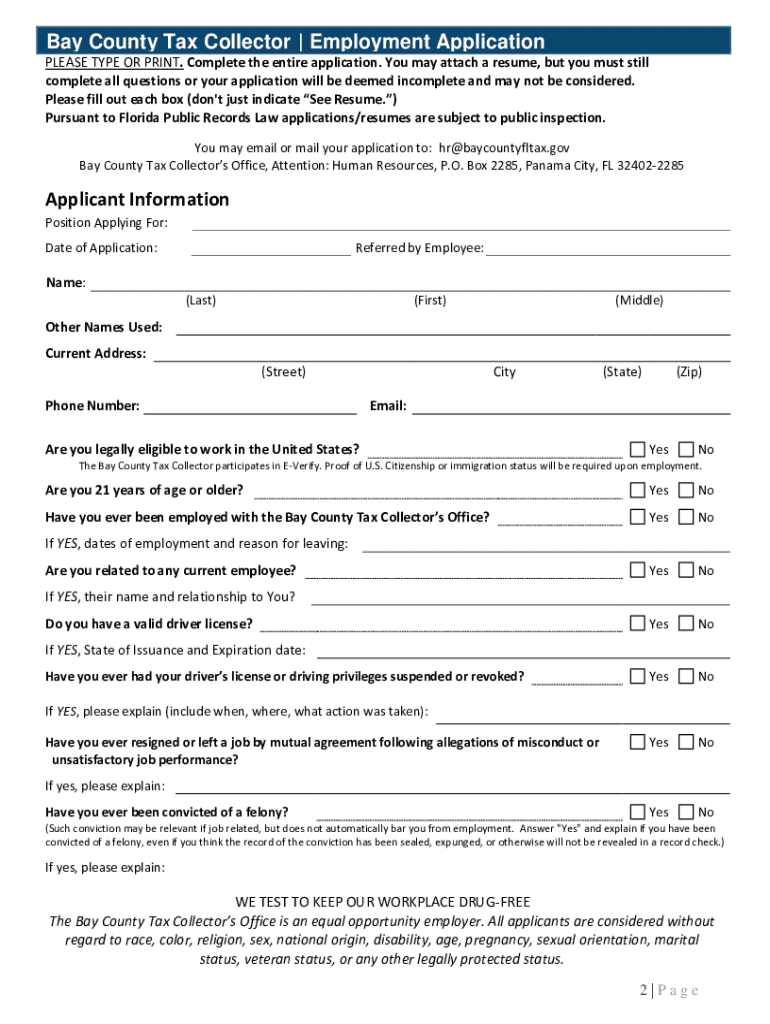

Get the free Bay County Tax Collector | Employment Application

Get, Create, Make and Sign bay county tax collector

How to edit bay county tax collector online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bay county tax collector

How to fill out bay county tax collector

Who needs bay county tax collector?

Bay County Tax Collector Form: A Comprehensive How-to Guide

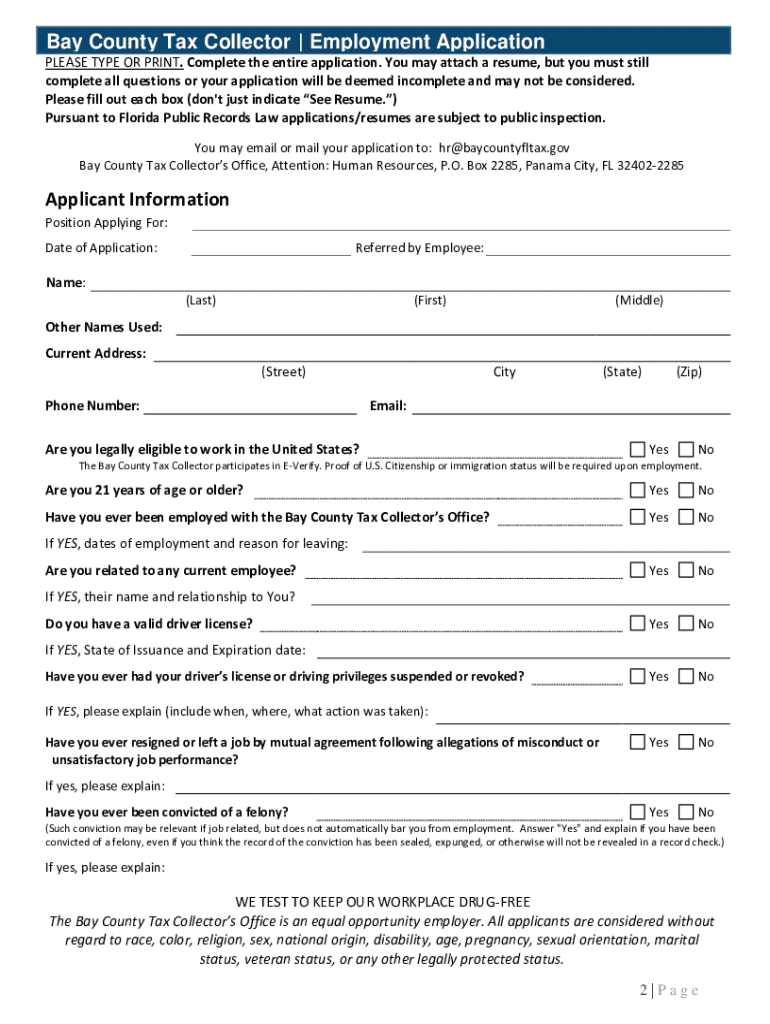

Understanding the Bay County Tax Collector Form

The Bay County Tax Collector Form serves as a vital document for individuals and businesses in Bay County seeking assistance with property tax management. This form is instrumental for property owners who need to report changes, claim exemptions, or manage payments. Understanding the necessity of this form is crucial for compliant and efficient property tax management.

Filling out the Bay County Tax Collector Form is essential for anyone who owns property within Bay County, including homeowners, commercial property owners, and real estate investors. It facilitates the correct assessment and payment of property taxes, ensuring that individuals meet their financial obligations to the county's tax authority.

Key features of the Bay County Tax Collector Form

One of the key features of the Bay County Tax Collector Form is its interactive functionalities that allow users to fill out the form easily. The form is designed with a user-friendly interface, making it accessible for individuals who may not be tech-savvy. The advantages of using a platform like pdfFiller include the ability to edit the form in real-time, add comments, and easily share it with others.

Compared to traditional paper forms, the digital version offers numerous accessibility benefits. For instance, users can access the Bay County Tax Collector Form from anywhere at any time. This flexibility is particularly useful for busy professionals or those who live far from the tax collector’s office. Moreover, pdfFiller's platform streamlines the entire process from filling out to submitting the form.

Step-by-step guide to filling out the Bay County Tax Collector Form

To successfully complete the Bay County Tax Collector Form, it's essential to approach the task methodically. Here’s a comprehensive step-by-step guide to ensure you fill it out correctly:

Editing and modifying the Bay County Tax Collector Form

If you need to make changes to your Bay County Tax Collector Form, pdfFiller makes editing straightforward. After accessing your saved form, you can easily update any field to reflect new information. This includes changing personal details or correcting any mistakes.

eSigning the Bay County Tax Collector Form

eSigning your Bay County Tax Collector Form is crucial as it grants legal validity to the document. With pdfFiller, you can easily add your eSignature directly to the form.

To eSign your document, navigate to the eSignature tool within pdfFiller and follow these steps: first, select the area where your signature is required; second, choose whether to draw, upload, or use a pre-saved signature; and finally, confirm your signature to finalize the process. Make sure your signature meets any specific requirements set by the Bay County tax authority.

Submitting the Bay County Tax Collector Form

After completing and signing your Bay County Tax Collector Form, it’s time to submit it. You have multiple options available for submission to ensure convenience and speed. You can choose to file your form online through the Bay County website, send it via mail, or deliver it in person at the tax collector's office.

Frequently asked questions (FAQs)

Navigating the regulations and requirements surrounding the Bay County Tax Collector Form can sometimes lead to confusion. Here are some of the most common queries regarding this form:

Related forms and resources

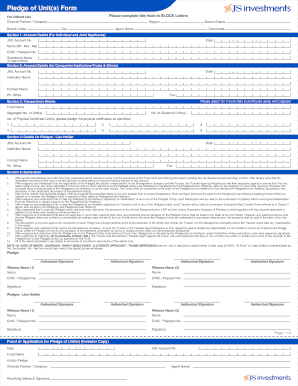

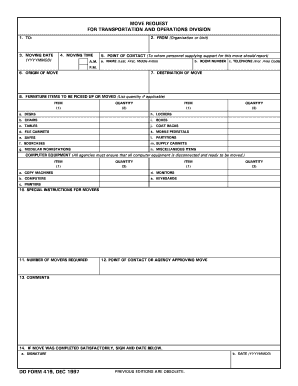

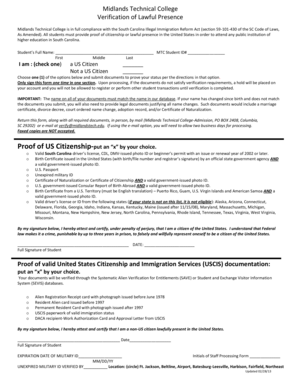

Alongside the Bay County Tax Collector Form, several other forms may also be necessary depending on your financial situation or property type. Familiarity with these related forms can streamline your tax management process.

Updating your information post-submission

Maintaining current information with the Bay County Tax Collector’s office is essential for avoiding issues with property assessments and tax liabilities. Should your personal or property details change after submitting the Bay County Tax Collector Form, it's crucial to update the tax collector’s office promptly.

To update your information, reach out to the tax collector by phone, or submit the appropriate forms online through the Bay County website. Having your original form on hand can help expedite the updating process.

Tax payment options and information

Bay County residents have several options available to pay their property taxes. Understanding these methods can simplify compliance and convenience. Payments can be made online, by mail, at designated locations, or through electronic funds transfer. Leveraging pdfFiller to keep track of these payments ensures efficient record-keeping and easy document management.

Bay County tax process insights

Understanding the property tax assessment and billing processes in Bay County is vital for all property owners. The tax collector's office operates several programs that help residents better understand their tax obligations and the basis for assessments.

Resources available for guidance include educational workshops hosted by the tax collector’s office and detailed online resources. Familiarizing oneself with these insights can significantly benefit property owners and help avoid misunderstandings regarding their tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bay county tax collector online?

How do I edit bay county tax collector in Chrome?

How do I edit bay county tax collector on an Android device?

What is bay county tax collector?

Who is required to file bay county tax collector?

How to fill out bay county tax collector?

What is the purpose of bay county tax collector?

What information must be reported on bay county tax collector?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.