Get the free Non-lodgment Advice

Get, Create, Make and Sign non-lodgment advice

Editing non-lodgment advice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-lodgment advice

How to fill out non-lodgment advice

Who needs non-lodgment advice?

Non-lodgment advice form: A comprehensive how-to guide

Understanding non-lodgment advice

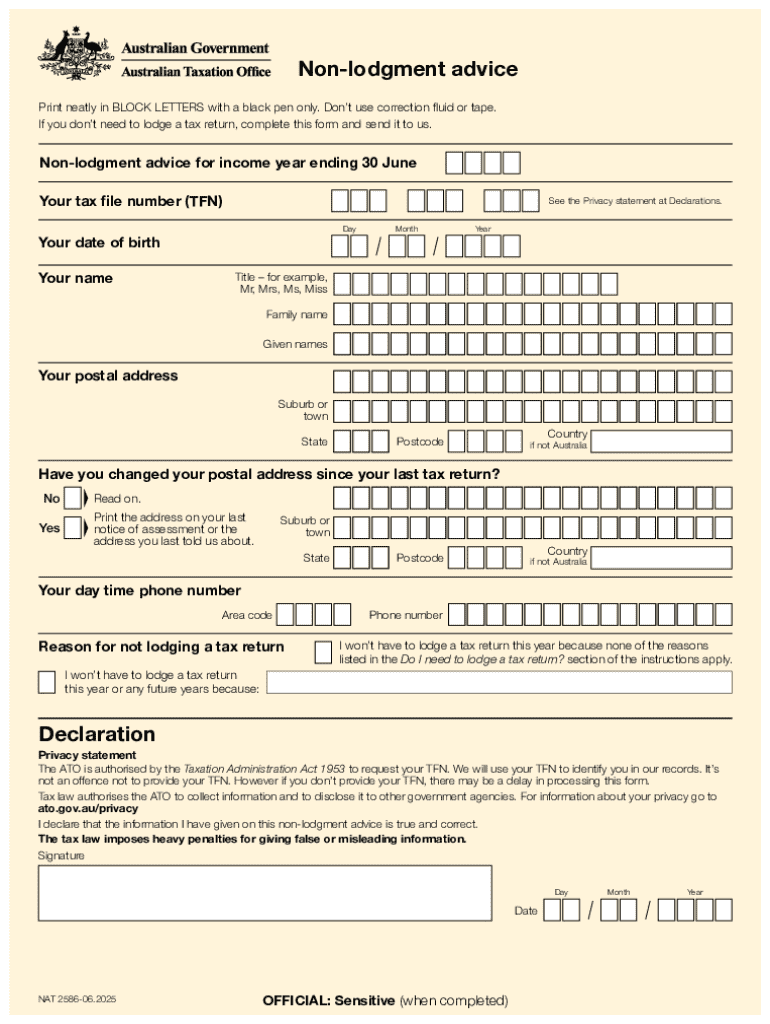

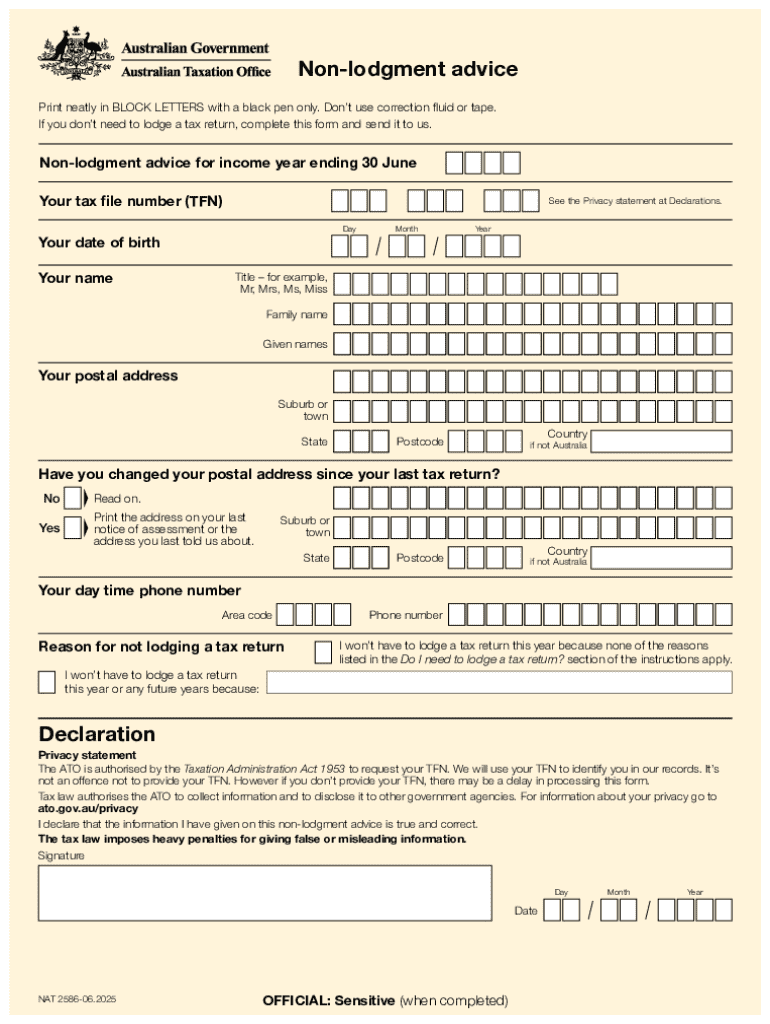

Non-lodgment advice is a formal communication to the Australian Taxation Office (ATO) indicating that an individual or entity will not be lodging a tax return for a specific year due to not having a taxable income. This form is particularly important in helping the ATO understand the tax obligations of individuals or entities who do not need to submit tax returns, thus preventing any misunderstandings or unnecessary follow-up inquiries.

The importance of non-lodgment advice in tax reporting lies in its ability to clarify an individual's tax status. It ensures that taxpayers are aware of their obligations and helps manage expectations regarding their tax affairs. This form should be submitted in situations where income thresholds are not met or when specific circumstances impact a taxpayer's ability to lodge a return.

Common misconceptions about non-lodgment advice include the belief that it is only necessary for individuals with no income at all or that it isn’t required annually. In reality, if your income is below the tax-free threshold of $18,200 or if special circumstances apply, non-lodgment advice is often necessary.

Determining your need for non-lodgment advice

The first step in determining whether you need to submit a non-lodgment advice form involves assessing your income levels. Generally, if your earnings are below $18,200 in a financial year, you may not be required to lodge a tax return. Understanding the distinction between taxable income and the tax-free threshold is crucial here.

If you earned less than the prescribed threshold, you should also consider situations such as having no income at all, seasonal employment, or income-generating opportunities that were minimal in nature. Additionally, if you've entered a transitional phase such as changing jobs or pursuing education, this could influence your lodging status.

Key benefits of submitting non-lodgment advice

By submitting a non-lodgment advice form, you can avoid unnecessary tax penalties. The ATO issues penalties for failing to lodge a tax return, and in some cases, these can escalate quickly. By clearly indicating your non-lodgment status, you protect yourself from these unforeseen costs.

Streamlining your tax affairs is another significant benefit. By notifying the ATO about your status, you avoid future complications or the need to produce documents that aren't applicable to your situation. Furthermore, this form maintains open communication with the ATO, preventing misunderstandings that can arise from failure to report your status.

Step-by-step guide to completing the non-lodgment advice form

Completing the non-lodgment advice form requires gathering specific information. Start by collecting your personal details, including your full name, date of birth, and tax file number. It’s also vital to provide your postal address and contact information to ensure the ATO can reach you if needed.

The next step involves specifying your reason for non-lodgment. This could relate to earning below the taxable income threshold or simply having no taxable income for the period in question. Be thorough in your explanations to avoid ambiguity in the ATO's assessment.

Common errors to avoid include ensuring your name and address are accurate. Mistakes can lead to delays in processing your non-lodgment advice. Additionally, be careful not to misidentify your income status, as this could mislead the ATO regarding your obligations.

Submitting your non-lodgment advice form

Once you have completed your non-lodgment advice form, the next step is submission. The ATO provides an electronic submission option via their Online Services, making the process accessible and efficient. If you prefer a traditional method, you can also submit the form through mail or deliver it in person at your local ATO office.

Ensuring you receive confirmation of receipt from the ATO is essential. This confirmation indicates that your advice has been processed and can prevent future complications related to your tax status.

What happens after submission?

After submitting your non-lodgment advice form, you can expect an acknowledgment from the ATO. This acknowledgment indicates that your non-lodgment status is recorded and processed. The timeframes for processing can vary, but generally, you should expect feedback within a few weeks.

Understanding the outcome of your submission is crucial. If approved, it confirms your status and prevents any issues moving forward. There may be follow-up actions if your circumstances change, such as receiving income later in the financial year.

Implications of not submitting non-lodgment advice

Failing to submit non-lodgment advice can lead to potential penalties and consequences. The ATO may issue penalties for not lodging a return, especially if they believe you have an outstanding income. More importantly, this can impact future tax returns, leading to complications down the road.

Furthermore, the importance of keeping thorough records cannot be overstated. Having all relevant documents ready can save considerable time and effort in the future, particularly if your tax situation changes.

FAQs about non-lodgment advice

One common question is whether non-lodgment advice is necessary every year. The answer is no; it depends on your income situation. If your circumstances change—perhaps earning income in a year where you normally wouldn't—it's essential to resubmit a new non-lodgment advice.

Another frequent query pertains to amendments. If you've submitted non-lodgment advice and later realize changes are needed, you can amend it through the ATO’s online platform. Staying proactive about your tax responsibilities is vital to avoid complications.

Navigating the tax implications of non-lodgment advice

Understanding your obligations after submitting non-lodgment advice is crucial for maintaining good standing with the ATO. While this advice serves as a declaration of your current income status, it's vital to remain aware of any changes in your financial situation year on year.

Tax planning considerations play a significant role in ensuring you stay compliant. Keeping track of your income sources and potential deductions can help mitigate tax liabilities in future years. Should you seek further assistance, consider utilizing resources like pdfFiller, which can streamline your document management process.

Conclusion and insight on using pdfFiller for non-lodgment advice

Submitting a non-lodgment advice form may seem daunting initially, but the process can be simplified using pdfFiller. This platform empowers users to efficiently edit PDFs, eSign, and manage their documents from a single, cloud-based location.

With interactive tools available, pdfFiller allows you to experience seamless document editing, signing, and collaboration. By utilizing pdfFiller, you can ensure that your tax affairs are managed promptly, relieving you of unnecessary stress and keeping your tax records accurate and accessible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non-lodgment advice?

How do I make changes in non-lodgment advice?

How do I complete non-lodgment advice on an iOS device?

What is non-lodgment advice?

Who is required to file non-lodgment advice?

How to fill out non-lodgment advice?

What is the purpose of non-lodgment advice?

What information must be reported on non-lodgment advice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.