Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form: A Complete How-to Guide

Understanding the W-9 form

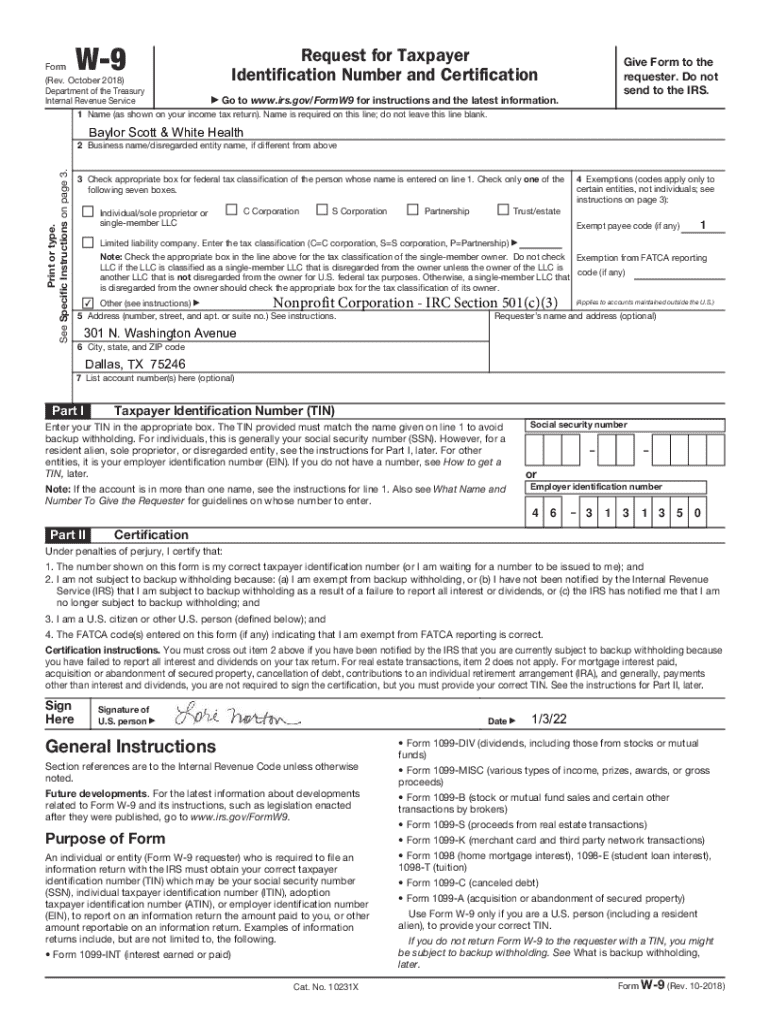

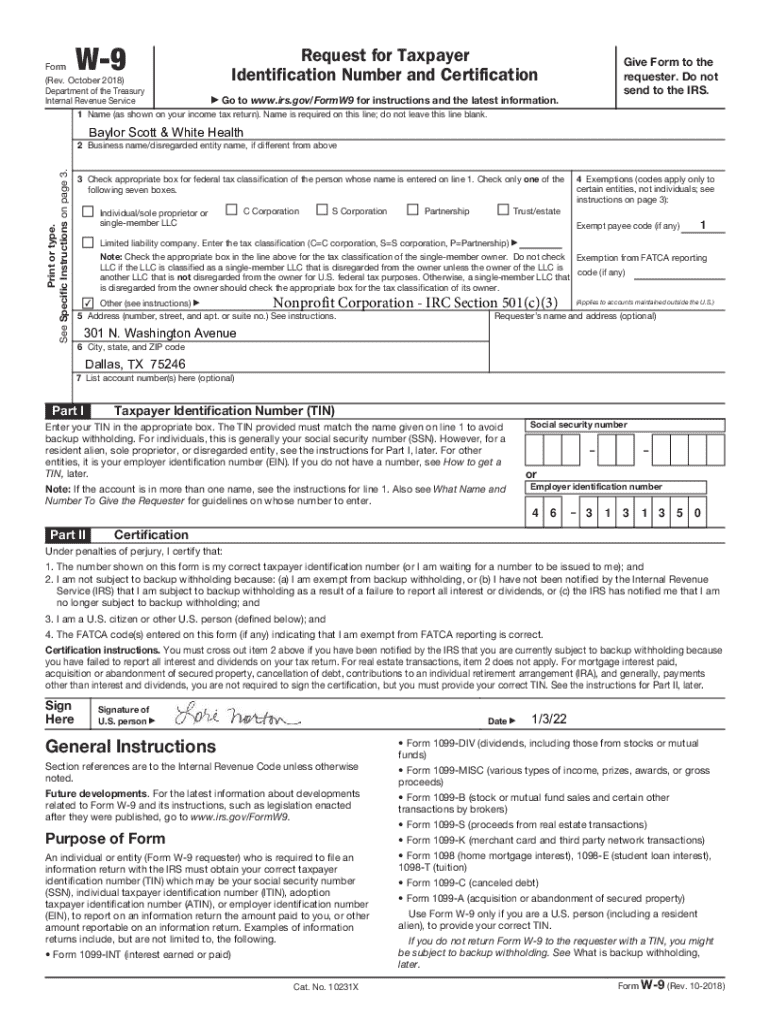

The W-9 form is a pivotal document in the realm of tax reporting, primarily used in the United States. Designed by the IRS, it serves to collect essential information from individuals and businesses so that the income can be accurately reported by payers to the IRS.

Its primary purpose is to provide the correct taxpayer identification number (TIN) that helps ensure the right tax identification during the reporting process. When clients or companies hire independent contractors, freelancers, or even other businesses, they often require the completion of a W-9 form to meet compliance standards.

Detailed breakdown of the W-9 form fields

Filling out the W-9 correctly is crucial. The form consists of several fields that require attention to detail. Starting with the 'Name' section, individuals are required to input their legal name as it appears on their tax return. If conducting business under a different name, you must include that as well.

The next critical section is the Taxpayer Identification Number (TIN), which can either be a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses. It's essential to distinguish between these two, as the form intends to ensure the IRS correctly identifies the taxpayer.

Address information must be accurate to ensure that all communications are directed correctly. Finally, the form culminates in a certification signature, where the signer affirms that the TIN provided is correct and that they are not subject to backup withholding.

Step-by-step instructions for filling out the W-9 form

Filling out a W-9 form may seem daunting, but with the right information, it becomes straightforward. Below is a comprehensive guide to ensure accuracy and completeness.

Modifying, signing, and managing your W-9 form with pdfFiller

Managing your W-9 form can also be streamlined using pdfFiller, a powerful tool that enables you to edit PDFs efficiently. Using pdfFiller, users can easily modify their forms and ensure accuracy before submission.

The eSigning process offered by pdfFiller simplifies the workflow, allowing users to sign documents quickly and securely without needing to print and scan. Once completed, the W-9 can be saved to your account, ensuring access across multiple devices and easy sharing with required parties.

pdfFiller also offers features for version control, meaning that updates to your W-9 can be managed seamlessly, ensuring that everyone has the latest version on hand at all times.

Common use cases for the W-9 form

The W-9 form serves various purposes across different sectors. Primarily, it's useful in business-to-business transactions where one company hires another for services rendered. For freelancers and contractors, it's a standard requirement for most assignments to ensure that income is reported correctly.

Additionally, the W-9 is often required in real estate transactions, especially for landlords gathering information from tenants or independent contractors involved in property management. Understanding these use cases can help streamline operational procedures and ensure compliance.

Filing and submission guidelines for the W-9 form

Submitting your W-9 is as essential as filling it out correctly. Typically, the completed W-9 form is sent directly to the party who requested it, whether that be a client, business partner, or financial institution.

When working with multiple clients, you don’t need to submit a new W-9 for each client, unless your information changes. It's wise to keep track of your submissions for your records, especially in case of discrepancies during tax reporting.

Legal considerations and compliance

Understanding the legal implications of the W-9 form is crucial for compliance with IRS regulations. Incorrect information can lead to consequences such as delayed payments or even penalties during tax filing.

It's essential to ensure that your information is not only correct but also submitted timely. Compliance with IRS guidelines can safeguard you from potential audits or issues with tax returns due to discrepancies.

Avoiding common mistakes when submitting the W-9 form

When submitting your W-9, certain errors can disrupt the process. Common mistakes include providing an incorrect TIN, failing to sign and date the form, or submitting an outdated version.

To avoid these pitfalls, double-check all your information before submission and utilize the features in pdfFiller that can assist with reducing mistakes, such as auto-filling and validation checks.

Related tax forms and resources

While the W-9 form is crucial for independent contractors, it often works in conjunction with other forms, like the 1099-MISC. This document is typically issued to report payments made to contractors. Understanding these related forms can provide additional clarity during tax season.

For comprehensive tax preparation guide, it’s helpful to refer to official IRS resources that can assist with various aspects of filing tax returns and provide additional insights into required documentation.

Frequently asked questions (FAQs) about the W-9 form

A common inquiry regarding the W-9 forms pertains to its validity period. A W-9 does not expire in a traditional sense; it remains valid as long as the information provided is accurate and unchanged. However, it’s wise to review your W-9 for updates if you change your name, business structure, or tax identification number.

If you find yourself without a TIN, it’s essential to apply for one as the W-9 requires a valid TIN to be complete. If you are in a situation where you’re awaiting a TIN, communicate with the requester to discuss alternative solutions.

Additional insights on business relationships and tax implications

Navigating business relationships requires an understanding of tax implications, especially for contractors and freelancers. The W-9 form also impacts how businesses manage payroll and tax withholding responsibilities. Having clear contracts and documentation helps clarify roles and minimize tax confusion.

Additionally, when financial institutions require a W-9, they are often verifying the accurate ownership of accounts to ensure compliance with IRS regulations. It highlights how intertwined many business processes are with tax responsibilities, making the accuracy of the W-9 an essential aspect of financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-9 to be eSigned by others?

How can I get w-9?

Can I create an eSignature for the w-9 in Gmail?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.