Get the free Exhibit E

Get, Create, Make and Sign exhibit e

Editing exhibit e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out exhibit e

How to fill out exhibit e

Who needs exhibit e?

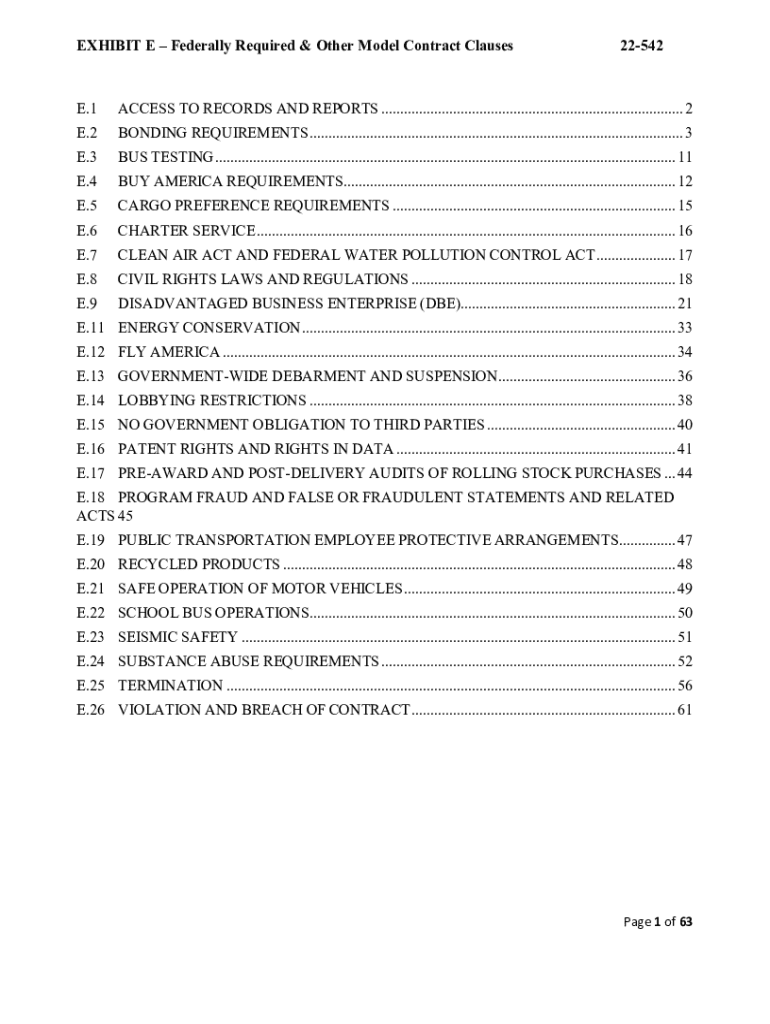

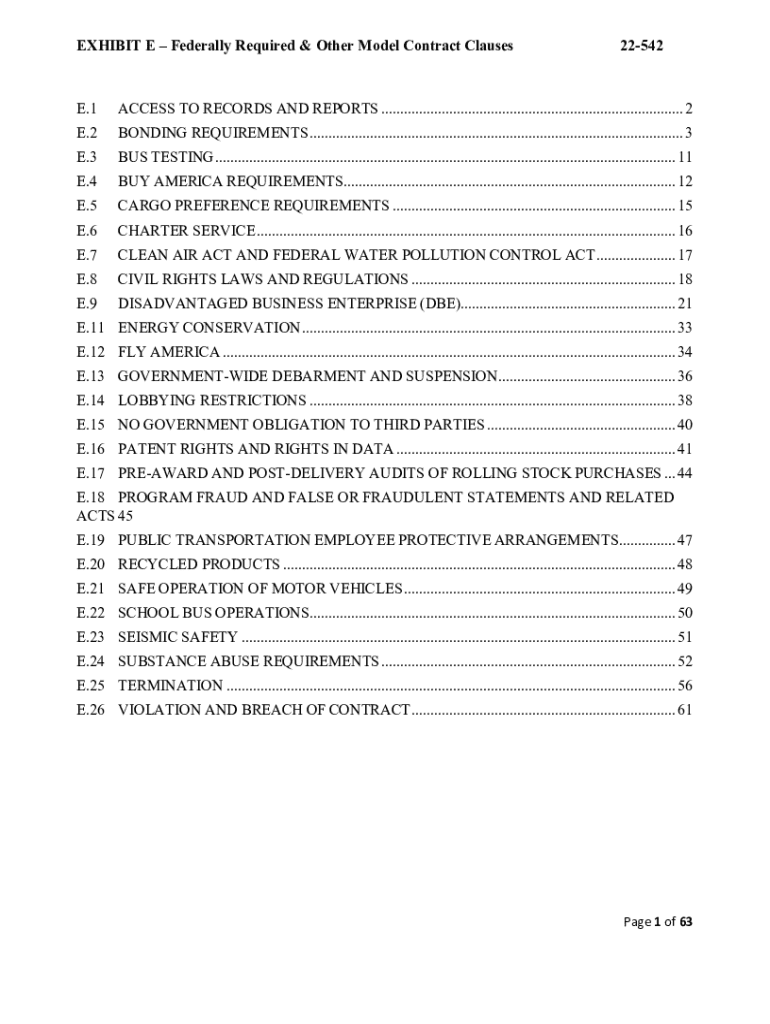

Understanding the Exhibit E Form: A Comprehensive Guide

Understanding the Exhibit E Form

The Exhibit E Form is a vital document often utilized in various legal and financial transactions. Essentially, it serves as a supplementary attachment that provides detailed information pertinent to the primary contract or agreement. It is commonly used in real estate, business transactions, and legal filings to clarify specific terms and conditions which might otherwise be overlooked.

Importance of the Exhibit E Form cannot be overstated as it ensures that all parties involved have a clear understanding of their rights and obligations. It acts as a formal record, preventing disputes by documenting the nuances of agreements in detail. Given the complexities of many transactions, who needs to use the Exhibit E Form? Primarily, parties involved in contracts, such as buyers, sellers, landlords, and tenants, will find this form essential.

Key components of the Exhibit E Form

Delving into the Key Components of the Exhibit E Form reveals its multifaceted nature. The form typically comprises several sections, each dedicated to covering different facets of the transaction. Understanding these sections can be crucial for accurate completion.

Essential information required in an Exhibit E Form can include:

Furthermore, understanding the language of the Exhibit E Form is critical. Common terms and phrases encountered in this document include 'indemnification', 'liability', and 'non-disclosure', all of which carry specific legal implications.

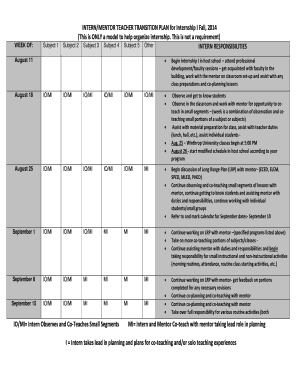

Step-by-step instructions for completing the Exhibit E Form

Completing the Exhibit E Form can appear daunting, but breaking it down into manageable steps simplifies the process. The following detailed guidance can aid users comprehensively.

Preparing your information

Before starting the form, it’s wise to gather required documents. Collect any contracts, prior correspondence, and relevant legal documentation that will assist in filling out the form effectively. Identifying all key participants is equally essential; this includes anyone who will sign or be affected by the agreement.

Filling out the form

When it comes to filling out the form, taking a section-by-section approach can ensure accuracy. Be meticulous with each piece of information, as errors can lead to significant misunderstandings. Tips for accurate data entry include double-checking all figures and providing full names or titles to avoid confusion.

Reviewing the completed form

Once the Exhibit E Form is filled in, reviewing the document is vital. Use a checklist for accuracy, ensuring that all required fields are addressed. Common mistakes to avoid are overlooking signature lines and neglecting to attach necessary supplementary documents.

Editing and customizing the Exhibit E Form

Using tools like pdfFiller provides a user-friendly approach to editing and customizing the Exhibit E Form. This platform allows users to modify existing forms quickly, add or remove sections according to specific needs, and change formatting and layout for better presentation.

Fundamentally, knowing how to navigate the pdfFiller tool enhances user experience, making it straightforward to adapt the form to unique requirements.

Signing the Exhibit E Form

The signing process is an integral stage in finalizing the Exhibit E Form. Options for eSigning with pdfFiller are extensive; users can use electronic signatures that conform to legal standards, making the process both efficient and secure.

Legal validity of eSignatures is crucial, as they are generally recognized in the same regard as handwritten signatures in many jurisdictions. Steps to obtain signatures from multiple parties can be managed effectively with pdfFiller, allowing for the distribution of documents seamlessly to relevant individuals for their approval.

Collaborating on the Exhibit E Form

Collaboration can enhance the effectiveness of utilizing the Exhibit E Form. By inviting team members to view or edit the form, all involved parties can contribute actively to the document's accuracy and completeness. Features such as commenting and reviewing allow for productive discussions and revisions.

Managing changes and version control is facilitated with tools like pdfFiller, where users can reliably track adjustments made by collaborators, ensuring everyone stays updated.

Managing the Exhibit E Form after completion

Post-completion management of the Exhibit E Form includes saving and storing the document securely. Knowing where to save the form, whether in the cloud or on a local drive, is vital for easy access later on. Many individuals opt for cloud services like pdfFiller, which offers reliability and ease of use.

Sharing options for distribution are diverse, allowing users to send forms directly from the platform or export them to various formats as needed. Tracking changes and updates ensures that users stay informed on the modifications of the document over time.

Real-life applications of the Exhibit E Form

Understanding the real-life applications of the Exhibit E Form can help contextualize its importance. Scenarios where Exhibit E is critical include real estate transactions, joint ventures, and partnerships where specifics regarding revenue sharing, responsibilities, or liabilities must be outlined clearly.

Case studies demonstrate effective use of Exhibit E forms in negotiations. For instance, in a recent real estate deal, the clear definition of responsibilities related to maintenance duties through an Exhibit E Form avoided disputes and ensured smoother transactions, allowing both parties to understand their commitments fully.

Feedback from users highlights the clarity and usefulness of having such a detailed document, reinforcing its role in safeguarding interests in complex agreements.

Troubleshooting common issues with Exhibit E forms

When working with the Exhibit E Form, certain common issues can arise. Identifying frequent errors, such as incomplete sections or errors in party signatures, can help streamline the process for users.

Solutions for common problems include regularly reviewing the form during the completion process and utilizing checklists to ensure all areas are filled accurately. When users encounter persistent issues, consulting resources or seeking assistance from experts familiar with legal forms can provide clarity and guidance.

Related document templates and forms

Other forms and templates closely related to the Exhibit E Form include the Exhibit A and B Forms, which serve different yet significant purposes. Understanding when to use other legal or financial documents is crucial, as various scenarios necessitate specific forms tailored to particular agreements.

Comparative features of related templates highlight the unique attributes of the Exhibit E Form, which emphasizes detail and specificity in contexts where clarity is paramount.

Frequently asked questions (FAQs) about the Exhibit E Form

Addressing common queries about the Exhibit E Form provides clarity for potential users. Questions range from understanding its uses to resolving misunderstandings about legal implications attached to its completion.

Clarifying misconceptions ensures that users approach the Exhibit E Form with confidence. Additional tips from experts can enhance user comfort levels, especially in complex negotiations where stakes are high.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify exhibit e without leaving Google Drive?

How can I send exhibit e for eSignature?

How do I edit exhibit e in Chrome?

What is exhibit e?

Who is required to file exhibit e?

How to fill out exhibit e?

What is the purpose of exhibit e?

What information must be reported on exhibit e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.