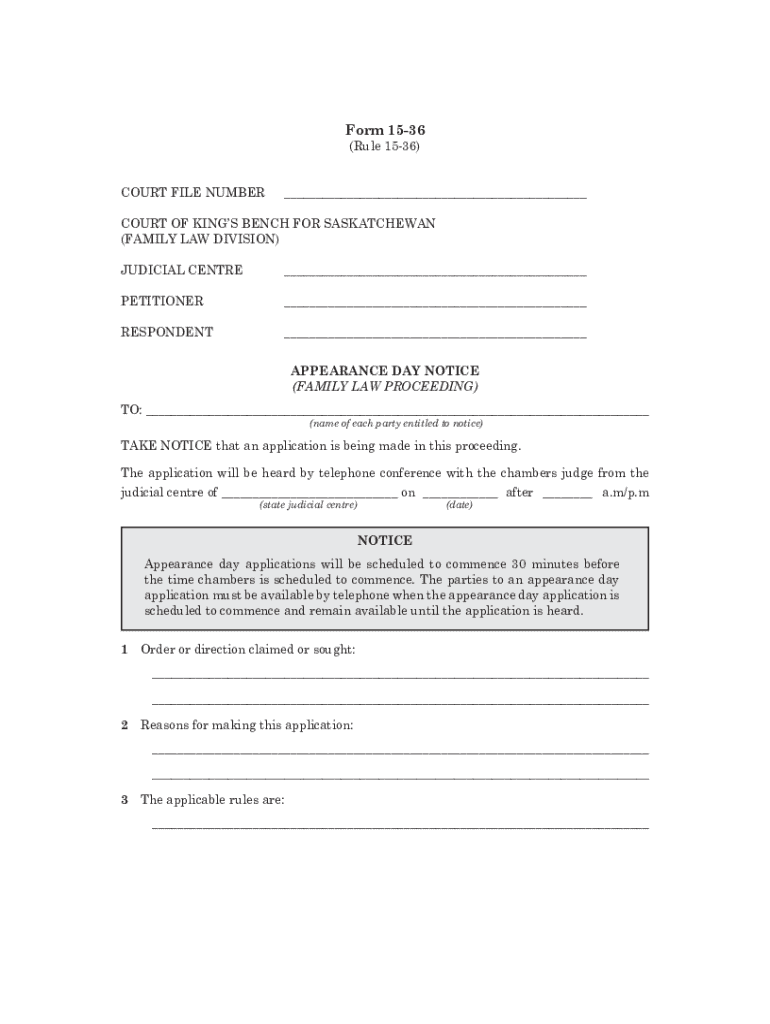

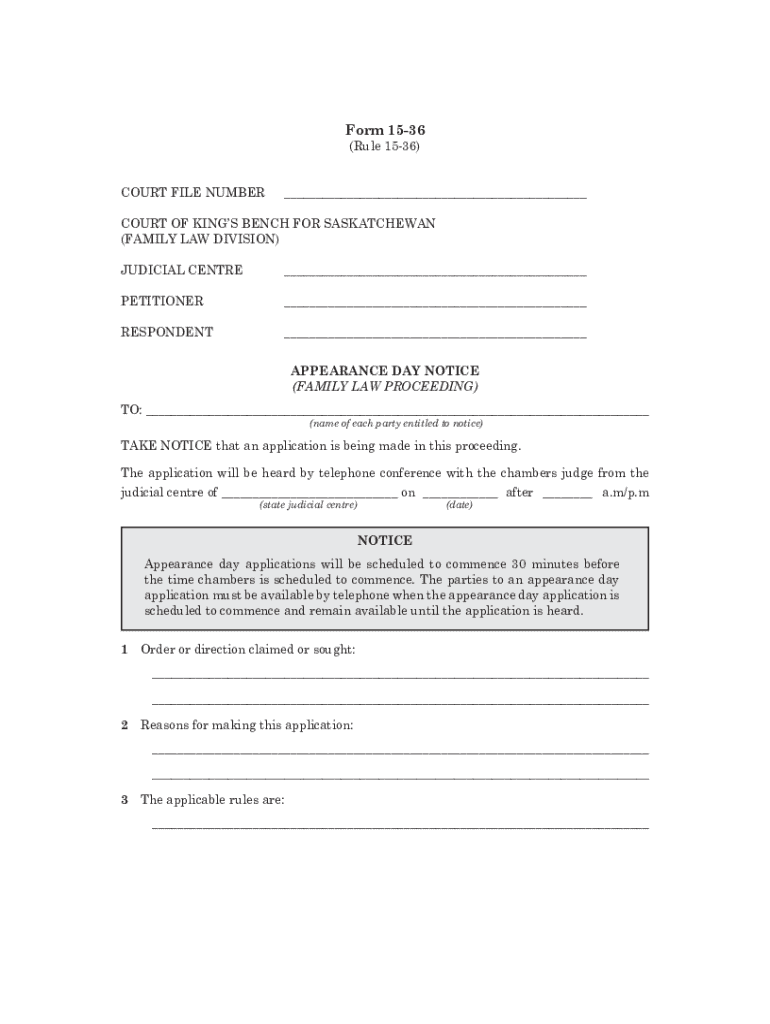

Get the free Form 15-36

Get, Create, Make and Sign form 15-36

Editing form 15-36 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 15-36

How to fill out form 15-36

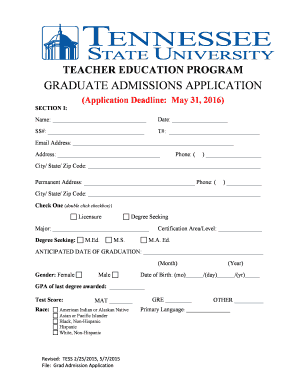

Who needs form 15-36?

Form 15-36 Form: A Comprehensive How-to Guide

Overview of Form 15-36

Form 15-36 is a specific document utilized in various administrative and legal contexts, particularly within the financial and governmental sectors. This form is essential for individuals and organizations when reporting certain types of financial information or transactions. The significance of Form 15-36 lies in its ability to streamline bureaucratic processes, ensuring compliance with regulatory requirements and facilitating transparent communication among stakeholders.

Typically, the key stakeholders who utilize Form 15-36 include financial institutions, tax professionals, businesses, and individuals seeking to declare their financial situations clearly and accurately. This form holds critical relevance for maintaining accurate records, thus aiding in audits, tax assessments, and other official reviews.

Understanding the components of Form 15-36

Form 15-36 comprises multiple sections, each designed to collect specific information critical for its intended use. Among these, personal information is a foundational component, which requires details such as the name, address, and identification of the filer. This section ensures that the person or entity submitting the form is accurately identified.

The financial data section captures a comprehensive account of the filer’s financial details, including income, expenses, and assets. Certification and signature sections serve to validate the information provided, making it crucial for the integrity of the submission. Required fields must be filled out completely, while optional fields may provide additional context and should be used thoughtfully. Familiarizing oneself with commonly used terms related to Form 15-36 is essential for accurate completion.

Detailed instructions for filling out Form 15-36

Filling out Form 15-36 can be straightforward when approached methodically. Start with **Step 1: Gather necessary documents**. You will typically need identification documents, recent financial records, and any previous forms submitted related to the matter at hand.

**Step 2: Fill in your personal information** is crucial. Ensure accurate data entry, like legal names and current addresses, as discrepancies can lead to processing delays.

In **Step 3: Provide financial data**, prepare your financial information neatly and clearly. Utilize well-organized tables or lists if permitted, as clear presentation aids in easier processing.

Next, in **Step 4: Review and certify the information**, double-check all entries for accuracy to avoid common errors, which can delay processing. Lastly, **Step 5: Sign and date the form** accordingly; if you are using an electronic format, ensure you follow the guidelines for effective electronic signatures.

Common pitfalls and troubleshooting

When filling out Form 15-36, some frequent mistakes often include entering incorrect personal information or skipping required fields. Failure to submit necessary attachments, such as proof of income, can also result in incorrect submissions. To correct errors in the form after submission, reach out to the respective authority promptly to understand their established process for amendments.

Utilize available resources such as FAQs on official websites or forums dedicated to Form 15-36 to resolve common issues. Local support or consultations can also provide clarity on specific situations.

Editing and managing your Form 15-36

Editing Form 15-36 becomes seamless through tools like pdfFiller. To start, simply import your form into the pdfFiller workspace. The platform offers straightforward features that allow users to add text, insert images, and modify existing content effortlessly, making it easier to correct or update your form.

Once your edits are complete, use the e-signature capabilities in pdfFiller to sign the document electronically. You can also share the form with colleagues or advisors for input, utilizing collaboration features that enhance teamwork when filling out the form.

Filing your completed Form 15-36

After completing Form 15-36, you have several submission options. Online submission is often the fastest method, allowing for immediate processing. Alternatively, if you prefer a physical copy, mail-in options should include proper addressing as per the instructions provided on the form. If you choose in-person filing, consult the office hours and required documents to ensure smooth processing.

Be mindful of important deadlines that accompany Form 15-36 submissions, as missing them may lead to penalties or processing delays. After submission, you should receive confirmation of receipt; if not, follow up with the agency to ensure your submission was processed.

Frequently asked questions (FAQs) about Form 15-36

One common question is what to do if you do not receive a response after submitting Form 15-36. It's advisable to allow a reasonable processing time before following up with the appropriate office. If you filed for you and your partner, a key point to clarify is whether Form 15-36 can be filed jointly; check the specific guidelines to understand joint filing eligibility.

If you need a copy of your submitted form, contacting the office to which it was submitted is the best route. They will provide guidelines on how to obtain sufficient copies for your records.

Additional tools and resources available on pdfFiller

pdfFiller offers interactive tools for preparing and managing your forms, including Form 15-36. Discover templates for similar forms that can save time and enhance productivity. Additionally, pdfFiller’s customer support is available to assist users with any dilemmas they may encounter throughout the process, ensuring high-efficiency form management.

Real-life scenarios: success stories using Form 15-36

Success stories from users of Form 15-36 demonstrate the impact and efficiency of utilizing this form correctly. For instance, small business owners who accurately used the form were able to secure necessary funding by providing clear and verified financial disclosures.

Users have noted that leveraging platforms like pdfFiller simplifies the process of form management. Testimonials highlight the convenience of editing features and the swift e-signature process that enhanced their efficiency in handling Form 15-36.

Related forms and documents

In addition to Form 15-36, individuals often encounter various forms that require similar information. Commonly required forms may include Form 1040 for income tax filing and Form 1099 for income reporting. Both of these forms serve distinct purposes but share foundational elements that users should familiarize themselves with.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 15-36?

How do I execute form 15-36 online?

How do I fill out the form 15-36 form on my smartphone?

What is form 15-36?

Who is required to file form 15-36?

How to fill out form 15-36?

What is the purpose of form 15-36?

What information must be reported on form 15-36?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.