Get the free Comparing Capital Allocation Efficiency in Public and Private Equity Markets

Get, Create, Make and Sign comparing capital allocation efficiency

How to edit comparing capital allocation efficiency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comparing capital allocation efficiency

How to fill out comparing capital allocation efficiency

Who needs comparing capital allocation efficiency?

Comparing Capital Allocation Efficiency Form

Understanding capital allocation efficiency

Capital allocation efficiency refers to the effectiveness with which a company utilizes its financial resources to achieve maximum returns. This efficiency is measured by how well investments translate into profitable outcomes and growth. In a competitive business environment, a firm’s ability to judiciously allocate capital can significantly impact its sustainability and overall performance. Efficient capital allocation hinges not only on accurate financial reporting but also on aligning investments with strategic goals.

Understanding the nuances of capital allocation is crucial across various industries. For instance, tech companies prioritize innovation and research & development, while manufacturing firms may focus on infrastructure or machinery upgrades. This differentiation highlights how capital allocation strategies are tailored to meet specific operational requirements and market demands, ultimately influencing the financial health of an organization.

Overview of the capital allocation process

The capital allocation process can be broken down into several key stages, each crucial for optimal decision-making. These stages include:

These stages are influenced by various factors, such as market conditions, organizational culture, and regulatory frameworks. Companies often adapt their capital allocation strategies based on internal assessments and external economic signals to maintain competitiveness.

Capital allocation efficiency metrics

Measuring capital allocation efficiency is vital for organizations seeking to refine their investment strategies. Several key metrics are commonly used, including:

While each of these metrics has its pros and cons, understanding their nuances allows companies to choose the ones that best suit their financial goals and contexts. For example, ROI is easily understandable, but it may not capture the long-term viability of investments compared to EVA, which factors in the cost of capital.

Comparing capital allocation efficiency among organizations

When comparing capital allocation efficiency, looking at real-world case studies of successful organizations offers valuable insights. For example, tech giants like Apple and Google expertly balance innovation with critical ROI assessments, often leading to consistently high market valuations. In contrast, manufacturing firms have been known to adopt a more conservative approach, prioritizing incremental upgrades to their operations to ensure steady growth.

Benchmarking tools play a crucial role in such comparisons. Organizations can utilize software and services designed for assessing capital allocation metrics against industry standards, identifying gaps and opportunities for improvement. Analyzing financial performance indicators against peer groups not only brings perspective but also fosters strategic alignment.

Real-life experiences from firms demonstrate that agility and responsiveness in capital allocation lead to better performance outcomes. Best practices adopted by these organizations offer key lessons on how to navigate changing market conditions and emerging trends effectively.

The role of technology in capital allocation efficiency

Technological advancements are reshaping capital allocation strategies in profound ways. Data analytics tools, for instance, enable organizations to mine large datasets for insights, enhancing the accuracy of capital allocation decisions. By leveraging predictive analytics, companies can forecast future market conditions, ensuring that their capital is invested wisely.

Additionally, integration with document management solutions, such as pdfFiller, streamlines the entire capital allocation documentation process. This platform allows users to create, edit, and manage allocation forms efficiently. Its collaborative features facilitate effective communication across teams, enabling members to sign and share documents seamlessly, thereby expediting decision-making.

Looking ahead, the future of capital allocation will likely involve more advanced algorithms and machine learning applications. These technologies will further refine investment assessments, automate routine tasks, and support strategic planning efforts, making capital allocation processes more efficient and less error-prone.

Interactive resources for evaluating capital allocation efficiency

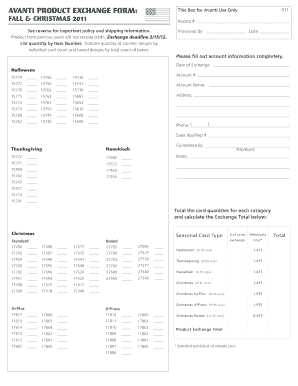

Creating a capital allocation efficiency form is a vital step for organizations looking to enhance their capital management strategies. By utilizing pdfFiller's array of digital tools, users can easily create customized forms designed to capture essential allocation metrics. The process involves several steps:

Utilizing digital templates ensures consistent evaluation across teams, leading to more accurate data collection and analysis. This consistency is critical for reliable reporting and informed decision-making.

Best practices for enhancing capital allocation efficiency

Enhancing capital allocation efficiency is an ongoing process that requires strategic foresight and regular adjustments. To achieve this, organizations can adopt the following best practices:

By embedding these practices into the organizational culture, companies can create an environment geared towards continuous improvement in capital allocation efficiency.

Final thoughts on capital allocation efficiency

Effective capital allocation is a cornerstone of financial success in any organization. Drawing from the insights shared in this guide, key takeaways emphasize the importance of choosing appropriate metrics, leveraging technology for efficiency, and fostering collaboration within teams.

A continuous improvement mindset ensures that organizations remain responsive to market dynamics and strategic shifts. By adopting these principles, teams can not only enhance their capital allocation efficiency but also support sustainable growth and resilience in an ever-evolving business landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my comparing capital allocation efficiency in Gmail?

How can I modify comparing capital allocation efficiency without leaving Google Drive?

Can I create an electronic signature for the comparing capital allocation efficiency in Chrome?

What is comparing capital allocation efficiency?

Who is required to file comparing capital allocation efficiency?

How to fill out comparing capital allocation efficiency?

What is the purpose of comparing capital allocation efficiency?

What information must be reported on comparing capital allocation efficiency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.