Comprehensive Guide to the Employee Business Expense Policy Form

Understanding employee business expense policy

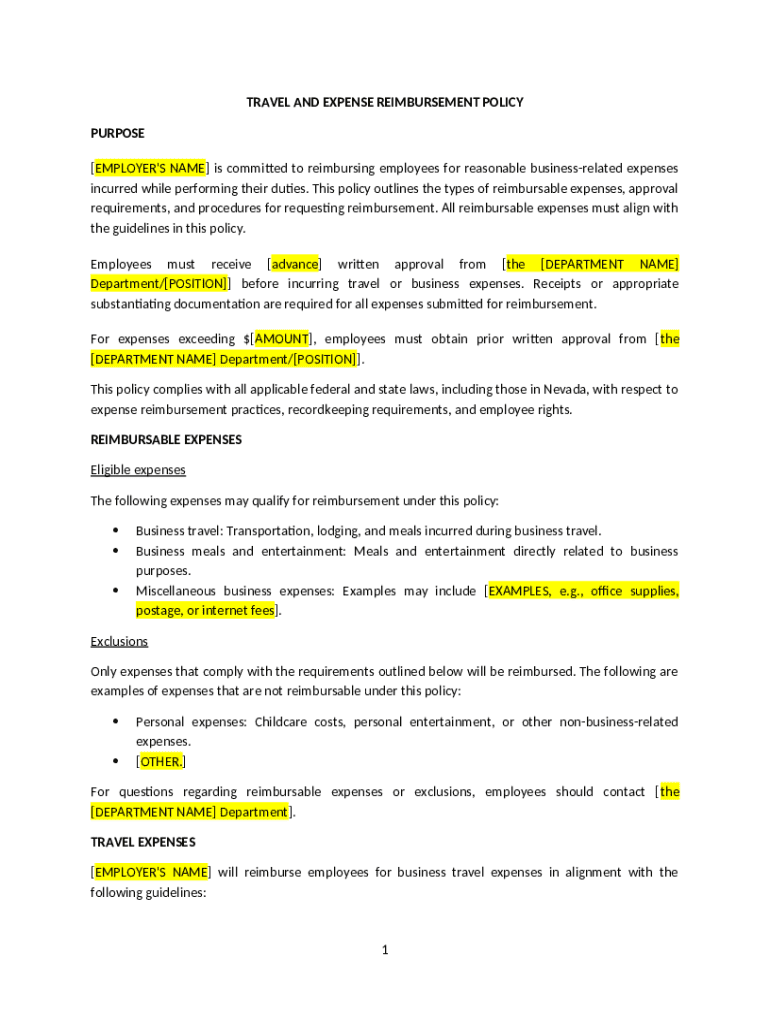

An employee business expense policy is a formal document that defines the rules and procedures for managing business-related expenses incurred by employees. This policy establishes clear guidelines for what expenses are reimbursable, how to submit them, and the documentation required for approval. The significance of a structured expense policy in an organization cannot be overstated. It not only ensures compliance with financial regulations but also aids in budgeting and forecasting. Ultimately, a well-crafted policy fosters a beneficial relationship between employees and the organization by increasing transparency and reducing misunderstandings.

The benefits of having a defined employee business expense policy are manifold. For employees, it provides clarity on what can be claimed, helping to avoid confusion and ensuring that they are fairly compensated for legitimate expenses. For the organization, it streamlines the reimbursement process, aids in expense tracking, and helps prevent fraud or misuse of funds.

Purpose and scope of the policy

The primary goal of the employee business expense policy is to specify the types of expenses that are eligible for reimbursement while outlining the process for employees to follow when incurring such expenses. This policy aims to promote accountability and responsibility among employees regarding business spending. The applicability of the policy typically covers all employees who incur expenses while performing their job duties, whether they be full-time, part-time, or contractual workers.

An effective expense policy should categorize allowable expenses, such as travel, meals, lodging, and supplies, while also clearly indicating non-allowable expenses. This distinction helps employees understand where to draw the line, thereby minimizing potential disputes and ensuring a smoother reimbursement process.

Key elements of the employee business expense policy form

When creating an employee business expense policy form, it's essential to include various key components. These elements should constitute a comprehensive structure that aligns with organizational goals while being flexible for specific departmental needs. Common sections to include are: personal information, expense categories, itemized expense entries, documentation requirements, and a sign-off section for supervisory approval.

Moreover, the policy should be tailored to fit the unique requirements of different departments such as Sales and Marketing, where expenses may vary significantly. Additionally, organizations with international operations should consider the contrast between local and global expenses, ensuring that the policy is relevant for all locations where employees operate.

Step-by-step guide to filling out the employee business expense policy form

Filling out the employee business expense policy form should be a straightforward process. Here’s a step-by-step guide to ensure accuracy and compliance:

Personal information: Start with entering your name, position, and department accurately to enable proper processing.

Expense category selection: Choose the appropriate category for your expense, such as travel, meals, lodging, or supplies.

Itemized expense entry: Provide detailed descriptions and exact amounts for each expense incurred to ensure transparency.

Documentation requirements: Attach necessary receipts and any supporting documents as indicated in the policy guidelines to substantiate your claims.

Sign-off and submission process: Review your entries, obtain any required managerial approvals, and submit the form according to your company’s submission process.

Interactive features for managing expenses

Technology plays a supportive role in making the management of employee business expenses easier. Using tools such as pdfFiller allows users to fill out, edit, and sign forms seamlessly. The platform offers interactive features such as real-time collaboration, enabling teams to work on expense submissions together, thereby minimizing errors and ensuring that all necessary input is accounted for.

Furthermore, with cloud-based tracking systems, organizations can conveniently keep an eye on submitted expenses, ensuring transparency and accountability in the reimbursement process. This helps HR departments to quickly resolve queries and streamline workflows around expense management.

Common FAQs about employee business expense policies

Many employees often have questions regarding the employee business expense policy, so addressing frequently asked questions can help clarify misunderstandings. For instance, what actions should be taken if an expense claim is denied? Employees should be encouraged to seek feedback for clarity and may need to provide additional information or documentation to support their claims.

Another common query relates to lost receipts. Organizations typically require documentation for expense claims, but in cases of lost receipts, employees should follow their company’s specific protocol, which may include providing a written explanation or alternative verification. Other common inquiries revolve around the timing and processing of expense reimbursements, as well as clarifications on specific expenses such as meals and travel allowances. Employees should be well-educated on what can be claimed and the reimbursement process to ensure everything runs smoothly.

Travel expenses: Special considerations

Travel expenses come with their own unique set of guidelines. Organizations should clearly separate allowable travel expenses from non-allowable ones. Typical allowable expenses might include airfare, hotel accommodations, meals, and transportation services like taxis or car rentals, whereas expenses such as personal costs incurred during business travel may not be covered.

To ensure compliance and manage costs effectively, it’s crucial for employees to be proactive in their travel planning. For example, booking flights in advance, utilizing corporate travel discounts when available, and keeping meal costs within specified limits can help mitigate expenses while adhering to company policies.

Strategies for minimizing employee expenses

Employees can adopt several best practices to reduce costs while ensuring compliance with expense policies. For instance, using corporate travel programs often allows employees to access discounted rates for flights and hotels, resulting in significant savings. Additionally, wisely choosing meal options and planning ahead to group meals can save money without compromising the quality of employee experiences.

On the organizational side, it's beneficial to establish expense management systems that provide employees with clear guidelines and expectations around expenditures. Training sessions focusing on expense management can equip employees with the knowledge to manage their finances accurately and responsibly, thus contributing to overall company efficiency.

Non-reimbursable expenses and misconceptions

Understanding the types of non-reimbursable expenses is crucial for maintaining clarity. A comprehensive list may include personal meals, leisure activities, or any expenses that are not directly related to business activities. Educating employees on these exclusions can help minimize frustration during the reimbursement claim process.

Additionally, it's important to dispel common myths surrounding business expenses. One misconception is that all expenses incurred while traveling for work are automatically reimbursable. In reality, expenses must align with company policy guidelines. Stressing these points can lead to better understanding and compliance.

Tools and resources for expense management

Organizations should leverage modern software solutions like pdfFiller for effective expense management. This platform offers numerous benefits, including ease of document creation, editing, and management. Centralizing document management can streamline workflows and reduce the time spent on administrative tasks. Moreover, providing links to templates and forms that assist in policy creation offers employees easy access to accurate resources, promoting adherence to procedures.

By utilizing tools such as these, businesses can foster an environment where expense management is both efficient and user-friendly. This ultimately supports a transparent process that benefits both employees and the organization.

Ensuring compliance and comfort

Ensuring compliance with legal requirements is essential when crafting an employee business expense policy. This means keeping abreast of the latest regulations and adapting the policy as necessary to remain lawful and equitable. Creating a transparent expense reporting culture encourages open communication, allowing for feedback and facilitating continuous improvement of the policy.

Engaging employees in policy discussions fosters a sense of ownership and accountability. Feedback channels should be established to cultivate a constructive dialogue about the policy's efficacy and areas needing enhancement. By doing so, the organization enhances employee trust and commitment to adhering to the expense guidelines.

Policy review and updates

Regularly reviewing and updating the employee business expense policy is vital to ensure ongoing relevance and effectiveness. Factors that may trigger a policy review include changes in business operations, alterations in applicable laws, or feedback from employees highlighting challenges or concerns with the existing policy.

Engaging employees in the policy review process can provide valuable insights and enhance the overall quality of the policy. Such involvement not only empowers employees but also fosters a cooperative culture where individuals feel valued and heard. It is crucial that the expense policy evolves along with the organization’s needs and employee concerns.