Get the free Dealing Account

Get, Create, Make and Sign dealing account

How to edit dealing account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dealing account

How to fill out dealing account

Who needs dealing account?

Dealing Account Form: A Comprehensive Guide for Investors

Understanding the dealing account

A dealing account is a specialized brokerage account that allows individuals and institutions to buy and sell financial securities through a broker. Its primary purpose is to facilitate seamless transactions in various financial markets, including stocks, bonds, commodities, and currencies. Unlike a traditional savings or checking account, a dealing account provides access to advanced trading platforms, analytical tools, and market insights.

Having a dealing account comes with several advantages that cater to both novice and seasoned investors. First, it offers direct access to financial markets, enabling traders to act quickly in dynamic market conditions. Second, it provides flexibility in trading, allowing users to capitalize on short-term opportunities or hold positions for the long term. Finally, dealing accounts contribute to portfolio diversification by offering a range of investment options, which can mitigate risks associated with single-asset investments.

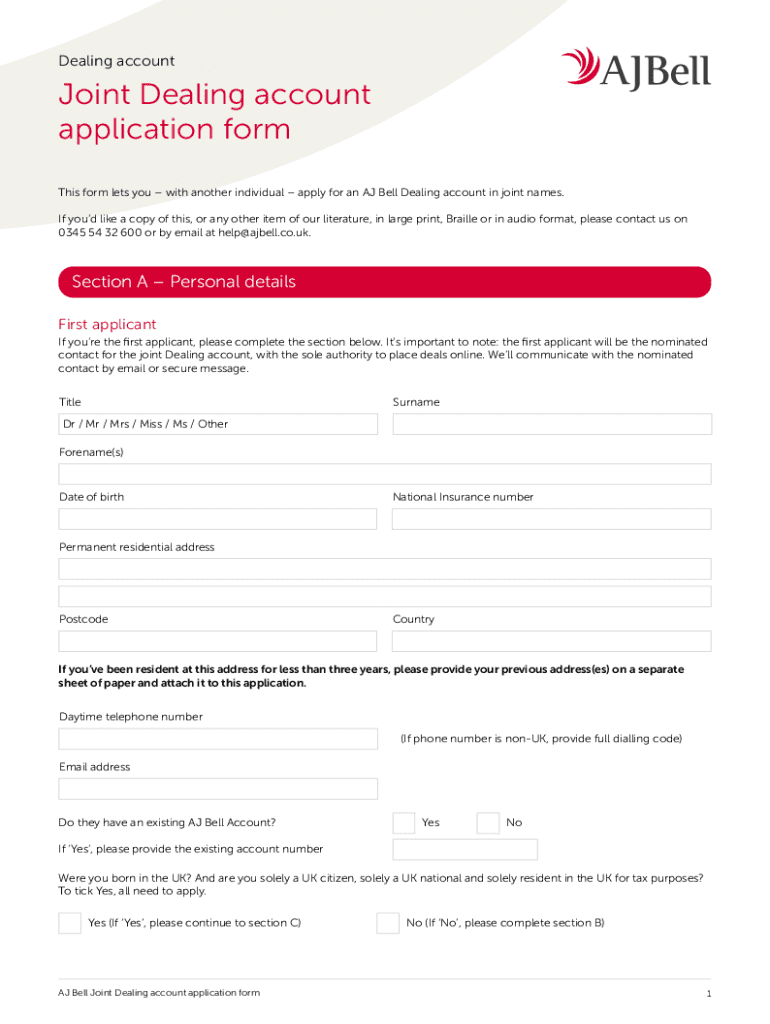

The importance of the dealing account form

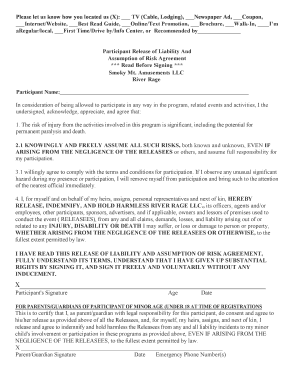

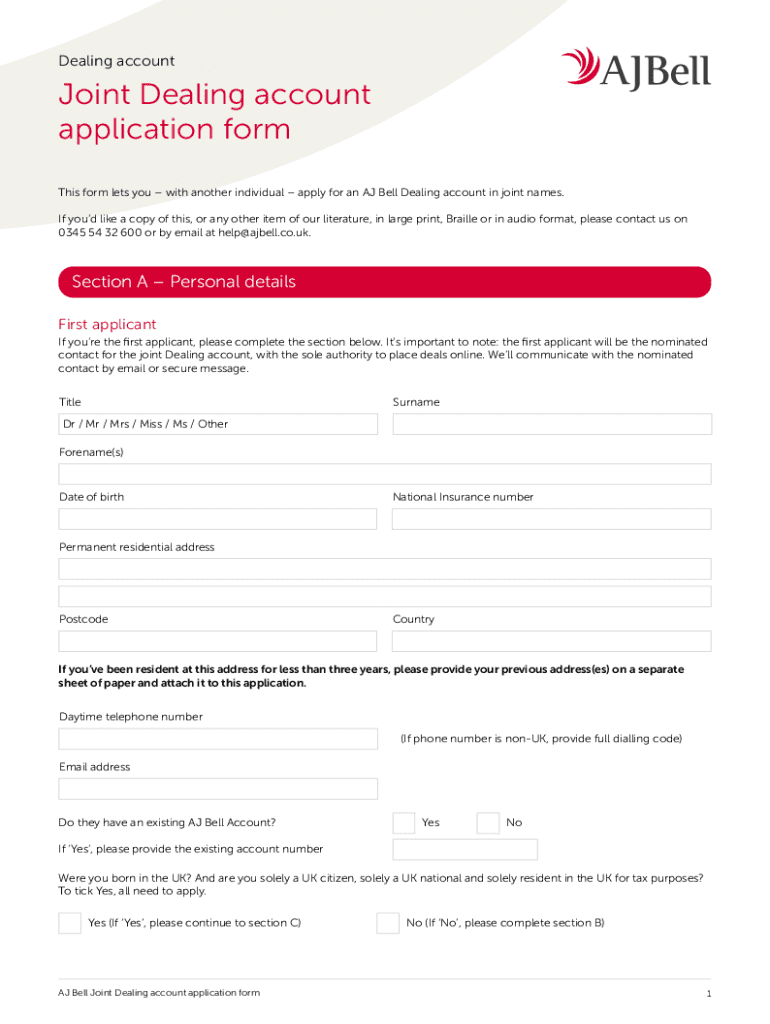

The dealing account form is essential for setting up a new trading account. This form collects vital information necessary for the brokerage to verify the identity, financial background, and investment eligibility of the applicant. Its importance extends beyond simply gathering personal data; it establishes a foundation for responsible investing and compliance with regulatory requirements.

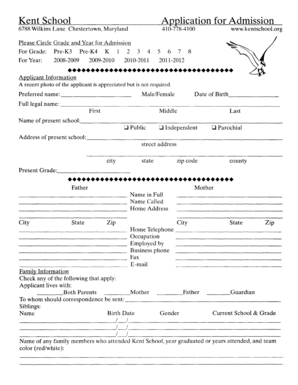

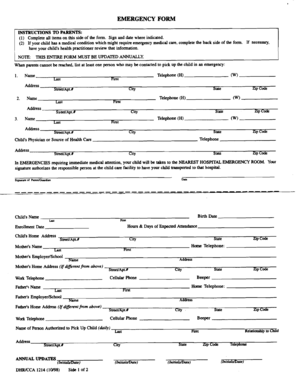

Key information usually required in the dealing account form includes personal identification, such as government-issued ID, proof of address, and detailed financial history including income sources and net worth. Additionally, applicants must disclose their investment experience, highlighting previous exposure to various markets and types of assets.

Step-by-step guide to completing the dealing account form

Filling out the dealing account form may seem daunting, but following a structured approach simplifies the process significantly. Here’s a step-by-step guide to ensure an effective submission.

How to edit and manage your dealing account form

Once your dealing account is set up, you might need to edit or update the information on your dealing account form over time. Changes in contact information, employment, or financial status may require updates to ensure your account remains compliant and accurate.

Editing your account information is typically straightforward. Document your changes clearly and submit them according to the brokerage’s procedures—this could be through an online portal or via email. Best practices include regularly reviewing your account details every few months to ensure all information is current.

Signing your dealing account form

Once you've completed the dealing account form, you will need to sign it. Many brokerages now utilize electronic signatures, which streamline the process significantly. The eSignature process allows you to sign documents digitally, leading to faster processing times and less reliance on physical paperwork.

Advantages of electronic signing include speed and convenience, as you can sign from anywhere, and it also offers enhanced security features, making your signed documents more tamper-proof than traditional handwritten signatures.

Frequently asked questions about the dealing account form

When completing the dealing account form, many applicants have common queries. For instance, what happens if a mistake is made during the submission? The procedure typically allows you to either rectify the error quickly or contact customer support for assistance.

Maintaining compliance and ongoing management

Maintaining compliance with your dealing account is crucial for responsible investing. Periodic updates are often required to keep your information current, especially if there are changes in your financial situation or investment strategy.

Furthermore, staying informed about regulatory changes affecting your investments can help you navigate potential risks or opportunities as they arise. Regular communication with your brokerage can ensure your account complies with all applicable laws and regulations.

Interactive tools for managing your dealing account

Tools such as pdfFiller offer features that enhance the management of documents related to your dealing account. With options for document tracking, version control, and collaborative tools, you can ensure effective communication and management among your team or investment partners.

Utilizing templates can be particularly handy for ensuring consistency in your document submissions. Moreover, data analytics tools integrated into these platforms can provide insights that help you make informed investment decisions.

Exploring related forms and services

Apart from the dealing account form, several related forms play a vital role in your investment journey. For instance, investment risk warnings inform you about potential downsides associated with various financial products.

Opportunities for continued learning and growth

Continual learning is essential in the investment realm. Various educational resources available through platforms like pdfFiller can help deepen your understanding of market trends and product offerings. Engaging in community forums can also provide valuable insights from fellow investors, enhancing your investment knowledge.

Many brokerages offer webinars, tutorials, and articles that discuss investment strategies and market dynamics, ensuring that you have access to the information needed to make informed decisions.

Future developments in dealing accounts and forms

As technology evolves, so do the processes involved in managing dealing accounts. Digital account management is expected to become more integrated and user-friendly, fostering an environment where investors can interact with their accounts seamlessly.

Innovations in document security also promise to enhance the safety of personal and financial information shared through dealing account forms, helping to mitigate risks associated with data breaches.

Tips for effective investing with your dealing account

To make the most of your dealing account, it’s essential to develop sound portfolio management strategies. Diversification, regular assessment of your investments, and being proactive in your trading activities can lead to improved investment outcomes.

Moreover, staying informed by utilizing news and analysis resources can provide the insights necessary to make timely investment decisions, keeping your portfolio aligned with market conditions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute dealing account online?

How do I fill out the dealing account form on my smartphone?

How do I edit dealing account on an Android device?

What is dealing account?

Who is required to file dealing account?

How to fill out dealing account?

What is the purpose of dealing account?

What information must be reported on dealing account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.