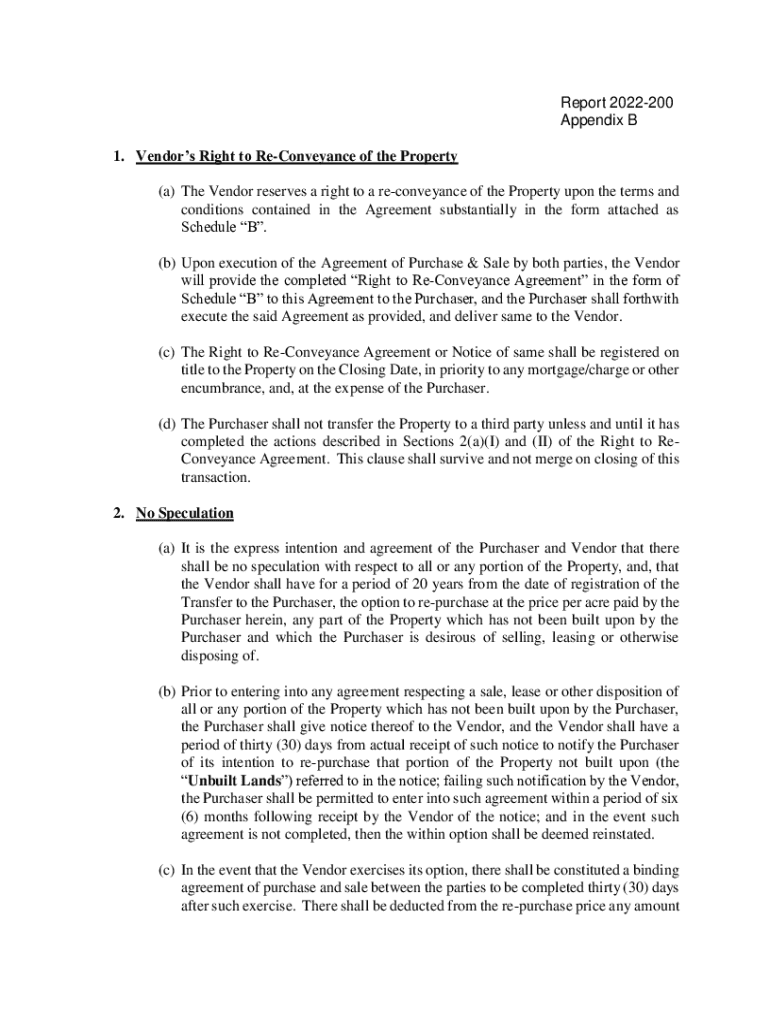

Get the free Report 2022-200

Get, Create, Make and Sign report 2022-200

Editing report 2022-200 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out report 2022-200

How to fill out report 2022-200

Who needs report 2022-200?

Guide to Completing the Report 2022-200 Form

Understanding the Report 2022-200 Form

The Report 2022-200 Form is a crucial document adhering to regulatory compliance standards for various industries. This form provides a comprehensive framework for organizations to report vital financial and operational data, ensuring transparency and accountability in their operations.

The importance of the Report 2022-200 Form lies in its ability to facilitate accurate reporting that supports regulatory bodies in enforcing compliance. This helps prevent issues such as fraud and misrepresentation and protects both the organization's and stakeholders' interests.

Typically, organizations in regulated sectors, including finance, healthcare, and manufacturing, need to file this report. Understanding if your organization falls within these requirements is the first step to ensuring smooth compliance.

Detailed breakdown of the form sections

The Report 2022-200 Form comprises several key sections, each serving a distinct purpose while collecting vital information.

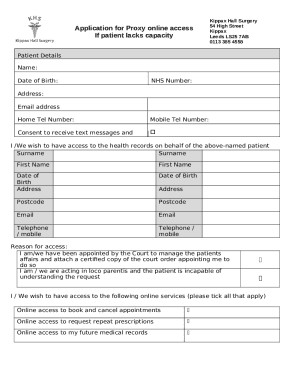

Section 1: Identifying information

This section requires basic information about your organization, including name, address, and contact details. Ensuring accuracy in these fields is critical, as discrepancies can cause delays in processing your form.

Common pitfalls in this section include misspelled names or incorrect addresses. Double-checking these details can save time and prevent complications in compliance.

Section 2: Financial data reporting

Financial data reporting is pivotal for assessing the economic health of your organization. Key financial metrics such as revenue, expenses, and profitability should be clearly outlined. Ensuring accurate figures is essential to maintain credibility with regulators and stakeholders.

Adopting best practices for gathering this data, such as maintaining thorough accounting records, can enhance the accuracy of your reporting and streamline the process significantly.

Section 3: Operational metrics

This section focuses on key performance indicators (KPIs) relevant to your operations. These may include productivity rates, customer satisfaction scores, or compliance metrics. When reporting non-financial impacts, aim for clear definitions and methodologies to substantiate your data.

Section 4: Certification and submission

The final section requires signatures from authorized individuals within your organization. This acts as a certification of the information provided. Ensure you are aware of important submission deadlines to avoid penalties, as late filings can have significant repercussions.

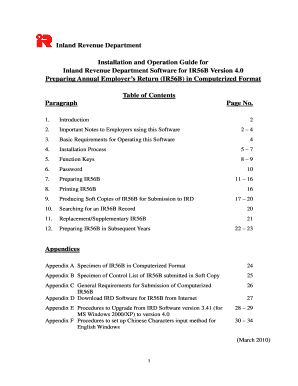

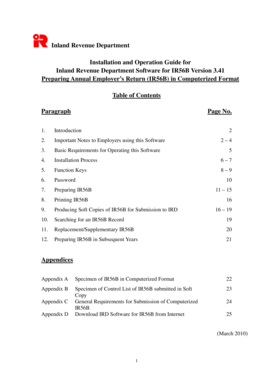

Step-by-step guide to completing the Report 2022-200 Form

Completing the Report 2022-200 Form requires careful planning and execution. Here’s a structured approach to simplify the process.

Step 1: Preparing your documents

Gathering all relevant documents before filling out the form is essential. This includes financial statements, operational data, and previous filings. A checklist can help ensure that nothing is overlooked.

Step 2: Filling out the form

As you fill out the form, focus on accuracy. Consistency is vital, so it's advisable to use figures that align with your financial statements. Tools like pdfFiller can enhance your submission process, offering features that facilitate editing and signing.

Step 3: Reviewing and editing your submission

Once the form is filled, collaborate with your team for a final review. Utilizing pdfFiller’s editing tools can help pinpoint discrepancies and ensure precision in your submission.

Step 4: Submitting the form

There are multiple submission methods available, including online submissions or traditional paper filings. Confirming your submission and following up ensures timely processing and helps tackle any potential issues before they arise.

Common errors and how to avoid them

Common errors in the Report 2022-200 Form can lead to complications and delays. Some of the top mistakes include inaccurate data entry, missing signatures, and filing after deadlines.

Consequences of incorrect filings can range from fines to intensified scrutiny from regulatory bodies. Utilizing tools like pdfFiller can minimize errors by providing templates with built-in prompts and checklists that guide you through the form.

Frequently asked questions (FAQs)

In navigating the Report 2022-200 Form process, you may have several questions:

Interactive tools and resources

To assist in completing the Report 2022-200 Form, various interactive tools are at your disposal. pdfFiller provides templates tailored to this report, simplifying the process for users.

Additionally, a downloadable checklist can help ensure you meet all requirements, along with links to relevant regulatory guidelines crucial for compliance.

Real-world applications and case studies

Examining successful submissions of the Report 2022-200 Form reveals best practices across various industries. Companies that maintain organized financial records and prioritize compliance are more efficient in filing.

However, some cases illustrate the challenges faced, like last-minute data compilation leading to errors. Learning from these instances can provide insights for future filings.

Best practices for future reporting

Planning ahead for the next report filing is paramount. Establishing a timeline can enable your organization to maintain up-to-date records throughout the year, streamlining the filing process.

Strategies for maintaining compliance year-round include regular audits, training for team members on updates in regulations, and fostering a culture of transparency in financial reporting.

Additional support and tools available on pdfFiller

pdfFiller offers a robust document management solution that extends beyond the Report 2022-200 Form. Users can leverage this platform for various document needs, such as contracts, compliance forms, and more.

By integrating pdfFiller into your workflow, you can enhance efficiency, collaboration, and maintain better control over your document lifecycle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find report 2022-200?

How can I edit report 2022-200 on a smartphone?

How do I fill out the report 2022-200 form on my smartphone?

What is report 200?

Who is required to file report 200?

How to fill out report 200?

What is the purpose of report 200?

What information must be reported on report 200?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.