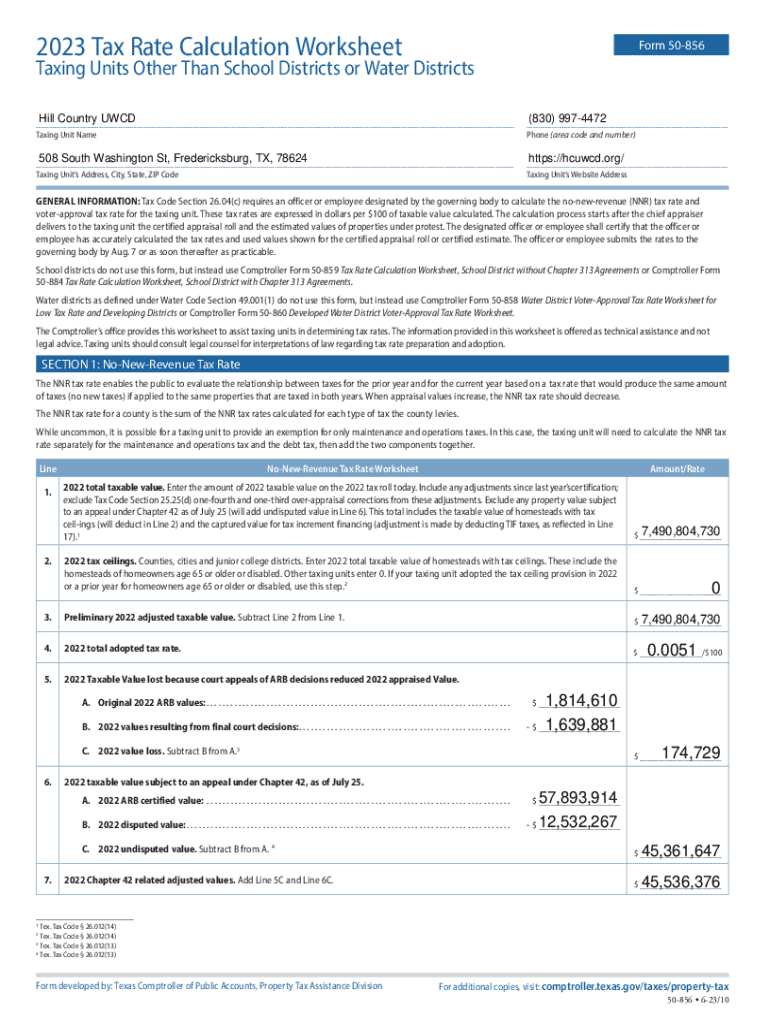

Get the free 2023 Tax Rate Calculation Worksheet

Get, Create, Make and Sign 2023 tax rate calculation

How to edit 2023 tax rate calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 tax rate calculation

How to fill out 2023 tax rate calculation

Who needs 2023 tax rate calculation?

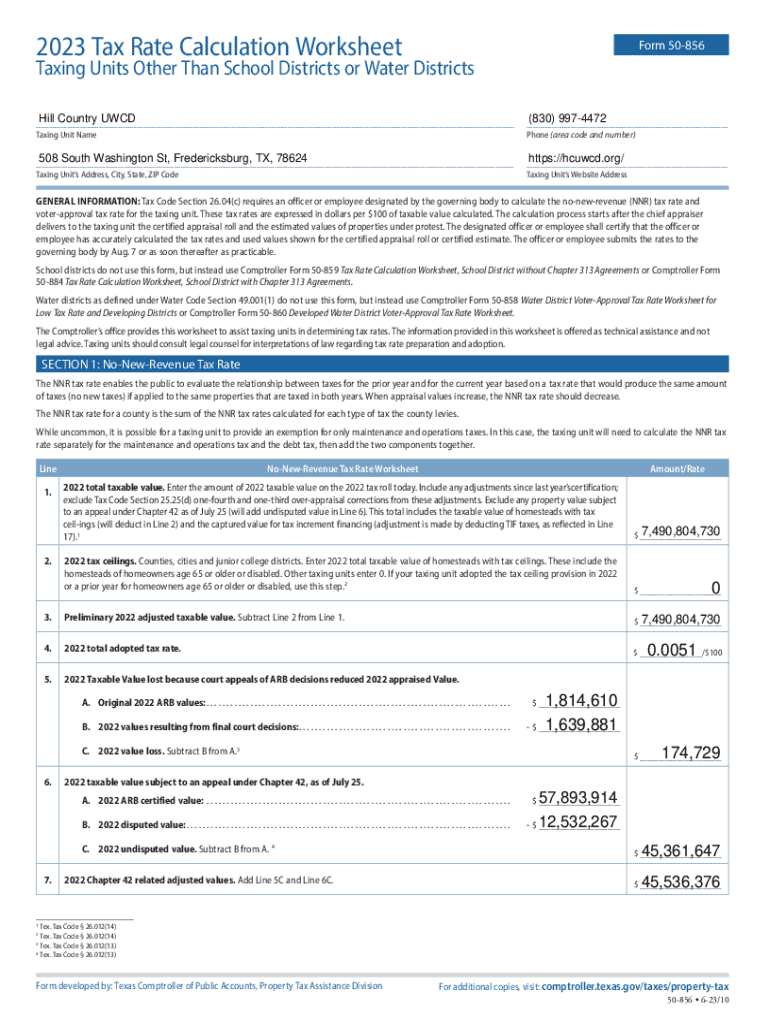

2023 Tax Rate Calculation Form Guide

Understanding the 2023 tax rate calculation

The 2023 tax rate calculation form is an essential tool for individuals and businesses to determine their tax obligations accurately. This form simplifies what can often be a daunting process, allowing users to break down their income and applicable deductions effectively. Understanding how tax rates are calculated is crucial, as these figures directly impact your financial responsibilities and planning for the year.

Tax rates, defined as a percentage at which income or profits are taxed, can change annually based on various factors such as government policy, economic conditions, and inflation. In the United States, the tax structure is progressive, meaning that different portions of income are taxed at different rates. Each year, the IRS publishes tax brackets that outline these rates, which are utilized when filling out the 2023 tax rate calculation form.

Key components of the tax rate calculation

The 2023 tax rate calculation form encompasses several critical components, including tax brackets, deductions, and credits. Tax brackets categorize income levels, each assigned a specific tax rate. For instance, income up to a certain threshold may fall within a lower tax bracket, while income surpassing that amount climbs into higher brackets. It's essential to review these brackets closely to forecast tax liabilities accurately.

In addition to the basic tax rate, deductions play a significant role in how much one ultimately pays in taxes. Deductions reduce taxable income, which can lead to lower overall tax amounts. The 2023 federal tax brackets can be mitigated by either standard deductions or itemized deductions based on individual circumstances. Credits, on the other hand, directly reduce the amount of tax owed, making them particularly valuable.

Step-by-step instructions to use the 2023 tax rate calculation form

Before filling out the 2023 tax rate calculation form, it's crucial to prepare adequately. Begin by gathering all necessary documents such as W-2 forms, 1099s, and any other income or deduction sources. Understanding where your income comes from, including wages, self-employment income, and investments, will simplify the process. Knowing these figures upfront can prevent potential miscalculations later.

Once you're prepared with all relevant documents, you can proceed to fill out the form section by section. The first segment typically asks for personal information. Next, you will report various income types and categorically list them, including wages and self-employment profits. Depending on your financial situation, tackle deductions next, deciding if you will take the standard deduction or if itemizing is in your favor.

Common errors to avoid

Many people miss critical tax deductions or misreport income figures, leading to increased tax liabilities. It’s vital to double-check all amounts entered on the 2023 tax rate calculation form. Also, failure to account for possible deductions can unfairly inflate tax obligations. This mistake is often due to misunderstandings or unawareness of available tax benefits that you might qualify for, so it's beneficial to do thorough research or consult with a tax professional.

Another common error comes from miscalculating income, particularly if you have income from multiple sources. Keeping meticulous records and maintaining clear documentation will assist in ensuring accuracy in your calculations and claims, thus maximizing your potential savings.

Tools for calculating your tax responsibilities

Interactive tax calculators available online provide an excellent way for individuals to estimate their taxes before completing the 2023 tax rate calculation form. These resources are essential for confirming the accuracy of reported figures and understanding potential liabilities. Many of these calculators are updated annually and are specific to 2023 tax brackets and rules, allowing you to input your information and see immediate results.

Utilizing interactive calculators can also help you explore the impact of potential deductions or credits before you make final calculations. A major advantage of these tools is their immediacy and simplified interface, often aiding users in navigating through complex tax scenarios. Moreover, comparing alternative calculator options helps ensure you find the one that best suits your needs.

Using pdfFiller's tax rate calculation form

pdfFiller offers an intuitive platform for managing the 2023 tax rate calculation form digitally. One of the standout features of pdfFiller is its interactive capabilities that make filling out the form easy and efficient. Users can edit PDF documents without converting them into word processing formats, significantly simplifying the process.

Editing, eSigning, and collaborating with teammates become seamless with the pdfFiller platform. The ability to share the completed calculations securely and invite others to contribute means managing tax documents can be more collaborative where necessary. These collaborative features are particularly beneficial for small business owners who often share tax documents with accountants or tax attorneys.

Resources for understanding tax implications

It can be challenging to navigate the maze of local and federal tax regulations that affect your 2023 tax calculations. Staying informed about changes in tax legislation is crucial. Many local and federal tax resources offer comprehensive guides, newsletters, and personal assistance meant to help individuals and businesses understand their tax obligations.

Furthermore, knowing how to access local tax regulations can also offer insights into state-specific deductions or credits. As tax laws can frequently change, it's advisable to periodically review updated tax regulations from trusted sources, including government websites and reliable tax consultancy services.

Managing your tax documents and filing

Organizing your tax documents makes the filing process smoother and less stressful. Create a defined system for categorizing financial documents. This includes critical forms, payment receipts, and any correspondence related to prior taxes. Whether you opt for a physical filing system or a digital archive, having a dedicated and accessible location for your tax paperwork is vital.

When it comes to filing and paying your taxes, several methods are available, such as online submissions through platforms like pdfFiller or traditional mail-in methods. Online filing can often be a quicker and more efficient way to ensure timely submission. Additionally, understanding different payment options, such as credit card payments, direct debit, or installment plans can ease financial strains during tax season.

Utilizing pdfFiller’s solutions for tax season

With pdfFiller's cloud-based platform, users can enjoy seamless access to the 2023 tax rate calculation form from any device, anywhere, at any time. Its robust editing and management features allow users to handle their tax documentation with ease. Being able to edit PDFs and share them securely without losing formatting is a game changer for anyone managing tax forms.

Collaborating with tax professionals becomes straightforward as they can access your documents and perform necessary edits or sign-offs as required without the difficulties traditionally associated with physical document exchanges. Utilizing pdfFiller facilitates a stress-free tax season, allowing you to stay organized and compliant effortlessly.

Continuous tax education

Staying informed about evolving tax laws and regulations significantly benefits individuals and businesses alike. Engaging with resources that offer continuous updates and education about taxes can empower you to make informed decisions. This includes enrolling in workshops or webinars focused on tax literacy or following credible financial news for the latest information.

Networking with others facing similar tax filing challenges can also provide a support structure. Joining forums or community groups where individuals share experiences and tips can enhance your confidence in navigating tax seasons. It's not just about staying aware of changes; it’s about proactively seeking knowledge to optimize your tax outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2023 tax rate calculation without leaving Google Drive?

Can I create an electronic signature for the 2023 tax rate calculation in Chrome?

How do I edit 2023 tax rate calculation straight from my smartphone?

What is tax rate calculation?

Who is required to file tax rate calculation?

How to fill out tax rate calculation?

What is the purpose of tax rate calculation?

What information must be reported on tax rate calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.