Get the free Sepa Direct Debit Mandate

Get, Create, Make and Sign sepa direct debit mandate

How to edit sepa direct debit mandate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sepa direct debit mandate

How to fill out sepa direct debit mandate

Who needs sepa direct debit mandate?

Comprehensive guide to the SEPA Direct Debit Mandate Form

Understanding SEPA Direct Debit

The Single Euro Payments Area (SEPA) is an initiative by the European Union designed to harmonize bank transfers and direct debit transactions across member countries. SEPA simplifies cross-border transactions by allowing individuals and businesses to pay and receive payments in euros, using a single bank account. The SEPA Direct Debit system offers an efficient method for recurrent payments such as subscriptions, utilities, and memberships, ensuring that these transactions operate smoothly across borders.

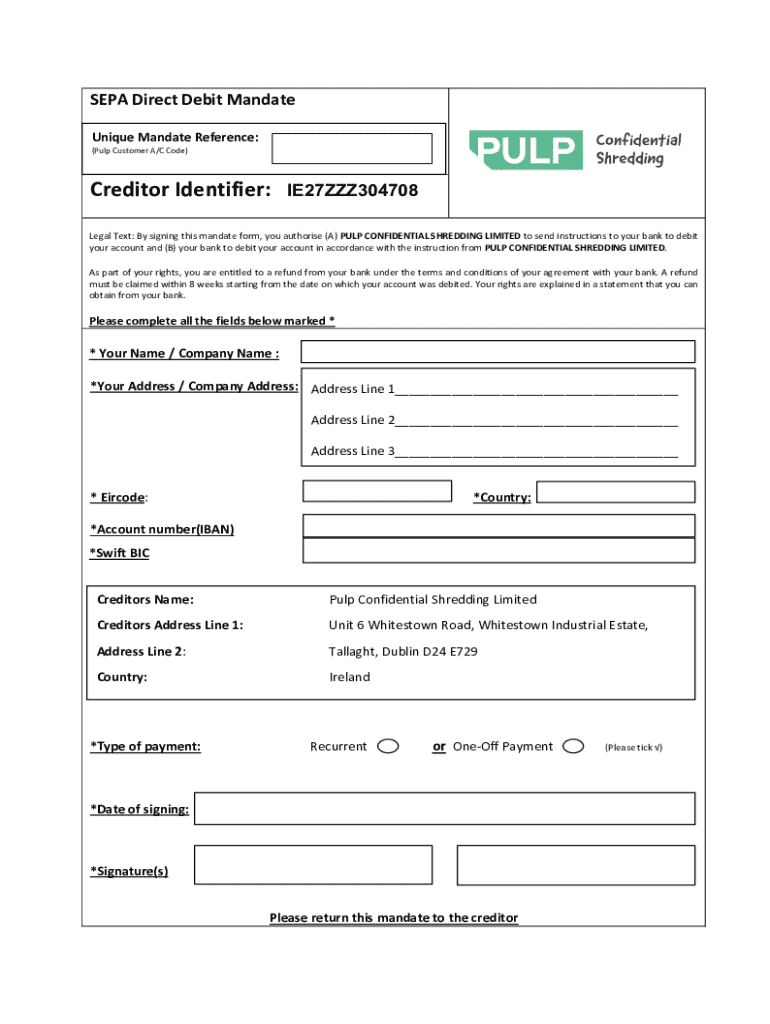

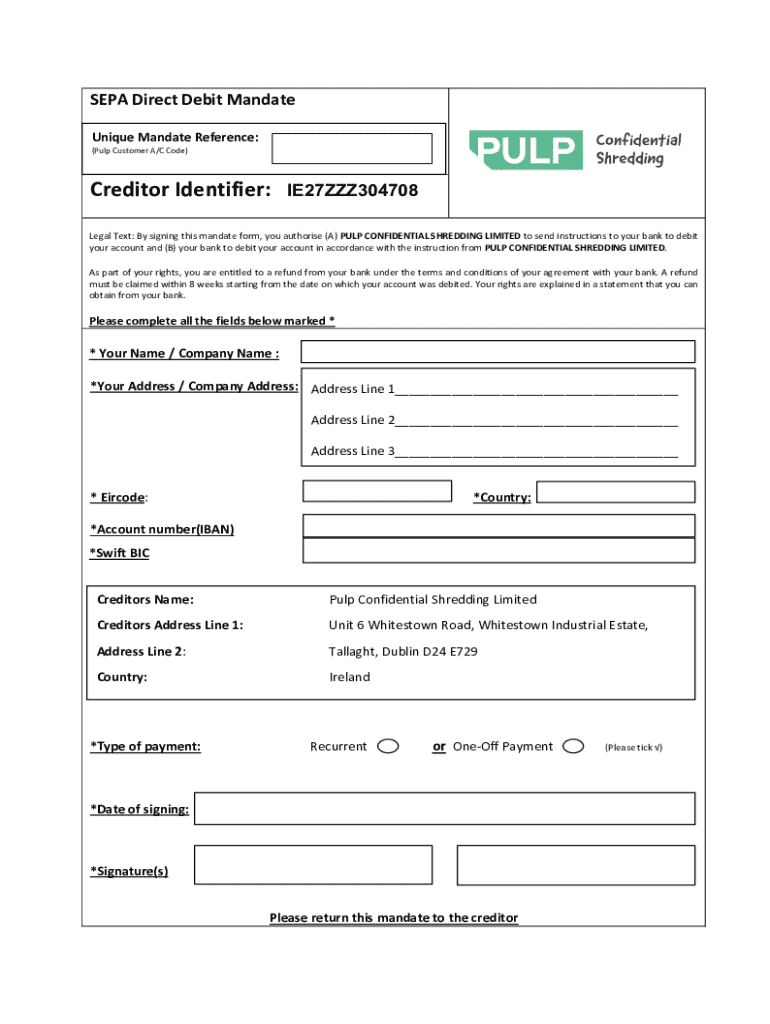

The SEPA Direct Debit Mandate Form Explained

A SEPA Direct Debit Mandate Form is crucial for initiating direct debit payments. This form outlines the agreement between the creditor and the debtor, allowing the creditor to withdraw funds directly from the debtor's bank account. It serves as a legal document that enforces the payment process and protects both parties involved by adhering to SEPA regulations.

A mandate is required particularly when setting up regular payments or subscriptions. If a debtor only needs to authorize a one-off payment, a different process may suffice, but having a mandate ensures that all legal bases are covered.

How to obtain the SEPA Direct Debit Mandate Form

To get started with a SEPA Direct Debit Mandate Form, you can download the PDF version from reliable sources like pdfFiller. This ensures you have an official template that complies with SEPA standards. Follow these steps to easily obtain the form:

Filling out the SEPA Direct Debit Mandate Form

Filling out the SEPA Direct Debit Mandate Form requires accurate information to ensure that your payment process runs smoothly. Essential details include your bank account numbers, personal identification information, and the creditor’s details. Each section of the form must be completed thoroughly to avoid complications during payment initiation.

Common mistakes when filling out the form include incorrect bank details or failing to provide a signature. To ensure accuracy, double-check all entries and use a legible format for all written information.

Submitting your SEPA Direct Debit Mandate

Once the form is filled out completely, it's time to submit it to your creditor. You can submit the completed SEPA Direct Debit Mandate Form in several ways, such as via email, postal mail, or online through your creditor’s portal. It’s essential to ensure that the submission method is secure and that you retain a copy of the form for your records.

After submission, expect to receive a confirmation from your creditor, typically sent via email. This confirmation is crucial as it confirms your authorization for the payments, marking the successful setup of your direct debit arrangements.

Managing your SEPA Direct Debits

Managing your SEPA Direct Debits is an ongoing process. Should you need to edit or revoke a mandate, it’s important to act promptly. This may involve filling out a new mandate form with updated bank details or submitting a revocation request to halt payments. Timely updates prevent errors or unintended charges from occurring due to outdated information.

Tracking payments is essential for financial management. Utilize tools available on platforms like pdfFiller to monitor your transactions and keep accurate records of all debits related to your account.

Leveraging pdfFiller for SEPA Direct Debit management

pdfFiller offers innovative solutions for managing your SEPA Direct Debit Mandate Form. With interactive features, users can edit documents in real-time and collaborate effortlessly on shared files. The platform also supports eSigning functionalities, which streamline the process of signing documents electronically. This aspect reinforces pdfFiller’s role as a comprehensive document solution.

Moreover, pdfFiller’s cloud-based advantages allow users to access their documents from anywhere, making it convenient for those who work remotely or travel frequently. This flexibility enhances productivity, ensuring that managing SEPA Direct Debit forms remains efficient.

Frequently asked questions about SEPA Direct Debit

Many individuals and businesses have questions surrounding the SEPA Direct Debit process. Common inquiries include concerns about international transaction capabilities and whether there are associated fees or charges specifically related to SEPA Direct Debits. Understanding these aspects can dramatically improve the experience of using direct debit services.

For additional clarifications, consider reaching out directly to bank support or your creditor for specific questions regarding the mandate form or its functionality.

Case studies: Successful SEPA implementations

Numerous businesses have successfully adopted the SEPA Direct Debit system, proving its benefits. Companies that embraced SEPA have reported significant efficiency gains and enhanced user satisfaction. For example, a European subscription service reported a 30% increase in client retention after switching to SEPA Direct Debit.

From these case studies, valuable lessons have emerged, emphasizing the importance of maintaining clear communication with creditors and customers to maximize the benefits of using SEPA Direct Debit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sepa direct debit mandate to be eSigned by others?

How do I complete sepa direct debit mandate online?

How do I edit sepa direct debit mandate in Chrome?

What is sepa direct debit mandate?

Who is required to file sepa direct debit mandate?

How to fill out sepa direct debit mandate?

What is the purpose of sepa direct debit mandate?

What information must be reported on sepa direct debit mandate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.