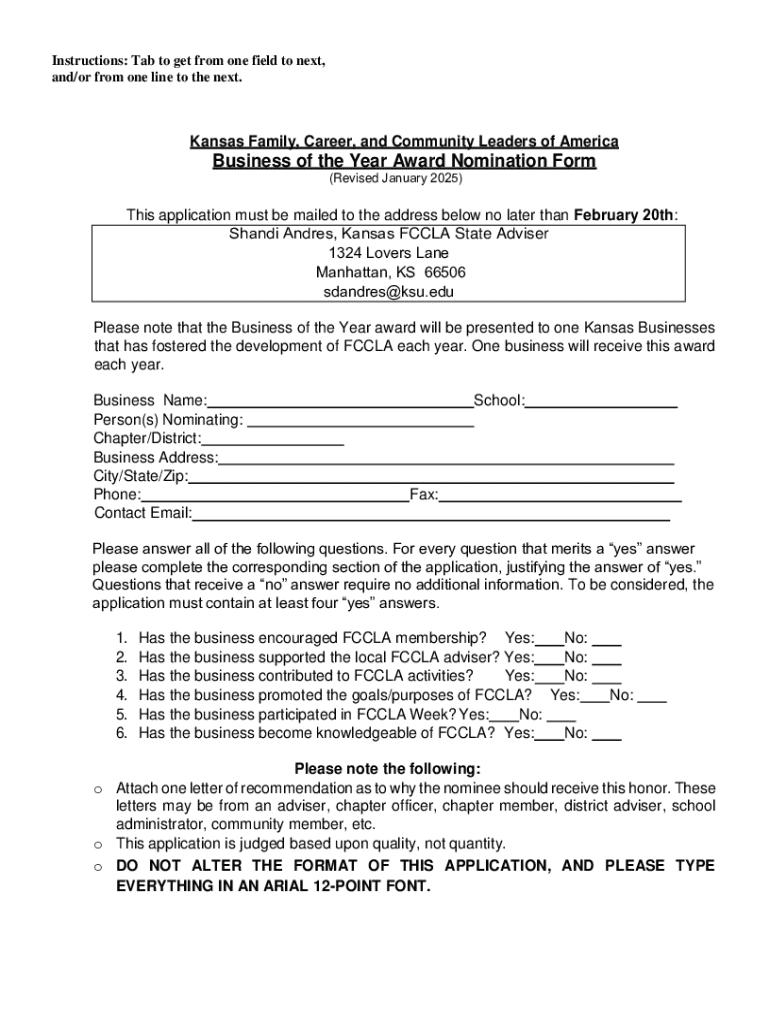

Get the free Business of the Year Award Nomination Form

Get, Create, Make and Sign business of form year

Editing business of form year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business of form year

How to fill out business of form year

Who needs business of form year?

Business of Form Year Form: A Comprehensive Guide

Understanding business form essentials

Accurate documentation is the backbone of efficient business operations and legal compliance. A business must understand its documentation requirements to avoid penalties and streamline its processes. Different forms serve specific purposes, such as tax filings, licenses, contracts, and employee records. The form year is particularly significant because it dictates the version of forms being used, along with any associated regulations.

Common form types include federal tax forms from the IRS, state-specific compliance documents, and various industry-related forms. Grasping the nuances of these forms can save time, money, and potential legal issues. For instance, using outdated forms or missing deadlines can lead to penalties or extra scrutiny from regulatory bodies.

Navigating form year regulations

Each year brings updates to the regulations governing business forms, requiring companies to stay informed for compliance. Businesses must review annual changes from both federal and state agencies to ensure adherence. Regulatory changes can stem from changes in tax law, health regulations, or labor laws.

For instance, significant reforms in tax laws can affect federal forms like the 1040 or 1120, altering how businesses report income and expenses. Different sectors, such as healthcare, construction, or retail, might also face sector-specific changes that necessitate updates in reporting formats.

Types of business forms by year

Understanding the main categories of forms used in business can improve compliance and data accuracy. Here are various important forms:

New modifications occur annually, so reviewing the IRS guidelines and state regulations is vital to ensure all used forms are current.

Filling out business forms correctly

Properly completing business forms is crucial to avoid delays or penalties. Begin by referring to specific instructions provided for each form, often found on the IRS or state websites. Ensure accuracy by triple-checking entries, particularly in numerical fields.

To aid in this process, take a systematic approach using a checklist of required documents and information. Here are some common pitfalls to avoid when filling out business forms:

To simplify these tasks, tools like pdfFiller offer interactive form assistance to ensure accuracy while filling out forms. Users can also save their progress, making the completion process smoother.

Editing and collaborating on forms

In the world of business documentation, editing and collaboration are essential for correct submissions. pdfFiller provides features that allow for easy form editing and real-time collaboration among team members. Users can assign roles, comment, and make revisions to ensure collective inputs before finalizing a document.

Cloud-based tools simplify this further, providing access to forms from anywhere. By utilizing these advancements, businesses can enhance communication and reduce the chances of errors associated with multiple document versions. Best practices for sharing forms among teams include:

eSigning business documents

Electronic signatures (eSignatures) have become standard in contemporary business practices, offering a secure and efficient way to finalize documents. They provide a level of convenience that physical signatures can’t match, enabling faster transactions.

Utilizing pdfFiller, you can easily eSign documents with just a few clicks. The platform guides users through the eSigning process, ensuring the signature meets legal requirements across various jurisdictions. Legal validity is essential, and eSignatures are generally recognized in most regions; however, checking local laws regarding eSigning is advisable.

Managing and storing business forms

Effective management and storage solutions for business forms are vital to maintaining compliance and organization. Digital organization strategies should revolve around categorizing forms for quick retrieval. Here are some effective strategies:

Security should also be a priority; pdfFiller offers features to keep sensitive documents protected while maintaining easy access for authorized users.

Year-end compliance and reporting

The end of the year poses specific challenges, especially regarding compliance and reporting. Businesses must prepare all key forms and documents necessary for year-end financial reporting, such as W-2s for employees and 1099s for contractors. Missing these documents can lead to tax issues and heightened scrutiny from the IRS.

Understanding the implications of year-end audits also influences how carefully forms need to be managed and stored. Not having the necessary documentation readily available could impact a business's financial health and compliance statistics. Utilize pdfFiller's tools to streamline year-end management, ensuring all documents are available, accurate, and submitted promptly.

Frequently asked questions about business forms

It's natural to have questions about business forms, especially concerning compliance and procedures. Some frequently raised queries include:

Success stories: Businesses leveraging pdfFiller for form management

Many businesses have transformed their operations by utilizing pdfFiller for effective form management. Case studies from varied sectors demonstrate notable enhancements in efficiency and accuracy. Companies have reported a significant reduction in time spent on document handling and improved collaboration among departments.

Testimonials highlight user-friendly platform features and the ability to digitize paper processes quickly, making form management a breeze. For instance, a local construction firm saw a 50% decrease in the time taken to submit compliance forms after adopting pdfFiller.

Future trends in business forms

The future of business forms is leaning towards increased digitization and automation. Expectations for the coming years include more standardized forms that cater to various industries and potential advancements in artificial intelligence to aid in the form completion process.

As regulatory requirements evolve, innovative solutions for document management will become critical. Staying abreast of technological advancements is essential for businesses aiming to optimize their processes using tools like pdfFiller, ensuring they remain compliant and competitively agile.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business of form year to be eSigned by others?

How do I fill out business of form year using my mobile device?

Can I edit business of form year on an Android device?

What is business of form year?

Who is required to file business of form year?

How to fill out business of form year?

What is the purpose of business of form year?

What information must be reported on business of form year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.