Get the free Form Ct-1120k

Get, Create, Make and Sign form ct-1120k

How to edit form ct-1120k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-1120k

How to fill out form ct-1120k

Who needs form ct-1120k?

A Comprehensive Guide to the CT-1120K Form

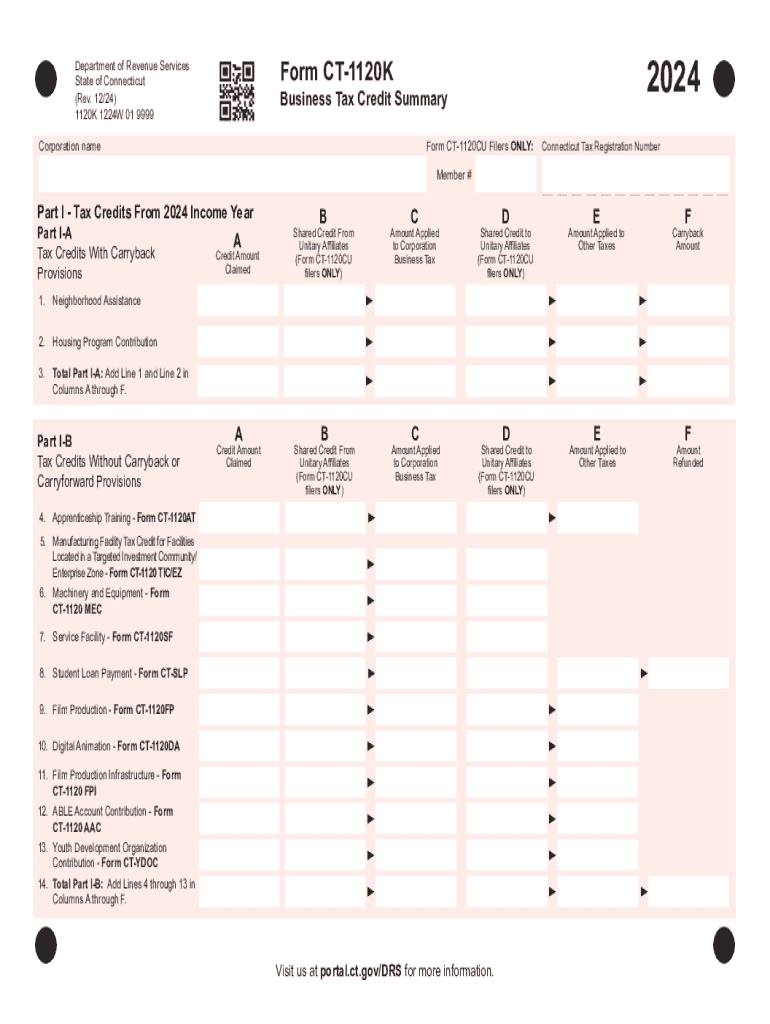

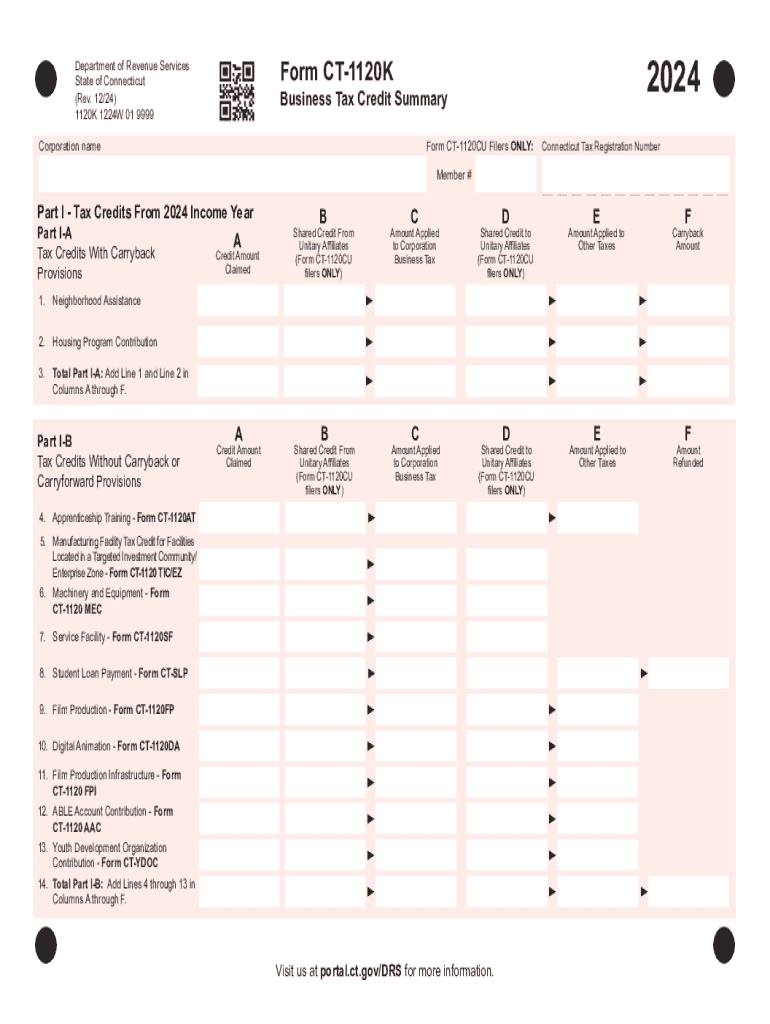

Understanding the CT-1120K form

The CT-1120K form is a vital document that corporations in Connecticut must file to report their income and calculate their corporate business tax liabilities. This form is specifically designed for entities, including corporations, that are doing business within the state. The CT-1120K is essential for ensuring compliance with state tax regulations and for understanding your corporation's financial standing.

Filing the CT-1120K is not just a bureaucratic requirement; it plays a crucial role in the financial ecosystem of Connecticut by documenting corporate income, expenses, and taxes owed. Preparing this form accurately can help corporations take advantage of deductions, credits, and other perks that can lessen their tax burden.

As with most tax-related documents, there are specific due dates when the CT-1120K must be filed to avoid late fees and interest penalties. It's important to stay updated on these key dates to ensure timely compliance.

Who needs to file the CT-1120K?

Eligibility to file the CT-1120K is limited to corporations operating in Connecticut. This includes domestic and foreign corporations that derive income from activities within the state. Understanding your eligibility is crucial as failing to file when required can attract hefty fines.

Entities that are typically required to complete the CT-1120K include C corporations, limited liability companies (LLCs) taxed as corporations, and S corporations. It's a common misconception that all business types need to fill this out; however, partnerships and sole proprietorships do not use the CT-1120K.

Step-by-step guide to filling out the CT-1120K

Filling out the CT-1120K accurately requires a systematic approach. Start by gathering all the necessary information, which includes financial statements, income records, and information on your corporate structure.

Gather necessary information

You will need the following documents:

Section-by-section breakdown

The CT-1120K is divided into several parts that need to be completed carefully.

Part I covers Basic Information. Here, you enter your business details like business name, address, and tax ID number. Provide accurate information, as errors can lead to processing delays.

Part II focuses on Income Details where you need to report different types of income accurately. This includes sales revenues, dividends, interest income, and any other sources of income your corporation receives.

In Part III, you'll document available Deductions and Credits. Understanding which deductions you qualify for can significantly reduce your tax obligation.

Part IV involves Tax Computation that requires you to calculate your tax obligations based on the income reported and the deductions claimed.

Lastly, Part V requires you to sign and make a declaration, which is a critical step. Failing to sign can lead to the form being considered invalid. Ensure that the signature is made by an authorized officer of the corporation.

Common mistakes to avoid when completing the CT-1120K

Common mistakes in reporting can lead to unnecessary complications. One frequent error is misreporting income. Ensure that all sources are correctly listed to maintain transparency. Another common issue relates to miscalculations in tax obligations. Check and double-check your figures to avoid discrepancies that might trigger audits.

It's also important to double-check personal and business information, including the tax identification number. A simple typo can cause significant processing issues. Moreover, ensure all required fields are filled; leaving any section incomplete can delay your filing.

Using pdfFiller to edit and manage the CT-1120K form

pdfFiller offers a seamless solution for filling out, editing, and managing the CT-1120K form. With user-friendly features, it simplifies the often complex process of corporate tax filings. You can upload your CT-1120K using pdfFiller’s interface to streamline your preparation.

Once uploaded, you can easily edit the form as required, adding information or correcting errors with ease. The collaborative tools allow team members to contribute or review entries in real-time, enhancing overall efficiency.

Enhancing efficiency when filing the CT-1120K

To improve efficiency while filling out the CT-1120K form, utilize the document management tools offered by pdfFiller. These tools can help you organize your documents in one accessible location, which is particularly useful during tax season.

Moreover, utilizing templates can save you time and effort. pdfFiller provides pre-populated fields that can aid in minimizing input errors while speeding up the completion process. Using a cloud-based management system allows for easy access to your documents from anywhere.

Interactive tools associated with the CT-1120K

Interactive tools, such as tax calculators, can help estimate potential tax liabilities based on your inputs. These tools assist in projecting tax outcomes, aiding in better financial planning.

For any evolving questions related to the CT-1120K or particular filing scenarios, interactive FAQs on pdfFiller can serve as a valuable resource. Live chat support is also available for real-time assistance, ensuring that help is at hand whenever required.

Keeping your CT-1120K records organized

Proper document management is essential for maintaining your CT-1120K records. This includes creating a structured filing system that allows easy retrieval of past forms and supporting documentation. pdfFiller's secure storage options enable you to keep documents safe yet easily accessible.

Additionally, maintaining an audit trail is crucial for any corporation's transparency. This can include tracking changes made to the form and documenting who accessed the information. These practices ensure compliance and enhance financial integrity.

Further considerations and updates on CT-1120K

Tax laws are continually evolving, and keeping abreast of changes concerning the CT-1120K is essential. Recent updates may alter eligibility, available deductions, or deadlines for submission. Staying informed ensures you are leveraging the most beneficial tax positions available.

Companies should regularly check for announcements from the Connecticut Department of Revenue Services regarding any time-sensitive updates that may impact their filing responsibilities.

Frequently asked questions (FAQ) about the CT-1120K form

Navigating the CT-1120K can lead to numerous questions. Many filers seek clarification on whether they are indeed required to file, how to handle specific deductions, or understand complex scenarios involving multi-state income.

Common queries typically revolve around understanding deadlines, required documentation, and the impact of filing errors. As such, it's beneficial to have these FAQs readily accessible to streamline the filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form ct-1120k online?

Can I create an electronic signature for signing my form ct-1120k in Gmail?

How do I edit form ct-1120k on an iOS device?

What is form ct-1120k?

Who is required to file form ct-1120k?

How to fill out form ct-1120k?

What is the purpose of form ct-1120k?

What information must be reported on form ct-1120k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.