Get the free Uep Credit Card Authorization

Get, Create, Make and Sign uep credit card authorization

How to edit uep credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uep credit card authorization

How to fill out uep credit card authorization

Who needs uep credit card authorization?

Comprehensive Guide to UEP Credit Card Authorization Forms

Overview of UEP credit card authorization forms

A UEP credit card authorization form is a crucial document used by businesses to obtain permission from a cardholder for processing credit card transactions. This form serves as a safeguard, ensuring transparency and trust between the service provider and the customer. The primary purpose of the authorization form is to legally authorize the payment for goods or services, helping to mitigate the risk of fraudulent charges.

In the realm of electronic payment processing, these forms play an essential role. They streamline transactions and provide a clear framework for both parties to follow, ultimately facilitating smoother financial interactions. UEP, or Universal Electronic Payment, authorization introduces standard practices to enhance efficiency and security in processing payments.

Why use a UEP credit card authorization form?

The advantages of utilizing a UEP credit card authorization form extend to individuals and teams, offering benefits that lead to more efficient transaction handling. Firstly, the form streamlines transactions by simplifying the authorization process; businesses can quickly and securely obtain the necessary permissions to proceed with charges. This is especially important for companies that deal with high transaction volumes or recurring payments.

Moreover, it enhances security measures. The form helps protect against unauthorized charges, providing cardholders with peace of mind knowing that their payment information is handled securely and with accountability.

Various use cases illustrate its practicality. E-commerce businesses benefit greatly as they can process credit card information efficiently while maintaining a record of customer authorization. Subscription services rely on these forms to ensure continuous consent for charged fees. Non-profits and charitable organizations also utilize such forms to manage donations securely, building trust with their support base.

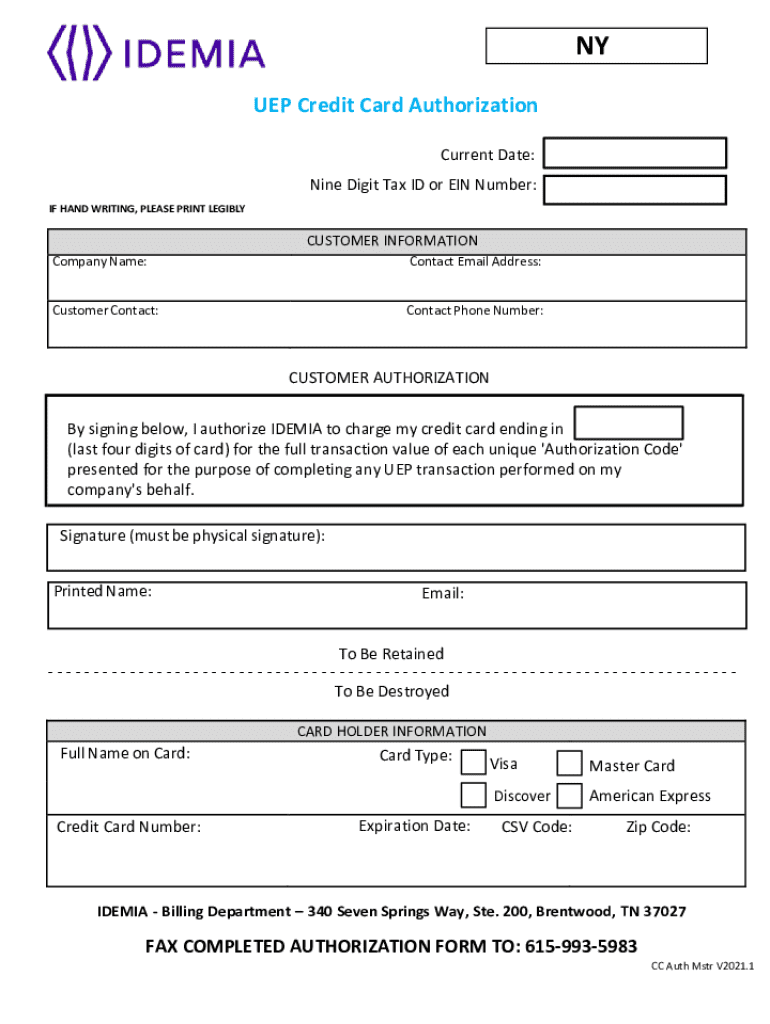

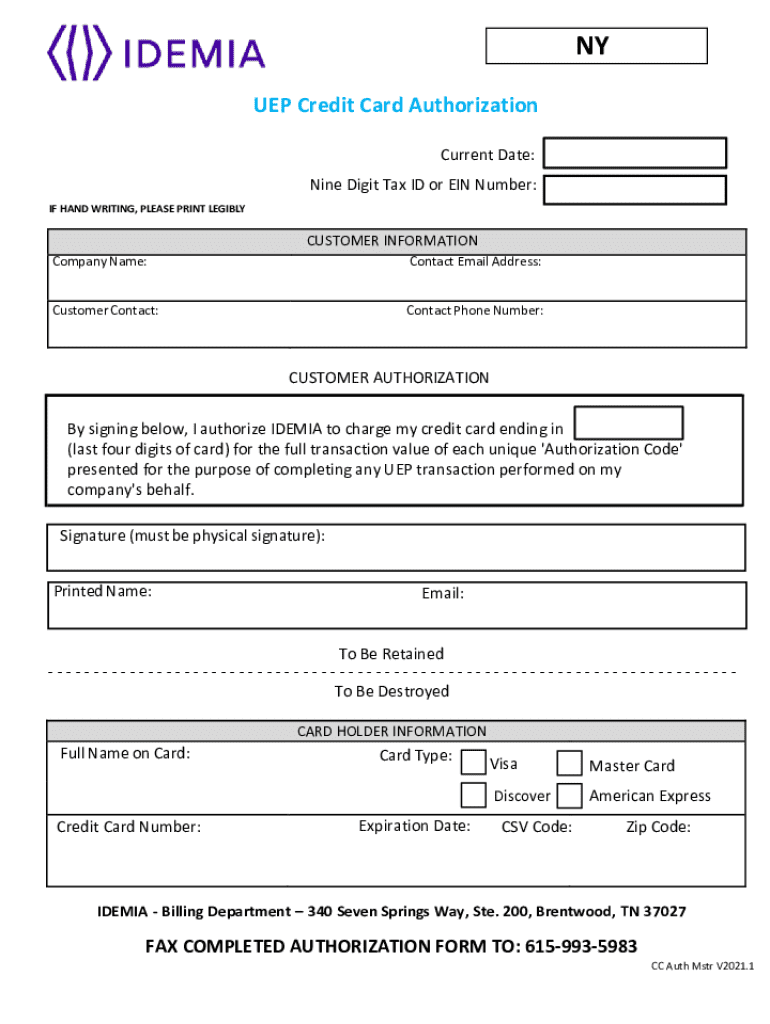

Key elements of a UEP credit card authorization form

A comprehensive UEP credit card authorization form must contain essential fields that capture all necessary details to facilitate a transaction. Key areas include the cardholder's information, which includes their name, contact information, and card details. Clear identification of the payment amount authorized is critical, ensuring both parties understand the financial expectations tied to the agreement.

Furthermore, a signature requirement is vital as it provides tangible consent from the cardholder for the transaction. This aspect not only protects the business but also empowers cardholders by allowing them to exercise control over their financial accounts.

In addition, there may be conditional fields, such as requiring the business name and contact information, aiding in clear identification of the entity involved. Verification of the billing address serves to further secure the transaction, ensuring that the details match the cardholder’s records.

How to fill out the UEP credit card authorization form

Filling out a UEP credit card authorization form correctly is paramount for effective processing. Following a systematic approach can help avoid common pitfalls. Start by collecting all necessary information related to the cardholder and the transaction. This ensures that you're well-prepared to fill in each field accurately.

Next, input the cardholder’s details, making sure the information is current and correct. Specifying the transaction amount is crucial; errors here can lead to disputes or chargebacks. Review the accompanying terms and conditions of the authorization to ensure both you and the cardholder are aligned on expectations.

Lastly, obtaining the necessary signature completes the authorization process, providing a record of consent should any issues arise in the future. Common mistakes to avoid include omitting key details or misplacing the cardholder’s information, which could invalidate the authorization.

Editing and customizing the form

Accessing and customizing the UEP credit card authorization form is made easy with pdfFiller. The platform allows users to create, edit, and enhance their forms without technical hurdles. Start by navigating to the document within pdfFiller's interface to import or open your existing form.

Editing tools within pdfFiller enable users to modify existing fields, add necessary components, and customize the look and functionality of their forms. Adding interactive fields for online use can also facilitate seamless interactions, allowing your clients to fill out forms digitally, thus enhancing user experience.

When tailoring the form, think about specific needs; for instance, what additional fields could improve the process? Consider incorporating unique branding elements to ensure the form aligns with your organizational identity.

Managing and storing your UEP credit card authorization forms

Managing and securely storing your UEP credit card authorization forms are essential for operational efficiency and compliance. With pdfFiller, you can utilize online document management features that allow for easy organization and retrieval of all your forms. This capability is particularly useful for businesses that need to keep track of multiple authorizations and transactions.

Cloud storage options provide secure environments to hold your documents, ensuring that sensitive data remains protected. Sharing and collaborating on forms with team members is a feature that sets pdfFiller apart; it allows multiple users to access, edit, and review documents without compromising data integrity.

Signing the UEP credit card authorization form

The eSignature aspect of the UEP credit card authorization form is crucial for ensuring a valid agreement. Electronic signatures are legally recognized in numerous jurisdictions, providing the necessary authentication that accompanies the signed document. This feature is essential for businesses that need proof of consent to protect against potential disputes.

Utilizing pdfFiller’s eSignature features simplifies this process. The platform allows for quick signing capabilities, ensuring that both parties can authorize transactions without delay. To maintain compliance and legal validity, both the signer’s identity and their consent must be verifiable, which is inherently built into the pdfFiller system.

Troubleshooting common issues

Inevitably, challenges may arise regarding UEP credit card authorization forms. For instance, misplaced or lost forms can disrupt the transaction process. In such cases, it’s vital to maintain a robust document management system, like pdfFiller, which can help recover lost forms quickly without compromising section integrity.

Handling payment disputes or customer queries is another common situation. A properly filled authorization form provides a solid foundation for resolving such issues by acting as a documented agreement. Ensuring that all information is correct and up to date can significantly streamline responses to queries, enhancing customer satisfaction.

Frequently asked questions (FAQs)

It’s common for users to have various questions regarding UEP credit card authorization forms. For instance: What exactly is a UEP credit card authorization form? This form is a documented permission for charging a cardholder’s account, capturing important transaction details and consent.

How secure is electronic authorization? Electronic authorization via platforms like pdfFiller employs high-end security protocols to protect sensitive information. Users also frequently ask whether they can cancel an authorization after submission. Generally, it depends on the terms set prior to authorization, but customers usually have recourse options.

Lastly, questions about denied authorizations are valid; if a payment is denied, the form will help understand why, providing guidance on next steps.

Resources and additional features in pdfFiller

Utilizing interactive tools for document management elevates how businesses handle their forms. pdfFiller offers various features designed to enhance user experience, from customizable templates that speed up document creation to options for integrating with other payment solutions, making your workflow much smoother.

Moreover, you can import existing templates into pdfFiller, saving time and effort while ensuring uniformity in documentation. By leveraging all features available in pdfFiller, organizations can ensure a robust framework for handling UEP credit card authorization forms that meet their unique processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit uep credit card authorization on an iOS device?

How can I fill out uep credit card authorization on an iOS device?

How do I complete uep credit card authorization on an Android device?

What is uep credit card authorization?

Who is required to file uep credit card authorization?

How to fill out uep credit card authorization?

What is the purpose of uep credit card authorization?

What information must be reported on uep credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.