Get the free a-4p

Get, Create, Make and Sign a-4p

Editing a-4p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a-4p

How to fill out a-4p

Who needs a-4p?

A-4P Form: Comprehensive Guide to Completion and Management

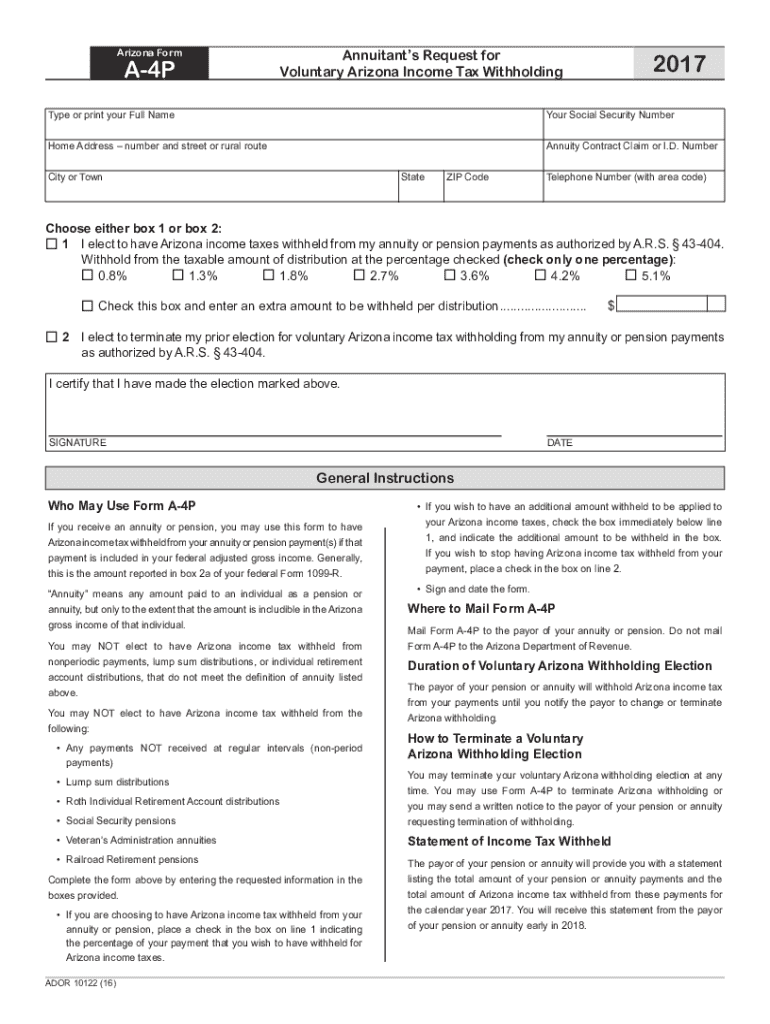

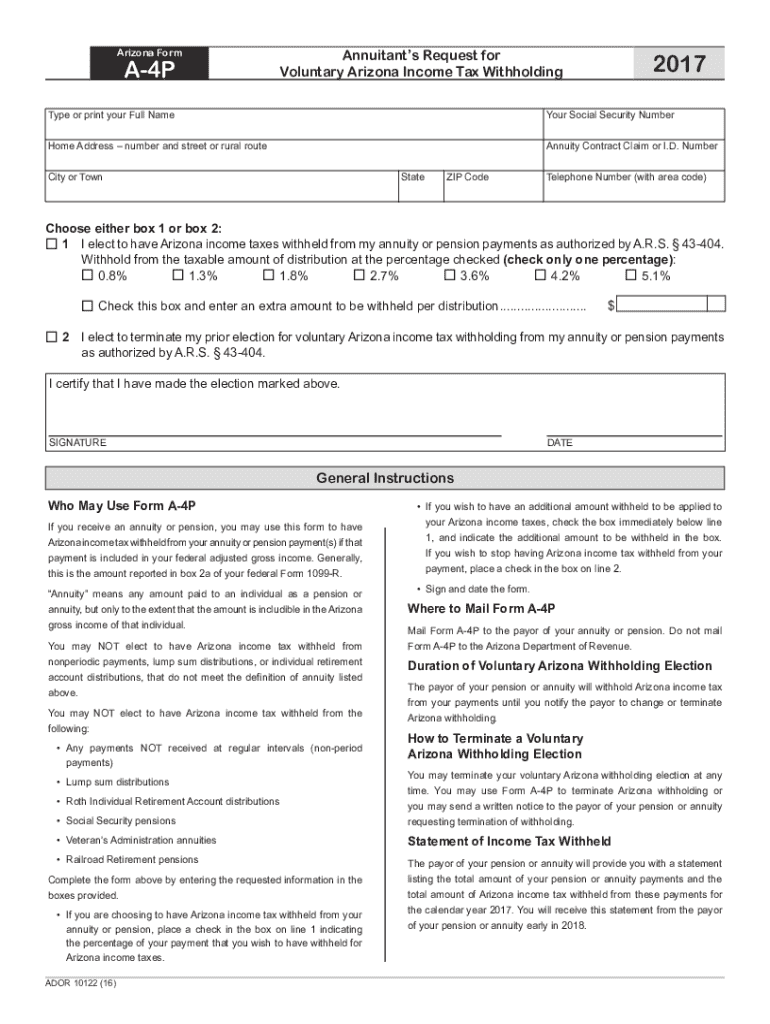

Overview of the A-4P form

The A-4P form is a crucial document used for tax withholding purposes in various jurisdictions, particularly for employees and businesses. This form allows individuals to declare their withholding allowances and ensure that their tax deductions are accurate throughout the year. The importance of the A-4P form cannot be overstated, as it ensures that employees are not over- or under-withheld on their taxes, which can impact their financial well-being.

Commonly utilized by both employees and businesses, the A-4P form provides a streamlined way to adjust withholding allowances based on personal circumstances. For individuals, this means they can ensure that their tax deductions reflect their current financial situation, including factors such as marital status and dependents. Businesses, on the other hand, use the A-4P form to manage their employees' tax withholding accurately and efficiently.

Preparing to fill out the A-4P form

Before filling out the A-4P form, it's essential to understand the requirements for submission. Individuals must meet certain eligibility criteria to use this form effectively. Typically, anyone working in a job where taxes are withheld can submit an A-4P form. It is crucial for employees who wish to change their withholding allowances due to changes in their financial or personal circumstances. Common reasons for submitting the form include marriage, divorce, or the birth of a child.

Gathering the necessary information and documents is the first step in preparing for completion. On the A-4P form, you'll need to provide your personal information, such as your name, address, and Social Security number. Additionally, consider your financial information: your income details, possible deductions, and any credits you may qualify for. Ensuring you have all of this information readily available will make the process smoother.

Detailed instructions for filling out the A-4P form

Filling out the A-4P form correctly is key to ensuring your tax withholdings are accurate. Here’s a step-by-step guide to help you through the process.

It's important to avoid common mistakes when filling out the form to prevent delays. Ensure that you don't miscalculate your allowances or leave any sections incomplete, as this can impede processing and lead to incorrect withholdings.

Editing and modifying the A-4P form

If you need to edit your A-4P form after filling it out, pdfFiller is a valuable tool. Begin by uploading your completed form to the pdfFiller platform, where interactive editing tools make modifications quick and easy. Adjust any incorrect information, whether it's your personal details or your withholding allowances.

After making your changes, it's crucial to save your modifications efficiently. pdfFiller allows you to save and export your completed forms for submission or future reference. Users can choose to print the A-4P form directly from pdfFiller, which provides added convenience and ensures compliance with submission deadlines.

eSigning your A-4P form

eSigning the A-4P form offers numerous benefits, primarily a faster approval and submission process. By utilizing pdfFiller’s electronic signing features, you can quickly add your signature to the document without needing to print it out.

To eSign using pdfFiller, first upload your A-4P form. Once it's uploaded, follow the prompts to add your electronic signature—in a secure manner. This not only saves time but also provides an efficient way to submit your forms from anywhere.

Submitting your A-4P form

After completing and signing your A-4P form, you will need to submit it. There are various submission methods available. Many jurisdictions now allow for online submissions, making the process faster and more efficient. Check your local tax office's website for specific online options available to you.

Alternatively, if you opt for mail-in submission, be sure to include all required documents and double-check that you are using the correct mailing address. Many people overlook potential pitfalls, such as omitting necessary forms or using an outdated address, which could delay processing.

To track your submission, you can typically verify if your A-4P form has been received via your local tax office’s online tracking tools.

Managing your A-4P form post-submission

Once your A-4P form is submitted, it's crucial to keep track of your withholding status. Monitoring any changes in tax withholding is necessary, especially with life events that could influence your financial situation. Regularly review your withholding to ensure it aligns with your current circumstances, updating your A-4P form whenever needed.

pdfFiller offers document management tools that can assist you in organizing your forms and documents for effective future use. With the incorporation of cloud storage benefits, users can access their documents from anywhere, ensuring you have the necessary forms ready for any tax adjustments.

FAQ about the A-4P form

Often, users have questions regarding the A-4P form. Some common queries include what to do if you make a mistake on your form. It's essential to act quickly—if you realize an error after submitting, contact your local tax office for guidance on rectifying the issue.

Another frequent question involves how often the A-4P form should be updated. Major life events, changes in income, or changes in dependents are all indicators that an update may be necessary. Regularly reviewing your situation will help you determine if any adjustments are needed, ensuring you're always on track with your tax obligations.

Conclusion on the importance of accurate A-4P form management

Accurately managing your A-4P form is vital in ensuring your tax withholdings align with your personal and financial circumstances. This form plays a critical role in tax planning, allowing individuals and businesses to maintain financial stability throughout the year.

Utilizing pdfFiller simplifies the process of handling the A-4P form efficiently. With its comprehensive document editing capabilities and cloud-based solutions, users can navigate the complexities of tax withholding with ease. Empower yourself to take control of your financial documentation with pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my a-4p in Gmail?

How do I fill out a-4p using my mobile device?

Can I edit a-4p on an Android device?

What is a-4p?

Who is required to file a-4p?

How to fill out a-4p?

What is the purpose of a-4p?

What information must be reported on a-4p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.