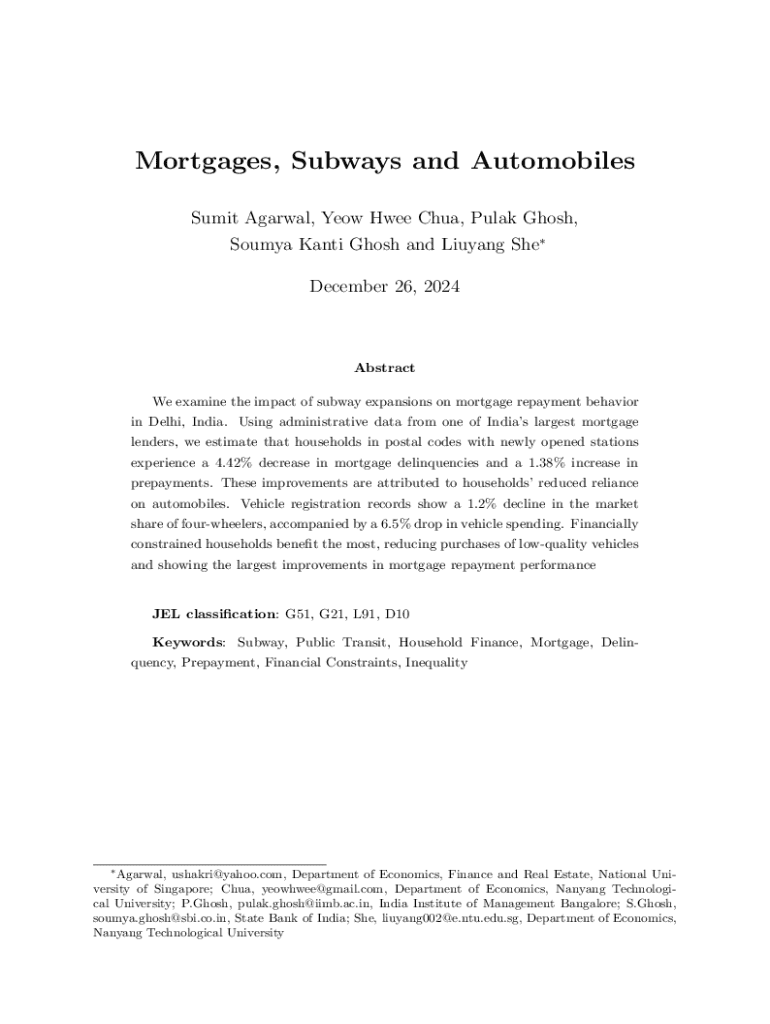

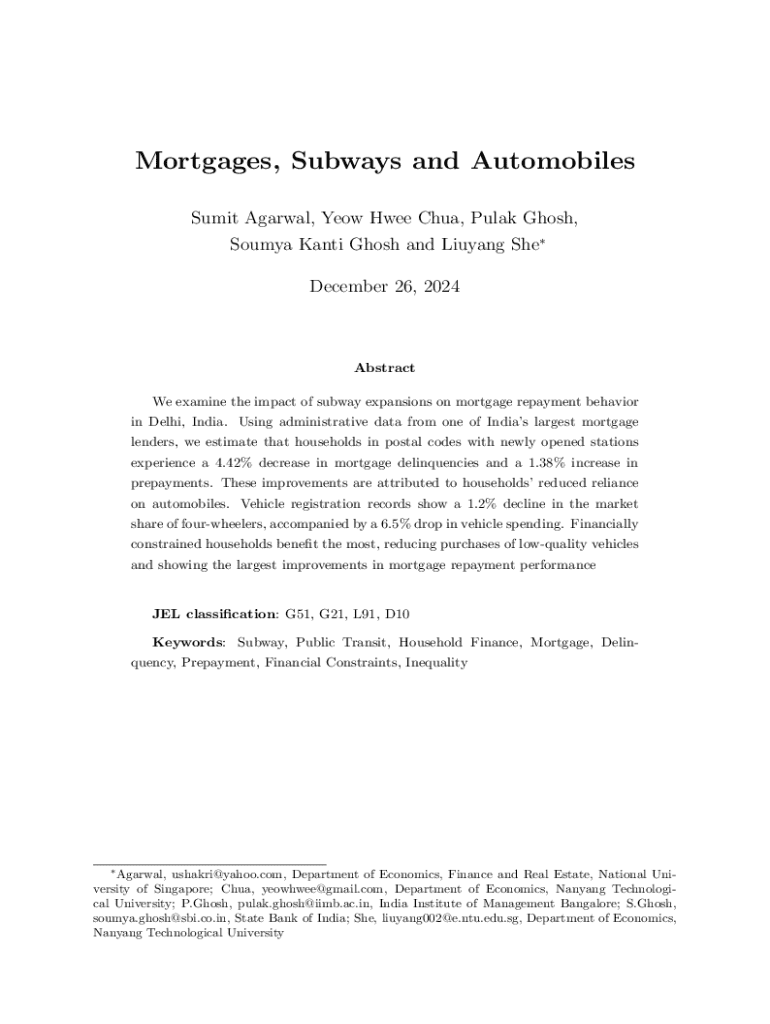

Get the free Mortgages, Subways and Automobiles

Get, Create, Make and Sign mortgages subways and automobiles

Editing mortgages subways and automobiles online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgages subways and automobiles

How to fill out mortgages subways and automobiles

Who needs mortgages subways and automobiles?

Mortgages, subways, and automobiles form: A comprehensive guide

Understanding the form’s purpose

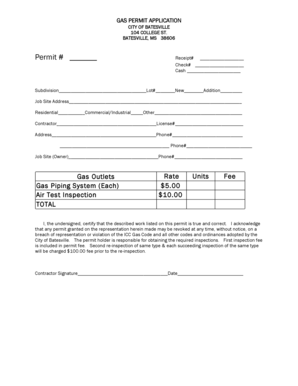

The Mortgages, Subways, and Automobiles Form is a crucial document used across various domains, primarily in securing financial assistance for mortgages, facilitating public transportation planning, and acquiring automobile loans. This form serves as a bridge between individuals, financial institutions, and transit agencies, enabling the compilation of necessary information for approvals and funding decisions.

It’s essential for urban planners, public transit authorities, potential homeowners, and car buyers. Understanding how to properly utilize this form can lead to smoother transactions and approvals, ultimately benefiting individuals in their pursuit of efficient transportation solutions.

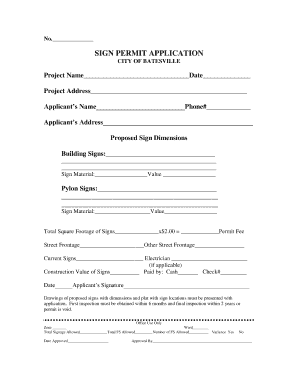

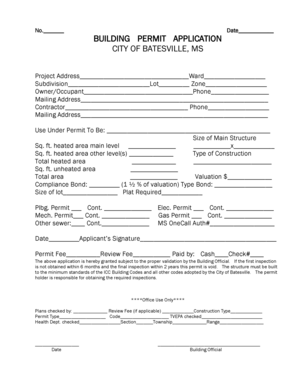

Key sections of the form

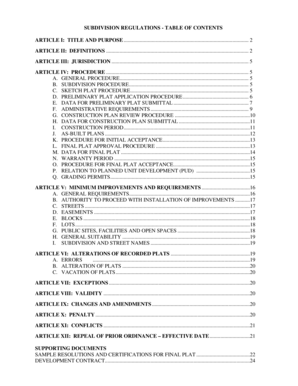

The form is structured into three essential sections: Mortgages, Subways, and Automobiles. Each section requires specific pieces of documentation and data necessary for successful processing.

Mortgages section

In the mortgage section, applicants must provide various documentation, including proof of income, employment verification, and existing debts. Completing this section accurately is vital since lenders use this information to assess eligibility for a loan.

To avoid common pitfalls like submitting incomplete paperwork, ensure all required fields are filled out and documents are attached before submission.

Subways section

In the subway section, users must provide necessary transit-related data. This often includes demographic information and projected ridership counts, which contribute to urban planning decisions and are instrumental in determining funding allocations.

Public transit agencies can access resources to evaluate eligibility based on these inputs, ensuring that they align with community transportation goals.

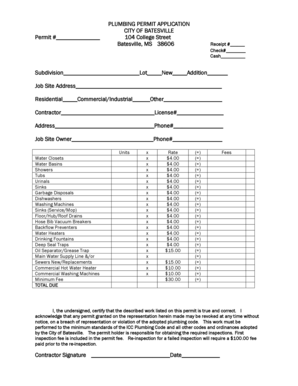

Automobiles section

The final section pertains to automobile purchases. Applicants must submit information about the vehicle, including make, model, VIN, and financing terms. Understanding these financing options is crucial since they can have long-term implications on one’s credit and financial stability.

As automobile buyers navigate their decisions, knowing how to align their financial options with their purchase strategy is vital for a successful acquisition.

Step-by-step editing guidance

pdfFiller provides a user-friendly platform for accessing the Mortgages, Subways, and Automobiles Form effortlessly. To begin, users can visit pdfFiller's website and search for the specific form. The platform allows for intuitive navigation, where individuals can easily find the form categorized under related documents.

Once the form is accessed, filling it out can be made easier by utilizing pre-filled fields and saving commonly used data. This can reduce the time needed for future submissions and ensure accuracy.

Editing the form to meet different circumstances, such as refinancing a mortgage or changing vehicle details, can be done easily through pdfFiller. Users can save multiple versions of the form to meet specific needs without starting from scratch each time.

Signing and collaborating on the form

Electronic signatures are becoming increasingly accepted in mortgage and transportation agreements. pdfFiller offers an eSigning feature that meets legal standards, ensuring your signature is secure and valid. This allows for convenient sign-off from anywhere, speeding up the process significantly.

Additionally, the collaboration features on pdfFiller let teams work together on the form. Users can invite colleagues or advisors to review and provide feedback on the document, enhancing the accuracy and completeness of the submitted information.

Managing your forms

Utilizing cloud-based systems for form management offers unparalleled convenience when dealing with the Mortgages, Subways, and Automobiles Form. Storing documents in pdfFiller allows for easy access and organization, ensuring that completed applications are available when needed.

One key benefit of using pdfFiller is the ability to track changes and versions of documents. By maintaining a detailed history of edits, users can quickly identify any miscommunications or errors that may arise during the approval process.

Navigating challenges with form submission

Despite thorough preparation, form rejections can occur. Understanding the typical reasons for rejection, such as incomplete information or discrepancies in documentation, can assist users in addressing these issues. It's crucial to double-check all entries and ensure that all required information is provided to minimize the risk of rejection.

If challenges arise, pdfFiller offers robust customer support to help navigate form-related inquiries. Users can find a range of resources, including frequently asked questions, which address common concerns encountered during the form submission process.

Exploring advanced features of pdfFiller

pdfFiller stands out by offering advanced features that improve the user experience when filling out the Mortgages, Subways, and Automobiles Form. These include customizable templates that cater to specific needs across the areas of finance and transportation.

Users can tailor document settings according to individual preferences, enhancing both usability and efficiency. Furthermore, integrating pdfFiller with relevant financial software or transportation databases boosts functionality, allowing users to manage their documents in a comprehensive way.

Best practices for document management

Maintaining privacy and security while managing sensitive information is paramount. Users should ensure that their documents are securely stored and that they are aware of the measures needed to protect personal data. Using password protection and encryption can significantly enhance the security of submitted forms.

Staying updated with regulatory changes is equally essential as they impact the forms used for mortgages and transportation applications. Users should regularly check for updates and adapt their documents to reflect new laws and guidelines to remain compliant.

Real-life applications and case studies

Numerous testimonials exist from individuals who have successfully navigated the complexities of the Mortgages, Subways, and Automobiles Form using pdfFiller. For instance, a family looking to secure a mortgage was able to streamline their application process through effective document management, resulting in timely approval.

Another example involves a public transit agency that utilized the subway section of the form to gather community feedback. By effectively managing responses and conducting analyses, they received vital data to improve their services. These cases highlight how proper utilization of the form can significantly impact outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mortgages subways and automobiles?

Can I create an electronic signature for signing my mortgages subways and automobiles in Gmail?

How do I edit mortgages subways and automobiles on an Android device?

What is mortgages subways and automobiles?

Who is required to file mortgages subways and automobiles?

How to fill out mortgages subways and automobiles?

What is the purpose of mortgages subways and automobiles?

What information must be reported on mortgages subways and automobiles?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.