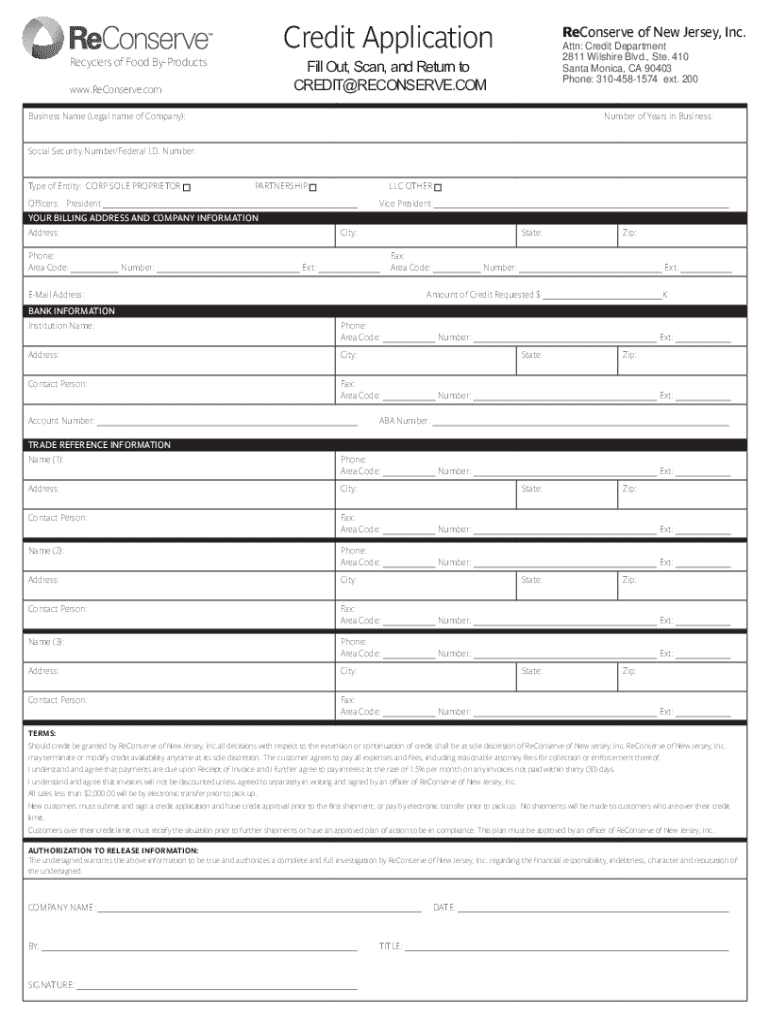

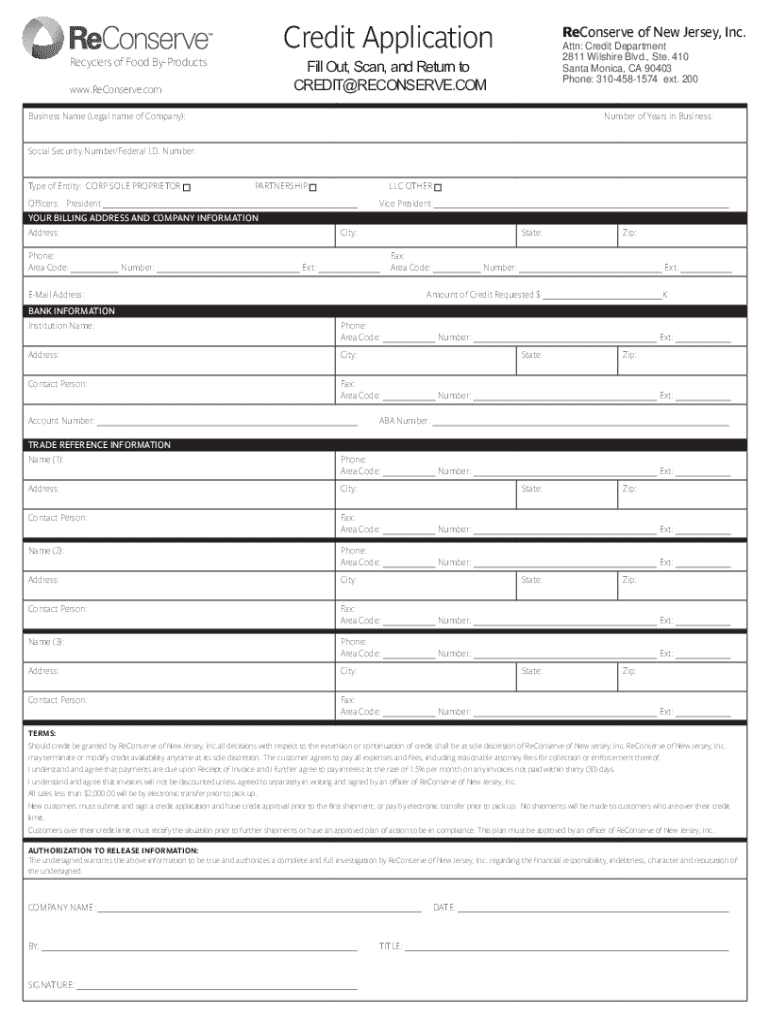

Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form: A Comprehensive How-to Guide

Understanding credit applications

A credit application form is a document used by financial institutions to gather essential information from individuals or businesses seeking credit or loans. Completing a credit application provides lenders insights into an applicant's financial situation, helping assess their eligibility for credit.

Accurate completion of a credit application is vital, as any discrepancies could delay processing or lead to denial of credit. A well-prepared application reflects your financial habits and responsibility, influencing lending decisions.

Common scenarios requiring a credit application include applying for a mortgage, auto loans, personal loans, or business financing. Whether purchasing a new home or starting a business, understanding how to fill out a credit application is crucial for securing funding.

Types of credit application forms

There are various types of credit application forms designed to cater to different needs. Personal credit applications are for individuals seeking loans, whereas business credit applications are intended for companies aiming to secure financing.

With the rise of technology, applicants can choose between online and offline applications. Online forms offer convenience, while offline applications may be necessary in specific cases. Additionally, variations by lender and purpose mean different forms may require unique information based on the lender’s specific guidelines.

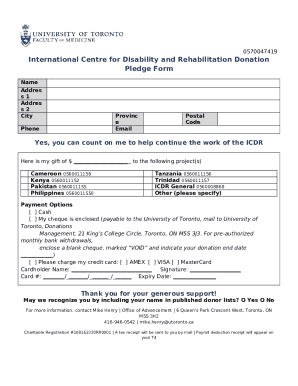

Key sections of a credit application form

A credit application form typically consists of several key sections, beginning with personal information such as your name, address, and contact details. It’s often necessary to provide a Social Security Number (SSN), which aids in verifying your identity.

Following personal details, you need to outline your employment and income. Providing accurate income information is crucial, as lenders may require documentation like pay stubs or tax returns to verify your earnings. For self-employed individuals, presenting income can be more complex but should also include relevant documentation.

The financial information section requires a disclosure of any current debts, liabilities, and a summary of assets and savings, giving the lender a complete picture of your financial health. Additionally, a brief overview of your credit history, including your credit score, plays a significant role in the credit approval process.

Step-by-step guide to completing a credit application form

Before filling out a credit application form, gather all necessary documents. This includes proof of identity, income verification, and details about your current assets and debts. Ensuring you have the paperwork ready streamlines the application process.

As you fill out the form, focus on each section individually. To avoid common mistakes, double-check your entries for accuracy and completeness. Errors can lead to processing delays or even denial of credit, so careful attention is critical. After filling out the application, take time to review it thoroughly.

Editing and managing your credit application

Using pdfFiller's tools for editing PDF forms can significantly simplify the process of managing your credit application. pdfFiller provides easy access for users to edit, sign, and store their documents on a single cloud-based platform.

With pdfFiller, accessing features for quick edits is straightforward. Collaborative tools allow users to share applications with others for feedback before final submission, ensuring that all details are accurate and polished. Once completed, you can easily save and retrieve your credit application whenever needed, providing seamless document management.

Signing your credit application

The eSignature process utilizes electronic signatures, which are increasingly accepted by financial institutions for credit applications. Understanding the different types of signatures allowed is crucial; most lenders require a signature that confirms consent for the application.

Using pdfFiller, signing your application is simple. The platform enables you to create and use customizable electronic signatures, which are legally recognized. Knowing the legal aspects of eSigning ensures that your application holds validity.

Submitting your credit application

There are several submission methods available for a credit application. You can choose to submit your application online, which is often faster, or opt for mail-in applications if required by the lender. Each method may have different processing times, so clarity on your chosen method is essential.

After submission, it's common to face a waiting period while your application is processed. Knowing what to expect can alleviate concerns; lenders typically take anywhere from a few days to a week to respond. To ensure timely processing, consider inquiring about submission confirmation and follow-up procedures.

Managing responses and next steps

Once you receive a response from the lender, understanding the difference between approval and rejection letters is vital. Approval letters often outline your credit limit and terms, while rejection letters indicate areas of concern that may need to be addressed.

If your application is rejected, don't be discouraged. Take time to analyze the reasons for the denial, and use this information to strengthen any future applications. Proper preparation is important for securing financial commitment, so continuous improvement to your credit profile can yield better results over time.

FAQs on credit application forms

Filling out a credit application can provoke many questions. Here are some frequently asked questions that may help clarify your concerns:

Additional considerations for teams

For teams collaborating on credit applications, establishing best practices is crucial. Utilizing a streamlined process saves time and reduces errors, ensuring every team member understands their roles.

Cloud-based platforms like pdfFiller enhance team collaboration by providing easy document management and sharing options. By using these tools, teams can manage credit applications efficiently while ensuring high levels of accuracy and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit application directly from Gmail?

Can I edit credit application on an iOS device?

How can I fill out credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.