Get the free -;;;;;;t

Get, Create, Make and Sign t

Editing t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out t

How to fill out t

Who needs t?

Comprehensive Guide to Using the T Form: Enhancing Your Document Management with pdfFiller

Understanding the T Form

The T Form is a crucial document used primarily for tax-related purposes in various jurisdictions. It serves individuals and organizations by streamlining the reporting of financial activities to tax authorities. Its importance lies in providing a standardized format for collecting essential financial data, ensuring compliance and accuracy in reporting.

Implementing the T Form in document management can significantly enhance efficiency. By centralizing financial information, it reduces errors often associated with manual entry and helps users meet deadlines more effectively. With its focused structure, the T Form allows users to present necessary information without overwhelming complexity.

Who should use the T Form?

The T Form is particularly beneficial for both individuals and teams engaged in financial activities. Whether you are a freelancer managing your own taxes or part of a larger corporation overseeing multiple financial submissions, the T Form serves as an essential tool for managing your documentation effectively.

Organizations that handle numerous documents on a daily basis, such as accounting firms or tax preparation services, find the T Form indispensable. Specific industries like real estate and e-commerce also benefit significantly. They often have complex financial transactions that require meticulous documentation for taxation purposes.

Step-by-step instructions for filling out the T Form

Starting with the T Form can seem daunting, but breaking it down into manageable steps simplifies the process. Here’s how you can effectively fill it out.

1. Gather necessary information

Before beginning, ensure you collect all necessary personal and financial details. This includes your name, address, and social security number, alongside financial data such as income sources, expenses, and deductions. Additionally, having supporting documentation, such as past tax returns and expense receipts, will facilitate accurate reporting.

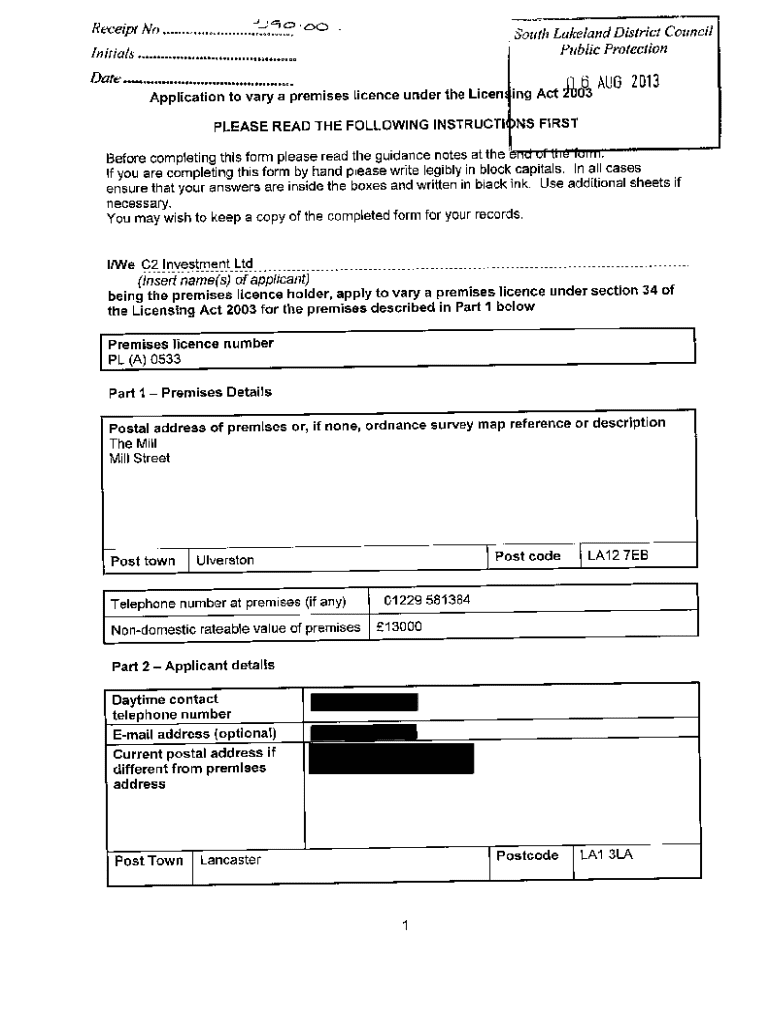

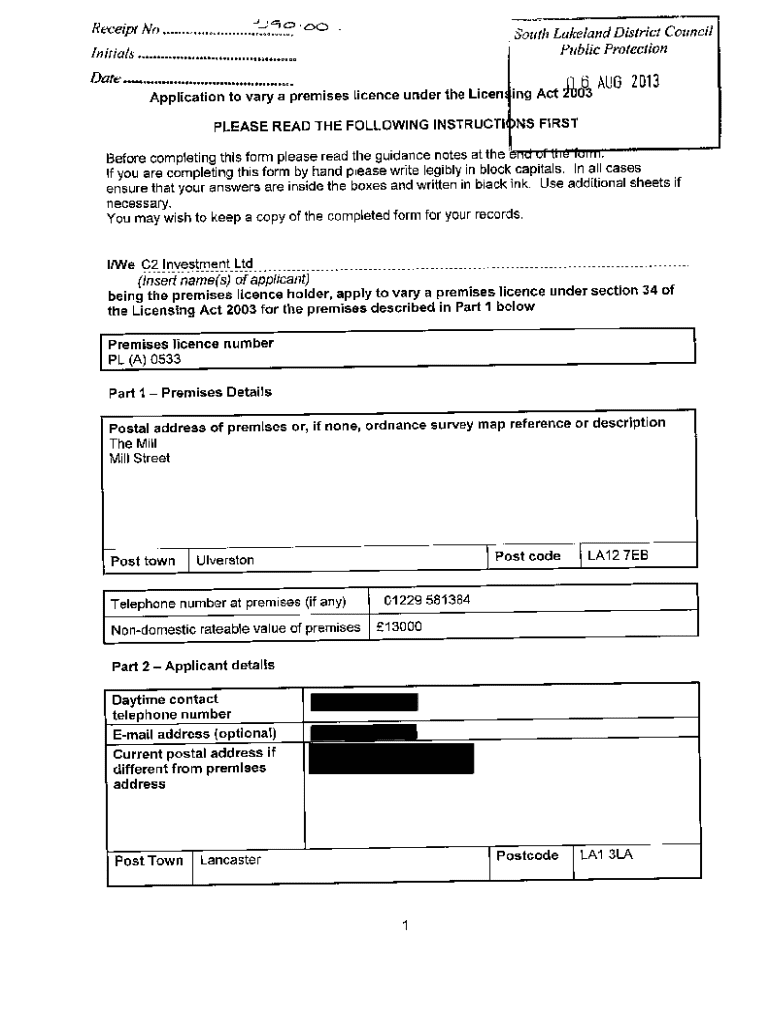

2. Accessing the T Form via pdfFiller

To begin, log into your pdfFiller account and navigate to the T Form template available in their library. The template is user-friendly, and pdfFiller offers various interactive tools that can assist in filling out the form accurately, making it a seamless experience for all users.

3. Filling out the T Form

As you proceed to fill out the T Form, tackle it field by field. Make sure to double-check each entry for accuracy, as common mistakes include numerical errors and omitted information. A thorough review can save you from complications later on, particularly during submission.

4. Editing and customizing your T Form

pdfFiller's editing tools enable you to modify the T Form easily. You can add notes or comments to specific fields if clarification is needed. These features enhance collaboration, especially if you're working within a team, ensuring everyone is on the same page.

5. Signing the T Form

Once the form is filled, you can easily sign it within pdfFiller using eSigning options. Verifying signatures is crucial to secure the document, ensuring that all parties are satisfied with the content and ready to proceed.

6. Submitting the T Form: Best practices

To enhance the chances of a successful submission, ensure that all fields are correctly filled out, double-check for completeness, and submit the form within the required deadlines. Tracking your submission status through pdfFiller's features allows for peace of mind as you await processing.

Managing your T Form

Efficiently managing your T Form is as crucial as filling it out. With pdfFiller, you can store and organize your forms in the cloud, ensuring they're accessible from anywhere. Taking advantage of a searchable document repository eases the retrieval process during audits or yearly assessments.

Furthermore, pdfFiller’s collaborative features allow team members to share T Forms and manage permissions. This collaboration is vital in a professional environment, ensuring easy access for all contributors while maintaining data security.

Frequently asked questions about the T Form

Advanced tips for optimizing your use of the T Form

To fully leverage the T Form, consider utilizing pdfFiller's analytics tools. These tools provide insights into form use and can help you refine processes based on real data. Additionally, integrating the T Form with other applications such as accounting software can streamline your workflow further, reducing the need for duplication of efforts.

Security is also paramount when managing sensitive data on the T Form. Ensure to utilize password protection and other security measures offered by pdfFiller to safeguard your information against unauthorized access.

Contact support for assistance with the T Form

Should you encounter challenges while working with the T Form, pdfFiller's customer support team is available to assist you. You can reach them through various channels, including live chat for immediate help. Additionally, the website offers user guides and a comprehensive community forum where you can find answers to common questions.

Testimonials and success stories

Many users have shared how utilizing the T Form through pdfFiller has significantly increased efficiency in their document management processes. From individuals simplifying their tax reporting to businesses gaining clarity in financial documentation, the feedback has been overwhelmingly positive.

Case studies demonstrate tangible impacts, such as reduced time spent on filing and improved accuracy in submissions. These success stories not only underscore the value of the T Form but also highlight how pdfFiller empowers users to manage their documents effectively.

Conclusion: maximizing your efficiency with the T Form

By integrating the T Form into your document management routine through pdfFiller, you can elevate your efficiency significantly. This approach not only simplifies the complexities of financial documentation but also ensures compliance with regulatory requirements.

Explore other templates and forms available on pdfFiller to further enhance your document management capabilities, creating a seamless workflow that contributes to your overall organizational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my t directly from Gmail?

How can I send t for eSignature?

How can I get t?

What is t?

Who is required to file t?

How to fill out t?

What is the purpose of t?

What information must be reported on t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.