Get the free Business Series

Get, Create, Make and Sign business series

Editing business series online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business series

How to fill out business series

Who needs business series?

Business Series Form: A Comprehensive How-to Guide

Understanding the Business Series Form

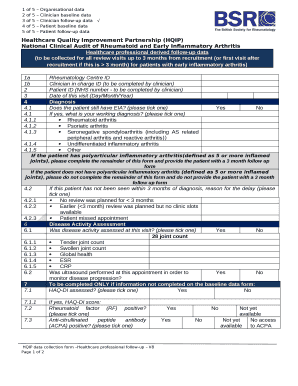

A business series form is a pivotal document when setting up a Series Limited Liability Company (LLC). This form is designed to outline the structure and operational framework of a business series, which allows different segments or 'series' to operate under a single parent entity while maintaining separate legal identities.

The purpose of using a business series form is to streamline operations and provide enhanced legal protections for businesses. Various industries, including real estate and e-commerce, benefit significantly from this structure. The key features include liability protection, ease of administration, and the ability to segregate liabilities amongst series, which can be beneficial for asset protection and operational efficiency.

Overview of Business Series Structures

A Series LLC is an innovative business structure that allows a single LLC to create multiple distinct series, each with its own assets, liabilities, and operations. This structure is particularly advantageous for entrepreneurs and businesses looking to minimize risk while maximizing operational flexibility. Each series operates independently, making it easier to manage different business ventures under one LLC umbrella.

When comparing Series LLCs to traditional LLCs, the former offers unique benefits, such as lower costs related to liability insurance and legal compliance due to the consolidation of filings. This structure is commonly utilized in industries like real estate, where separate properties can be structured as distinct series, limiting liability exposure.

Steps to create a Business Series Form

Creating a business series form involves several crucial steps that require careful consideration and adherence to state regulations. Let's explore these steps in detail.

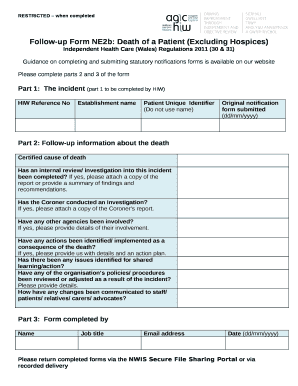

Managing your business series form

Once your business series form is established, managing it effectively is crucial for success. Ongoing documentation and reporting requirements will depend on the nature of each series and local regulations. Additionally, maintaining a clear separation between each series is imperative to protect against liability risk.

Best practices for document management can often include regular audits and keeping meticulous records. Moreover, financial management strategies can ensure that each series operates within its budgetary limits while also extracting maximal potential from the parent LLC's resources.

FAQ section: Common inquiries regarding business series forms

A business series form raises numerous questions for potential users. Below are some of the most common inquiries.

Real-world applications of business series forms

Business series forms are being actively used across various sectors, providing effective solutions to complex legal and operational challenges. For instance, in real estate, individual rental properties can be structured as separate series, allowing landlords to isolate risks associated with each property effectively.

E-commerce businesses also leverage the benefits of Series LLCs to manage different product lines under individual series, maximizing operational efficiency while minimizing potential liability exposure. These applications serve as a testament to the viability and effectiveness of business series forms for modern enterprises.

Exploring limitations and considerations

While structuring as a Series LLC has many advantages, it's not without drawbacks. Legal uncertainties can arise, especially as the Series LLC structure is relatively new and regulations can vary significantly by jurisdiction. Furthermore, complications may occur in jurisdictions that do not recognize Series LLCs, potentially complicating operational matters.

Businesses contemplating this structure should engage with legal advisors to identify and mitigate risks while ensuring compliance with local laws. Additionally, addressing financial risks is crucial; each series should be funded and managed with care to avoid cross-series liabilities.

Interactive tools and resources

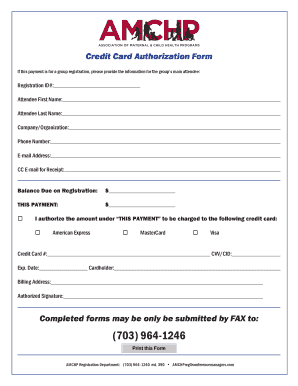

To simplify the complexities associated with business series forms, utilizing interactive document templates from pdfFiller can greatly enhance the filling and editing process. The platform offers user-friendly solutions that allow business owners to create, modify, and manage their Series LLC documentation efficiently.

Additionally, pdfFiller enhances collaboration among teams with features that allow for easy sharing, commenting, and real-time editing. This kind of functionality not only streamlines workflows but also fosters better communication, ensuring that everyone involved stays informed and aligned throughout the process.

Getting started with your Business Series Form

Getting started with your business series form has never been easier. pdfFiller provides an intuitive platform where users can access and utilize interactive forms seamlessly. With detailed instructions and guides, users can fill out, edit various legal documents, and manage their files efficiently.

The process involves easily navigating through the available templates, customizing them to suit specific needs, and leveraging the electronic signature capabilities for all required approvals. This ensures that your business series form is ready for filing and compliant with regulations in a streamlined manner.

Contact and support information

If you run into challenges with your business series form, pdfFiller offers comprehensive support options to assist users in navigating their document needs. Whether it’s technical difficulties or questions about filling out forms, personalized support is readily available.

Users can reach out to the support team for detailed guidance, access user forums, and find valuable community resources that can provide additional insights. Engaging with support services not only enhances the user experience but also ensures that your documents are always compliant and effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business series to be eSigned by others?

How do I complete business series online?

Can I create an eSignature for the business series in Gmail?

What is business series?

Who is required to file business series?

How to fill out business series?

What is the purpose of business series?

What information must be reported on business series?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.