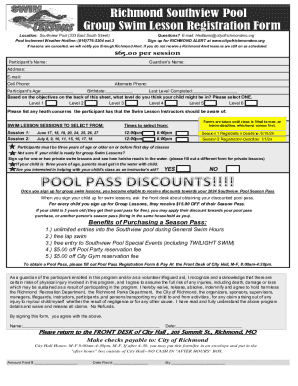

Get the free Dealing Account Application Form

Get, Create, Make and Sign dealing account application form

Editing dealing account application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dealing account application form

How to fill out dealing account application form

Who needs dealing account application form?

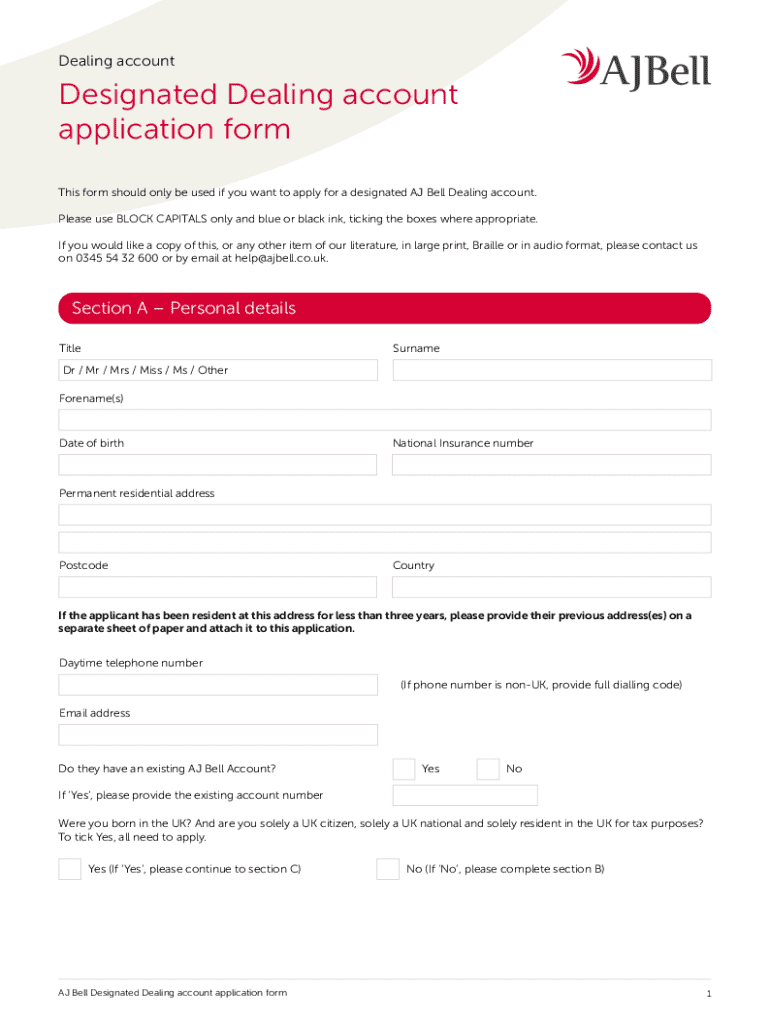

Dealing Account Application Form: A Comprehensive Guide

Understanding a dealing account

A dealing account is primarily designed for individuals and entities looking to trade financial instruments such as stocks, bonds, and derivatives. Unlike standard savings or checking accounts, a dealing account allows for direct trading and investment activities, enabling users to actively engage in financial markets.

Having a dealing account is vital for investors as it provides the necessary platform for executing market trades efficiently. It not only opens the door to potential capital gains but also offers tools for managing investment portfolios effectively. Furthermore, understanding the specific features of dealing accounts can greatly enhance an investor's ability to optimize their financial strategies.

A key distinction between dealing accounts and other types of accounts—like savings accounts—lies in their intended use and functionality. Dealing accounts offer features tailored for trading activities, such as margin trading, access to market analytics, and various order types, making them essential for investors who wish to navigate the complexities of the financial market.

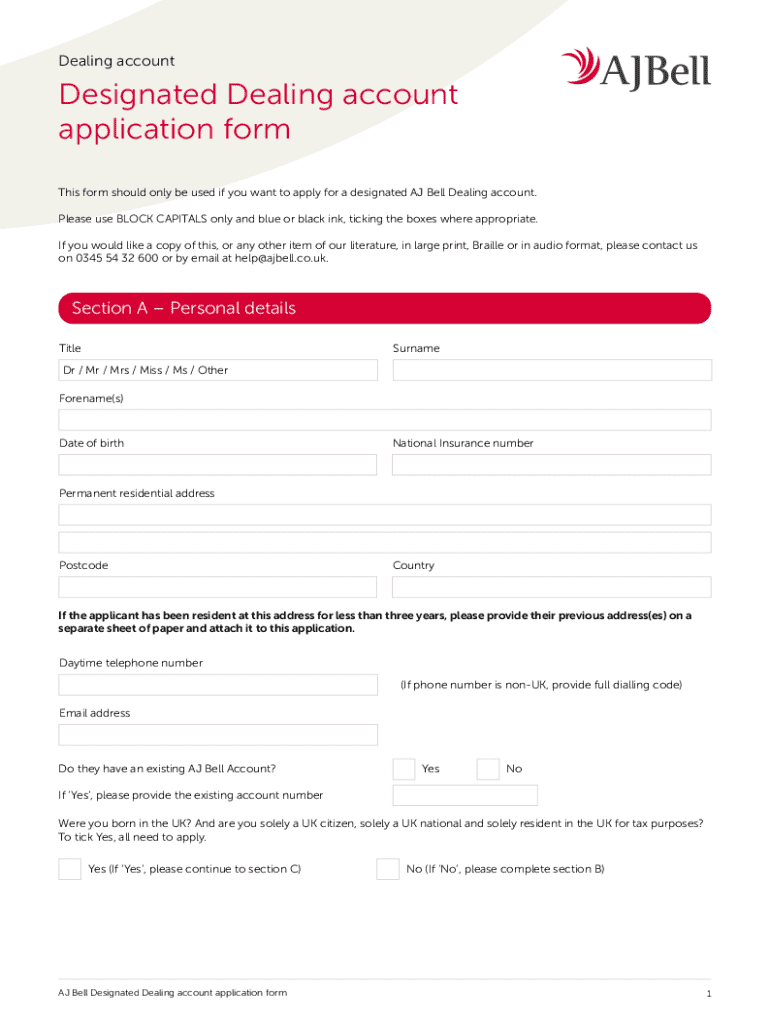

Essential attributes of a dealing account application form

When applying for a dealing account, the application form is a crucial document that gathers pertinent information about the applicant. Essential sections typically found in the dealing account application form include:

Familiarizing yourself with common terms and definitions used in the application form can significantly streamline the process. Terms like 'margin trading' and 'liquid assets' are pivotal to understanding how to effectively manage your account.

Step-by-step guide to filling out the dealing account application form

Filling out a dealing account application form can seem daunting, but breaking it down into manageable steps can simplify the process.

Step 1: Gathering required information

Before diving into the application form, ensure you have all necessary documentation on hand. This includes identification documents such as a passport or driver's license, proof of address like a recent utility bill or bank statement, and relevant financial history, including employment details and any prior trading experience.

Step 2: Completing the application form

As you fill out the form, aim for clarity and detail in each section. Pay special attention to accuracy when entering your financial information, as discrepancies can lead to delays or even denial of your application. Utilize interactive tools that help guide the process, ensuring no section is overlooked.

Step 3: Reviewing the application for accuracy

After completing the form, take time to review it thoroughly. Use a checklist to ensure all items, such as dates, account numbers, and personal information, are accurately captured. Accuracy is paramount in financial applications, as any errors can hinder your ability to open the account.

Step 4: Submitting your application

Once everything is verified, you can submit your application. Submission methods vary; some may prefer online forms for speed and convenience, while others might opt for paper submissions via mail. Upon submission, you can typically expect a confirmation email detailing the next steps.

Editing and signing the application form

If you need to make changes post completion, pdfFiller offers user-friendly editing features that allow you to easily modify any part of your dealing account application form. Maintaining a record of your revisions is also crucial, ensuring that no detail is missed in the final submission.

Electronic signature: legitimizing your application

In today's digital age, electronic signatures are widely accepted, adding convenience to the application process. By utilizing pdfFiller, you can effortlessly sign your form electronically, ensuring that your application is valid and legally binding without the hassle of printing and scanning.

Managing your dealing account post-application

Upon successful application approval, managing your dealing account becomes fundamental. Understanding the approval process typically involves a waiting period for verification, during which the financial institution will review your application and documents.

Accessing your account online is usually straightforward. You can log into your account via the broker's website, where you can view balances, transaction history, and access trading tools. If you need to make changes to your account, such as updating personal information or modifying beneficiaries, this can usually be done directly through the platform or by contacting customer service.

Frequently asked questions about the dealing account application form

It’s common to encounter questions during the application process. Firstly, if your application is denied, take the time to review the feedback provided, as it can offer insights for your next attempt. The typical processing time for approval varies, but it's generally within a few business days.

In scenarios where a dealing account is closed, it's often possible to reopen it, depending on the financial institution's policies. Contacting customer support is the best course of action to inquire about specific requirements for reinstatement.

Interactive tools and resources

pdfFiller provides a variety of resources to support users through the application process. Accessing pdfFiller’s Resource Hub can provide valuable tools, including an interactive checklist that outlines preparation steps before submitting your dealing account application form.

Additionally, you can benefit from tutorials on utilizing pdfFiller for document management, ensuring you have a clear understanding of the platform’s extensive capabilities. Exploring community insights and success stories can also motivate and guide users through their financial journeys.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the dealing account application form electronically in Chrome?

Can I create an eSignature for the dealing account application form in Gmail?

How can I edit dealing account application form on a smartphone?

What is dealing account application form?

Who is required to file dealing account application form?

How to fill out dealing account application form?

What is the purpose of dealing account application form?

What information must be reported on dealing account application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.