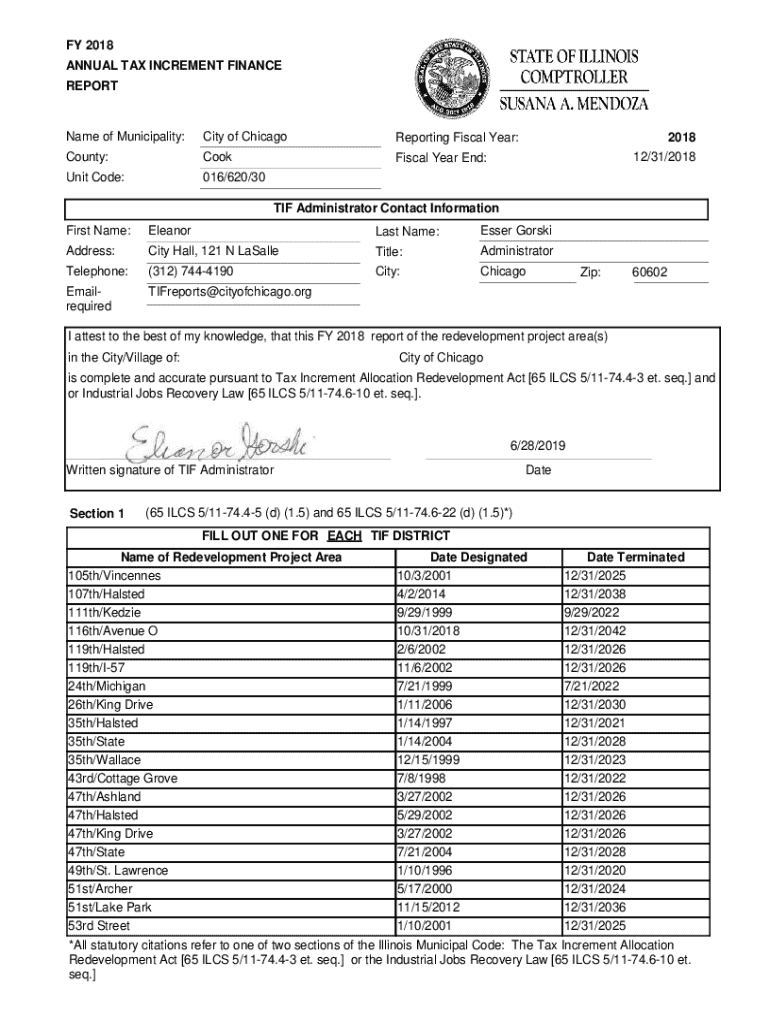

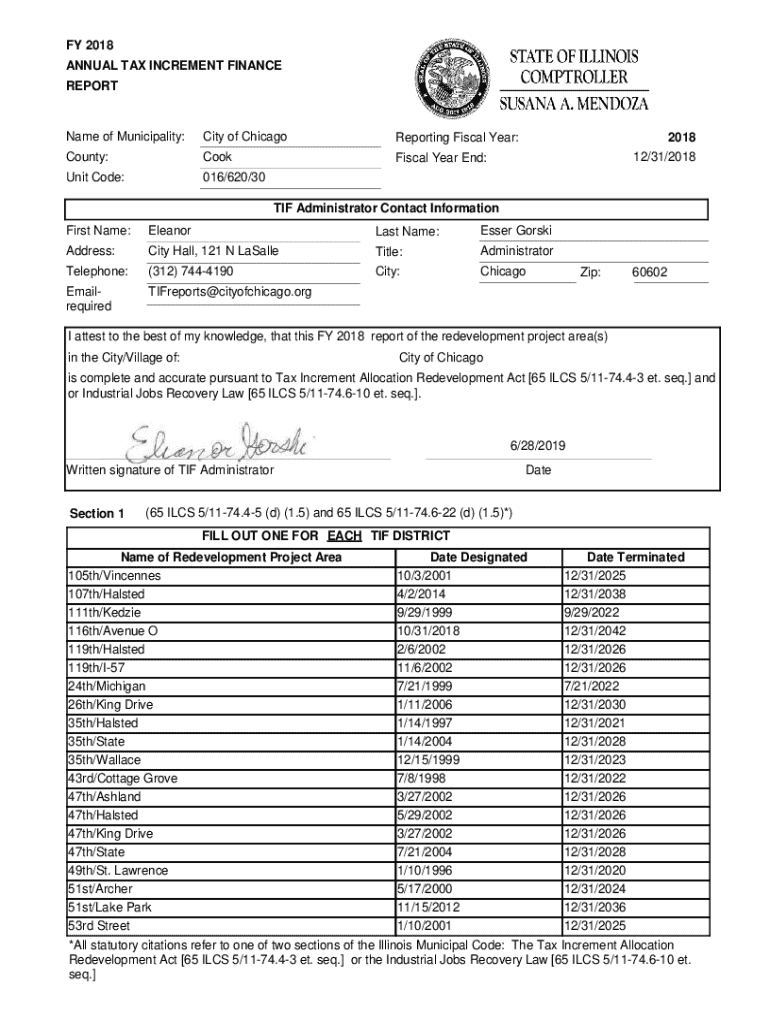

Get the free Fy 2018 Annual Tax Increment Finance Report

Get, Create, Make and Sign fy 2018 annual tax

Editing fy 2018 annual tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fy 2018 annual tax

How to fill out fy 2018 annual tax

Who needs fy 2018 annual tax?

Your Guide to the FY 2018 Annual Tax Form

Understanding the FY 2018 Annual Tax Form

The FY 2018 annual tax form is a critical document that taxpayers must complete to report their income, deductions, and credits for the financial year ending December 31, 2018. This form serves as a comprehensive overview of an individual’s or entity’s tax obligations, ensuring compliance with federal tax regulations set forth by the IRS.

Filing the annual tax form is essential not only for meeting legal obligations but also for potentially receiving refunds or verifying tax liabilities. Failure to submit the form on time can result in penalties, so understanding its importance is paramount for all taxpayers.

Types of FY 2018 Tax Forms

For FY 2018, taxpayers primarily utilized several forms, with the most common being Form 1040. Each form caters to different filing needs, ensuring taxpayers can choose the one that fits their financial situations the best.

Essential deadlines for FY 2018 tax filing

Staying aware of important tax deadlines is crucial for effective tax management. For FY 2018, the key dates include:

Preparing to file your FY 2018 tax form

Accurate preparation is key to a smooth filing process. Before you start filling out the FY 2018 annual tax form, gather all necessary documents, including:

Organizing these documents in advance can save you significant time and effort when preparing your tax form.

Step-by-step guide to filling out the FY 2018 tax form

Filing the FY 2018 tax form may seem daunting, but breaking it down into manageable steps makes the process easier. When filling out Form 1040, attention to detail is essential.

If you're using simpler forms like 1040A or 1040EZ, follow specific guidance that reduces the number of steps and complexity for filing.

Common mistakes to avoid when filing

Filing errors can lead to delays in processing and potential fines. Being aware of common pitfalls helps ensure a smoother experience. Some frequent errors to watch out for include:

How to file your FY 2018 tax form

Filing options for the FY 2018 annual tax form are versatile, allowing taxpayers to choose according to their preferences. Two primary methods include traditional paper filing and e-filing.

The step-by-step process for e-filing through pdfFiller involves creating an account, uploading necessary documents, editing your tax form, and submitting it—all while ensuring document security and compliance.

Managing your tax documents post-filing

After filing your FY 2018 tax form, efficiently managing your documents is vital to streamline any future processes, potential audits, or additional tax claims.

Support and assistance for FY 2018 tax filing

If challenges arise during the tax filing process, various resources are available for obtaining assistance. The IRS provides several channels and resources, including hotlines and frequently asked questions on their website.

Additional insights and tools

In addition to the filing process, taxpayers can benefit from interactive tools offered by pdfFiller. These resources play a significant role in optimizing the tax preparation experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fy 2018 annual tax without leaving Google Drive?

How do I execute fy 2018 annual tax online?

How can I fill out fy 2018 annual tax on an iOS device?

What is fy annual tax?

Who is required to file fy annual tax?

How to fill out fy annual tax?

What is the purpose of fy annual tax?

What information must be reported on fy annual tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.