Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

How to edit form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

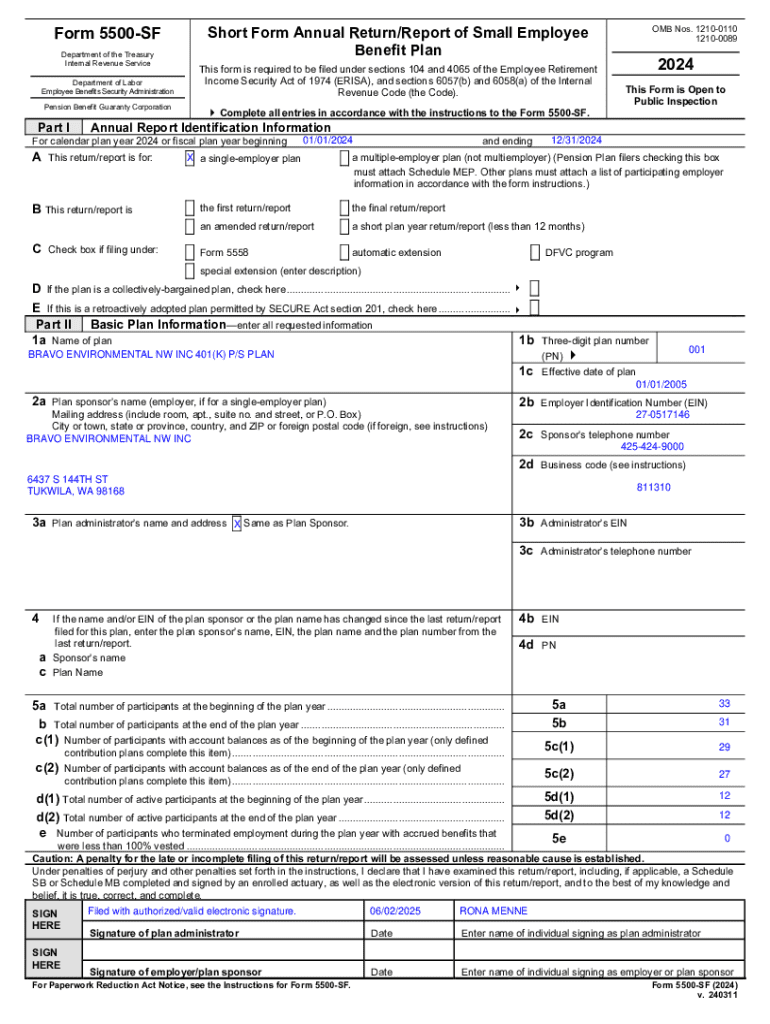

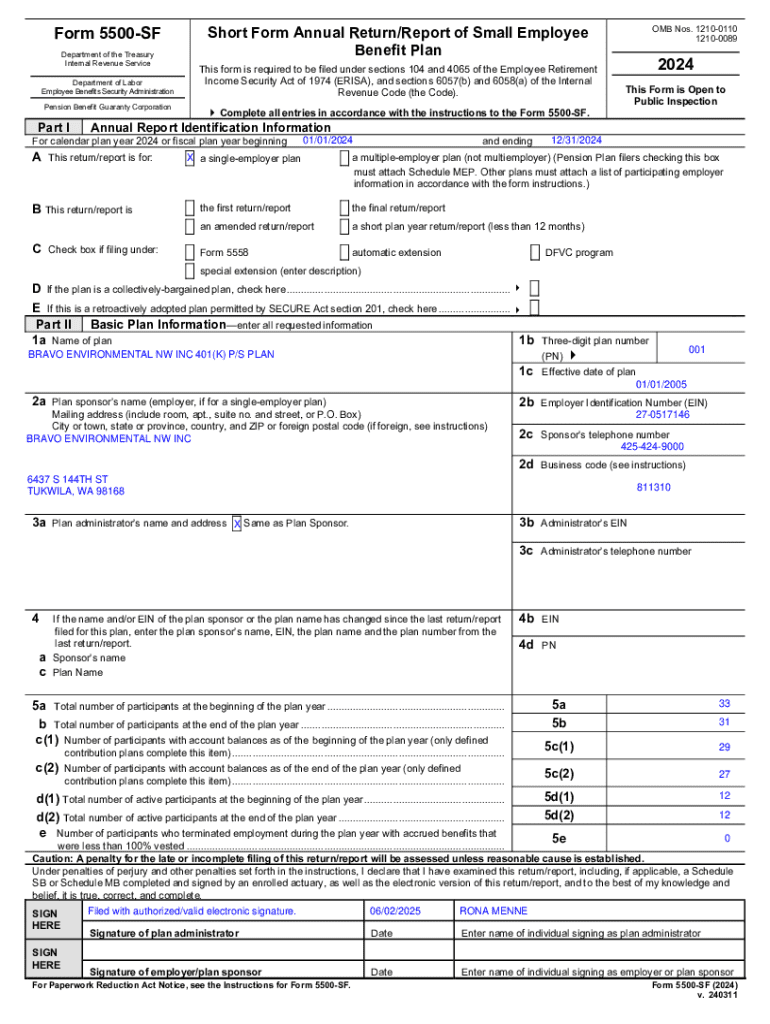

Understanding Form 5500-SF: A Comprehensive Guide

Overview of Form 5500-SF

Form 5500-SF stands for the Short Form Annual Report of Employee Benefit Plan. This form is specifically designed for small employee benefit plans that meet certain criteria, enabling them to file a simplified version of the standard Form 5500. The primary purpose of Form 5500-SF is to provide the Department of Labor, IRS, and the Pension Benefit Guaranty Corporation with essential information about the plan's financial condition, investments, and operations.

The importance of Form 5500-SF cannot be overstated; it helps ensure that employee benefit plans comply with federal regulations while providing transparency to plan participants regarding their benefits. By submitting this form, plan administrators demonstrate adherence to fiduciary duties and commitment to safeguarding participant interests.

Quick links

For those looking to access necessary resources conveniently, here are some essential links:

Electronic filing requirements

The Department of Labor mandates that all forms, including the Form 5500-SF, be filed electronically through the EFAST2 (Electronically File A Form 5500). EFAST2 significantly speeds up the submission process while enhancing data accuracy and accessibility. Electronic filing provides several advantages, such as real-time filing updates, immediate confirmation of receipt, and easier corrections if errors arise.

To file electronically through pdfFiller, follow these steps: 1) Create an account or log in. 2) Select and fill out the Form 5500-SF template. 3) Use built-in tools for editing and ensuring accuracy. 4) Submit your form digitally and receive instant confirmation.

Instructions for completing Form 5500-SF

Filling out Form 5500-SF requires careful attention to detail and adherence to the filing instructions. In 2023, the IRS has revised the instructions, which are essential to ensure compliance. Here’s a breakdown of the key sections of the form:

Changes to note

Each year, the IRS implements updates to the Form 5500-SF, and 2023 is no exception. Recent changes have included enhanced reporting requirements and new compliance questions to align with current regulations. These amendments can lead to significant implications for plan administrators and require careful attention to ensure full compliance.

For instance, new compliance questions in Part V demand detailed responses concerning plan audits and fiduciary activities. Plan administrators should familiarize themselves with these changes to avoid potential complications.

Filing procedures

Understanding who must file Form 5500-SF is essential for compliance. Typically, small employee benefit plans with fewer than 100 participants, which meet specific eligibility requirements, must file the form. If you're unsure whether your plan qualifies, reviewing the IRS's guidelines is beneficial.

Delinquent filer voluntary compliance (DFVC) program

The Delinquent Filer Voluntary Compliance (DFVC) program is a vital resource for those who have missed the filing deadline for Form 5500-SF. This program allows late filers to submit their forms without incurring severe penalties, encouraging compliance with ERISA regulations.

Benefits of participating in the DFVC program include reduced penalties and the opportunity to rectify filing errors. To apply, filers need to submit the required forms and pay applicable fees. This proactive step can significantly mitigate the consequences of late filing.

Understanding penalties

Failing to file Form 5500-SF or submitting inaccurate information can lead to various penalties. Administrative penalties can accumulate quickly, while additional enforcement penalties may apply depending on the severity of the non-compliance.

To avoid these penalties, maintain accurate records and stay informed about compliance requirements. Regular audits can help mitigate risks before they escalate.

Signature and authorization

Form 5500-SF must be signed by an authorized individual, typically the plan administrator. The signature serves as an assurance of the accuracy and completeness of the submitted information. Understanding the role of authorized service providers can be beneficial, especially for organizations that outsource this function.

Accurate representation on the form is crucial for compliance. Any discrepancies in filings could result in penalties or audits, emphasizing the need for thorough review processes before submission.

Interactive tools & resources

pdfFiller offers a suite of interactive tools that streamline the management of Form 5500-SF and enhance user experience. With features like editing tools, users can fill out the form accurately, while eSigning capabilities allow for a quick and efficient signing process.

FAQs about Form 5500-SF

Many users have questions regarding the specifics of filing Form 5500-SF. Common queries include eligibility requirements, exemptions for certain plans, and procedures for filing extensions. Understanding these details can greatly assist in the compliance process, ensuring that filers complete their submissions accurately and on time.

Specific scenarios often arise that may complicate filing, such as changes in plan structure or participant counts. Being prepared with comprehensive answers for these questions can offer clarity and ease in the filing process.

Important considerations for plan administrators

Plan administrators bear the responsibility of ensuring compliance with federal regulations concerning Form 5500-SF. This includes keeping thorough documentation and records that can support the details submitted on the form. The best practices for maintaining records involve regular audits, organized record-keeping systems, and continuous education on regulatory changes.

Staying informed about regulatory changes is pivotal, as the landscape of employee benefits may shift frequently. Being proactive in this regard can prevent issues and enhance the integrity of the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 5500-sf in Gmail?

Where do I find form 5500-sf?

Can I create an eSignature for the form 5500-sf in Gmail?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.