Get the free Simple Ira Salary Deferral Election

Get, Create, Make and Sign simple ira salary deferral

Editing simple ira salary deferral online

Uncompromising security for your PDF editing and eSignature needs

How to fill out simple ira salary deferral

How to fill out simple ira salary deferral

Who needs simple ira salary deferral?

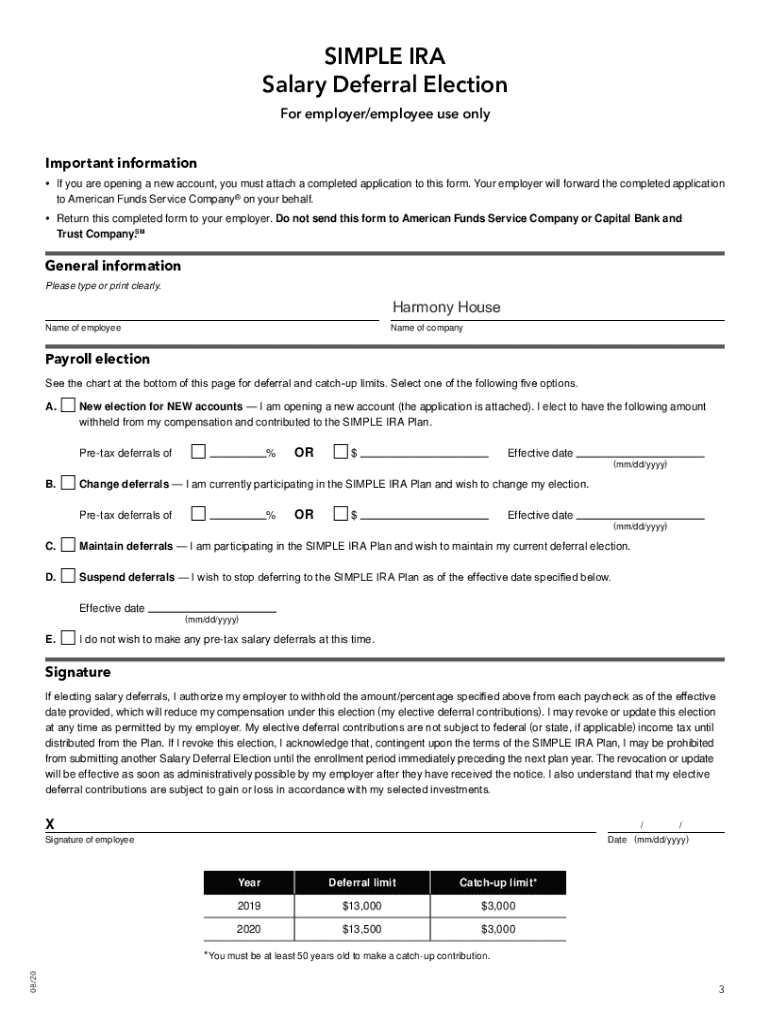

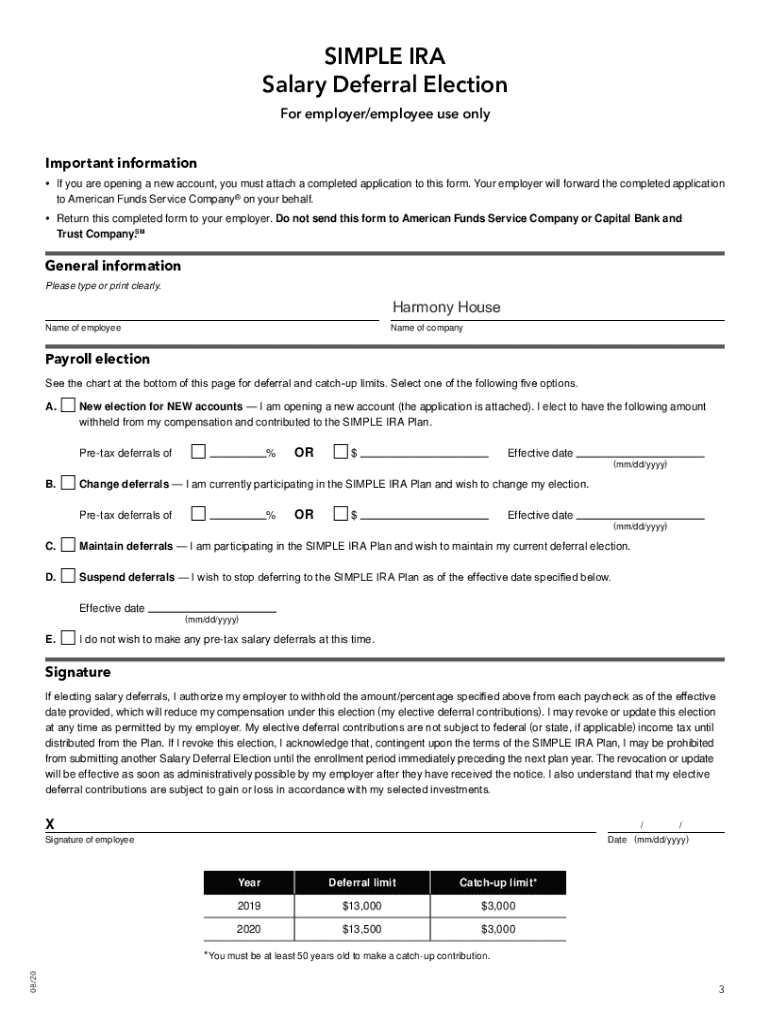

Understanding the Simple IRA Salary Deferral Form

Understanding Simple IRA salary deferral

A Simple IRA, or Savings Incentive Match Plan for Employees, is a type of retirement savings plan tailored for small businesses and their employees. This plan allows both employees and employers to contribute to individual retirement accounts but with a simplified approach compared to traditional IRAs and 401(k) plans. Notably, the Simple IRA salary deferral form is a crucial document that enables employees to elect how much of their salary they wish to defer into their IRA account.

The primary benefit of salary deferral contributions to a Simple IRA is that they allow employees to save for retirement on a tax-advantaged basis. Contributions are deducted from gross income, lowering taxable income and deferring taxes on investment gains until withdrawal. This can significantly impact an employee's long-term savings and retirement readiness.

However, eligibility is essential when participating in a Simple IRA. Typically, employees must earn at least $5,000 in any two preceding years and project to earn that amount in the current year. Employers must ensure compliance with these guidelines to facilitate the plan's success.

Overview of the Simple IRA salary deferral form

The Simple IRA salary deferral form serves as a formal document where employees indicate the amount they wish to contribute from their paycheck toward their Simple IRA. This form is critical because it formally communicates the employee's decision to their employer and outlines how much of their salary should be allocated for retirement savings.

When completing the form, employees must provide specific information including personal details such as their name and Social Security number. Accurate information is crucial for processing contributions and ensuring compliance with IRS regulations.

Failure to accurately complete the salary deferral form may result in incorrect contributions, which can lead to tax penalties and affect retirement planning. Thus, ensuring every detail is correct and complete is of utmost importance.

Step-by-step guide to completing the Simple IRA salary deferral form

Completing the Simple IRA salary deferral form requires careful attention to detail. Here’s a breakdown of the key steps involved:

Common mistakes to avoid when filling out the form

When completing the Simple IRA salary deferral form, certain pitfalls can lead to complications later. Here are some common mistakes to avoid:

Making changes to your salary deferral elections

Life changes such as a new job, a significant raise, or changes in financial circumstances may lead you to reevaluate your salary deferral elections. Fortunately, modifying your contribution is possible within certain limits and timelines. Employees can typically change their salary deferral amount once a year or during the open enrollment period provided by your employer.

To modify your deferral amount, review your options with your financial advisor and ensure that you meet any necessary criteria. Communicate your new election to your employer in a timely manner, ideally following the same formal process as the original submission to avoid any delays in contributions.

Interactive tools and resources for managing your Simple IRA

Managing your Simple IRA can become more efficient with the right tools. For example, pdfFiller offers a seamless platform to fill out, edit, and eSign your Simple IRA salary deferral form. With access to cloud-based document management features, users can effortlessly edit their forms from anywhere.

Using pdfFiller, you can collaborate with your financial advisor in real-time, making it easier to adjust contributions as your financial situation changes. This level of convenience ensures that your retirement savings can be easily monitored and adjusted whenever necessary.

Tracking your Simple IRA contributions

Keeping track of your Simple IRA contributions is vital for effective retirement planning. Employees are usually required to report their contributions for tax purposes, and understanding IRS Form SAR-SEP can save you from potential issues. This form helps in the filing process and ensures you're compliant with IRS regulations.

To maintain clear records, document your contributions meticulously. This includes noting the amount and frequency of contributions and any changes made to your salary deferral elections. Good record-keeping can help you better plan for retirement needs and provides essential data when reviewing your financial health.

FAQs regarding Simple IRA salary deferral

Understanding the intricacies of the Simple IRA salary deferral form often leads to common questions. Here are some frequently asked queries that can guide your process:

Customer testimonials and experiences with pdfFiller

Users of pdfFiller frequently share positive experiences regarding the management of their Simple IRA documents. From families who have effectively planned for retirement to small businesses that streamlined their employee processes, the platform has led to significant improvements in managing important paperwork.

User reviews often highlight the ease of document editing and signing, which has fostered greater compliance with retirement planning. Case studies illustrate how teams have successfully tackled document management challenges by utilizing pdfFiller's capabilities, leading to organized and efficient workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the simple ira salary deferral electronically in Chrome?

How do I edit simple ira salary deferral on an Android device?

How do I fill out simple ira salary deferral on an Android device?

What is simple ira salary deferral?

Who is required to file simple ira salary deferral?

How to fill out simple ira salary deferral?

What is the purpose of simple ira salary deferral?

What information must be reported on simple ira salary deferral?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.