Get the free Dca 579

Get, Create, Make and Sign dca 579

How to edit dca 579 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dca 579

How to fill out dca 579

Who needs dca 579?

Understanding the DCA 579 Form: A Comprehensive Guide

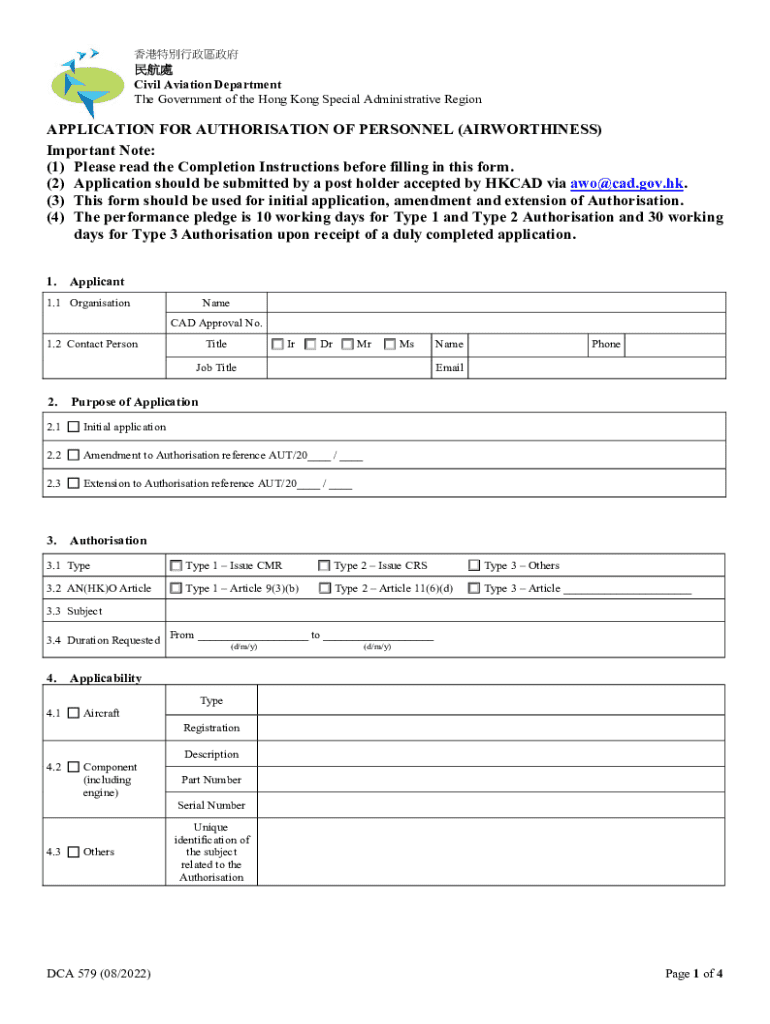

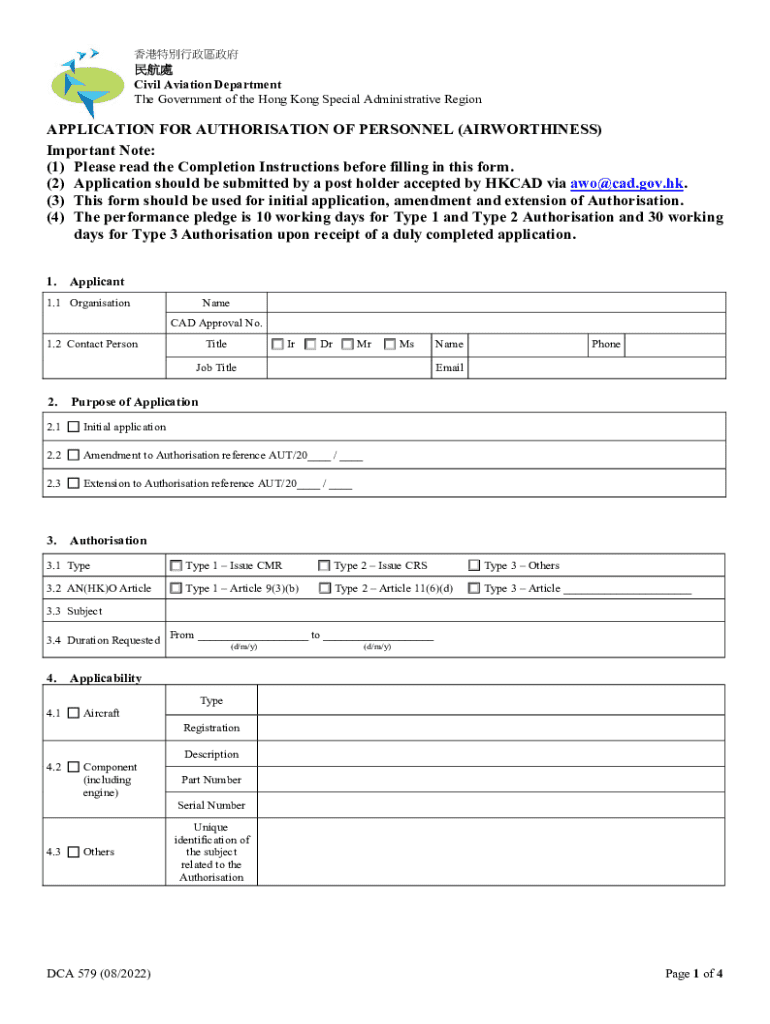

Overview of the DCA 579 Form

The DCA 579 Form is a critical document often required in various official transactions, primarily relating to compliance and regulatory needs. This form plays a substantial role in documenting specific types of financial activities and is recognized for ensuring that these activities adhere to established legal standards.

Understanding the significance of the DCA 579 Form is essential for individuals and businesses alike, as it helps maintain organized and legitimate documentation of transactions that might be subject to scrutiny from regulatory bodies or require formal record-keeping.

Purpose of the DCA 579 Form

The primary purpose of the DCA 579 Form is to document specific financial transactions. This documentation aids in transparency and accountability in financial reporting, making it a fundamental component for compliance with various legal requirements. By filling out this form accurately, individuals and organizations can ensure that they meet all necessary regulations.

Many businesses are mandated to submit the DCA 579 Form depending on the nature of their financial operations. This requirement ensures that all transactions are systematically reported and can be easily traced during audits or assessments. Organizations that engage in significant financial dealings, taxation, or audits generally require the DCA 579 Form to comply with applicable financial laws.

Eligibility and requirements

Eligibility for filling out the DCA 579 Form typically applies to individuals and businesses that engage in specific types of financial transactions or that fall under certain regulatory frameworks. If you are acquiring loans, initiating investments, or managing significant financial activities, you are likely required to submit this form.

Key qualifications for filling out the DCA 579 may include having a valid business license, being registered with regulatory authorities, or demonstrating a need for documentation in financial dealings. Additionally, applicants must be prepared to provide supporting documentation to accompany the form, such as proof of identity, business registration documents, or financial statements.

Step-by-step instructions for completing the DCA 579 Form

Completing the DCA 579 Form efficiently requires careful attention to detail. Follow these steps to ensure your form is filled out correctly and completely.

Step 1: Gather required information

Start by collecting all necessary personal and business information that will be needed for the form. This typically includes your full name, address, Social Security Number (or Tax ID for businesses), relevant transaction details, and any other specifics applicable to the transaction.

Step 2: Access the DCA 579 Form

The DCA 579 Form can be easily accessed through various platforms. You may download it online from official government websites, or you can opt for printed versions available at local government offices. Carefully ensure that you use the latest version of the form to avoid any issues.

Step 3: Detailed instructions for each section of the form

Once you have the form, fill it out diligently. Pay attention to the following fields:

It's crucial to double-check your form for errors or omissions, as mistakes can lead to complications or delays in processing your documentation.

Editing and signing the DCA 579 Form

Once you've completed the DCA 579 Form, the next step involves ensuring all information is correct and preparing to finalize it through editing and signing. Editing the form can be done easily online with tools like pdfFiller, which allows you to make modifications on the platform.

To electronically sign the form, users can utilize pdfFiller’s eSigning capabilities. Follow this step-by-step process:

For teams working together, utilizing pdfFiller’s collaboration features can streamline the process, enabling multiple team members to review and approve the completed form efficiently.

Submitting the DCA 579 Form

Submission of the DCA 579 Form can be accomplished either digitally or physically, depending on the requirements outlined by the accepting authority. If submitting digitally, ensure you follow the correct channels and that your submission meets the formatting standards needed for acceptance.

Key considerations for timely submission include understanding the deadlines outlined for specific transactions and ensuring you allow enough time for processing. Delays can cause issues in timelines, particularly for financial transactions or regulatory compliance.

Common FAQs about the DCA 579 Form

When filing the DCA 579 Form, you may encounter several common questions. Here are some straightforward answers to help clarify any uncertainties you may face.

Managing your DCA 579 documentation

Keeping track of your DCA 579 Form and related documentation is essential for maintaining organized financial records. Establishing an efficient document management system will not only assist you during audits but also facilitate easy retrieval of information when needed.

Best practices for document organization include implementing workflow systems, utilizing cloud storage solutions for easy access, and using tools like pdfFiller to enhance document management. This way, you can maintain updated copies of all your critical documents, minimizing the chance of losing important information.

Troubleshooting issues with the DCA 579 Form

While filling out or submitting the DCA 579 Form, you may encounter various challenges such as technical errors, formatting issues, or inaccuracies in provided information. Knowing how to troubleshoot these common problems can save time and stress.

If you run into difficulties, begin by reviewing all information entered for potential errors or omissions. Additionally, ensure you are using the latest version of the form. When problems persist, reaching out to professional assistance is advisable to clear uncertainties.

Additional support for users

For those seeking extra help with the DCA 579 Form, a wealth of resources are at your disposal through pdfFiller. From instructional guides to one-on-one support, users can find assistance easily.

Contacting support for personalized assistance can clarify form-filling complexities. Whether you're looking for help with a detailed walkthrough or anything else, pdfFiller offers training and tutorials tailored to enhance your form management skills.

Enhancing your document creation workflow with pdfFiller

User experience on the pdfFiller platform significantly enhances the efficiency of managing the DCA 579 Form and similar documents. Choosing pdfFiller not only allows seamless PDF editing but also streamlines eSigning and collaboration features.

With interactive tools like form auto-fill, cloud storage, and templates, pdfFiller empowers users to optimize their document creation workflow effortlessly. Success stories from users illustrate how pdfFiller transformed their document management processes, making it straightforward and professional.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute dca 579 online?

How do I edit dca 579 online?

Can I edit dca 579 on an iOS device?

What is dca 579?

Who is required to file dca 579?

How to fill out dca 579?

What is the purpose of dca 579?

What information must be reported on dca 579?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.