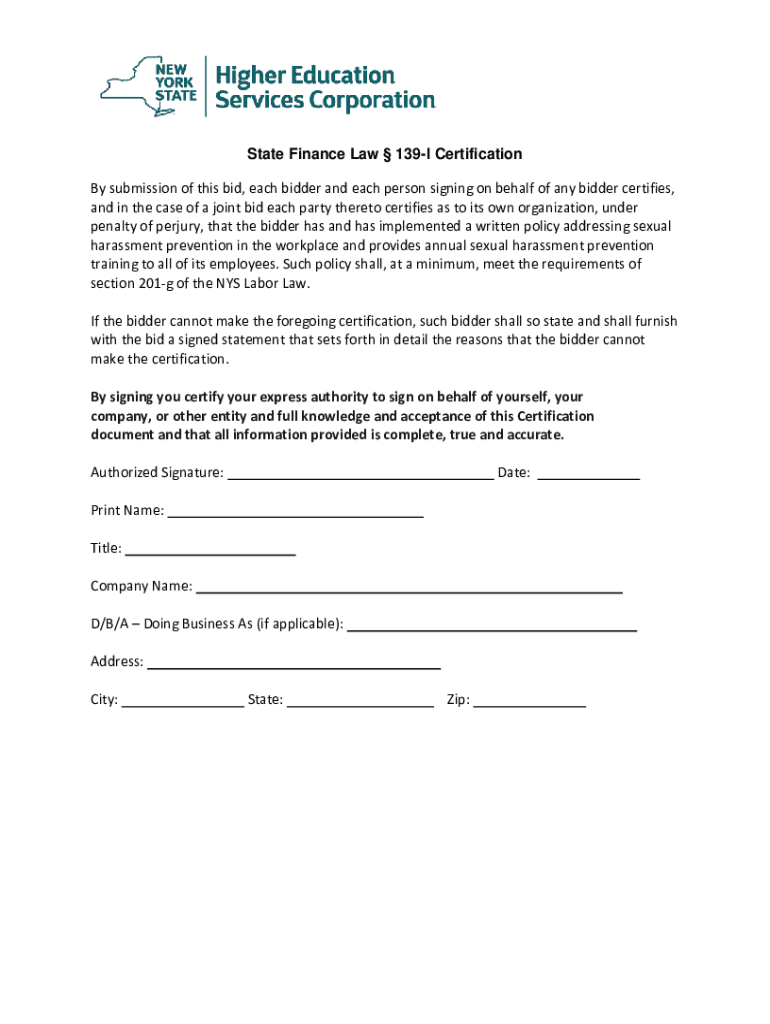

Get the free State Finance Law § 139-l Certification

Get, Create, Make and Sign state finance law 139-l

How to edit state finance law 139-l online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state finance law 139-l

How to fill out state finance law 139-l

Who needs state finance law 139-l?

Understanding the State Finance Law 139- Form: A Comprehensive Guide

Understanding the State Finance Law 139- Form

The State Finance Law 139-l Form is a crucial document required by the State of New York, primarily designed for financial reporting by entities receiving governmental funds. This form ensures that organizations outline their fiscal activities, thus maintaining transparency and accountability in the use of public resources. Organizations, including non-profits and governmental contractors, typically use this form to demonstrate compliance with state financial regulations and policies.

Complying with the State Finance Law is vital for any organization managing state funds. The law mandates that entities outline their financial performance to avoid mismanagement and to establish trust with the government and the public. Non-compliance can lead to severe repercussions, such as fines, mandatory audits, and potential disqualification from future funding opportunities.

Key components of the State Finance Law 139- Form

The 139-l Form consists of multiple sections tailored to capture detailed financial data about the reporting entity. Understanding these sections is crucial for accurately completing the form.

Step-by-step instructions for completing the 139- form

Completing the 139-l Form requires careful preparation. Before initiating the form, you should gather the necessary documents such as financial statements, proof of expenditures, and previous submissions for reference.

When filling out the form, clarity and accuracy are paramount. Begin with Section A, ensuring all organizational details are accurate; verify against tax documents to avoid mistakes. In Section B, ensure that all financial data aligns with your statements—consider cross-referencing this with your accounting team. Lastly, for Section C, ensure that the signatory has the authority to certify the document.

Tools and resources for efficient form management

Utilizing tools like pdfFiller can significantly streamline the process of filling out the 139-l Form. pdfFiller provides an intuitive platform where users can edit and fill forms online, simplifying document management.

One particularly useful feature is the collaborative options that pdfFiller offers, enabling team members to work on the document simultaneously. This reduces delays and enhances efficiency throughout the completion process.

Case studies: Real-world applications of the 139- form

Several organizations have successfully utilized the 139-l Form to indicate compliance and transparency in their financial activities. For example, a non-profit organization in New York managed to secure continued funding after demonstrating adherence to the requirements outlined in the form.

However, many also face challenges while filling it out. Common hurdles include understanding financial jargon and keeping track of deadlines, which can lead to last-minute submissions that raise flags during the review process.

Managing and submitting the completed 139- form

Once completed, timely submission of the 139-l Form is crucial. The specific submission guidelines and deadlines depend on the funding agency involved. Generally, forms should be submitted electronically through the designated state portal to ensure efficient processing.

Tracking your submission allows you to confirm that your form has been received and is under review. Most funding agencies provide a mechanism to check the status of submissions, ensuring that you remain updated on the progress.

New updates and changes to the State Finance Law 139- form

Changes to the State Finance Law can directly affect how organizations complete the 139-l Form. Recent amendments have expanded financial reporting requirements, thereby increasing the granularity of data required.

Organizations must stay informed about these changes to ensure continued compliance and take advantage of any updates that facilitate easier reporting.

Frequently asked questions (FAQs) about the State Finance Law 139- form

Many individuals and organizations have queries when it comes to completing the 139-l Form. Addressing these common concerns is vital for ensuring successful submissions and avoiding pitfalls.

Interactive tools for enhanced engagement

Utilizing pdfFiller's platform offers numerous interactive tools to enhance engagement and streamline the completion of the 139-l Form. Templates available within pdfFiller allow for quick start and easy navigation through the required sections.

Additionally, interactive checklists and automated reminders help manage the workflow, ensuring that critical tasks are completed in a timely manner. Such tools greatly decrease the likelihood of errors while promoting a seamless document management experience.

Getting help and support

Navigating the complexities of the 139-l Form can be daunting, but help is available. Various resources exist for organizations seeking guidance on specific requirements or issues arising during completion.

Whether it’s reaching out to the appropriate state authorities for clarifications or utilizing customer support offered through pdfFiller, users have ample avenues for obtaining assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit state finance law 139-l straight from my smartphone?

How do I fill out state finance law 139-l using my mobile device?

How can I fill out state finance law 139-l on an iOS device?

What is state finance law 139-l?

Who is required to file state finance law 139-l?

How to fill out state finance law 139-l?

What is the purpose of state finance law 139-l?

What information must be reported on state finance law 139-l?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.