Get the free Where to Find Tins?

Get, Create, Make and Sign where to find tins

How to edit where to find tins online

Uncompromising security for your PDF editing and eSignature needs

How to fill out where to find tins

How to fill out where to find tins

Who needs where to find tins?

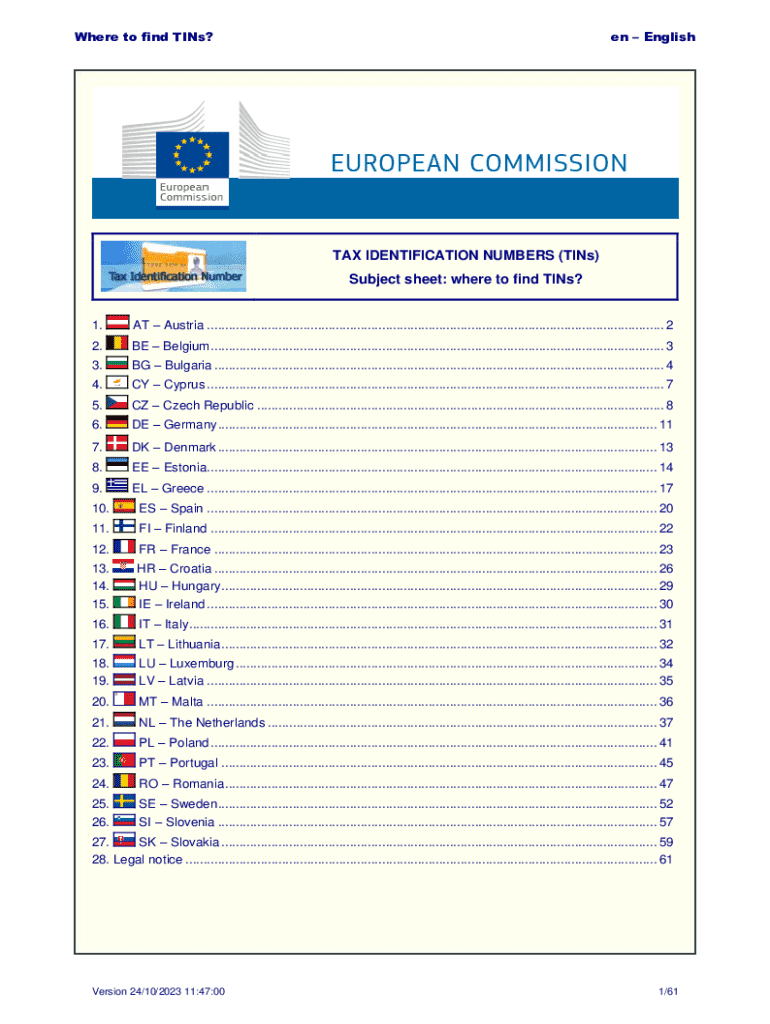

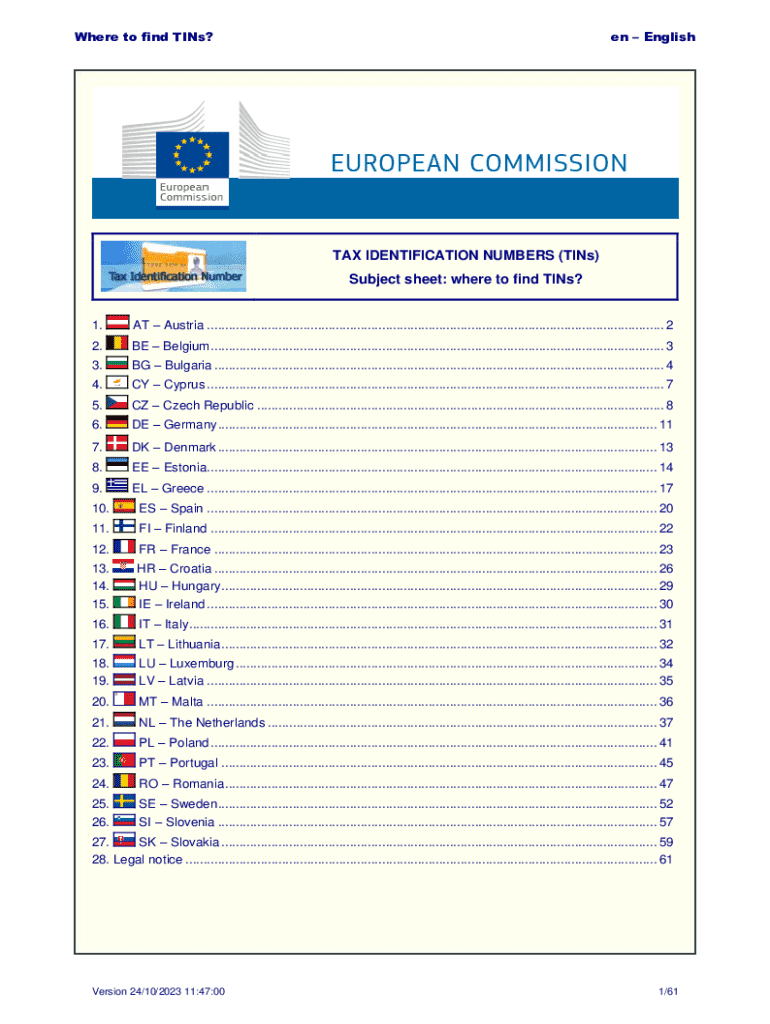

Where to find TINs form: A comprehensive guide

Understanding TINs forms

A Taxpayer Identification Number (TIN) is a vital component of any individual’s or entity’s tax documentation. It serves as a unique identifier for taxpayers, making it essential for processing tax returns and various financial transactions. This guide provides valuable insights and resources to help you find and manage your TIN forms efficiently.

Understanding the importance of a TIN is crucial. It's used by the IRS to link taxpayers with their tax records, ensuring the accuracy of the tax system. Additionally, entities require a TIN to file business taxes and report income to the government.

Locating TINs forms

When searching for your TIN form, the easiest and most reliable way is through official government websites. In the U.S., the IRS website offers easy access to various TIN application forms, such as Form SS-4 for EINs.

Federal resources like the IRS provide comprehensive guidelines for TIN applications. However, for state-specific TIN requirements, it's essential to visit your state’s tax authority website.

Additionally, third-party online platforms can also help in obtaining TIN forms. However, the risk of outdated or incorrect information highlights the importance of ensuring you use reputable sites. Recommended platforms include pdfFiller for interactive document solutions or trusted financial service websites.

Filling out the TINs form

Filling out a TIN application form involves a few crucial steps to ensure accuracy and completeness. First, gather all necessary information such as personal identification, business details (if applicable), and prior tax information.

Common mistakes include providing incorrect information, failing to sign the form, and submitting incomplete applications. Following the guidelines can prevent delays in processing your TIN application.

pdfFiller’s interactive tools can simplify filling and editing TIN forms. Its user-friendly platform allows for electronic signatures and real-time collaboration, enhancing the efficiency of TIN applications.

Managing TINs forms

Once you've obtained your TIN, effective storage and organization of TIN documentation is vital. Best practices include digital storage solutions with backed-up cloud options and organizing physical files in labeled folders for easy access.

With multiple TINs to manage, establish a systematic approach to track each number's associated documentation. Utilizing platforms like pdfFiller offers secure storage and quick retrieval, which is particularly helpful for individuals managing both personal and business TINs.

If you need to access or modify your TIN forms later, pdfFiller makes it easy to edit saved forms securely. Regularly updating your information ensures compliance and accuracy.

Common queries regarding TINs forms

Many individuals often ask, 'Do I need a TIN?' The answer typically depends on your financial activities and jurisdiction. For instance, foreign nationals earning income in the U.S. usually require a TIN to file tax returns.

Additionally, exceptions exist for certain groups, such as some non-resident aliens, who may not need a TIN if their income falls below a specific threshold.

If there are any issues with your TIN, such as errors or discrepancies, it's essential to contact the relevant authorities immediately. The IRS provides resources for correcting TIN-related issues, and guidance is available directly through their helpline.

Limitations and considerations

Acquiring a TIN can come with specific limitations, especially for those in non-resident or special statuses. For instance, certain visa holders may encounter additional hurdles when applying for a TIN due to their residency status.

It's also essential to be aware of your legal responsibilities when it comes to TIN usage. Knowing the compliance requirements, such as data protection laws and proper handling of TIN documents, will help avoid any legal complications.

Navigating international TINs

For expatriates or anyone dealing with international finances, understanding Foreign Tax Identifying Numbers (FTINs) is crucial. Each country has specific requirements for obtaining an FTIN, which can often vary based on the individual's circumstances.

To acquire your FTIN, start by visiting the tax authority of your resident country. Many countries provide online applications for FTINs, along with guidelines for non-residents. Utilizing pdfFiller can assist in managing any documentation required for international tax matters.

Featured solutions and tools

pdfFiller not only provides tools for obtaining TIN forms but also comprehensive solutions for managing tax-related documents. Its user-friendly platform offers templates and a variety of interactive features tailored for tax documentation needs.

Membership benefits for frequent TIN users include access to exclusive discounts, premium support, and additional features tailored to enhance user experience, making tax season a breeze.

Helpful resources

Explore a wealth of resources available online to further your knowledge about TINs. The IRS website hosts a comprehensive FAQ section that addresses common issues and concerns related to TINs.

Furthermore, community forums and tax advice platforms can provide insights and answers from experienced peers, which can be incredibly beneficial, especially if you’re facing specific tax-related challenges.

Footer navigation

To make navigation easier, pdfFiller provides quick links to related forms and templates on their site. Additionally, their customer service team can assist with any queries or concerns about TINs or other document-related issues.

Should you need assistance, contact pdfFiller through their help center for immediate support. Remember that managing your TINs efficiently can save you a lot of time and hassle in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send where to find tins for eSignature?

How can I edit where to find tins on a smartphone?

How can I fill out where to find tins on an iOS device?

What is where to find tins?

Who is required to file where to find tins?

How to fill out where to find tins?

What is the purpose of where to find tins?

What information must be reported on where to find tins?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.