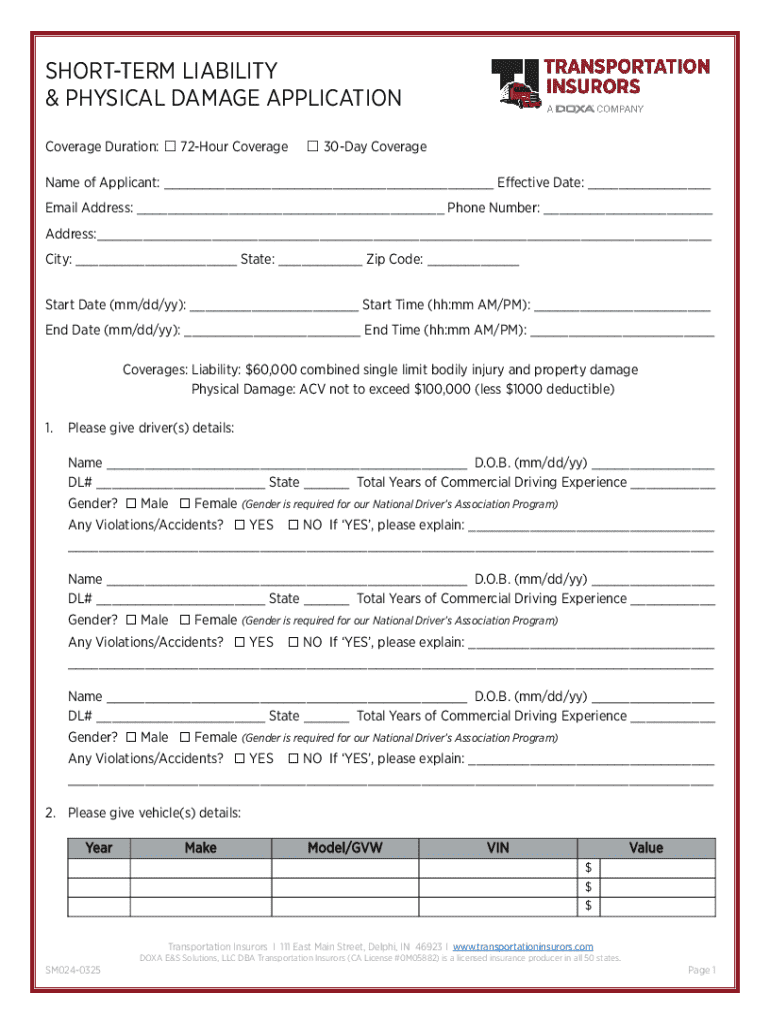

Get the free Short-term Liability & Physical Damage Application

Get, Create, Make and Sign short-term liability physical damage

Editing short-term liability physical damage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out short-term liability physical damage

How to fill out short-term liability physical damage

Who needs short-term liability physical damage?

A Comprehensive Guide to the Short-Term Liability Physical Damage Form

Understanding short-term liability physical damage

Short-term liability in a business context refers to obligations that must be settled within a year. These liabilities can arise in various sectors, including transportation, construction, and rental services. The ability to manage these liabilities effectively is crucial as they directly impact a company's financial health and operational efficiency.

The significance of physical damage coverage lies in its role as a safety net for businesses and individuals. It protects against financial losses resulting from unforeseen events, such as accidents, theft, or vandalism. Understanding what constitutes physical damage — from structural harm to equipment failure — is essential for adequately addressing potential risks.

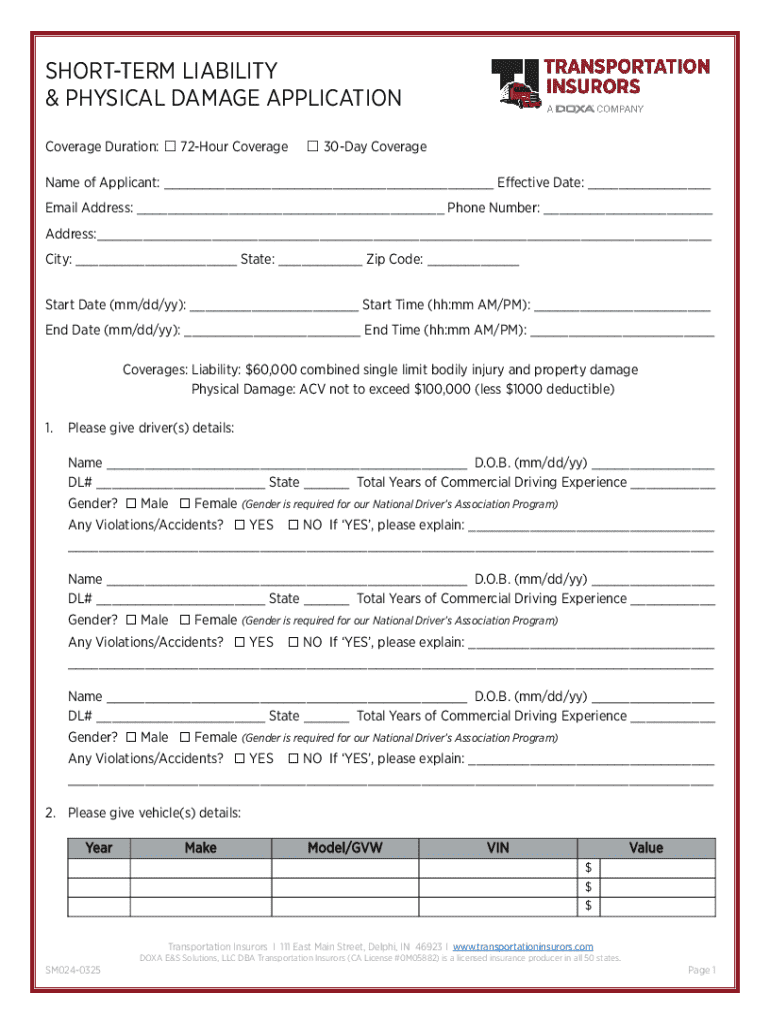

Overview of the short-term liability physical damage form

The short-term liability physical damage form serves as an official document necessary for filing claims related to physical damage incurred during the operational activities of a business. It is essential for ensuring that claims can be processed quickly and accurately, minimizing financial disruption.

Typical circumstances prompting the need for this form include incidents like vehicle accidents involving company cars, damage to rented equipment, or property damage during a service operation. The timely submission of the form is critical, as it typically should be filed within a specific timeframe defined by the insurer.

Key sections of the short-term liability physical damage form

The layout of the short-term liability physical damage form is designed to streamline the claims process. Among its key sections is contact information, where the claimant must provide accurate details. This step is vital because it ensures that all communications regarding the claim are directed to the correct individual, thereby reducing the potential for delays.

In addition to contact details, a detailed account of the incident is necessary. This section will typically have specific questions that help the claimant articulate the circumstances surrounding the damage. Clarity and precision are essential, as this section can significantly influence claim evaluations.

Step-by-step instructions for completing the form

Pre-completion checklist

Before filling out the short-term liability physical damage form, gather all necessary documents and information. Prepare relevant photographs of the damage, police reports (if applicable), and any witness statements. Reviewing your insurance policy beforehand can also clarify coverage specifics.

Detailed guidance by section

1. **Filling in contact information:** Begin by entering your legal name, address, phone number, and email address. Double-check for accuracy to prevent miscommunication.

2. **Outlining the incident:** Describe the circumstances that led to the damage, including the date and time, location, and any parties involved. Using precise language helps ensure your description is understood.

3. **Describing physical damage:** Clearly detail the nature of the damage, supported by visual evidence. Explain how the damage occurred and what items or areas are affected.

4. **Providing witness information:** If there were witnesses to the incident, include their contact details. This can support your claim if further information is needed.

5. **Signatures and date:** Ensure that you sign and date the form once completed. This verifies that the information provided is accurate to the best of your knowledge.

Common mistakes to avoid

When submitting your form, avoid common errors like omitting critical details, incomplete sections, or submitting the wrong documents. These mistakes can lead to delays in processing your claim. To ensure accuracy, consider having a colleague review your submission before it is sent.

Editing and managing your short-term liability physical damage form

Using pdfFiller for editing your short-term liability physical damage form offers numerous benefits. The platform allows users to modify PDF forms in real time, integrating essential features such as the e-signature options for prompt document completion. This flexibility supports efficiency, particularly in urgent situations.

Moreover, pdfFiller's collaboration tools empower teams to work together seamlessly on claims submissions. Team members can share the form easily, at any stage of the completion process, facilitating constructive feedback and ensuring all necessary information is included.

Frequently asked questions (FAQs)

One common question revolves around claim processing times. Generally, the processing duration can vary based on the complexity of the claim and the insurance provider's internal procedures, typically ranging from a few days to several weeks.

Another frequent inquiry concerns errors in submissions. If errors occur, contact the claims department immediately to correct them. Early communication can prevent further complications.

For those wondering about electronic submissions, many companies now permit electronic filing of the short-term liability physical damage form. Check with your insurer for support with this option.

Additional documentation that may be required includes photographs of the damage, receipts, or repair estimates, which can expedite the evaluation process.

Interactive tools for form management

pdfFiller offers valuable digital tools for users, such as fill and sign features that simplify the completion of the short-term liability physical damage form. These tools provide users with a user-friendly interface, reducing the chances of errors.

Tracking the status of your submission can also be managed effectively through the pdfFiller platform. Users can monitor each stage of their claims process, allowing proactive follow-up as needed, ensuring a smoother experience overall.

Conclusion on the necessity of proper documentation

Efficient claims processing hinges on proper documentation. Maintaining accurate records and promptly submitting the short-term liability physical damage form can streamline the process and enhance communication with your insurance provider. Overall, effective management of this documentation not only aids in timely resolution but also prevents unforeseen financial strain.

Utilizing pdfFiller for your document management needs further enhances your capabilities. The platform empowers users to edit, e-sign, and collaborate on forms conveniently while leveraging its cloud-based features to ensure access from any location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute short-term liability physical damage online?

How do I edit short-term liability physical damage on an Android device?

How do I fill out short-term liability physical damage on an Android device?

What is short-term liability physical damage?

Who is required to file short-term liability physical damage?

How to fill out short-term liability physical damage?

What is the purpose of short-term liability physical damage?

What information must be reported on short-term liability physical damage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.