Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Form

Understanding the credit card authorization form

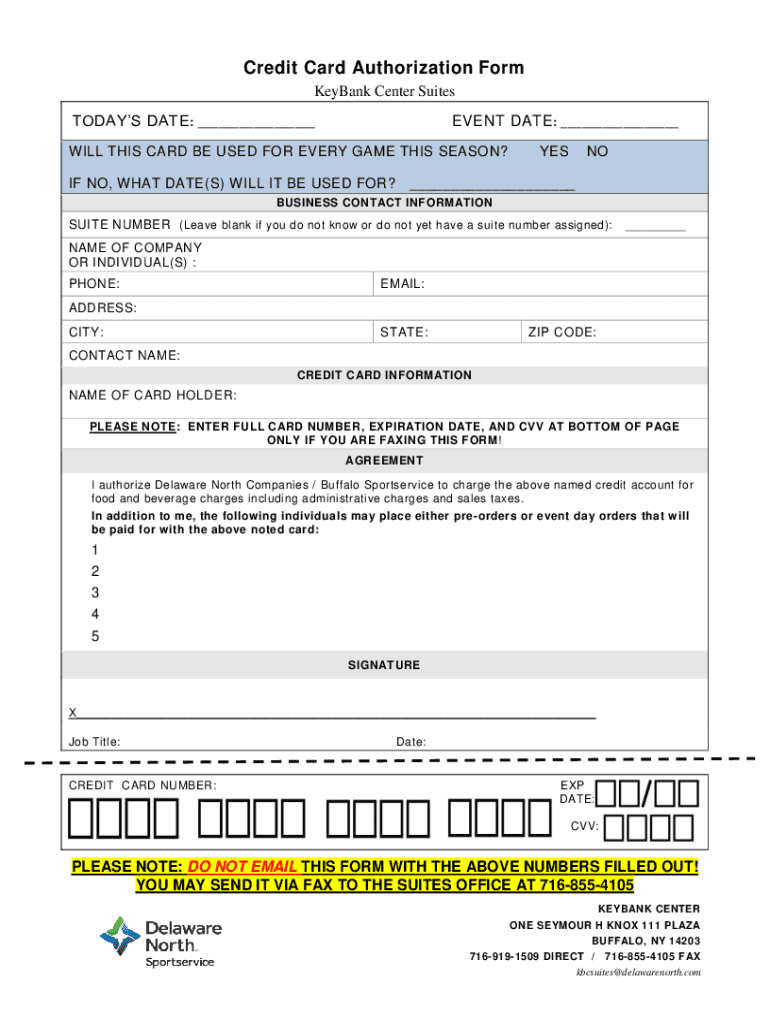

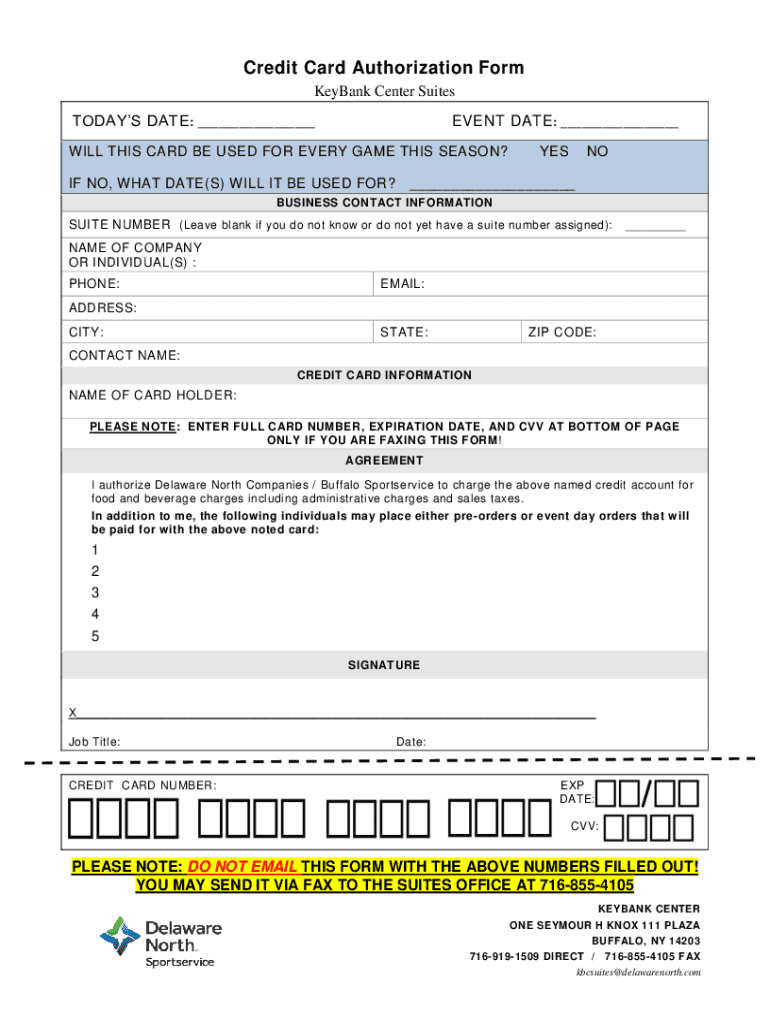

A credit card authorization form is a document that allows a business to charge a customer's credit card for services or goods provided. This form captures the necessary information to securely process a payment, ensuring both the merchant and customer are protected during the transaction.

Key components of a credit card authorization form usually include essential personal information, credit card details, and an authorization signature. Businesses typically require the following information: customer’s name, billing address, phone number, and email. For credit card details, it involves the card number, expiration date, CVV, and the cardholder's name. Finally, an authorization signature is crucial as it acts as consent for the transaction.

It is paramount to provide accurate information in the authorization form. Incorrect data can lead to failed transactions or disputes, resulting in chargebacks or loss of trust between the consumer and the business.

Benefits of using a credit card authorization form

Using a credit card authorization form offers multiple advantages to businesses. Primarily, it helps prevent chargeback abuse, as having signed consent from the cardholder confirms that the transaction is authorized. This can protect a business from losing revenue due to fraudulent claims.

Furthermore, the form establishes clear payment terms. It sets expectations between the customer and the merchant, ensuring all parties are on the same page regarding payment processes. It also enhances security and reduces fraud risks by collecting necessary details and maintaining a secure record.

Legal considerations

The legality of using credit card authorization forms varies by jurisdiction. While there's no blanket law requiring their use, many businesses choose to implement them for legal protection and to comply with financial regulations. Consumers appreciate the added layer of security, which fosters trust.

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is also crucial when handling credit card information. This guideline outlines best practices for securing card data to prevent theft and fraud.

Understanding regulations and laws in different jurisdictions is essential, especially if your business operates across state lines or internationally. Some countries have stricter guidelines for handling payment information, necessitating awareness and compliance.

How to create a credit card authorization form

Creating an effective credit card authorization form can be done efficiently with a structured approach. Follow this step-by-step guide to build your form:

Making your form user-friendly is vital to improving the customer experience. Consider using simple language, clear instructions, and adequately labeled fields to facilitate easy completion.

Storing and managing credit card authorization forms

Proper storage and management of credit card authorization forms are crucial for securing sensitive information. Best practices include determining whether to use digital or physical copies. Digital storage offers benefits like easier organization and accessibility, while physical copies may require secure filing systems.

Utilizing secure cloud storage options is recommended, as they often come with encryption and access controls that protect customer data. It's equally important to understand how long to keep signed forms. Generally, retaining them for a period of 3-5 years is advisable for financial records.

Always prioritize data privacy and protecting customer information by regularly reviewing your security policies and procedures.

Frequently asked questions

One common question is whether credit card authorization forms help prevent chargeback abuse. The answer is yes; the signed form serves as proof of authorization, aiding businesses in disputing chargebacks effectively.

Another important concept is 'Card on File.' It involves storing a customer's credit card information securely for future transactions, simplifying the payment process for recurring customers.

Handling disputes related to authorization forms must be done sensitively and promptly. Always review the form and the transaction details before responding, ensuring you have evidence to support your case.

Related payment processes and forms

Several payment processes are connected to the credit card authorization form. For example, learning how to take card payments over the phone is essential for businesses that provide services remotely. This requires additional security measures to protect sensitive information.

Understanding Card-Not-Present (CNP) transactions and their implications on fees is also critical. These transactions, where the card is not physically present, often incur higher processing charges due to increased risks of fraud. Additionally, knowing how payment gateways work can enhance your overall comprehension of the payment landscape.

Explore more solutions and resources

Various business types can significantly benefit from utilizing credit card authorization forms, especially those in the service and e-commerce industries. To further enhance knowledge, consider reading related articles and guides on effective payment processing practices.

Additionally, pdfFiller offers innovative tools for document creation and management, significantly facilitating the process of editing PDFs, eSigning, and collaboration for individuals and teams.

Testimonials and success stories

Numerous teams have reported improved efficiencies after adopting pdfFiller for managing credit card authorization forms. Real-life examples illustrate how having this form in place has successfully mitigated payment risks. Users have shared experiences of seamless transactions and significant reductions in fraud-related concerns.

Interactive tools

To assist in your credit card authorization form needs, explore our accessible templates available through pdfFiller. If you require personalized assistance, utilize our live chat service or email support for any questions or customization requests.

Engagement with these interactive tools simplifies the document creation process, ensuring you have everything set up correctly and are prepared for secure transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization form without leaving Google Drive?

How do I edit credit card authorization form straight from my smartphone?

How can I fill out credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.