Get the free Certificate of Insurance

Get, Create, Make and Sign certificate of insurance

Editing certificate of insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance

How to fill out certificate of insurance

Who needs certificate of insurance?

Certificate of Insurance Form: A Comprehensive Guide

Understanding the certificate of insurance (COI)

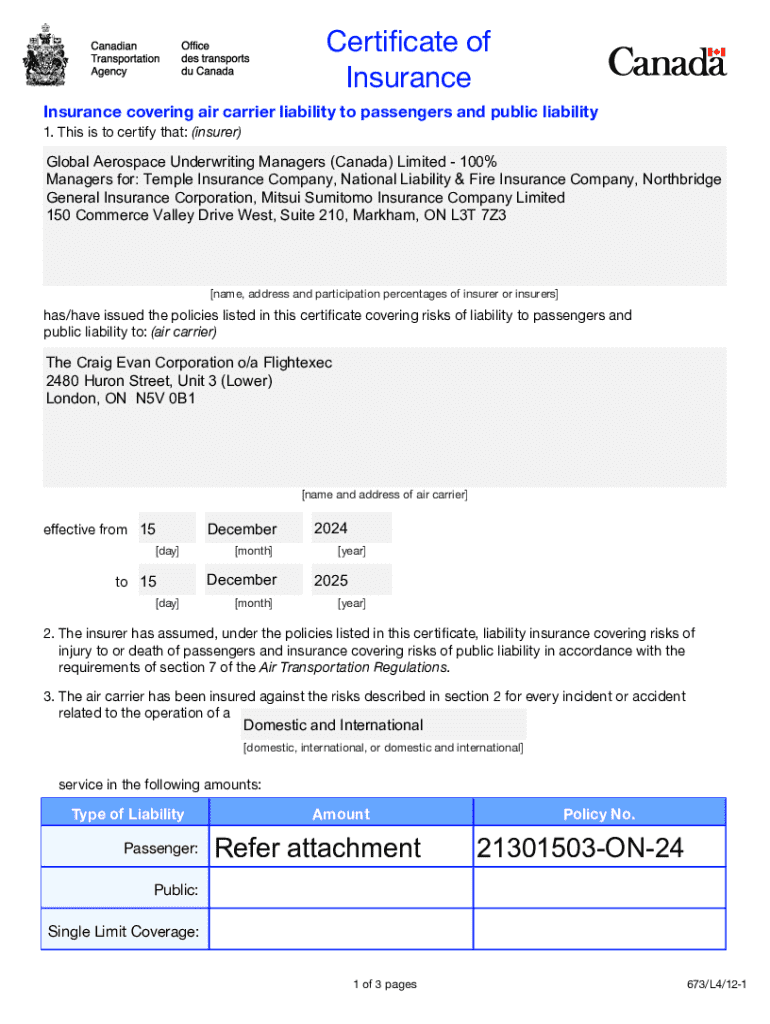

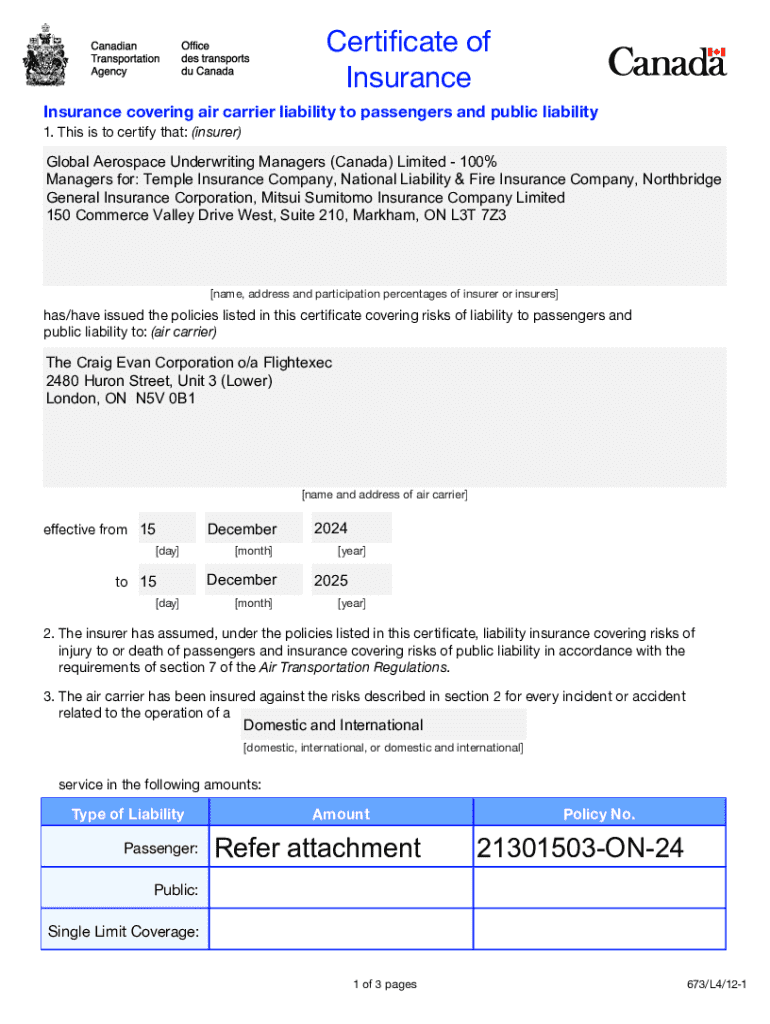

A Certificate of Insurance (COI) serves as an essential document that provides verifiable proof of insurance coverage. It outlines the specific types of coverage held by the policyholder and is typically issued by an insurance company or agent. The primary purpose of a COI is to protect both the policyholder and other parties involved in a business transaction, ensuring that the necessary insurance requirements are met.

In various industries, having a COI is crucial for conducting business legally and responsibly. It reassures clients, partners, and vendors that you are adequately insured against potential liabilities, property damage, or other unforeseen circumstances that may occur during operations.

Do you need a certificate of insurance?

Certain business scenarios necessitate a Certificate of Insurance. For instance, contractual obligations within commercial agreements often stipulate that one party must present a COI before services commence. Additionally, government entities may require proof of insurance coverage for projects, particularly in construction, to mitigate risks.

Several industries frequently request a COI, including:

Neglecting to provide a COI can lead to significant consequences, including project delays, additional costs, or project cancellations. Hence, understanding when a COI is required is vital for successful business operations.

How to obtain a certificate of insurance

Obtaining a Certificate of Insurance is a straightforward process, but it requires gathering relevant information beforehand. Start by collecting essential details about your business and operations, including existing insurance policies, types of coverage needed, and any requirements from other parties.

Then, reach out to your insurance provider to request a COI. Here are the key steps to facilitate this process:

Expect a brief turnaround time from your provider, generally between a few hours to a couple of days, depending on their policies and backlog.

Filling out your certificate of insurance form

Once you have your COI, ensure that it is filled out correctly to avoid issues down the line. Follow this step-by-step guide to assist you in completing the form accurately:

Pay attention to detail, as inaccuracies or omissions can render the COI invalid and result in complications or even lawsuits.

Editing and customizing your COI

Sometimes, you may need to customize your Certificate of Insurance for specific recipients or purposes. Utilizing pdfFiller allows for seamless online editing of your COI. The platform offers various features that streamline the customization process, making it easy for users to ensure that every detail is precise.

Key features include:

Collaboration is crucial, especially for organizations working with multiple stakeholders. pdfFiller provides a platform where teams can come together to edit and finalize documents efficiently.

Signing your certificate of insurance

Once your COI is complete, signing it is the next essential step. You can choose between traditional signatures or electronic signatures, both of which are legally acknowledged in many jurisdictions. Secure and validating e-signature options are available through platforms like pdfFiller.

When opting for electronic signatures, keep these legal considerations in mind:

Signing your COI correctly guarantees that it holds legal weight and can be used confidently for business transactions.

Managing your COI over time

A Certificate of Insurance is not a one-time document; it should be regularly updated and managed effectively. Keeping your COI up to date is crucial to ensure compliance with contractual obligations and minimize risks. Regular reviews of your coverage limits and terms are advisable, particularly after major changes to your business.

Key situations that require an updated COI include:

Additionally, utilizing cloud-based solutions like pdfFiller allows you to store, access, and collaborate on your COI efficiently. With tracking capabilities, you can easily manage document versions and revisions.

Including additional insured on your certificate with ease

Adding additional insured parties to your Certificate of Insurance is a common requirement. Doing so extends your coverage to protect third parties, often requested by clients or contractors. Including additional insureds provides peace of mind and builds trust in business relationships.

To include additional insureds effectively, follow these steps:

Avoid common mistakes such as failing to specify coverage levels for additional insureds or not confirming policy limits with your insurer. Verification can prevent coverage gaps and disputes.

Frequently asked questions about certificates of insurance

Navigating Certificates of Insurance can prompt many questions. Here are some frequently asked questions pertaining to COIs that can help clarify common concerns:

Addressing these FAQs can empower individuals and teams in effective risk management and insurance compliance.

Seeking expertise: Insurance advisors at your service

For those navigating the complexities of insurance coverage and Certificates of Insurance, consulting with an insurance expert can provide valuable insights. Professionals can guide you through nuances in policies, ensuring you meet your specific needs.

Additionally, platforms like pdfFiller support users with expert advice and document management tools, to maximize efficient utilization of insurance documents with confidence.

Instant certificate of insurance: A fast solution

In today's fast-paced business environment, the need for quick access to a Certificate of Insurance is becoming increasingly vital. Platforms like pdfFiller allow for instant issuance of a COI, streamlining the process for urgent needs.

Advantages of obtaining an instant COI include:

For instance, events requiring prompt submission of a COI often benefit from these instant services, mitigating risks and ensuring compliance.

Practical applications of COIs for small businesses

Small businesses often encounter situations that require a Certificate of Insurance, providing a safety net for liabilities and client confidence. For instance, a small construction firm might be mandated to provide a COI before starting a project. Failing to do so can lead to project delays or financial repercussions.

Users of pdfFiller have shared testimonials highlighting how obtaining a COI streamlined their operations and fostered trust. Such practical applications showcase the undeniable importance of having a COI as part of risk management.

Cross-industry COI expectations

Different industries have varying expectations and requirements regarding Certificates of Insurance. Understanding these nuances is key for compliance and smoother business transactions.

For instance, the construction industry may typically request a detailed COI specifying collateral damage liabilities, while event planning may focus on ensuring liability coverage for public exposure.

By adapting your COI to fit the expectations of different industries, you can enhance your business relationships and ensure successful operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit certificate of insurance in Chrome?

Can I edit certificate of insurance on an iOS device?

Can I edit certificate of insurance on an Android device?

What is certificate of insurance?

Who is required to file certificate of insurance?

How to fill out certificate of insurance?

What is the purpose of certificate of insurance?

What information must be reported on certificate of insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.