Get the free One Time Credit Card Payment Authorization Form - Amazon S3

Get, Create, Make and Sign one time credit card

Editing one time credit card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out one time credit card

How to fill out one time credit card

Who needs one time credit card?

One Time Credit Card Form: A Comprehensive How-To Guide

Understanding one time credit card forms

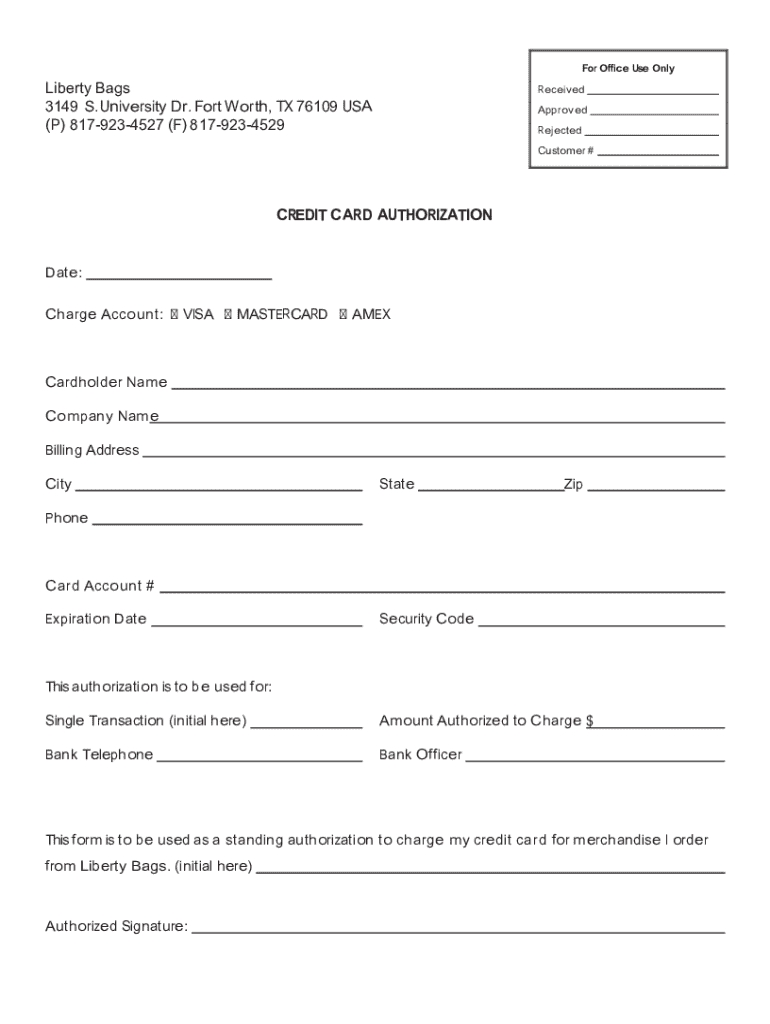

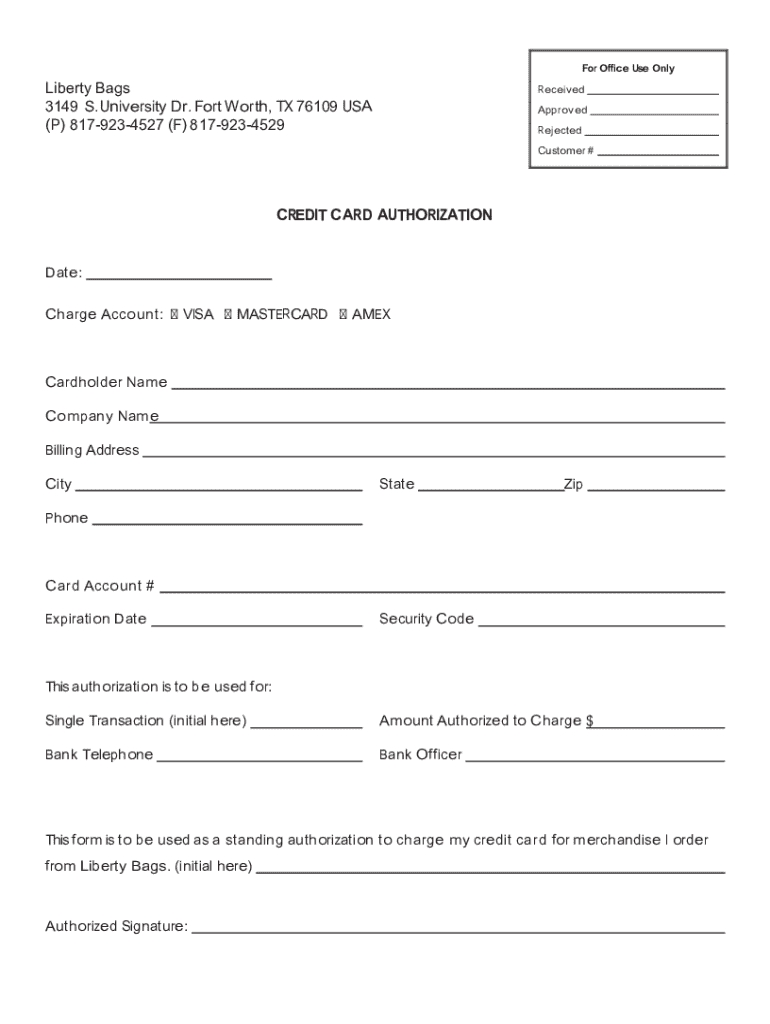

A one time credit card form is a specific document designed to facilitate single transactions via credit card payments. Its primary purpose is to enable businesses to accept payments from customers without the need for recurring billing, making it particularly useful for one-off purchases, services, or donations. This contrasts sharply with recurring payment forms, which are set up for ongoing transactions and require authorization for future charges.

Key features of one time credit card forms include a focus on security and user experience. Security features often encompass data encryption, secure connections, and compliance with payment processing regulations. The form's design is intentionally kept clear and simple, ensuring that users can complete their transactions quickly and with minimal confusion.

Importance of one time credit card forms

For merchants, adopting one time credit card forms offers significant advantages. They help reduce chargeback risks, which can occur when a customer disputes a transaction. A well-structured form allows for clear documentation of consent and transaction details, thereby protecting the merchant from potential fraud claims. Moreover, one time forms streamline transaction processes, leading to faster payment collection and improved cash flow.

Customers, too, find one time credit card forms beneficial. They provide enhanced security and privacy since the customer is not required to store any payment information for future transactions. This convenience allows customers to make quick purchases without the need to create accounts or share sensitive data repeatedly.

How to create a one time credit card form

Creating a one time credit card form can be accomplished in a few essential steps. The first step involves choosing a platform that specializes in form creation. For example, pdfFiller stands out with its user-friendly interface and robust features tailored specifically for document management. Opting for a cloud-based platform allows users to access, edit, and save their forms from anywhere, ensuring that they can operate seamlessly.

The second step is selecting a template. pdfFiller offers several templates for one time credit card forms that can be further customized to align with specific business needs. Customization options range from branding the form with logos to adjusting fields based on the type of transaction.

Next, fill in the necessary information. Common required fields include the name on the card, card number, expiration date, and CVV code. Optional fields might encompass a billing address or customer notes to improve transactional context. Once completed, the form can then be sent for electronic signature, which can be easily accomplished through pdfFiller’s e-sign feature, facilitating quick approvals and secure transactions.

How to use one time credit card forms in transactions

Using one time credit card forms for transactions involves a straightforward, step-by-step guide for merchants. Initially, the merchant initiates a transaction by sharing the one time credit card form with the customer. Encouraging customers to carefully review and ensure that all provided details are correct is crucial for minimizing errors and preventing payment issues.

Enhancing security during payment processing is another key aspect. Merchants can utilize pdfFiller’s security features, which include encrypted connections to safeguard sensitive information. Furthermore, pdfFiller provides collaboration tools, allowing team members to manage and track their documents efficiently, keeping an organized record of all transactions.

Best practices for handling one time credit card forms

To effectively manage one time credit card forms, implementing robust security measures is essential. Data encryption and secure storage should be prioritized to protect customer information. Additionally, ensuring that transactions include a CVV verification step can significantly reduce unauthorized use. It's also important to verify signatures where applicable, enhancing proof of consent.

Compliance with legal regulations, such as PCI compliance, is another crucial factor. Merchants must be aware of data handling regulations and ensure they follow best practices for retaining signed forms. Typically, it's recommended to maintain signed forms for at least a certain period, often ranging from a few months to years, depending on industry standards.

Common questions and FAQs

When crafting a one time credit card form, it's essential to include vital information such as the cardholder's name, card number, expiration date, and CVV. Merchants may wonder whether these forms can prevent chargeback disputes. While they can strengthen the case against chargebacks, it's prudent to couple them with comprehensive transaction documentation.

Ensuring the security of customer credit card information can be enhanced by utilizing secure platforms like pdfFiller for form creation and management. Finally, in the event that a transaction fails or is disputed, having clear, documented records from the one time credit card form can facilitate smoother resolution processes.

Real-life applications and case studies

Many businesses have successfully implemented one time credit card forms to streamline their payment processes. For instance, a local nonprofit adopted pdfFiller’s solutions for its fundraising efforts. By utilizing one time forms, they experienced a notable increase in donation processing speed and improved record-keeping.

Similarly, a small business offering seasonal services reported enhanced customer trust and reduced payment disputes after transitioning to one time credit card forms. The ease of use and secure environment provided by pdfFiller played a pivotal role in these advancements.

Tips for optimizing your use of one time credit card forms

To maximize the efficacy of one time credit card forms, coordinating closely with customer service is essential. By keeping customer service informed about the common issues faced during transactions, businesses can resolve problems promptly and enhance customer satisfaction.

Leveraging analytics can also provide insight into transaction success rates and customer behavior. Gathering feedback through customer surveys can further help refine the form's design and functionality, fostering an even smoother payment experience.

Related topics for further exploration

For businesses considering transition strategies, exploring digital payment solutions can lead to substantial advantages. Investigating other document templates available on pdfFiller will also reveal additional tools that can streamline overall operations. Moreover, integrating one time forms with CRM systems can enhance customer relationships and data management capabilities.

Additional features of pdfFiller

pdfFiller is more than just a tool for creating one time credit card forms; it is an all-in-one platform that facilitates eSigning, document management, and collaboration features. Users can seamlessly edit PDFs, ensuring that all documents remain current and professionally formatted. Additionally, its user-friendly interface and accessible cloud-based features make it a leading choice for individuals and teams needing comprehensive document solutions.

Choosing pdfFiller over other platforms for form creation and management allows businesses to streamline their entire documentation process, ensuring efficiency and security at every step of the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get one time credit card?

How do I edit one time credit card online?

How do I fill out one time credit card using my mobile device?

What is one time credit card?

Who is required to file one time credit card?

How to fill out one time credit card?

What is the purpose of one time credit card?

What information must be reported on one time credit card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.