Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-to Guide

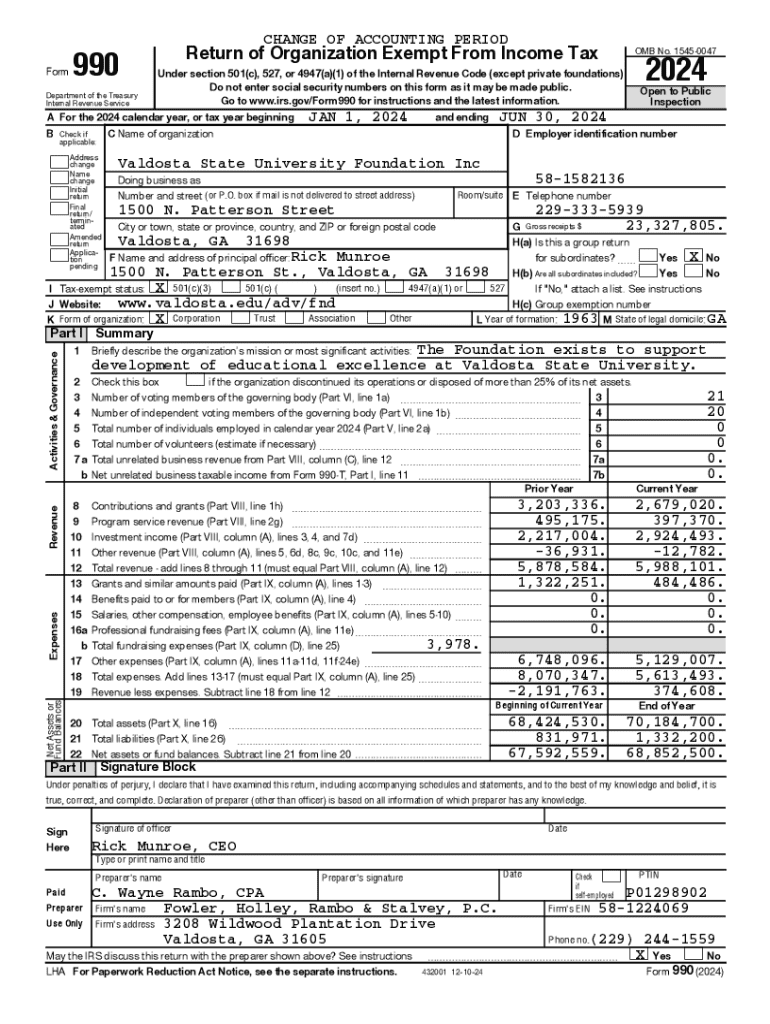

Understanding Form 990

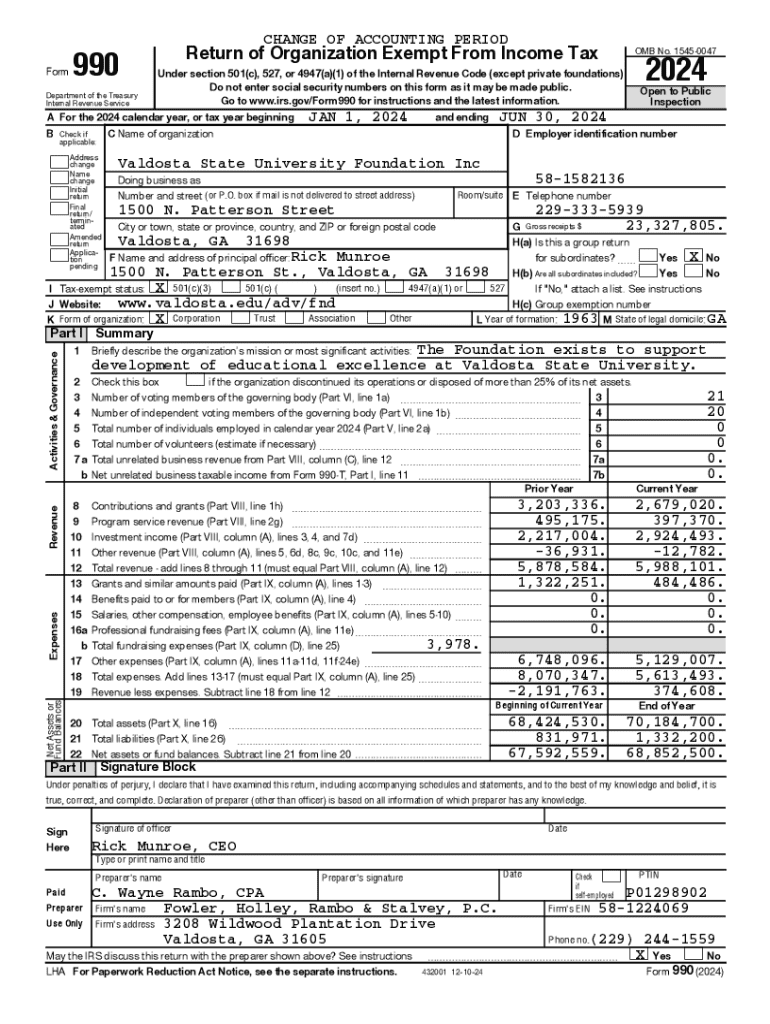

Form 990 is a pivotal document for tax-exempt organizations in the United States. It serves as an annual reporting return that provides essential details about the organization's mission, programs, and finances. The significance of Form 990 lies in its ability to promote transparency and accountability among nonprofits, allowing stakeholders—including donors and the public—to make informed decisions.

The key purposes of filing Form 990 include ensuring compliance with federal regulations, assisting the IRS in monitoring nonprofit activities, and offering insight into an organization’s financial health. This comprehensive overview not only aids external observers but also assists organizations in assessing their performance.

Types of Form 990

Nonprofits have a few variations of Form 990 to choose from, specifically Form 990, Form 990-EZ, and Form 990-N. The main difference revolves around the organization's size and its revenue. Form 990 is designed for larger organizations that typically have revenue over $200,000 or total assets exceeding $500,000. Form 990-EZ is a streamlined version for smaller entities, with revenue between $50,000 and $200,000. Finally, Form 990-N, also known as the e-Postcard, serves organizations with gross receipts under $50,000, simplifying their filing process.

Who must file Form 990?

The requirement to file Form 990 is contingent upon the type of nonprofit organization. Public charities, for instance, are generally obliged to file, while private foundations have separate requirements. Exempt organizations earn a tax-exempt status but still need to monitor their thresholds to ensure compliance. A crucial component is recognizing if the organization falls into the category of exempt from filing altogether, such as churches or certain government entities.

Understanding these nuances is vital for compliance. Organizations must accurately assess their type and revenue to determine filing necessity and ensure they adhere to established regulations.

Filing requirements and key deadlines

Filing deadlines for Form 990 are tied to the end of the organization’s accounting period. Generally, organizations must file by the 15th day of the fifth month after their fiscal year-end. For instance, if an organization’s fiscal year ends on December 31st, Form 990 must be filed by May 15th. It’s crucial to mark these dates and plan accordingly, as timely submission can prevent penalties.

Organizations can file Form 990 either online or via paper. Online filing is often recommended due to its efficiency and the ability to track submission. Regardless of the method chosen, certain documentation and attachments may be required to ensure a complete submission, including financial statements and supplementary schedules.

Step-by-step instructions for filling out Form 990

Before diving into the form, gather all necessary information such as financial records, program descriptions, and governance details. Utilize tools like pdfFiller to establish an account for easy document management; their platform facilitates the seamless filling, editing, and signing of Forms.

As you begin filling out Form 990, follow these guidelines for each section:

Common pitfalls and how to avoid them

Filing Form 990 can lead organizations into common pitfalls, often due to confusion or oversight. Frequent mistakes include reporting incorrect financial information, omitting required schedules, and misclassifying revenue. These errors can result in penalties or scrutiny from the IRS, undermining the organization’s credibility.

To enhance accuracy, follow these tips:

Managing and maintaining records post-filing

Retaining records related to Form 990 is essential for compliance audits and future references. Nonprofits should keep copies of their filed Form 990, supporting documentation, and correspondence for at least three to seven years, depending on IRS guidelines. This retention period ensures you can provide documentation for any inquiries or audits.

To effectively organize and secure these digital files, consider employing pdfFiller’s document management features. Their platform offers secure storage solutions, enabling easy retrieval and sharing while keeping sensitive information protected.

Understanding penalties for non-compliance

Failure to file Form 990 or submitting inaccurate information can lead to significant penalties. Organizations may incur fines that escalate based on the duration of non-compliance, potentially reaching thousands of dollars. More critically, non-compliance can jeopardize an organization’s tax-exempt status, impacting funding and public trust.

If an organization recognizes any compliance issues, it’s crucial to take immediate action. Correct the mistakes promptly and consult with a tax expert to navigate the process of rectification effectively.

Public inspection regulations

Form 990 must be made available for public inspection, allowing stakeholders and interested parties to access these filings. This requirement promotes transparency and instills confidence in donors, ensuring they can evaluate the organization’s accountability and financial practices.

Organizations must provide copies of Form 990 upon request, either in paper format or electronically. Understanding this public disclosure requirement emphasizes the importance of accurate and honest reporting.

Analysis and use of Form 990 for charity evaluation

Form 990 plays a critical role in evaluating nonprofit organizations, providing insights into their financial health and program efficiency. Donors and researchers often use the information gleaned from Form 990 to assess an organization's viability and impact.

Key indicators to review include:

Interactive tools and resources

Utilizing resources like pdfFiller streamlines the process of handling Form 990. Their interactive tools offer capabilities for filling, editing, signing, and managing documents seamlessly. Users can also access a wealth of online resources for quick assistance and guidance.

Positive user testimonials highlight the platform's effectiveness in simplifying document management, sharing success stories of organizations that successfully navigated their filing requirements and enhanced their operational efficiency.

History and evolution of Form 990

Form 990 has a storied history dating back to 1942, originally designed to gather fundamental information about nonprofits. Over the years, it has evolved significantly to include more detailed reporting requirements, reflecting the increasing demand for transparency and accountability within the nonprofit sector.

Recent changes have aimed to simplify the filing process and enhance the data collected. For example, the implementation of new schedules and modified reporting categories responds to contemporary challenges nonprofits face and aids both the IRS and the public in evaluating organizational effectiveness.

Related forms and additional considerations

Apart from Form 990, organizations might require additional IRS forms such as Form 1023 for tax-exempt status, or Form 990-T for unrelated business income. Understanding these related forms is critical for comprehensive compliance and effective organizational management.

Nonprofits should familiarize themselves with best practices to adhere to IRS regulations while ensuring they optimize their operational structures to support their goals effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990 online?

How do I edit form 990 straight from my smartphone?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.