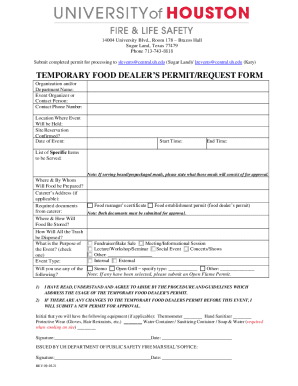

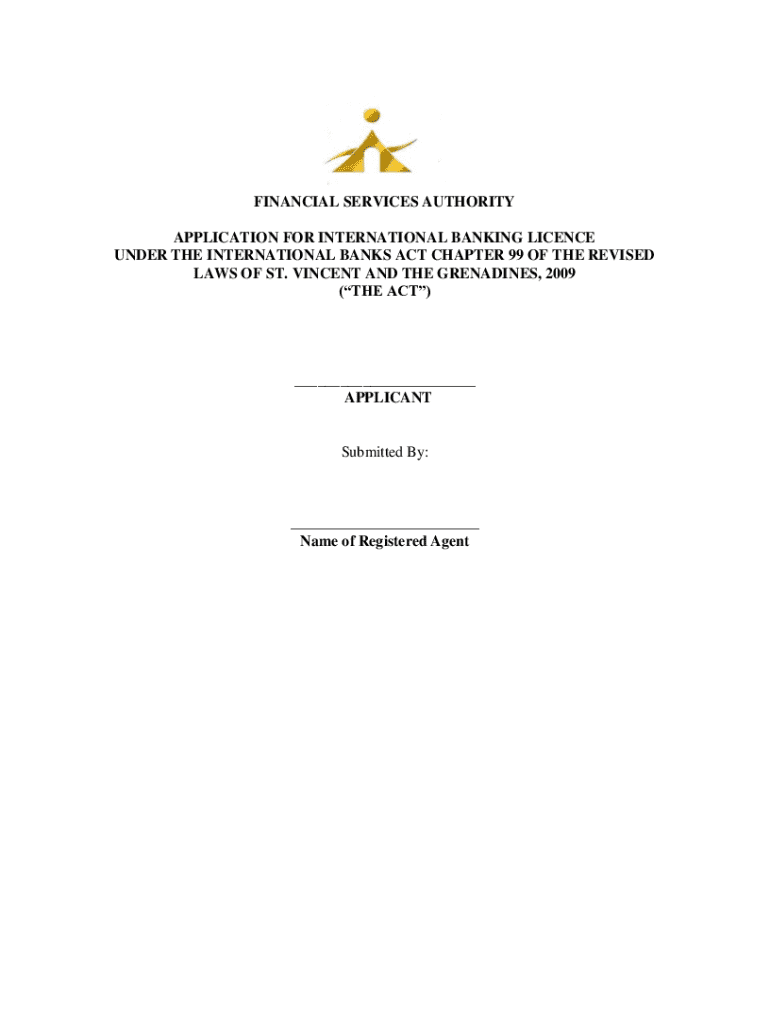

Get the free Application for International Banking Licence

Get, Create, Make and Sign application for international banking

How to edit application for international banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for international banking

How to fill out application for international banking

Who needs application for international banking?

Application for International Banking Form: A Comprehensive How-to Guide

Overview of international banking applications

International banking applications are essential tools for individuals and businesses engaged in cross-border financial activities. These applications facilitate transactions, account management, and investment services across different countries. Having the correct forms ensures compliance with legal requirements and smooth processing of international transactions, safeguarding your financial interests and ensuring access to global markets.

The international banking application form typically includes key features such as personal and financial information, required documentation, and declarations regarding the legitimacy of funds. Furthermore, it often outlines your intended use of the account, which can vary based on personal banking needs or business requirements.

Understanding the application process

Navigating the application for international banking form requires understanding the submission process. Typically, the first step involves gathering necessary documentation, such as identification and proof of funds. The next stage is completing the form accurately, followed by submitting it either electronically or in print to your banking institution. It's important to ensure that all information is correct to avoid unnecessary delays.

After submission, the processing timeline can vary depending on the bank and the jurisdiction. Generally, expect to wait anywhere from a few days to several weeks for approval. Common delays in the application process often stem from missing or incorrect information, lack of required documentation, or slow internal processes. To mitigate these delays, double-check your submission and provide all necessary documentation upfront.

Required information for the international banking form

When filling out the application for international banking form, you'll need to provide extensive personal and financial information. Personal details typically include your full name, date of birth, and your citizenship or residency status. Ensuring this information is accurately captured is vital for compliance and identity verification processes.

In addition to personal information, the form usually requires financial details regarding the source of your funds and your banking history. Supporting documentation such as government-issued identification and any additional verification documents—like tax returns or employment letters—may also be necessary to validate the information provided.

Special considerations for specific needs

Certain applicants must consider additional factors when applying for international banking services. For expatriates, the requirements can differ significantly from those applying from their home country. Typically, expatriates may need to demonstrate their residency status and provide local identification documents in addition to their home country ID.

Businesses applying for corporate accounts face a unique set of requirements as well. They might need to submit documentation such as incorporation certificates, business licenses, and financial statements. Additionally, foreign students seeking banking services may find it beneficial to inquire about student accounts, which often have tailored terms and conditions.

How to fill out the international banking application form

Filling out the application for international banking form correctly is crucial to avoid processing delays. Start with a clear understanding of each section. Typically, the form is divided into parts that capture personal details, financial status, and required declarations. Working methodically through these sections allows for a manageable approach to completing the form.

Common mistakes often occur in sections where detailed financial information is required. Double-check that figures are accurate and that you've signed where necessary. Reviewing your form thoroughly can save time and prevent complications later on.

Editing and managing your application

Once you've completed your application for international banking form, you may need to make edits or manage drafts efficiently. Utilizing tools like pdfFiller can streamline this process, allowing for easy editing of any changes needed in the form, whether due to new information or corrections.

Saving and storing a draft version is also simple with pdfFiller. This functionality permits you to go back and review the application before formally submitting it. Additionally, you can share the draft for collaboration with teammates or advisors to ensure every detail is accurate.

Signing the application form

After completing the application for international banking form, signing it correctly is a pivotal next step. With the advancement of technology, electronic signatures have become a convenient and legally recognized method of signing documents. Many banks now accept e-signatures, streamlining the process and allowing for faster processing.

It's important to ensure that when using an electronic signature, you comply with the bank's specific requirements and guidelines. pdfFiller makes it easy to sign your forms electronically, ensuring your signature is applied correctly and securely.

What to expect after submission

Once you submit your application for international banking form, it enters a review process where the bank evaluates your submission for completeness and authenticity. Understanding what happens next can alleviate any concerns during this waiting period. Typically, you can expect communication from the bank if further information is needed.

Most banks provide a way to track your application status online. If the bank requests additional documents or clarification, respond promptly to avoid complications. Being proactive can significantly help speed up the approval process.

Frequently asked questions (FAQs)

Addressing frequently asked questions related to the application for international banking form can provide further clarity. Common inquiries may involve the types of identification accepted, processing times, and what to do if issues arise during submission. Providing clear answers to these questions can help alleviate potential stress associated with the application process.

Should you experience troubles with your application, most banks offer dedicated support services to guide applicants through the process. Knowing who to contact for assistance can make the experience smoother.

Conclusion of the form submission process

Successfully completing the application for international banking form can be a streamlined process, especially with tools like pdfFiller. Their platform enables users to easily edit, sign, and collaborate on forms, ensuring that all necessary information is accurate and up-to-date. Remember to keep copies of all submitted documents for your records, ensuring a reference point for any future correspondence.

Being organized and prepared throughout the application process not only mitigates stress but also enhances your overall banking experience, positioning you favorably for successful global financial engagement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for international banking to be eSigned by others?

How do I fill out the application for international banking form on my smartphone?

How can I fill out application for international banking on an iOS device?

What is application for international banking?

Who is required to file application for international banking?

How to fill out application for international banking?

What is the purpose of application for international banking?

What information must be reported on application for international banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.