Get the free Ira Transfer Form

Get, Create, Make and Sign ira transfer form

Editing ira transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ira transfer form

How to fill out ira transfer form

Who needs ira transfer form?

Understanding the IRA Transfer Form: Your Comprehensive Guide

Understanding the IRA Transfer Process

An IRA transfer refers to the process of moving funds from one Individual Retirement Account (IRA) to another without incurring taxes or penalties. This can be an essential step for individuals looking to consolidate their retirement savings or take advantage of better investment options and lower fees offered by different financial institutions.

Considering an IRA transfer can be a strategic financial decision, particularly when the fees and services associated with your current IRA provider no longer meet your financial goals. By researching and comparing account options, you can find a provider that aligns better with your investment strategy.

Types of IRA Transfers: Direct vs. Indirect

When transferring your IRA, you can choose between a direct transfer or an indirect transfer. A direct transfer involves moving funds directly from one IRA to another, which eliminates the risk of tax withholding and complications. An indirect transfer, on the other hand, involves the account holder receiving the funds and then depositing them into a new IRA. However, this method has tight timelines and potential tax implications, so it’s crucial to understand the requirements before proceeding.

Preparing for Your IRA Transfer

Before initiating the IRA transfer, it's essential to prepare by gathering all necessary documentation. Key financial statements from both your current IRA provider and the new institution will be required to facilitate the smooth transfer of assets.

Alongside financial documentation, personal identification such as your Social Security number and proof of identity like a driver’s license or passport can be necessary. Keeping these documents in order can help streamline the transfer process.

Choosing the Right Financial Institution

Selecting the right financial institution to transfer your IRA to is critical. Evaluate different providers based on fees, available investment options, and customer service.

Additionally, researching customer reviews and ratings can provide valuable insights into the experiences of others, helping you make a more informed decision. Consider factors such as account maintenance costs, transaction fees, and the variety of investment choices available to ensure that the new institution meets your needs effectively.

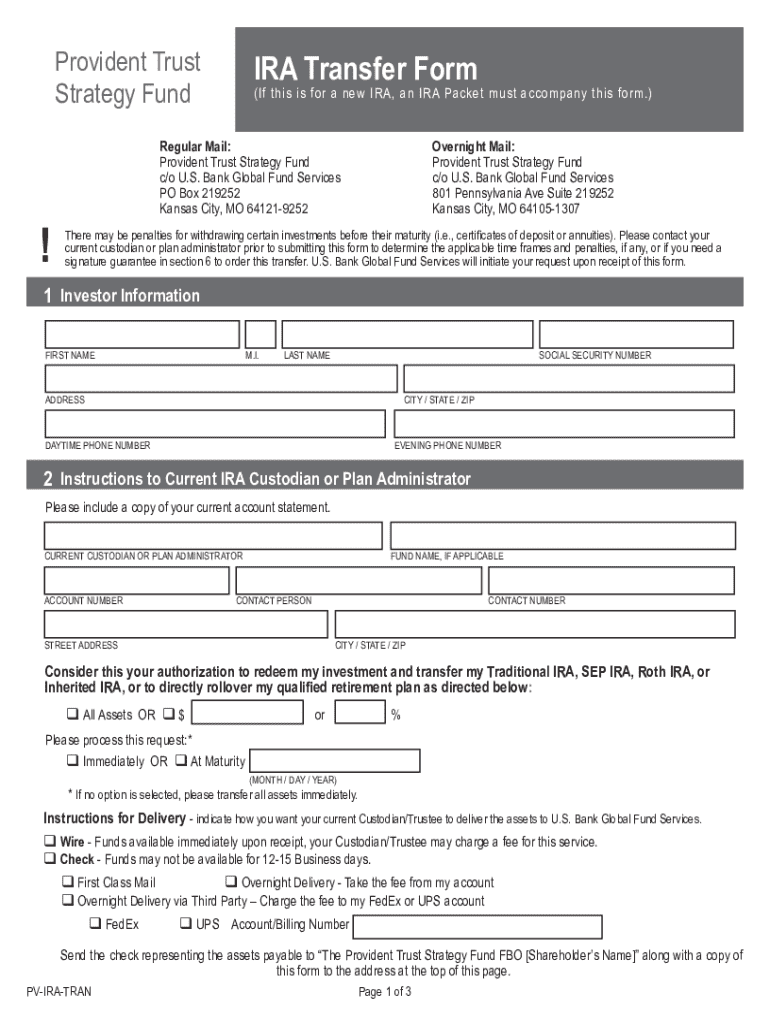

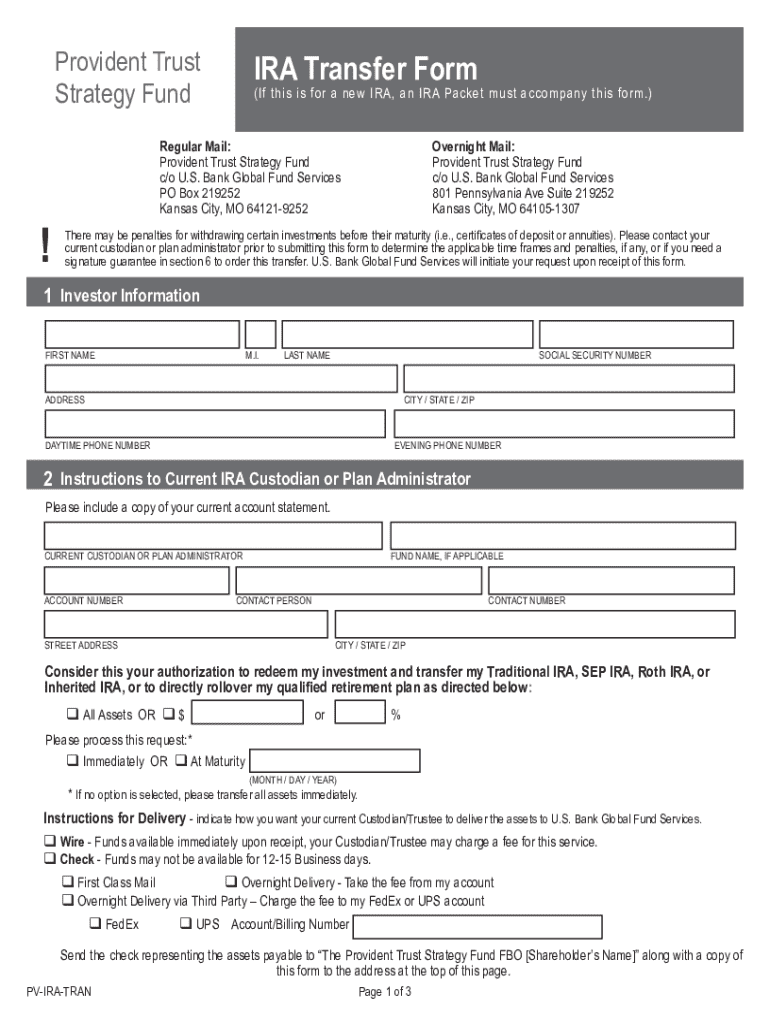

Step-by-Step Guide to Filling Out the IRA Transfer Form

Accessing the IRA transfer form is the next critical step in the process. You can find the necessary forms through pdfFiller which offers a user-friendly platform for document management.

To navigate the pdfFiller platform, visit their site and use the search function to locate the specific IRA transfer form. Once accessed, it’s important to fill out the form accurately to avoid delays in the transfer process.

Detailed Walkthrough of the Form Fields

The IRA transfer form consists of several essential sections that require careful completion.

Additionally, keeping an eye out for common pitfalls is essential. Ensure all information is accurate and that there are no accidental omissions which could hinder the transfer.

Editing and customizing your IRA transfer form

Once you have filled out your IRA transfer form, utilizing pdfFiller's editing tools can enhance its accuracy and clarity. You can easily add annotations or corrections to the form to ensure every detail is as it should be.

If there are pre-filled sections that require modifications, pdfFiller allows you to adjust those areas quickly, providing a seamless editing experience.

Collaborating with financial advisors

Collaborating with financial advisors can provide additional insights and support during the transfer process. pdfFiller's features allow users to share the form with financial advisors for input or approval. Utilizing the comments and feedback features can be beneficial in ensuring that the form aligns with your investment strategy before submission.

Signing the IRA transfer form

After filling out the form, the next step is to sign it. pdfFiller offers several options for eSigning, facilitating a straightforward signing process.

Creating your eSignature is a simple task on the pdfFiller platform. Once created, you can add your signature to the IRA transfer form directly.

Legal validity of eSignatures in IRA transfers

It's essential to understand the legal validity of eSignatures regarding IRA transfers. Under U.S. federal law, eSignatures are recognized as legally binding. Familiarizing yourself with eSignature laws and regulations can give you confidence in the electronic signing process.

Submitting your IRA transfer form

Once the IRA transfer form has been signed, you will need to submit it to initiate the transfer process. Best practices for submission include contacting your current IRA provider to inform them of the transfer and checking that all necessary documents are included.

Making sure to submit the required documentation can prevent delays and make the process smoother.

Tracking the status of your transfer

After submitting your form, tracking the status of your transfer is crucial. Contact your new financial institution to understand their processing times, and maintain regular follow-ups with both your current and new IRA providers. Understanding the typical processing times can alleviate concerns and clarify what to expect.

Common questions about IRA transfers

As you navigate through the IRA transfer process, questions may arise. One common query is, what happens if my transfer takes longer than expected? In such cases, it is advisable to reach out to both financial institutions involved for clarification and follow-ups.

Another frequent question is whether you can transfer your IRA to different types of accounts. The answer largely depends on the type of accounts and structures involved—consulting with a financial advisor can provide tailored advice.

Lastly, understanding the implications of tax and penalties during the transfer process is crucial. Knowing whether the transfer qualifies for tax-free status can help avoid unexpected financial consequences.

Managing your transferred IRA with pdfFiller

After successfully transferring your IRA, effective document management is crucial for ongoing compliance and performance monitoring. Utilizing pdfFiller allows you to organize your documents for future reference, ensuring all your financial information remains accessible.

Using pdfFiller for maintaining compliance and staying updated on any changes in financial regulations can be particularly useful, empowering you to stay on top of your retirement strategy.

Moreover, leveraging pdfFiller for ongoing financial management puts you in control of your retirement journey, equipping you with the tools necessary to make informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ira transfer form to be eSigned by others?

How can I get ira transfer form?

Can I create an eSignature for the ira transfer form in Gmail?

What is ira transfer form?

Who is required to file ira transfer form?

How to fill out ira transfer form?

What is the purpose of ira transfer form?

What information must be reported on ira transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.