Get the free Nc Substitute W-9 Form

Get, Create, Make and Sign nc substitute w-9 form

How to edit nc substitute w-9 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nc substitute w-9 form

How to fill out nc substitute w-9 form

Who needs nc substitute w-9 form?

A Comprehensive Guide to the NC Substitute W-9 Form

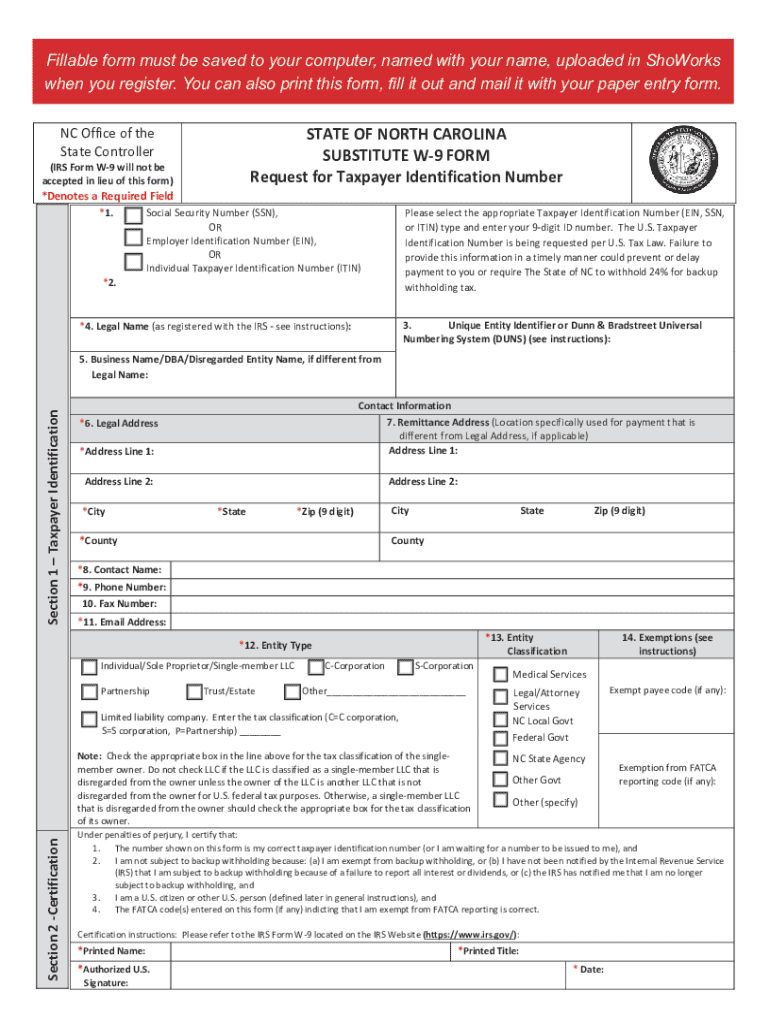

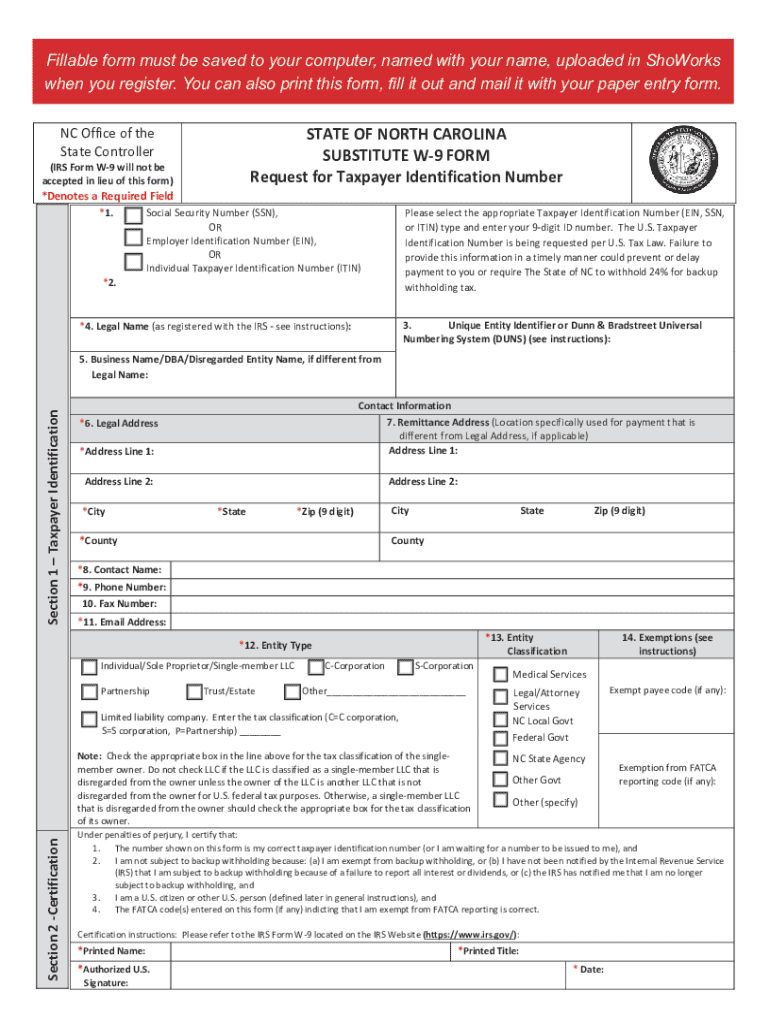

Understanding the NC Substitute W-9 Form

The NC Substitute W-9 Form is an essential document for those operating within the sphere of North Carolina-based transactions. This form provides a substitute option for individuals and businesses that need to report taxpayer information for tax purposes. It serves to collect accurate details about the payee to ensure correct state and federal tax reporting.

Using the NC Substitute W-9 Form is crucial not just for compliance but also for the accuracy of financial transactions. It helps streamline the process of issuing payments and ensures that the correct taxes are withheld and reported. Failure to utilize this form can lead to complications for both payees and payers, including potential tax penalties or audits.

Who needs to complete the NC Substitute W-9 Form?

Individuals and businesses operating in North Carolina often find themselves in situations where they need to complete a W-9 form. Commonly, these include freelancers, contractors, and vendors who receive payment for services rendered. Furthermore, any entity that receives taxable income must provide a W-9 to the payer.

The NC Substitute W-9 is especially necessary for local businesses that are required to report tax information to both the state and federal authorities. If you are an NC resident or operate a business within the state, understanding when and how to provide this information is essential for avoiding compliance issues.

Step-by-step instructions for filling out the NC Substitute W-9 Form

Filling out the NC Substitute W-9 Form correctly is imperative for ensuring smooth transactions. Here’s a comprehensive breakdown of the process:

Common mistakes to avoid when completing the NC Substitute W-9 Form

While filling out the NC Substitute W-9 Form, there are several pitfalls to avoid.

Interactive tools for managing your NC Substitute W-9 Form

pdfFiller offers a suite of interactive tools perfect for managing your NC Substitute W-9 Form efficiently. These tools greatly enhance the flexibility and functionality of document management.

FAQ section: Your questions about the NC Substitute W-9 Form answered

Addressing common questions surrounding the NC Substitute W-9 Form can clarify concerns for many users.

Additional support for users

If you need further assistance with the NC Substitute W-9 Form, pdfFiller offers robust support channels.

Explore more tools and features on pdfFiller

At pdfFiller, you can manage all your forms efficiently, ensuring ease and compliance across all documentation.

Final thoughts on navigating the NC Substitute W-9 Form

Successfully navigating the NC Substitute W-9 Form requires attention to detail and an understanding of tax forms. By leveraging the resources provided by pdfFiller, users can maintain a high level of accuracy and compliance with their documentation. Proper management of this form is integral to preventing future issues with state or federal tax authorities.

Empower your document journey with confidence knowing you have tools and guidelines at your disposal. With careful attention to the NC Substitute W-9 Form, you can avoid common errors and ensure the smooth processing of your transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my nc substitute w-9 form in Gmail?

How do I fill out nc substitute w-9 form using my mobile device?

How do I edit nc substitute w-9 form on an Android device?

What is nc substitute w-9 form?

Who is required to file nc substitute w-9 form?

How to fill out nc substitute w-9 form?

What is the purpose of nc substitute w-9 form?

What information must be reported on nc substitute w-9 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.