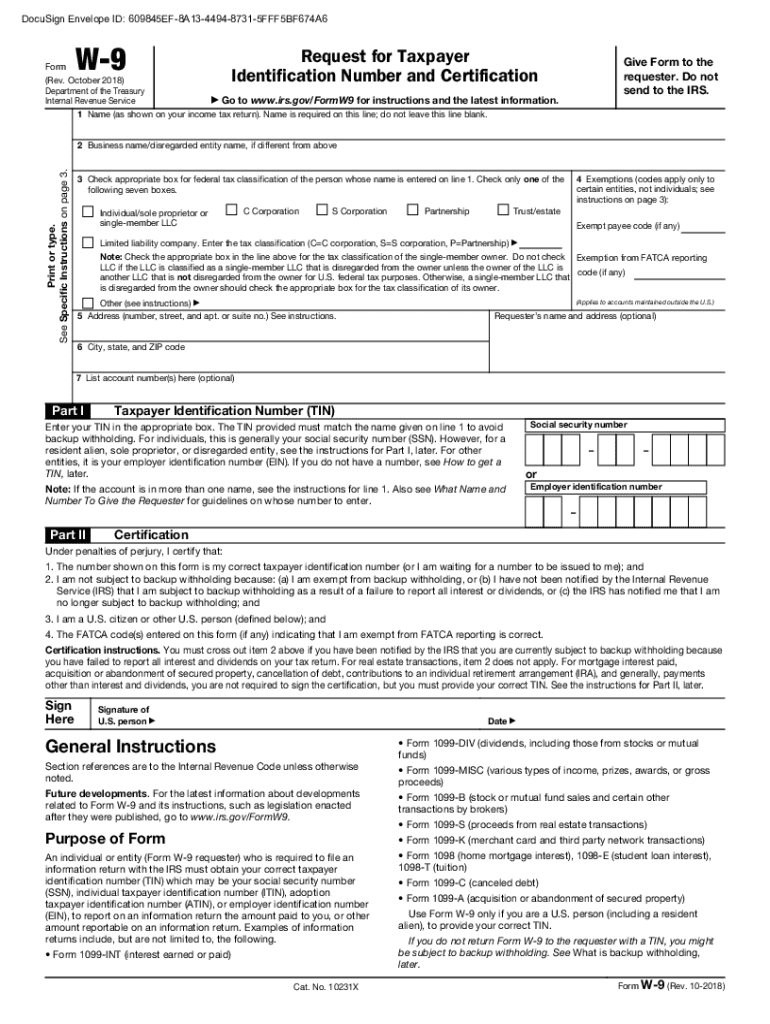

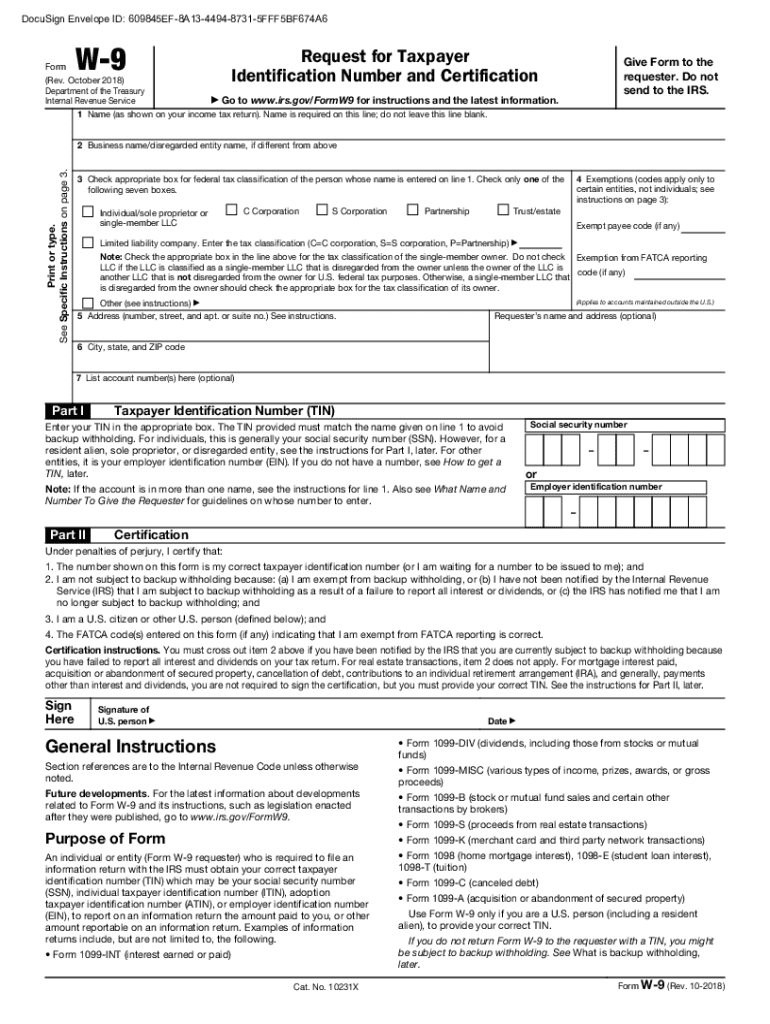

The W-9 form, officially designated as the 'Request for Taxpayer Identification Number and Certification', is a crucial document used primarily in the United States. It serves to formally request the Taxpayer Identification Number (TIN) of an individual or entity and certifies that the TIN provided is correct. The form is essential for tax reporting purposes for various types of income, establishing a clear line of documentation for the IRS.

For both individuals and businesses, the W-9 form plays a vital role. Businesses often rely on it to collect necessary information from independent contractors and freelancers, ensuring they have accurate data for reporting payments made to these individuals. For the issuers—contractors themselves—the W-9 allows them to document their tax identification correctly, helping them avoid issues when the IRS evaluates tax filings.

Step-by-step guide to filling out the W-9 form

Filling out a W-9 form may seem daunting, but with a clear understanding of each section, it can be a straightforward task. This guide will break down each part to facilitate ease of completion.

Personal information section

The top portion of the W-9 form requires your personal information. Start by clearly stating your name as it appears on your tax documents. If you operate under a business name, include that in the appropriate field.

Next, provide your current address. Ensure it’s up-to-date as the IRS will use this address for correspondence. If you reside in a state that has tax implications or requires specific local nuances, such as California or New York, be particularly attentive to this detail.

Tax classification

In this section, you need to select your tax classification. This is crucial for both your personal records and for businesses that need to classify you correctly for tax reporting. Typical classifications include:

Taxpayer Identification Number (TIN)

In this crucial step, you will provide your TIN. This might be either your social security number (SSN) or employer identification number (EIN). Freelancers typically use SSNs, while businesses will register under EINs. Accuracy here is imperative, as this number directly relates to your tax filings.

Certification signature

Lastly, you must sign the W-9 form, certifying the accuracy of the information you provided. The signature signifies that you understand the implications, especially regarding backup withholding. It’s essential to lag no steps in this process, as incorrect certification may lead to complications with the IRS.

Using the W-9 form for different scenarios

The utility of the W-9 form extends beyond just freelancers or sole proprietors. Various scenarios require its use to streamline would-be complicated tax reporting. Each arises from the unique dynamics of working relationships, business structures, or financial activities.

Independent contractors and freelancers

As an independent contractor or freelancer, you will be asked to submit a W-9 form when you start working with a new client. This form enables the client to report the payments they provide to you at the end of the year. Not submitting the W-9 can lead to delayed payments or additional tax withholdings, which can impede cash flow.

Financial institutions

Financial institutions also use the W-9 form during banking transactions. When you open a new account or apply for loans, banks often require a completed W-9 to validate your identity and TIN. This is key for avoiding any inconsistencies during the tax reporting process.

Employers

Employers who hire independent contractors or freelancers are responsible for obtaining completed W-9 forms to report income accurately. It helps them maintain transparency and compliance with IRS regulations, ensuring that they won't encounter issues during audits or when completing payroll taxes.

Managing your W-9 form: tips and best practices

Managing your W-9 form is more than just filling it out correctly; it involves securely storing, updating, and ensuring accuracy in your submissions. Here are some recommended practices that will save you from potential tax complications.

Storing your W-9 form securely

As this form contains sensitive identification data, it’s crucial to store your W-9 securely. Digital storage solutions, such as encrypted cloud services or secure document management software like pdfFiller, can provide easy access while ensuring your information remains protected against unauthorized access.

When to update your W-9

Timely updates to your W-9 form are vital whenever there’s a change in your personal information or tax classification. If you change your name, business structure, or address, you should submit an updated W-9 to all relevant parties. Being proactive ensures that your tax reporting remains seamless and uninterrupted.

Dealing with common errors

Avoiding mistakes is essential when it comes to your W-9. Common errors include incorrect TINs, outdated addresses, or misclassification of tax status. If you notice an error on a submitted W-9, promptly notify the requester and provide a corrected version. Keeping clear records of your submissions will aid in making necessary amendments expediently.

Filing and submitting your W-9 form

Once completed, the W-9 form doesn't get submitted directly to the IRS; instead, it’s provided to the individual or organization requesting it. However, following proper submission methods is important to ensure your information is received accurately and securely.

Submission methods

Your submission options include:

Records retention

Ensure to keep copies of your W-9 forms and any correspondence related to them. A good practice is retaining these documents for at least four years past your last tax filing, as this timeframe aligns with IRS audit guidelines. Having records allows you to respond to inquiries or issues promptly.

Deadlines and compliance considerations

While the W-9 itself doesn’t have a formal submission deadline, submitting it promptly when requested is critical. Delays in providing this form could lead to backup withholding on payments you receive. Ensure you are aware of the deadlines set by the requester to avoid complications.

It's also worthwhile to familiarize yourself with IRS regulations surrounding the W-9 to remain compliant and avoid penalties. The IRS provides resources that clarify the expectations and responsibilities related to the W-9.

Common questions and concerns regarding the W-9 form

Many individuals have questions when it comes to filling out the W-9 form, as misconceptions can lead to mistakes. Addressing these concerns can save you time and reduce uncertainty.

Understanding backup withholdings

Backup withholding is a term used when payers must withhold a certain percentage of payments to a payee. This commonly arises if the payee fails to provide the correct TIN or if they have been notified by the IRS regarding issues with their account.

If you submit your W-9 form correctly, you can usually avoid backup withholdings altogether. Communicate proactively with your payer regarding any issues with your TIN, and resolve them as swiftly as possible to prevent unnecessary financial complications.

Exploring related forms and resources

The W-9 form interacts with several related tax forms and processes. Understanding these forms enhances your ability to navigate tax obligations efficiently. Other forms you might run into include:

To access forms and further guidance, refer to the IRS website, where you can also find detailed instructions on filling and submitting specific documents.

Advanced scenarios involving the W-9 form

Advanced scenarios can arise with the W-9 form, particularly when dealing with varied types of partnerships or international partnerships. For example, complexities can occur in classifying partnerships that include foreign partners or when multiple entities participate in specific business ventures.

It's crucial to consult with a tax professional familiar with multi-entity structures or international tax compliance if you find yourself in such situations. They can guide you through filling out the correct forms for your circumstances, ensuring compliance with both federal and state laws.

Appendix

In our appendix, you'll find a sample completed W-9 form that illustrates how to accurately fill out each section according to the guidelines discussed in this guide. In addition, we provide a glossary of relevant terms to further clarify the critical aspects of the W-9 process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify w-9 without leaving Google Drive?

How do I make changes in w-9?

Can I sign the w-9 electronically in Chrome?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.