Get the free Mileage & Expense Claim

Get, Create, Make and Sign mileage expense claim

Editing mileage expense claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mileage expense claim

How to fill out mileage expense claim

Who needs mileage expense claim?

Mileage Expense Claim Form: A Comprehensive How-to Guide

Understanding mileage expense claims

A mileage expense claim is a formal request for reimbursement of vehicle-related costs incurred while performing duties related to one's job. Employees often use these claims to recover costs related to travel undertaken for business purposes. It's vital to understand the legal and financial implications of these claims; inaccurate submissions can lead to audits or financial penalties.

Accurate mileage reporting is crucial not just for financial reasons but also for maintaining compliance with tax regulations. The IRS, for example, has specific guidelines that dictate how mileage can be claimed. Enterprises must ensure accurate documentation to prevent disputes and enhance transparency within their financial practices.

Types of mileage that can be claimed

Understanding what constitutes claimable mileage is essential for any employee seeking reimbursement. Generally, mileage can be classified into business and personal categories. Business mileage includes trips taken for client meetings, business-related travel, and other official errands. In contrast, personal mileage incurred for commuting to and from work is typically not eligible for reimbursement.

Common scenarios for claiming mileage may include visiting clients or attending conferences. However, different regulations apply depending on the industry. For instance, sales representatives may claim more mileage as part of their jobs compared to employees in sectors with less traveling.

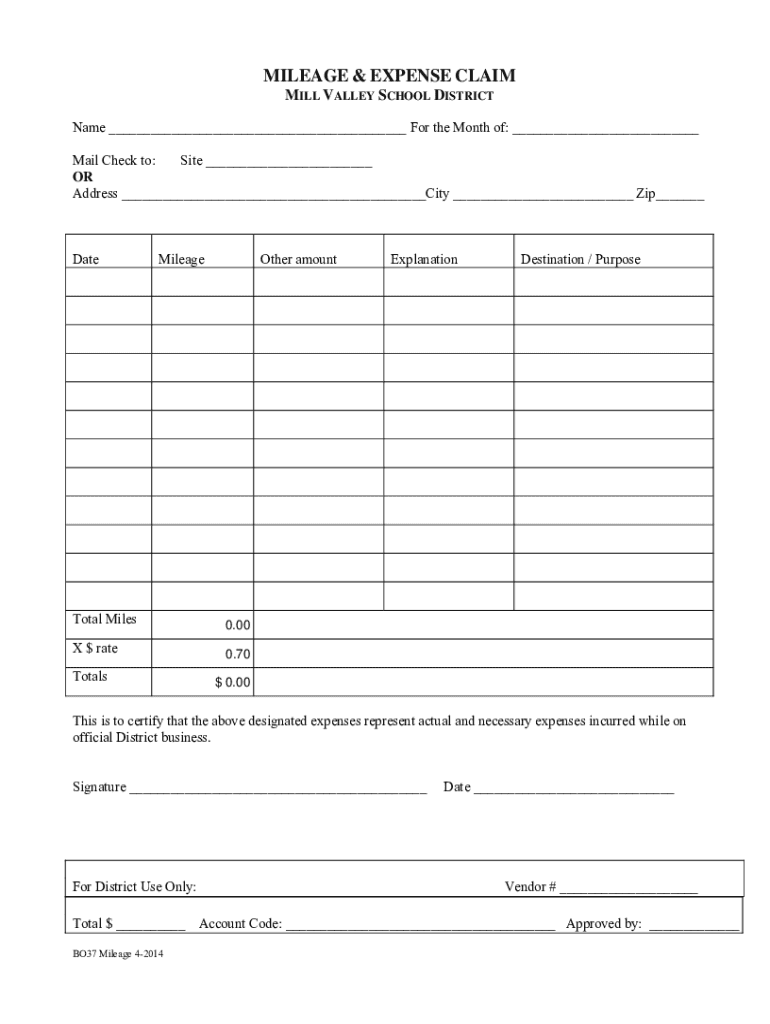

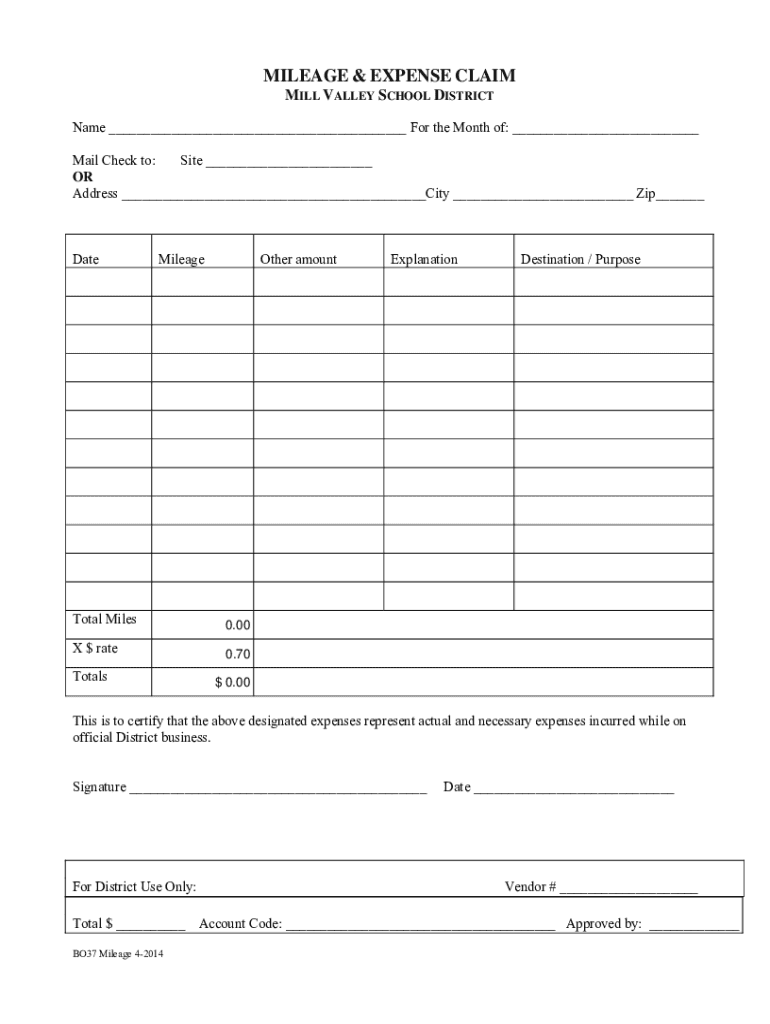

Role of the mileage expense claim form

The mileage expense claim form serves as the official document through which an employee requests reimbursement for travel expenditures. More than just a piece of paper, it encapsulates vital trip details, ensuring a record that can be audited if necessary. Required information typically includes the date of travel, the distance traveled, the purpose of the journey, and any relevant odometer readings.

Using this form is necessary whenever an employee wishes to be reimbursed for travel-related expenses. Without it, claims could go unrecognized, complicating financial reporting and accountability.

Step-by-step guide to filling out the mileage expense claim form

Filling out the mileage expense claim form correctly is essential for seamless reimbursement. Here’s a step-by-step guide to ensure you complete it accurately.

Benefits of using the mileage expense claim form via pdfFiller

Using the mileage expense claim form with pdfFiller offers several advantages. One of the primary benefits is a streamlined process for document management, resulting in a more efficient workflow. Accessibility is another significant aspect; you can fill out forms from anywhere, allowing for flexibility in busy work schedules.

Additionally, pdfFiller enhances collaboration and offers eSigning features, making it easy to share forms with supervisors or finance departments for prompt approvals. Secure cloud storage ensures your tax and financial records are safeguarded and easily retrievable whenever needed.

Common mistakes to avoid when submitting mileage claims

When submitting mileage claims, errors can lead to delays or denied reimbursements. Overestimating miles driven is a frequent issue; it’s crucial to keep accurate records of your trips. Additionally, neglecting to attach supporting documents, such as maps or gas receipts, can hinder the approval process.

It’s equally important to be aware of and adhere to company policies regarding mileage claims. Each organization has specific guidelines, and failing to comply may result in complications during the reimbursement process.

Real-life success story: How Jane saved money with her mileage claims

Jane, a sales representative, faced challenges in tracking her business mileage due to the sheer volume of travel on her job. After using pdfFiller, she found a template that simplified her mileage expense claim submissions, helping her detail each trip accurately in real-time.

Leveraging pdfFiller's features not only streamlined her process but also ensured she captured every eligible deduction, leading to significant savings on her taxes. Jane's case illustrates the importance of utilizing effective tools to manage and optimize mileage claims.

FAQs about mileage expense claim forms

Navigating the complexities of mileage expense claim forms raises several common questions. What if my mileage claim is denied? Usually, this may occur due to inaccuracies in reporting or lack of supporting documentation. It's vital to address the reasons for denial promptly and resubmit with the correct information.

Another common inquiry involves backdating mileage claims. Most organizations allow backdating up to a certain period, but it varies between businesses. Keeping a well-structured mileage log aids in this process. Lastly, ensure you have all necessary supporting documentation to bolster your claim and enhance approval chances.

Additional tips for maximizing your mileage reimbursement

To optimize your mileage reimbursement, regularly tracking your miles versus bundling claims can have distinct advantages. While regular tracking allows for accurate claims based on actual mileage, batching claims can simplify paperwork and streamline submissions.

Maintaining a detailed mileage log is essential for both tax purposes and personal record-keeping. This log serves as a comprehensive overview of your travel, assists in identifying patterns in trips, and ensures you don’t miss out on reimbursement opportunities.

Conclusion: Streamlining your mileage claims with pdfFiller

Efficiently managing your mileage claims is integral to ensuring proper reimbursements. By using pdfFiller, you are empowered to fill out the mileage expense claim form quickly and accurately, which aids in compliance with financial policies. Remember the key steps outlined throughout this guide, and do not hesitate to leverage modern tools for a smoother experience.

Interactive tools & resources

To assist further, you can access the mileage expense claim form template through pdfFiller to get started. Consider trying out an interactive mileage calculator that could help simplify your reimbursement calculations. Lastly, if you need additional guidance, pdfFiller offers support links to answer any specific inquiries you may have.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mileage expense claim without leaving Google Drive?

How can I send mileage expense claim to be eSigned by others?

Can I create an electronic signature for signing my mileage expense claim in Gmail?

What is mileage expense claim?

Who is required to file mileage expense claim?

How to fill out mileage expense claim?

What is the purpose of mileage expense claim?

What information must be reported on mileage expense claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.