Get the free Credit Card Authorization Form - LIMOCORP OF NEW YORK, LLC - Google Docs

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

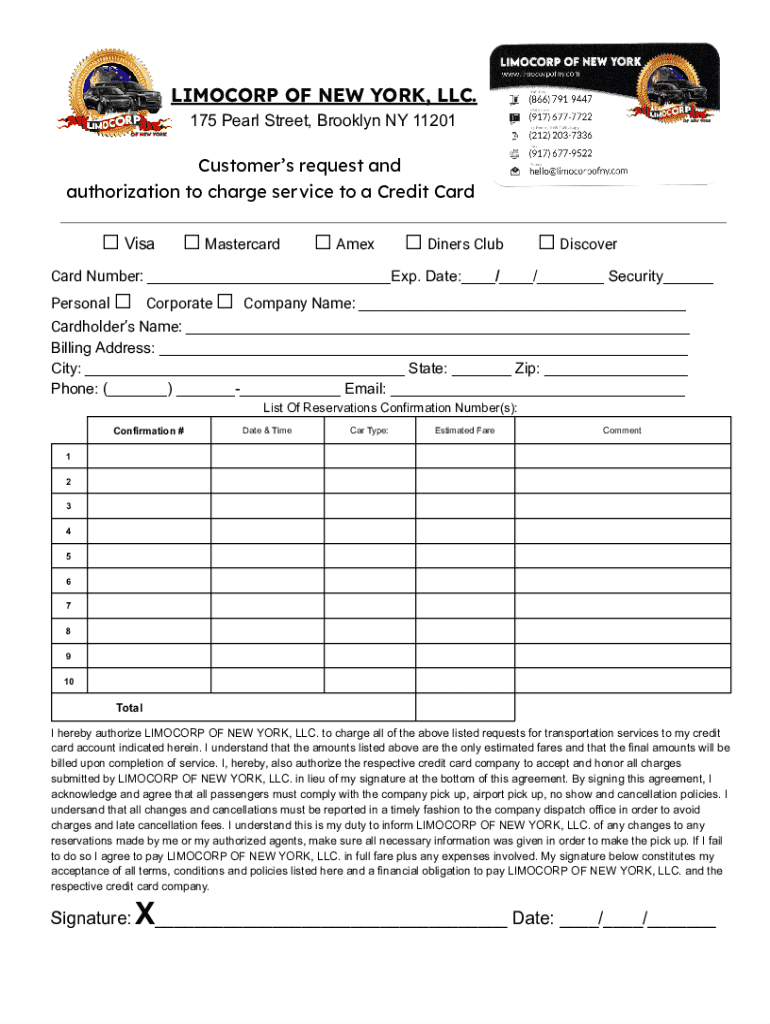

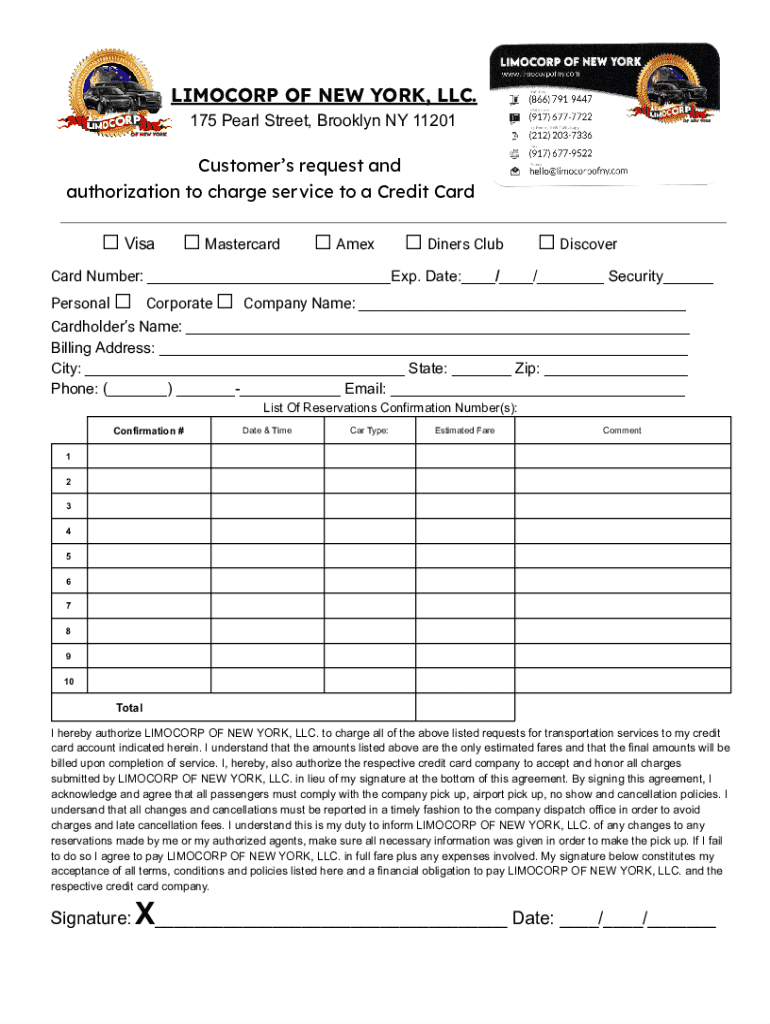

Understanding the Credit Card Authorization Form

Understanding the credit card authorization form

A credit card authorization form is a critical document that allows businesses to charge a customer’s credit card for services rendered or products sold. This form serves as a legal agreement between the customer and the merchant, providing explicit permission for the business to charge the specified amount to the customer’s credit card. By using this form, businesses can ensure that they have the necessary consent to process payments securely.

The use of credit card authorization forms has become increasingly common as credit card fraud rises. They help to streamline payment processing while also protecting the interests of both parties. A well-drafted authorization form can facilitate smoother transactions and significantly reduce the risk of chargebacks, giving businesses a better chance at maintaining cash flow.

Benefits of using a credit card authorization form

Defending against chargeback abuse is one of the most significant advantages of incorporating a credit card authorization form into your payment process. When customers submit authorization forms, they acknowledge their agreement to the charges, which can help businesses contest any unwarranted claims filed by customers regarding unauthorized transactions.

Establishing clear payment terms can enhance customer relations as well. The form sets the groundwork for what customers can expect from the transaction process, thus ensuring transparency. This transparency reduces confusion and helps prevent disputes, cultivating a trusting customer experience.

Moreover, by clearly documenting payment agreements and obtaining customer signatures, businesses can improve their overall security measures. This reduces the risks of fraudulent transactions, as customers must confirm their purchases before charges are applied to their credit cards.

Businesses can also leverage these forms to streamline payment processes. By implementing a standardized credit card authorization form, companies can speed up transactions and improve efficiency in order processing, making the customer experience smoother overall.

Legal considerations

Using credit card authorization forms may not be legally obligatory in every transaction, but they are highly recommended for certain types of businesses, especially those that require ongoing payments or fee structures. For example, subscription services directly benefit from having a credit card on file for auto-renewal transactions.

Compliance with Payment Card Industry Standards (PCI DSS) is crucial for any organization that handles credit card payments. These security standards exist to protect legitimate transactions from fraud. Using a credit card authorization form properly aligns with these regulations, demonstrating your commitment to secure payment processing.

Additionally, legal considerations can vary by jurisdiction. A business must understand local regulations regarding consumer data protection, as well as any other applicable financial regulations. Being aware of these nuances can prevent potential legal complications.

How to create a credit card authorization form

Creating a credit card authorization form is a straightforward process. By following these steps, businesses can draft an effective form suited to their needs.

While customizing your form, consider making it user-friendly. A clear and uncluttered design can enhance customer confidence, further encouraging customers to submit their credit card information accurately.

Storing and managing credit card authorization forms

Once you have successfully created a credit card authorization form, storing it securely is paramount. Best practices include deciding between digital or physical copies. The digital format often allows for easier access and management, while physical documents require more secure storage solutions.

Secure cloud storage options can be an excellent choice for businesses, as they offer redundancy and accessibility. Ensure that sensitive information is encrypted and that only authorized personnel have access to customer payment details.

As for data retention, follow industry guidance on how long you should keep signed forms. A general rule suggests maintaining records for at least three years to comply with financial regulations, but always stay informed about specific local regulations. Prioritizing data privacy and securing customer information should be at the forefront of any credit card management process.

Frequently asked questions

Many customers wonder whether credit card authorization forms really help prevent chargeback abuse. The short answer is yes. By having documented consent, businesses are more prepared to contest chargebacks, reducing financial losses from fraudulent claims.

Another common query is about the term 'card on file.' This refers to a customer’s credit card information being stored securely for future transactions. Maintaining a card on file is particularly advantageous for services requiring ongoing payments, as it ensures seamless renewals or recurring transactions.

Finally, handling disputes regarding authorization forms is essential. It's recommended to keep thorough records of communications and any authorizations given. Such documentation can serve as vital evidence to resolve disputes swiftly.

Related payment processes and forms

The relevance of credit card authorization forms extends beyond simple transactions; they are part of greater payment processes. Businesses must also understand how to take card payments effectively over the phone, using secure methods to protect customer information.

Another concept worth noting is the card-not-present (CNP) transaction. These occur when card information is processed without the physical card being present, often incurring higher fees due to increased fraud risk. Understanding these different types of transactions and their associated costs is crucial for businesses.

Lastly, becoming familiar with payment gateways and their functions offers insight into how customer payment information is processed securely. This knowledge plays an important role in merchants' decision-making processes when choosing payment processing solutions.

Explore more solutions and resources

Many businesses can benefit from implementing credit card authorization forms, including e-commerce, subscription services, and any service provider engaging in repeat billing. Understanding how to utilize these forms simplifies payment processing and enhances customer satisfaction.

For further reading, check out related articles and guides on payment processing available on pdfFiller. These resources can provide businesses with insights into effective payment management and compliance best practices.

Additionally, innovative tools for document creation and management on pdfFiller can greatly enhance your business processes, simplifying the use of forms and improving efficiency.

Testimonials and success stories

Teams have reported significant improvements in efficiency and customer satisfaction after adopting pdfFiller. With streamlined processes and user-friendly templates, businesses can produce well-organized credit card authorization forms quickly and securely, reducing friction during transactions.

Real-life examples are plentiful, showcasing how implementing credit card authorization forms has helped mitigate payment risks effectively. Businesses that previously faced high chargeback rates have successfully lowered them through diligent use of these forms, fostering trust and integrity with their customer base.

Interactive tools

To make the process even easier, pdfFiller offers a credit card authorization form template that can be easily accessed and customized. This interactive tool streamlines the document creation process, ensuring all necessary details are captured.

For personalized assistance on document creation, take advantage of our live chat feature. Our support team is ready to help you customize your forms according to your business needs. Additionally, email support is available for any questions or specific customization requests you may have.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How do I make changes in credit card authorization form?

How do I complete credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.