Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofit Organizations

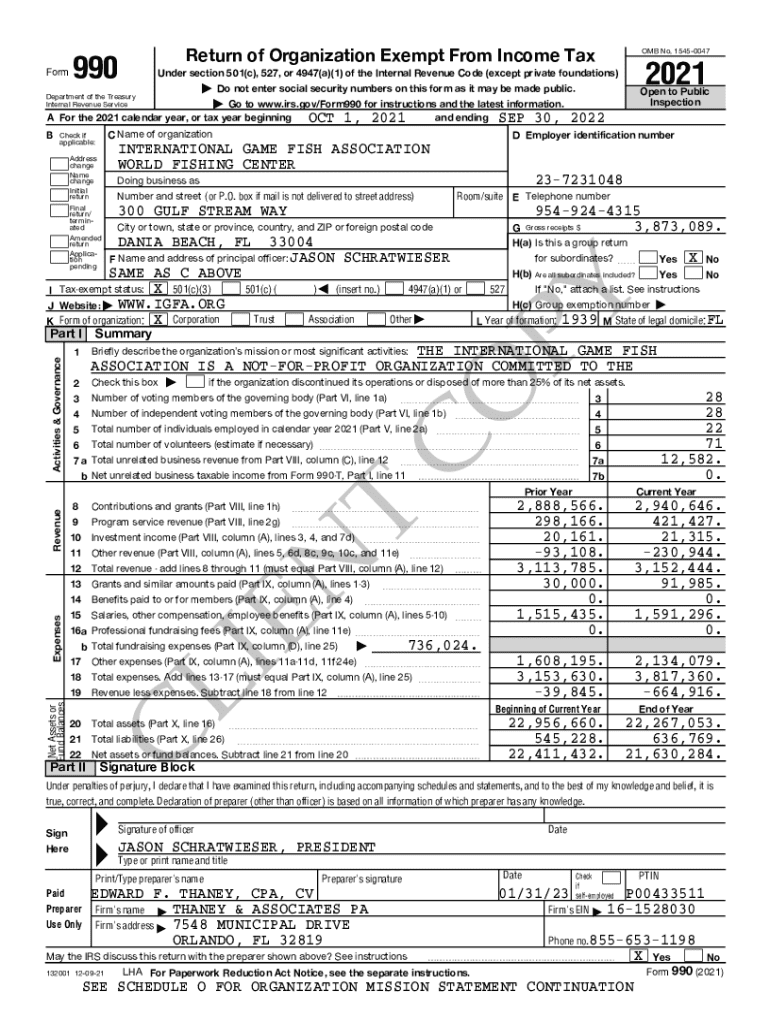

Overview of Form 990

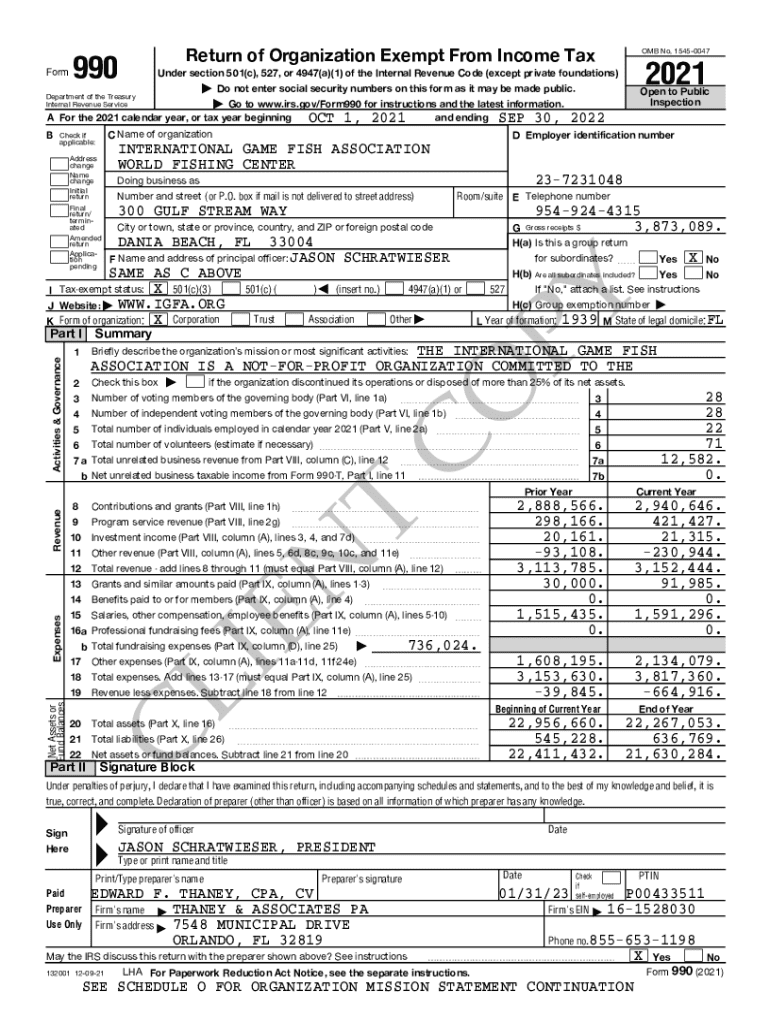

Form 990 is the IRS form utilized by tax-exempt organizations to provide the federal government with information regarding their financial activities. Designed to promote transparency and accountability, this form serves both the organization and the public. The submission of Form 990 is essential for maintaining tax-exempt status, thus playing a pivotal role in the nonprofit sector.

Nonprofit organizations are uniquely accountable to various stakeholders, including the government, donors, and the public. Completing Form 990 is crucial as it not only informs the IRS but also provides insights to stakeholders about the organization’s structure, mission, and financial health.

Variants of Form 990

Different types of Form 990 cater to organizations of varying sizes and types. Each variant serves to streamline the reporting process, ensuring that smaller organizations are not overwhelmed while still complying with regulations.

Organizations must choose the appropriate form based on their revenue and structure to ensure compliance with IRS regulations.

Filing requirements for Form 990

All tax-exempt organizations, including charities, foundations, and other nonprofits, are required to file Form 990 unless they fall under specific exceptions. The definition of tax-exempt organizations generally refers to those recognized under section 501(c)(3) of the Internal Revenue Code.

Understanding these requirements is essential for compliance and to avoid any unnecessary penalties.

Penalties for non-compliance

Failing to file Form 990 on time can lead to significant penalties. Late filing penalties amount to $20 per day, up to $10,000 for most organizations. For larger organizations, the penalty can be $100 per day, with a maximum of $50,000.

Inaccurate or incomplete information can also trigger penalties and potentially jeopardize a nonprofit's tax-exempt status. If the IRS identifies discrepancies, organizations may face additional scrutiny or even an audit.

Public inspection regulations

Form 990 is available for public inspection, promoting transparency in charitable organizations. Key details, such as mission statements, financial data, and governance structure, are accessible to the public, allowing potential donors and stakeholders to make informed decisions.

Historical context of Form 990

Form 990 has roots in past tax legislation aimed at ensuring accountability among nonprofit organizations. Initially introduced in 1942, this form has undergone several updates aimed at increasing transparency and improving the quality of reporting.

Utilizing Form 990 for charity evaluation research

Form 990 offers invaluable insights for stakeholders evaluating nonprofits. Key metrics, such as the organization’s financial health, executive compensation, and program effectiveness, can be assessed through this form.

Understanding the structure of Form 990

Familiarizing oneself with the structure of Form 990 is essential for accurate completion. The form comprises several key sections that outline the organization’s activities and financials.

Navigating these sections effectively can help organizations present an accurate and compelling narrative.

Step-by-step guide: How to fill out Form 990

To successfully file Form 990, organizations should follow a systematic approach to ensure all information is complete and accurate. Start by gathering necessary documentation, such as financial statements, budgets, and previous tax filings.

Tools for editing and managing Form 990

Utilizing effective tools for editing and managing Form 990 can enhance productivity. Cloud-based solutions like pdfFiller allow users to create, edit, and collaborate on documents seamlessly.

Third-party sources for Form 990 assistance

Many resources exist for organizations seeking guidance on Form 990 compliance. Professional accountants, tax advisors, and specialized software can offer tailored support.

How to read and analyze Form 990

Analyzing Form 990 involves digging into various sections to glean insights into the organization’s health and practices. Key indicators, such as program expenses, revenue diversification, and governance structure, speak volumes about the nonprofit’s efficiency and effectiveness.

Locating a Form 990 document

Finding Form 990 documents is vital for research and evaluation purposes. The IRS provides direct access to these forms, while various third-party databases serve as additional resources.

Fiduciary reporting responsibilities

Board members of nonprofit organizations have fiduciary responsibilities that encompass the obligation to ensure compliance with filing requirements, including Form 990. Understanding these responsibilities is crucial for maintaining organizational integrity.

Related forms and filings

In addition to Form 990, various other tax forms may be relevant for nonprofits. Understanding the interplay between these forms is key to ensuring comprehensive compliance.

Summary of key takeaways and best practices

Completing Form 990 accurately and submitting it on time is paramount for nonprofit organizations. Key takeaways include understanding the specific form requirements, maintaining accurate records, and leveraging available resources for assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 990 in Gmail?

How do I edit form 990 straight from my smartphone?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.