Get the free Qatar Financial Centre Licence

Get, Create, Make and Sign qatar financial centre licence

How to edit qatar financial centre licence online

Uncompromising security for your PDF editing and eSignature needs

How to fill out qatar financial centre licence

How to fill out qatar financial centre licence

Who needs qatar financial centre licence?

Qatar Financial Centre Licence Form: How-to Guide

Overview of the Qatar Financial Centre (QFC)

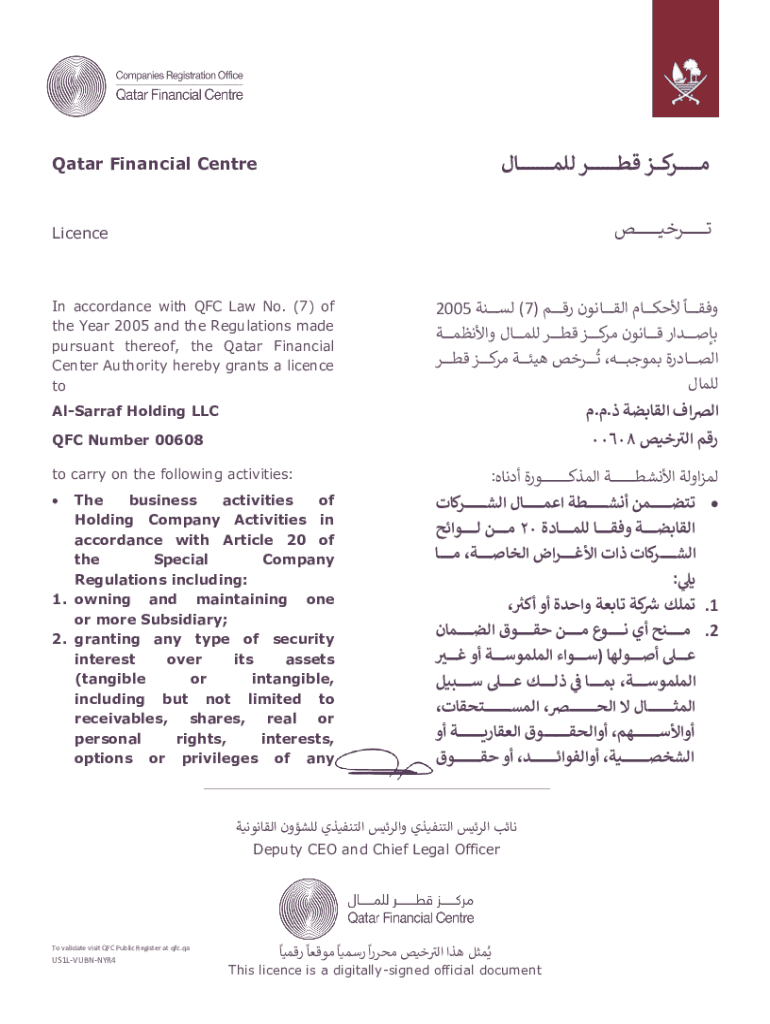

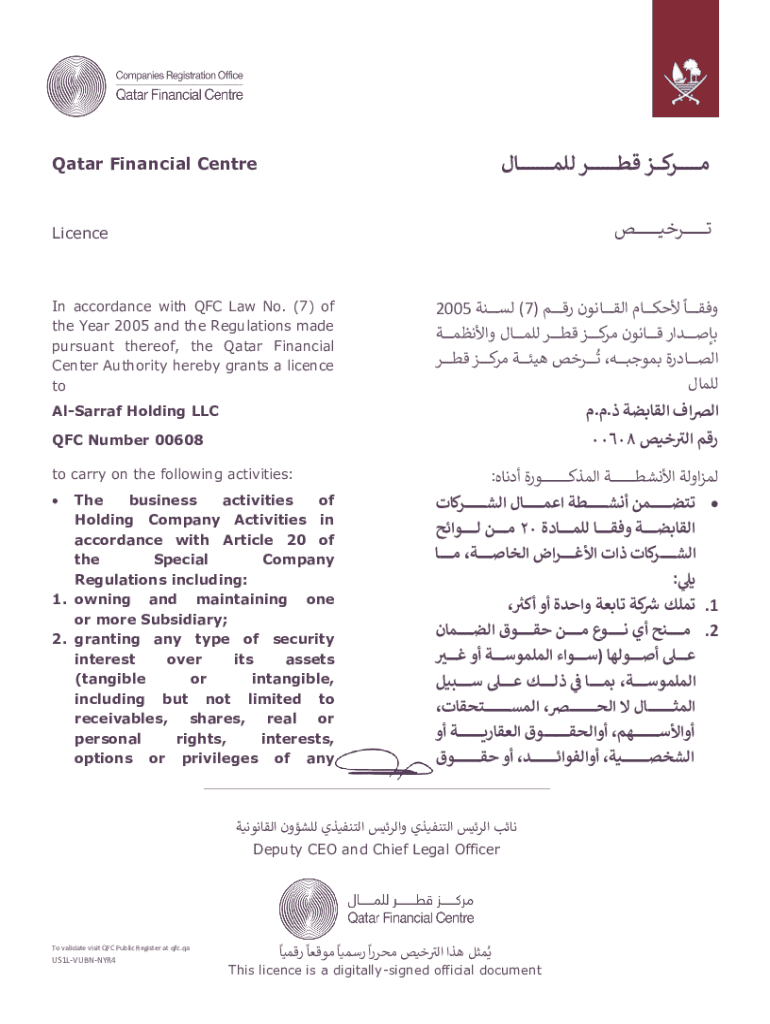

The Qatar Financial Centre (QFC) is a financial and business hub established in 2005 to support the development of Qatar's economy. With a unique legislative framework, it provides a conducive environment for various types of businesses, particularly in the financial services sector.

Key features of the QFC include a 100% foreign ownership policy, no personal income tax, and a straightforward licensing process aimed at attracting international businesses. Additionally, the QFC promotes business through accessible regulation and a robust judicial framework.

Licensing is crucial for businesses operating in the QFC, as it allows them to benefit from these features and facilitates compliance with local regulations. The QFC success story hinges significantly on its ability to draw foreign investments and diversify Qatar’s economy.

Understanding the Qatar Financial Centre Licence

The Qatar Financial Centre offers a range of licences tailored to different types of businesses. These include financial services licences, commercial licences, and those for specific activities like technology and consultancy services. Each licence permits various business activities, aligning with the strategic vision of Qatar's economic diversification.

Obtaining a QFC licence comes with numerous benefits. Apart from being able to operate in a business-friendly environment, licensed entities enjoy access to global markets, a professional workforce, and networking opportunities within the QFC community.

Eligibility criteria for QFC Licence

Not all businesses are eligible for a QFC licence. Generally, entities must align with the activities permitted under the QFC framework. Businesses can range from financial institutions to technology firms, but they must demonstrate a clear business plan and economic rationale.

However, applicants can face common challenges such as incomplete documentation or misunderstanding the requirements. Addressing these issues ahead of time can streamline the application process.

The Qatar Financial Centre Licence Form

The QFC licence application form is the gateway for businesses wanting to operate in this economic zone. This form requires detailed information about the company, ownership structure, proposed activities, and financial forecasts.

Key sections of the QFC licence form include general information about the business, identification of shareholders, descriptions of planned activities, and any other pertinent regulatory requests. Completing each section accurately is vital for a successful application.

To enhance your chances of a smooth approval process, it's helpful to review the form sections thoroughly before filling them out.

Step-by-step guide to filling out the QFC licence form

Completing the Qatar Financial Centre licence form can be straightforward if approached methodically. Here’s a step-by-step guide to help you navigate the process.

Step 1: Gather required documentation

Step 2: Complete the licence application form

When filling out the licence application form, ensure you provide clear, concise, and accurate information. Start by entering your business name, type, and proposed activities. Describing your business plan and financial projections clearly can significantly affect approval.

Step 3: Review your application

Before submitting, have a trusted colleague or mentor review your application. Common mistakes include typos, miscommunication about business activities, and omission of key documents. A thorough review can save you valuable time.

Step 4: Submit the application

Applications can usually be submitted online or via physical copies at designated QFC offices. Ensure you follow the correct format and include all required documentation.

Step 5: Follow up on your application

After submission, stay engaged by checking the status of your application online. If any issues arise, being proactive in addressing them can facilitate a quicker resolution.

Interactive tools for streamlining the QFC licence application

Utilizing interactive tools can drastically simplify the application process for a QFC licence. Document creation tools allow users to draft their applications systematically, while real-time collaboration features enable teams to work on the application collectively. For added efficiency, eSignature integration allows for faster approval processes, letting stakeholders sign documents digitally without the need for physical presence.

Post-submission journey

Once your QFC licence form is submitted, the approval process typically takes several weeks. Understanding the specific approval timeframe is essential, as it can vary based on business type and documentation complexity.

After receiving your licence, businesses are encouraged to familiarize themselves with the QFC's operating guidelines, which include compliance obligations that must be adhered to continuously.

Managing your QFC licence

Managing your QFC licence involves ensuring timely renewals and understanding any necessary modifications to your business operations. Maintaining good standing not only requires adherence to regulations but also engaging in community relations within the QFC.

Frequently asked questions about QFC licences

Many potential applicants find themselves with questions regarding the QFC licence application. Common inquiries include details about processing times, specific documentation required, and troubleshooting steps if disputes arise.

For issues that cannot be resolved independently, reaching out to QFC support is recommended to receive the most accurate guidance and ensure compliance with licensing requirements.

Additional considerations for businesses in QFC

Being part of the QFC community opens numerous networking opportunities that can significantly benefit businesses. Engaging in various training programs and workshops can provide insights into market trends and operational strategies.

Looking beyond the present, businesses should be aware of future trends in licensing within the QFC, including potential changes to regulations that could impact operations. Staying informed helps businesses adapt swiftly to any changes in the economic landscape.

Success stories

Numerous companies have successfully navigated the QFC licence application process and thrived within this dynamic environment. Analyzing these success stories underscores best practices in writing business plans, understanding regulatory requirements, and being proactive in compliance.

Lessons learned from these successful applicants provide valuable insights and can inspire new businesses to explore their ventures within the QFC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my qatar financial centre licence in Gmail?

Can I create an electronic signature for the qatar financial centre licence in Chrome?

Can I create an electronic signature for signing my qatar financial centre licence in Gmail?

What is qatar financial centre licence?

Who is required to file qatar financial centre licence?

How to fill out qatar financial centre licence?

What is the purpose of qatar financial centre licence?

What information must be reported on qatar financial centre licence?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.