Get the free Standard Contract Surety

Get, Create, Make and Sign standard contract surety

Editing standard contract surety online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard contract surety

How to fill out standard contract surety

Who needs standard contract surety?

Standard contract surety form - How-to guide

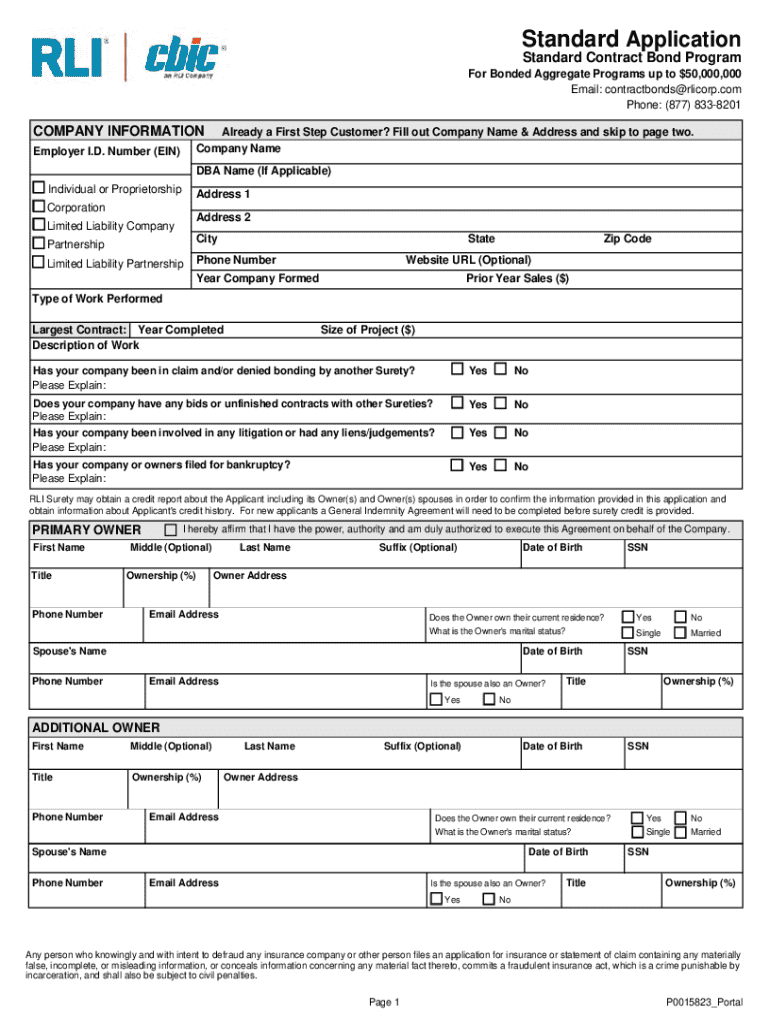

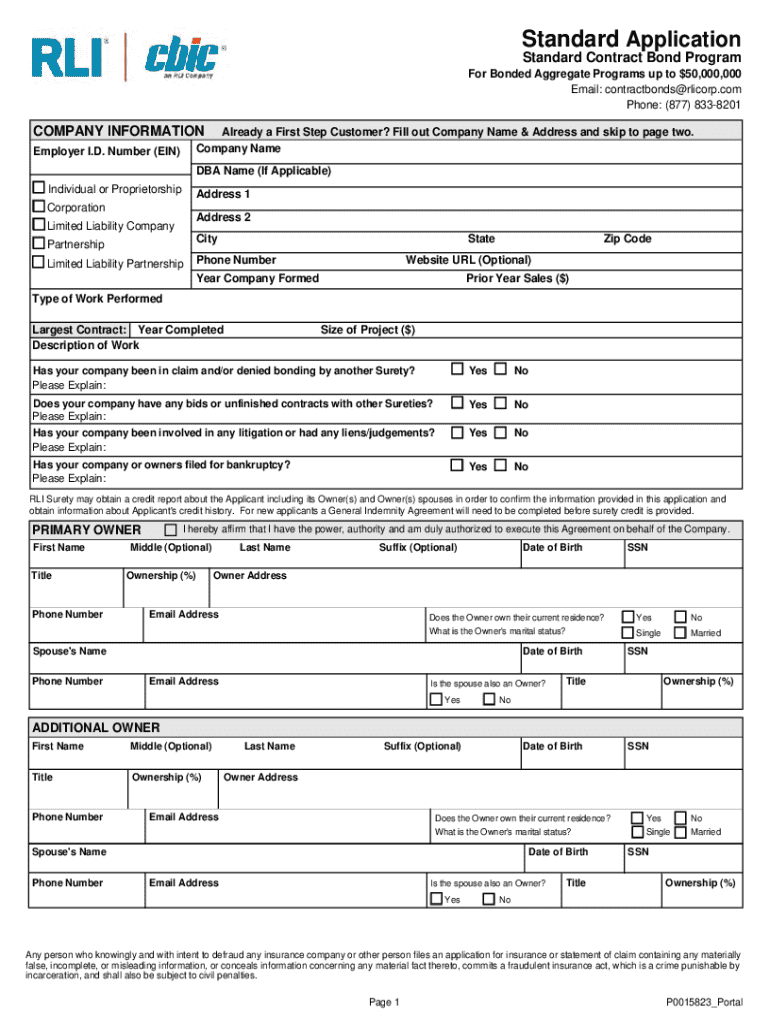

Understanding the standard contract surety form

A standard contract surety form is an essential document utilized in construction and other contractual agreements, reflecting the obligations that a contractor must fulfill. This form is pivotal in protecting the interests of project owners or obligees, ensuring that the contractor will complete the job as specified. Using a surety form mitigates risks associated with incomplete projects and financial losses.

The primary purpose of the standard contract surety form is to establish a legally binding agreement that outlines responsibilities and guarantees between parties involved. The presence of such a form provides assurance to project owners that the contractor possesses the necessary financial backing to complete the project, enhancing trust and accountability across the board.

Key components of the form

A standard contract surety form comprises several critical components that need to be clearly articulated to ensure compliance and clarity.

The role of surety bonds in contracting

Surety bonds play a pivotal role in contracting, acting as a safety net that protects all parties involved. Understanding how surety bonds function is crucial in navigating the contracting landscape effectively.

What is a surety bond?

A surety bond is a three-party agreement that ensures the fulfillment of contractual obligations. The three parties involved are the principal (the party undertaking the work), the surety (the guarantor), and the obligee (the party receiving the benefit of the bond). Should the principal fail to meet their obligations, the surety is responsible for compensating the obligee, thereby minimizing financial risk.

Types of surety bonds commonly used

Why you need a surety bond

Surety bonds offer several benefits for both contractors and project owners. For contractors, they enhance credibility and demonstrate financial responsibility, making it easier to secure work. For project owners, surety bonds serve as assurance that the project will be completed, mitigating potential losses and providing a mechanism for recourse in case of non-completion.

Interactive tools for preparing your surety form

In today’s increasingly digital world, utilizing interactive tools can streamline the creation and management of standard contract surety forms. By leveraging online platforms, users can not only save time but also enhance the accuracy of their documents.

Online form creation tools

pdfFiller offers a robust solution for creating customizable standard contract surety forms. Its document editing capabilities allow users to craft professional documents with ease. The step-by-step process of setting up a surety form online includes selecting a template, inputting relevant details, and saving in preferred formats.

Editing and customizing your form

Users can enrich their standard contract surety forms by adding custom clauses or terms that are specific to their contractual needs. Integrating company branding, such as logos and colors, is straightforward, allowing your documents to reflect corporate identity.

Collaborating with team members

Collaboration is made seamless with pdfFiller. The platform allows for real-time editing, facilitating team input and feedback. This interactive environment minimizes misunderstandings and ensures that everyone involved is on the same page throughout the drafting process.

Filling out the standard contract surety form

Completing a standard contract surety form correctly is crucial for itslegal standing. Attention to detail during this process can prevent costly mistakes and future disputes.

Step-by-step guide to completing the form

Common mistakes to avoid

Avoiding pitfalls during the completion of a standard contract surety form is imperative. A checklist of common mistakes includes failing to read the entire form carefully, overlooking required signatures, or misinterpreting terms.

By ensuring clarity in language, adhering to regulations, and double-checking entries, users can significantly reduce the risk of errors.

Signing and securing the surety form

Once all details are captured, the next step is ensuring the form is signed and secured. This seals the agreement and makes it legally binding.

eSignature options

pdfFiller provides an overview of eSignature options that meet legal standards. With electronic signatures becoming increasingly accepted, utilizing an eSignature solution simplifies the signing process, ensuring all parties can finalize documents from anywhere efficiently.

How to verify the signature

Verifying the authenticity of signatures is crucial for compliance. Employ measures such as detailed audit trails and timestamping features that pdfFiller offers, enhancing document integrity and meeting regulatory requirements.

Managing your surety documents

Post-signing, effective management of surety documents ensures that records are accessible and organized. The way you store these documents plays a vital role in contract management processes.

Efficient document storage solutions

pdfFiller’s cloud-based management features enable users to store their standard contract surety forms securely. This ensures that they are easy to access, retrieve, and review, facilitating an organized approach to document management.

Tracking changes and version control

Maintaining records of modifications is essential for auditing and reviewing contracts. Implementing best practices for version control not only helps in keeping track of changes but also plays a significant role in leveraging historical data for future reference.

Navigating potential challenges

Despite the advantages of using a standard contract surety form, users may be susceptible to certain challenges that can hinder the process.

Common issues with surety forms

Issues such as incomplete forms, misunderstandings regarding obligations, and lack of proper authorization can lead to disputes. Recognizing these roadblocks early can save time and resources.

Contacting surety providers for guidance

When faced with complex situations or uncertainties regarding contractual obligations, reaching out to surety providers for professional assistance is advisable. Prepare a list of key questions to ask, ensuring that you have clarity on requirements and obligations.

Conclusion: Empowering your contract management

Utilizing pdfFiller effectively for managing standard contract surety forms enhances the overall contract management experience. The ability to edit, eSign, collaborate, and manage documents from a single, cloud-based platform directly addresses the needs of individuals and teams seeking efficiency.

By transitioning to digital paperwork, users can streamline their processes, reduce errors, and foster seamless interactions, ultimately empowering a more productive contracting environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute standard contract surety online?

How do I make edits in standard contract surety without leaving Chrome?

How do I edit standard contract surety straight from my smartphone?

What is standard contract surety?

Who is required to file standard contract surety?

How to fill out standard contract surety?

What is the purpose of standard contract surety?

What information must be reported on standard contract surety?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.