Get the free Direct Deposit Authorization Form

Get, Create, Make and Sign direct deposit authorization form

How to edit direct deposit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization form

How to fill out direct deposit authorization form

Who needs direct deposit authorization form?

Understanding and Using the Direct Deposit Authorization Form

Understanding direct deposit authorization form

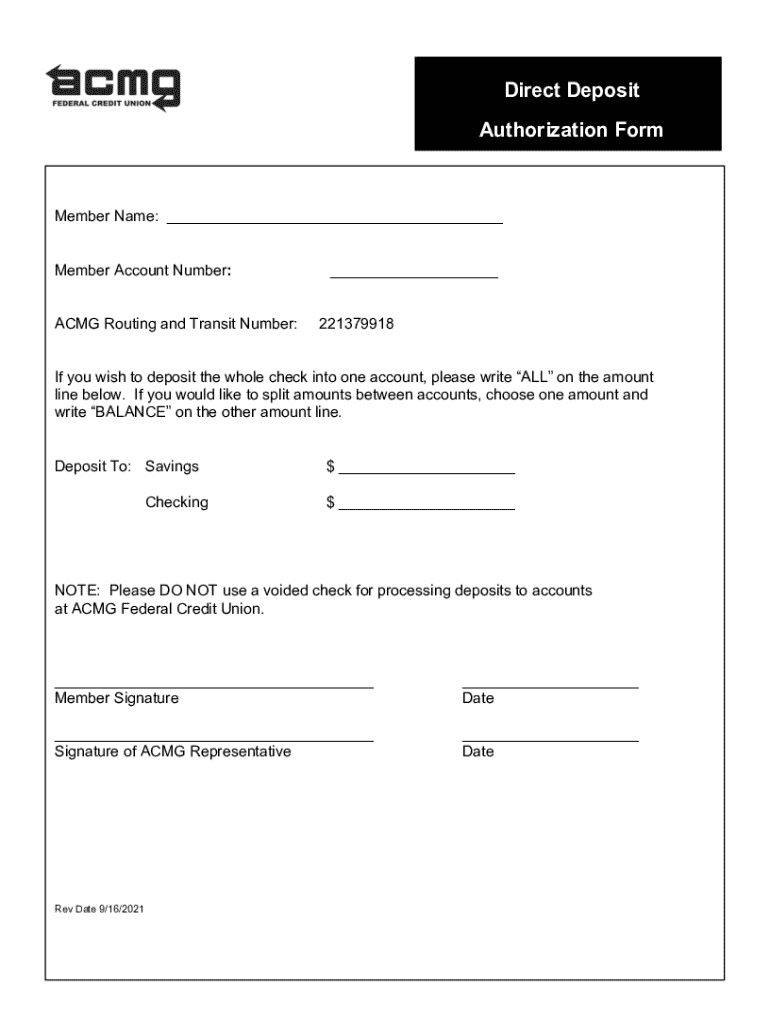

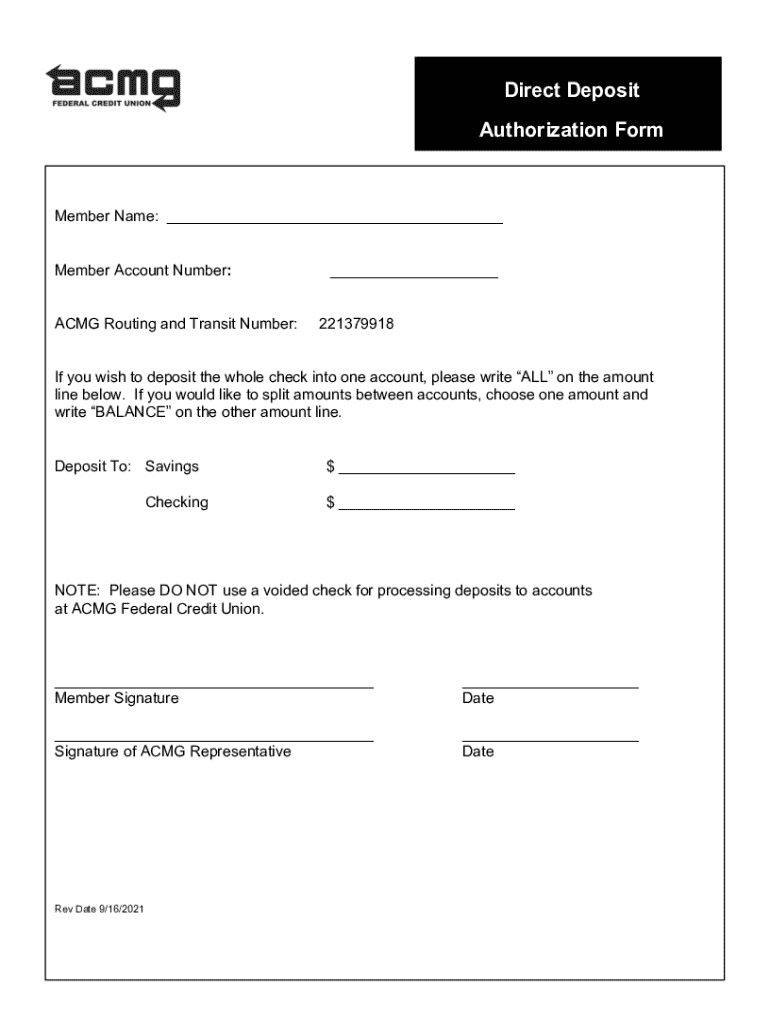

A direct deposit authorization form is a document used to authorize an employer or payment provider to deposit funds directly into a bank account. This method streamlines financial transactions, eliminating the need for paper checks and in-person deposits. Direct deposit is essential in both personal finance, where salary and benefits are deposited directly, and in business transactions, where quick and efficient payment processing is crucial.

The significance of using a direct deposit authorization form lies in its ability to enhance the efficiency and security of monetary transactions. By opting for direct deposit, individuals and businesses can avoid risks associated with lost or stolen checks, ensuring timely payments while reducing administrative burdens.

Components of a direct deposit authorization form

A standard direct deposit authorization form comprises crucial information that ensures the accurate handling of deposits. The basic information required includes personal identification details such as your full name, address, contact number, and Social Security number. These details verify your identity and help the payer or employer easily match the account with the appropriate individual.

Additionally, bank account details are indispensable; you must provide your account number and the bank's routing number. This information directs the funds to your specified bank account accurately. Moreover, the employer or payer's information, which includes their name, contact details, and any official business identifiers, is also essential to confirm that the source of the payment is legitimate.

Lastly, the consent and terms section outlines the conditions under which the authorization is granted. This clause often includes an agreement that you will notify the employer of any changes to your banking details or personal information.

How to fill out a direct deposit authorization form

Filling out a direct deposit authorization form involves several straightforward steps to ensure accurate processing. First, gather all necessary personal and financial information, which typically includes your bank details and employer identification. Having this information at hand will streamline the process and minimize errors.

Next, accurately fill in the bank account section, making sure to double-check both the account number and routing number. These numbers are sensitive and critical; a mistake can lead to delays or misdirected funds. Ensure you review your employer's requirements, as some may ask for additional documentation or signatures.

After filling out the form, sign and date it at the designated areas. Your signature indicates your authorization for your employer to initiate direct deposits into your account. To ensure accuracy, take the time to double-check all details, especially the routing and account numbers, as these are common sources of errors.

Editing and customizing your direct deposit authorization form with pdfFiller

Using pdfFiller greatly enhances the process of editing and customizing your direct deposit authorization form. To get started, access the pdfFiller platform, where you can upload your template directly or create a new form from scratch. With an intuitive interface, you can easily fill in your information, correct any errors, or adjust any pre-set form fields to better suit your needs.

The features offered by pdfFiller make direct deposit forms user-friendly. You can edit the text in your form seamlessly, adjusting any field quickly to reflect your updated personal or banking information. Additionally, pdfFiller enables you to add digital signatures securely, confirming your authorization digitally without the hassle of printing or scanning documents. Being able to collaborate with your employer or payroll department directly within the platform also streamlines the submission process.

Submitting your direct deposit authorization form

Once your direct deposit authorization form is complete, the next step is submitting it to your employer or payment provider. Different submission methods are available, such as online submissions through your payroll portal, in-person drop-offs during scheduled hours, or mailing it directly to your HR department or payroll provider. Choose the method that aligns best with your convenience and your employer's policies.

Best practices suggest confirming receipt of your submission with your employer or payer. Make a quick follow-up call or send an email to ensure that your form was received and processed. Additionally, keep a signed copy of your form for personal records, which can be useful for any future inquiries or modifications to your banking information.

Tracking and managing your direct deposit

To manage your direct deposits effectively, monitor your bank account regularly to ensure that deposits are processed as expected. Most banks provide mobile apps or online banking platforms that allow real-time tracking of transactions, making it easy to confirm each deposit once it is made.

In the event that a deposit fails to appear, it’s essential to check with your employer or payroll department to confirm that the deposit was initiated. If you change jobs or bank accounts, you’ll need to update your direct deposit information. To amend your previously submitted forms, simply fill out a new direct deposit authorization form and resubmit it using the same processes discussed.

Common issues and troubleshooting

Even with all precautions, issues such as delayed deposits or transaction errors can occur. If your direct deposit does not appear in your bank account on the expected date, the first step is to check your recent transaction history with your bank and confirm that there are no holds or other issues impacting your account.

Next, contact your employer's payroll department for clarification. Ensure that they processed the payment and inquire if they received any notifications from the bank regarding potential problems. Resources for immediate assistance typically include your bank's customer service or your employer's HR department, both of which can help resolve payment concerns swiftly.

Security considerations for direct deposit authorization forms

When completing a direct deposit authorization form, it’s paramount to understand the risks involved with sharing sensitive financial information. Know that this form facilitates access to your bank account, and ensuring that this information stays confidential is crucial in preventing fraud and identity theft.

Best practices include only sharing your direct deposit authorization form with trusted employers or payment processors. Always confirm that the organization is legitimate before submitting any personal data. pdfFiller enhances document security by implementing robust encryption and privacy measures, ensuring that your information is securely stored and tracked.

Frequently asked questions (FAQs) about direct deposit authorization forms

When it comes to direct deposit authorization forms, many users have common questions. One primary concern is the legitimacy of the form or how to validate that a direct deposit is set up correctly. Many individuals also wonder how long it takes for changes to be processed once a new form is submitted.

Generally, employers will process a direct deposit authorization form for the upcoming payroll cycle. If you are transitioning to a new bank or account, ensuring to submit the new form a couple of weeks ahead of the next payroll date is ideal. Other common queries revolve around adjusting current information or canceling a direct deposit, which can often be done by submitting a new or amended form.

Advanced features of pdfFiller for direct deposit management

pdfFiller not only streamlines the completion of direct deposit authorization forms but also offers advanced features that empower users to manage documentation effectively. With eSignature capabilities, users can securely sign documents digitally, eliminating the need for physical signatures, making the process faster and more efficient for both employees and employers.

Moreover, pdfFiller provides document storage and retrieval options, ensuring that all your forms, including direct deposit authorizations, are kept in one centralized location. This makes tracking documents far easier, particularly for teams managing payroll documentation, as they can collaborate seamlessly within the platform, reducing administration time spent on back-and-forth communication.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit direct deposit authorization form in Chrome?

How do I complete direct deposit authorization form on an iOS device?

How do I complete direct deposit authorization form on an Android device?

What is direct deposit authorization form?

Who is required to file direct deposit authorization form?

How to fill out direct deposit authorization form?

What is the purpose of direct deposit authorization form?

What information must be reported on direct deposit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.