Get the free Financial Fact Find

Get, Create, Make and Sign financial fact find

Editing financial fact find online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial fact find

How to fill out financial fact find

Who needs financial fact find?

Financial Fact Find Form How-to Guide

Understanding the financial fact find form

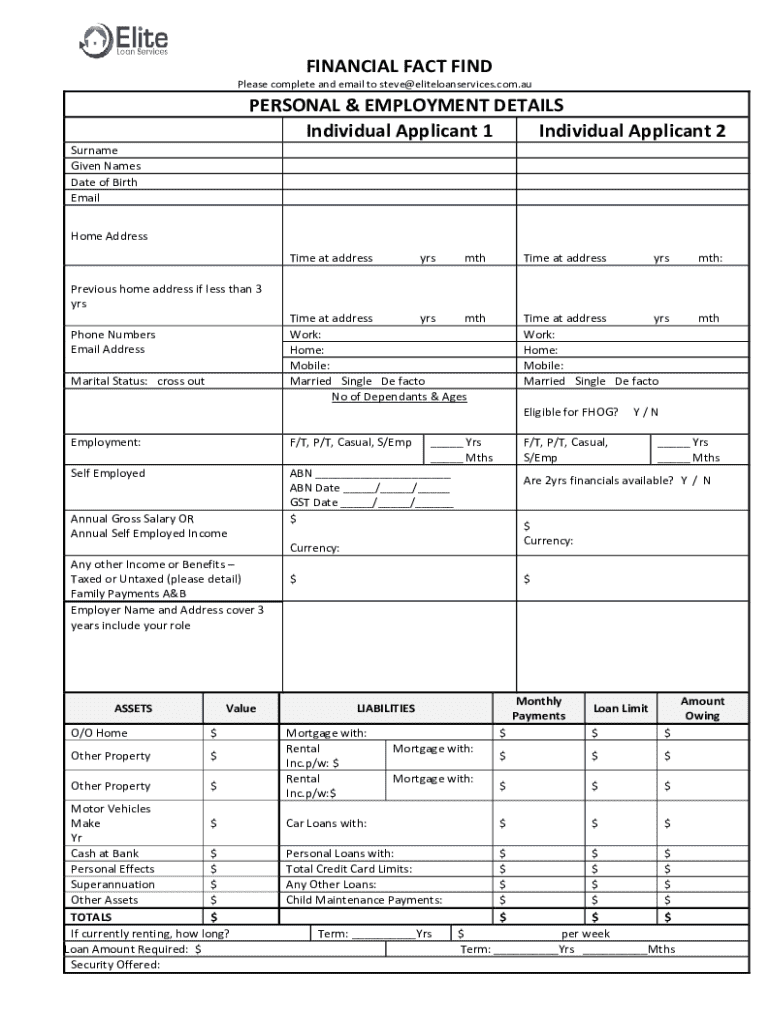

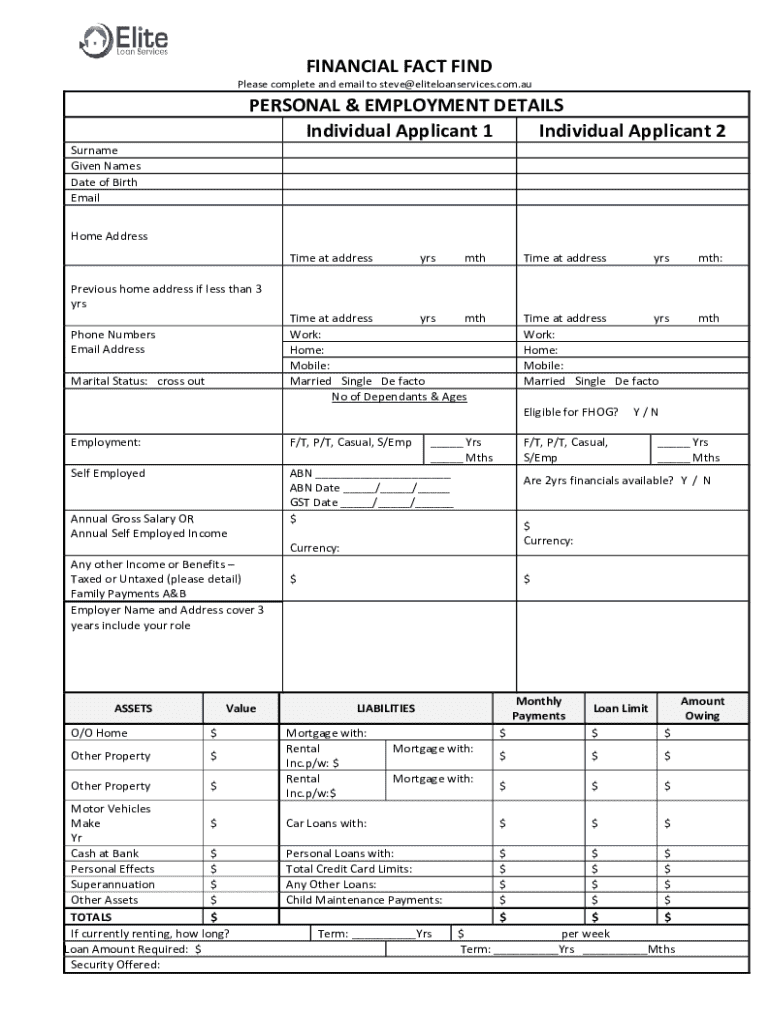

A financial fact find form is a critical document in financial planning, designed to capture a comprehensive snapshot of an individual's or a family's financial situation. This form serves to systematically gather essential information that financial consultants and advisors use to provide tailored financial advice. Understanding this form's components and significance ensures that clients set the right foundations for their financial future.

The financial fact find form is often utilized in various scenarios, such as during initial consultations with financial advisors, when applying for loans, or during estate planning. By providing detailed insights into an individual's financial landscape, it helps both parties understand unique circumstances and objectives.

Benefits of utilizing the financial fact find form

Utilizing a financial fact find form offers numerous advantages that streamline financial planning processes. Firstly, it facilitates streamlined information gathering, creating an efficient way for advisors to obtain relevant data quickly, which saves time for both the advisor and the client.

Moreover, having structured information enhances decision-making capabilities. Advisors can provide informed advice based on accurate data, leading to a more effective financial strategy. Finally, this form promotes improved financial transparency, fostering trust between clients and their advisors by ensuring that everyone is on the same page regarding financial realities.

Preparing to fill out the financial fact find form

Before completing the financial fact find form, individuals should gather necessary documents to provide accurate and relevant information. Key documents include recent bank statements, pay slips, tax returns, insurance policies, and information on any existing debts or obligations. Having these documents organized accelerates the completion process and ensures nothing is overlooked.

In addition to documents, it’s crucial to identify financial goals before filling out the form. Setting both short-term and long-term financial objectives allows individuals to articulate their needs clearly, ensuring their financial plans align with their future aspirations.

Step-by-step instructions for completing the form

Filling out the financial fact find form can be straightforward if you follow a clear step-by-step process. Start with personal information, where you'll need to provide your full name, date of birth, and contact information to help the financial advisor understand who they're working with.

Next, include your contact details to ensure efficient communication regarding financial planning strategies. Proceed to the superannuation section, where you can provide information about your current super fund and contribution history, which is crucial for retirement planning. The finances section demands a comprehensive overview of all income sources and ongoing expenses, while you must also outline your assets and liabilities for a complete financial picture.

Continue with details about insurance and estate planning, including current policies and any designated beneficiaries, as well as notes on wills and estate considerations. The form should also accommodate the contact details of your accountant and lawyer for professional advice. Finally, include space for additional information where you can share any unique financial circumstances.

Tips for editing and enhancing your financial fact find form

Once you have completed the financial fact find form, leveraging editing tools can significantly enhance your document's quality and effectiveness. Utilizing tools offered by pdfFiller, such as highlighting key sections, allows you to draw attention to important information for yourself or your financial advisor. Additionally, including interactive elements fosters seamless collaboration, allowing partners to engage with the document effectively.

Best practices for document management also come into play after editing. Keeping track of versions is vital to ensure that everyone is working off the most current information, while efficient document sharing creates opportunities for smoother communication and collaboration.

Managing the completed financial fact find form

After finishing the financial fact find form, proper management of this vital document is crucial. Choosing secure storage solutions, such as reputable cloud-based platforms, ensures that sensitive financial information stays protected, yet easily accessible when needed. Adopt best practices for document retrieval to maintain organization and efficiency within your personal financial documents.

When it comes to collaborating with financial advisors, sharing the completed form efficiently is essential. Leveraging tools available on pdfFiller allows for secure sharing methods, enabling advisors to review and offer insights without unnecessary delays.

Interactive tools to simplify the process

Integrating interactive tools within the financial fact find form experience can transform how you approach financial planning. Using financial calculators, for example, can help assess various financial scenarios and their implications quickly. Furthermore, links to additional financial planning tools can enhance the user experience, providing resources that support informed decision-making.

By employing interactive resources, individuals can visualize their financial trajectories, enabling them to set realistic goals and undertake effective planning sessions.

Common mistakes to avoid when filling out the financial fact find form

Filling out the financial fact find form should be done with diligence, as certain common mistakes can undermine its effectiveness. One frequent pitfall includes overlooking key details, such as accurate income reporting or failing to disclose all liabilities, leading to misguidance from financial advisors. Being thorough and attentive to these aspects is essential to ensure comprehensive financial advice.

Another misconception is about the complexity of the information required. Many individuals hesitate to fill out forms, believing that they must know every financial detail before doing so. The truth is that the form is meant to be a starting point for discussions, and incomplete information can often be clarified in subsequent conversations with financial professionals.

How pdfFiller enhances your financial fact find experience

pdfFiller transforms the financial fact find form experience by providing seamless eSigning and sharing features that streamline the document process. With the ability to create, edit, and share forms all within one platform, users can manage their financial documents effortlessly. Equally important are the collaborative tools that allow teams to work together on financial matters efficiently, no matter their location.

Accessing the form from anywhere at any time is another advantage, ensuring that critical financial information is always within reach, thereby fostering a proactive approach to financial planning.

Real-life applications of the financial fact find form

The practical use of the financial fact find form comes alive through real-life case studies and testimonials. For example, an individual seeking home financing successfully utilized the form to clarify their financial position to the lender, which ultimately secured better loan terms. In another scenario, a young couple preparing for retirement followed a structured approach with the form, leading them to identify areas for savings and strategically investing for the future.

These cases highlight how accurately completing the financial fact find form can have significant positive impacts on financial outcomes, reinforcing the importance of attention to detail and thoroughness in documentation.

Next steps after completing the financial fact find form

Completing the financial fact find form is just the beginning of a robust financial planning journey. The next logical step is to schedule a consultation with a financial advisor. This meeting allows for a thorough review of the completed form and the development of a tailored financial strategy based on your goals and circumstances.

Additionally, it’s prudent to set follow-up reminders for regular financial reviews. Staying proactive with financial planning ensures that objectives remain aligned with changing life circumstances, fostering continuous growth and financial security.

Why choose pdfFiller for your document needs

Choosing pdfFiller for managing your financial fact find form offers distinct advantages, particularly the benefits of a cloud-based platform. With features designed specifically for ease of access and collaboration, users can confidently manage their financial documents from the comfort of their homes or on-the-go. Additionally, robust customer support and resources are available to provide guidance, ensuring you have assistance throughout the journey.

Engaging with pdfFiller empowers individuals and teams to streamline their document processes, ultimately leading to increased efficiency and productivity in financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial fact find directly from Gmail?

How can I get financial fact find?

How can I edit financial fact find on a smartphone?

What is financial fact find?

Who is required to file financial fact find?

How to fill out financial fact find?

What is the purpose of financial fact find?

What information must be reported on financial fact find?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.