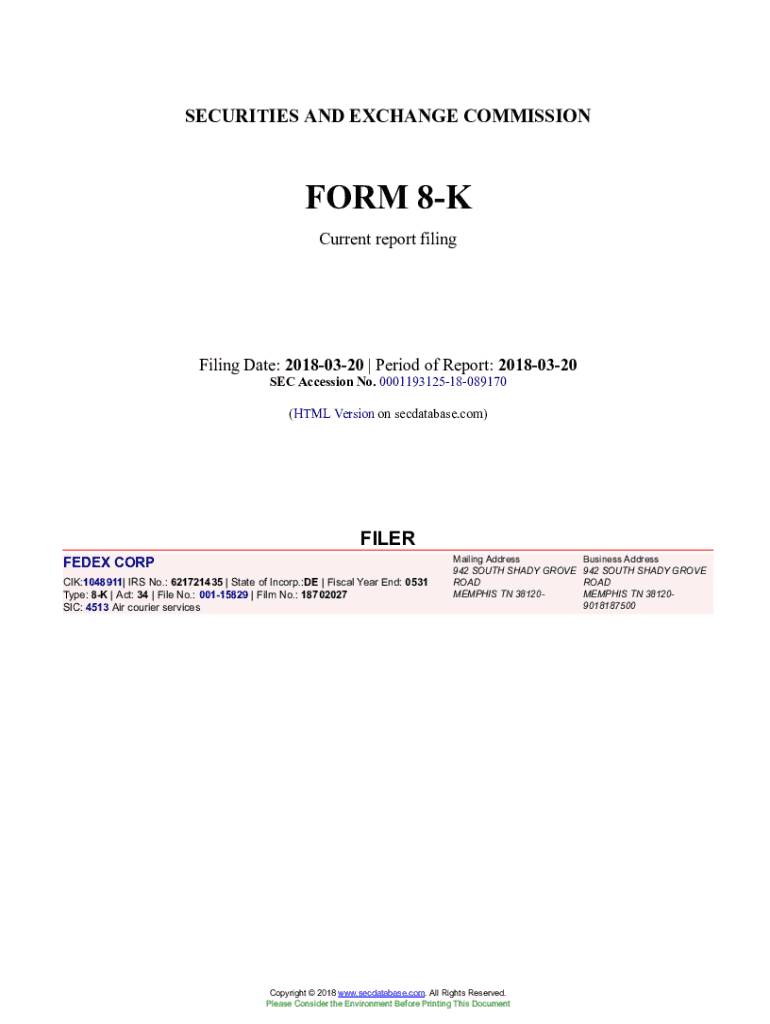

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Comprehensive Guide to Form 8-K: Understanding, Filing, and Compliance

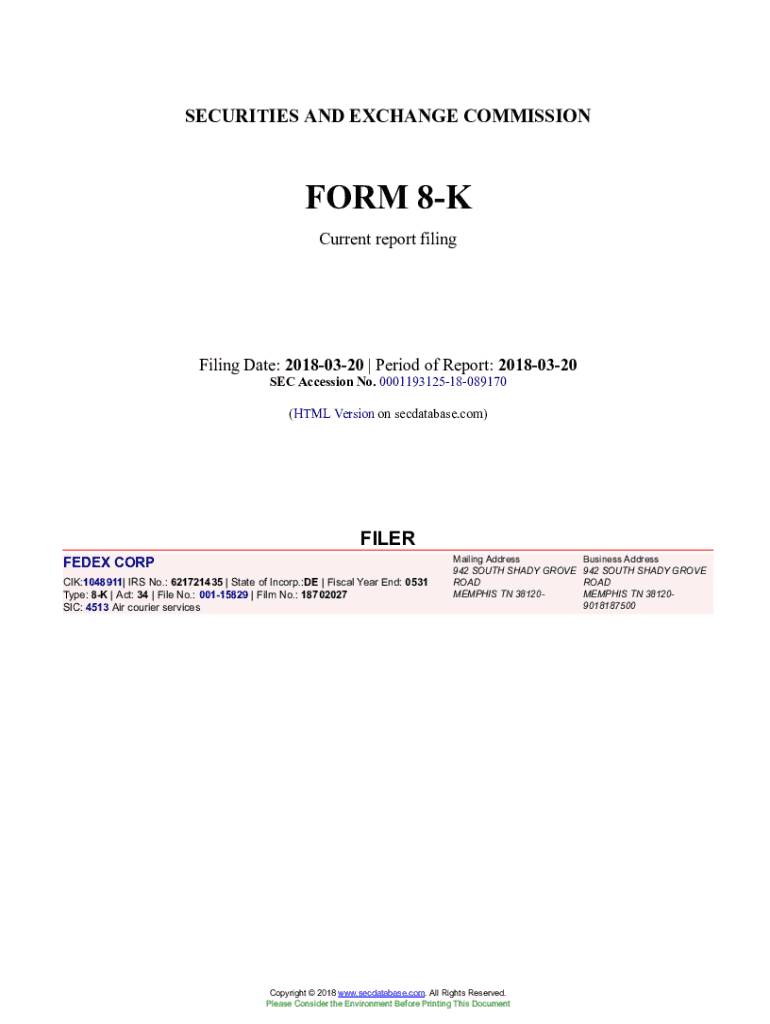

Understanding Form 8-K

Form 8-K serves as a critical tool for public companies in the United States, functioning as a current report that enables companies to disclose material events to the SEC and shareholders. This form is crucial for keeping investors informed about significant changes that could impact their investment decisions. Through timely disclosures, companies uphold transparency and accountability in their operations.

The importance of Form 8-K lies not only in compliance with SEC regulations but also in maintaining trust among investors and the broader market. An accurate and prompt filing can prevent misinformation and speculation, which might adversely affect stock prices and investor sentiment.

When is Form 8-K required?

Certain events trigger the necessity for filing Form 8-K. These include significant corporate activities such as mergers, acquisitions, the onset of bankruptcy proceedings, and changes in senior management. Additionally, disclosures like unregistered sales of equity securities also necessitate filing Form 8-K. By promptly reporting these events, organizations provide critical updates that influence stakeholder decisions.

Regarding deadlines, companies must file Form 8-K within four business days after the triggering event occurs. The consequences for failing to meet this timeline can be severe, with potential fines and damage to the company's reputation. Regulatory agencies take delayed filings seriously, which can lead to increased scrutiny.

How to read and interpret Form 8-K

Understanding the structure of Form 8-K helps investors extract vital information efficiently. The form is divided into several sections with clearly defined headings that aid in organization. Investors should look closely at the item numbers listed as they denote the nature of the disclosure, such as financial results, changes in asset control, or executive appointments.

For instance, Item 1.01 indicates the entry into a material definitive agreement, while Item 2.01 addresses the completion of an acquisition. Recognizing these distinctions is crucial for it enables investors to prioritize information pertinent to their interests.

Form 8-K items explained

Each item on the Form 8-K serves a specific purpose and can signal significant changes to the company’s operations. For instance, Item 1.01 pertains to material definitive agreements, which are crucial as they often signify large financial commitments or changes in business strategy. Similarly, Item 2.01 communicates essential information regarding asset acquisitions or dispositions that affect a company's financial landscape.

It's also important to contextualize these items historically. Over the years, regulatory bodies have adjusted the requirements for Form 8-K to enhance transparency and investor awareness. This evolution reflects a growing recognition of the vital role that timely and relevant information plays in financial markets.

Benefits of filing Form 8-K

The advantages of filing Form 8-K extend beyond regulatory compliance. By providing timely updates, companies enhance transparency and accountability, which is fundamental to maintaining investor trust. Investors are more likely to feel secure when they are kept informed of significant company developments, which can lead to a stable investment environment.

Additionally, timely filings may positively influence a company's market perception. Investors tend to react favorably to prompt communication and are likely to consider the organization as more credible. Furthermore, being compliant mitigates risks associated with regulatory penalties and upholds the company’s integrity in capital markets.

Common challenges and FAQs regarding Form 8-K

Navigating the complex requirements of Form 8-K can pose challenges for companies. Ensuring that all relevant information is accurate and filed timely is crucial, yet it can be an involved process. Companies should maintain clear lines of communication and collaboration among their finance, legal, and compliance teams to meet their filing obligations efficiently.

One frequently asked question concerns whether an 8-K can be amended. Generally, yes, a Form 8-K can be amended to correct errors or clarify information in a timely manner. Understanding all the nuances of the filing process is essential for companies to avoid potential pitfalls.

Tools for managing Form 8-K filings

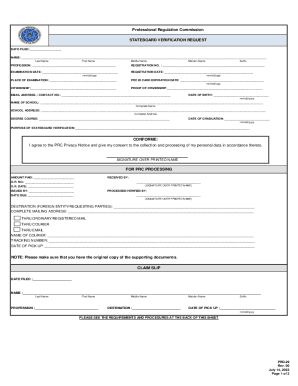

Utilizing solutions like pdfFiller can streamline the process of creating, editing, and managing Form 8-K filings. This cloud-based platform empowers users to quickly navigate the complexities of the form, ensuring accuracy and compliance. With robust features, users can edit documents seamlessly, reducing the time spent on preparing Form 8-K.

The capabilities within pdfFiller include templates specifically designed for Form 8-K that guide users through required disclosures. Moreover, with eSignature functionalities, companies can ensure timely submissions, allowing stakeholders to collaborate efficiently on document management.

Sector-specific considerations

Different industries approach Form 8-K filings uniquely based on the nature of their operations and investor relationships. For instance, in technology, rapid changes can frequently necessitate disclosures, while financial firms may focus more on regulatory compliance and operational adjustments.

Additionally, company size and structure play a role in tailored filing strategies. Small businesses often require less frequent disclosures compared to large corporations that may encounter continuous changes requiring regular updates. It's vital for organizations to customize their approach based on their unique contexts to ensure compliance and efficacy in communication.

Keeping informed on regulatory changes

The landscape of SEC regulations can evolve, making it essential for companies to stay updated on any changes to Form 8-K requirements. Regularly consulting resources such as SEC updates, financial news platforms, and industry publications can help organizations remain informed.

Engaging with professional guidance is also advisable, particularly when uncertainties arise. Companies should not hesitate to consult legal experts or advisors when considering amendments or new filings. This investment in knowledge can help ensure compliance and avoid pitfalls associated with non-compliance.

Accessing support and additional information

Companies seeking to learn more about Form 8-K filings can access numerous resources available online. Websites such as the SEC’s official page on Form 8-K provide guidance directly from regulatory authorities. Furthermore, pdfFiller’s platform offers specific tools designed for form management, which can simplify processes for users.

Engaging with community forums and user groups can also yield valuable insights for individuals and organizations alike. Networking with others who have navigated the complexities of Form 8-K can foster a richer understanding and promote best practices in filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k to be eSigned by others?

How do I complete form 8-k online?

How can I fill out form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.